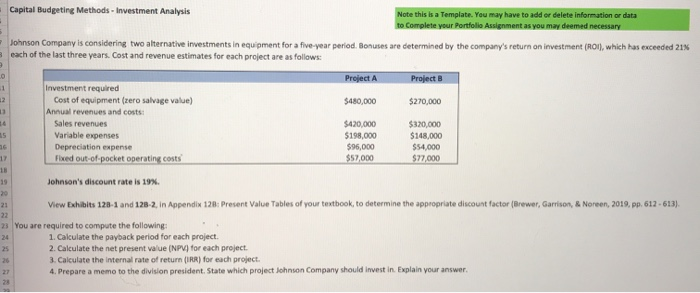

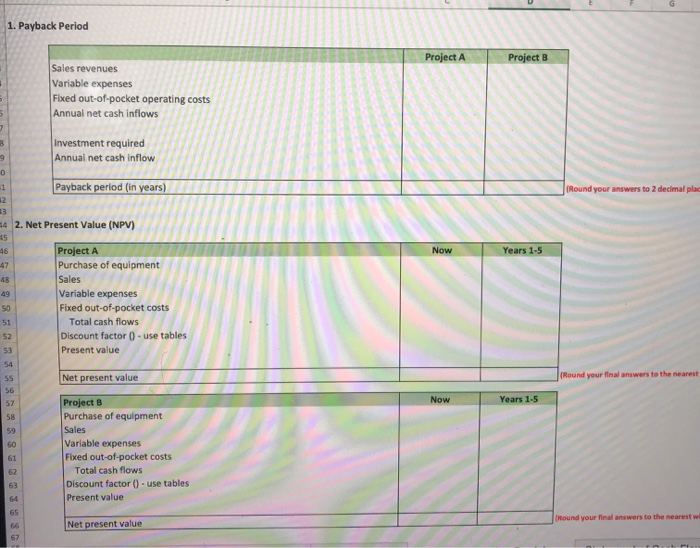

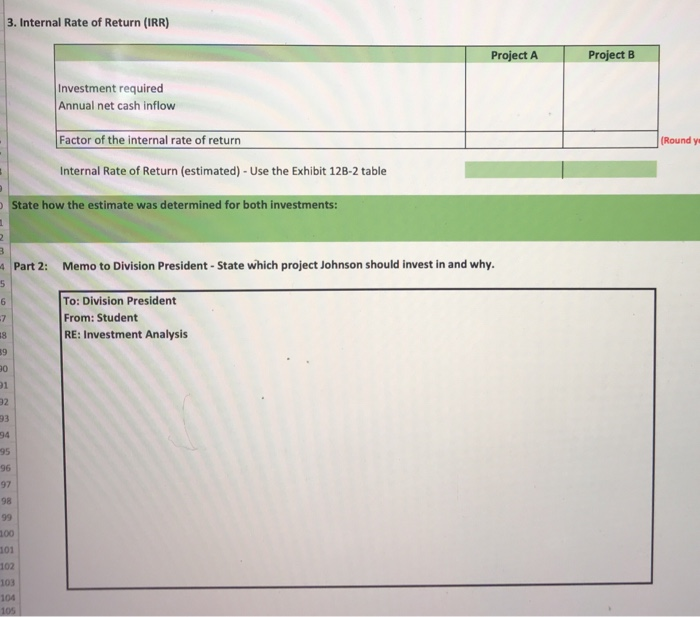

Capital Budgeting Methods - Investment Analysis Note this is a Template. You may have to add or delete information or data to Complete your Portfolio Assignment as you may deemed necessary Johnson Company is considering two alternative investments in equipment for a five-year period. Bonuses are determined by the company's return on investment (ROI), which has exceeded 21% each of the last three years. Cost and revenue estimates for each project are as follows: Project A Project B $480,000 $270,000 FANNN Investment required Cost of equipment (zero salvage value) Annual revenues and costs: Sales revenues Variable expenses Depreciation expense Fixed out-of-pocket operating costs $420,000 $198.000 $95,000 $57,000 $320,000 $148,000 $54.000 $77,000 Johnson's discount rate is 19% View Exhibits 128-1 and 128 2. in Appendix 128: Present Value Tables of your textbook, to determine the appropriate discount factor (Brewer, Garrison, & Noreen, 2019, pp. 612-613) You are required to compute the following: 1. Calculate the payback period for each project. 2. Calculate the net present value (NPV) for each project. 3. Calculate the internal rate of return (IRR) for each project. 4. Prepare a memo to the division president State which project Johnson Company should invest in Explain your answer. 1. Payback Period proj Sales revenues Variable expenses Fixed out-of-pocket operating costs Annual net cash inflows nino Investment required Annual net cash inflow Payback period (in years) Round your answers to 2 decimal plac 4 2. Net Present Value (NPV) 46 Years 1-5 47 Project A Purchase of equipment Sales Variable expenses Fixed out-of-pocket costs Total cash flows Discount factor - use tables Present value Net present value Round your final answers to the Now Years 1-5 Project B Purchase of equipment Sales Variable expenses Fixed out-of-pocket costs Total cash flows Discount factor () - use tables Present value Round your final answers to the nearest w Net present value 3. Internal Rate of Return (IRR) Project A Project B Investment required Annual net cash inflow Factor of the internal rate of return (Round y Internal Rate of Return (estimated) - Use the Exhibit 12B-2 table State how the estimate was determined for both investments: Part 2: Memo to Division President - State which project Johnson should invest in and why. To: Division President From: Student RE: Investment Analysis