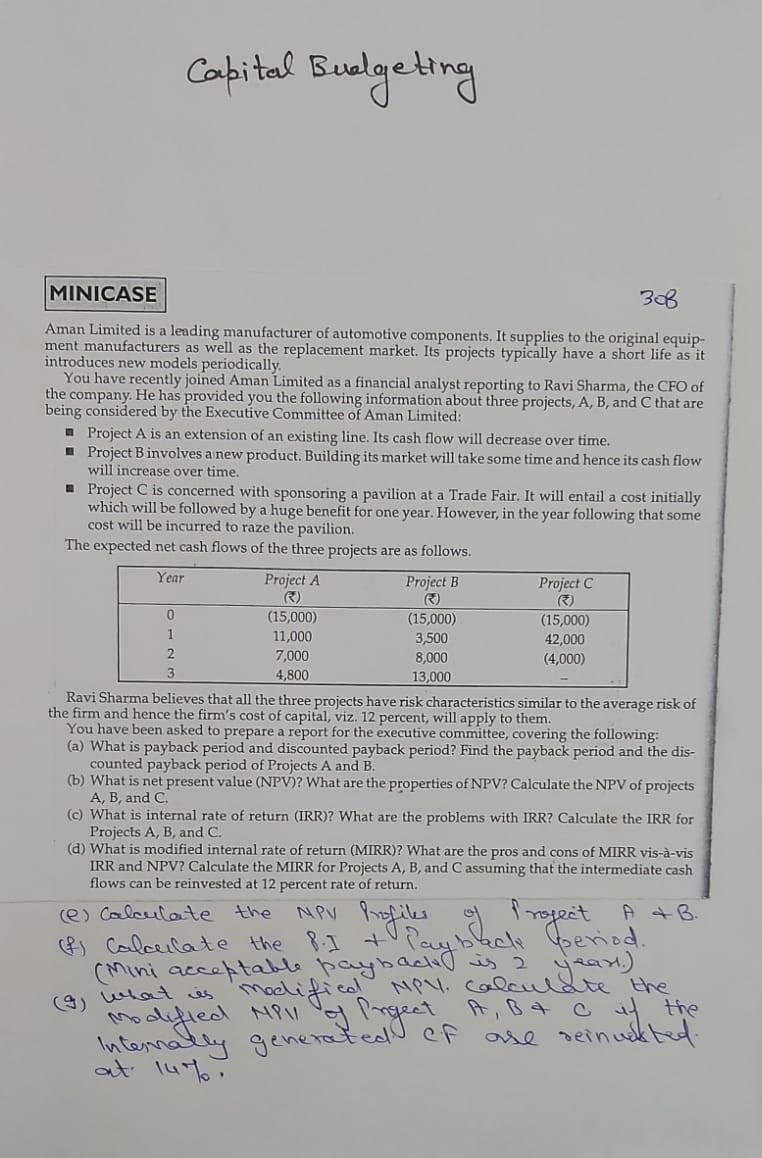

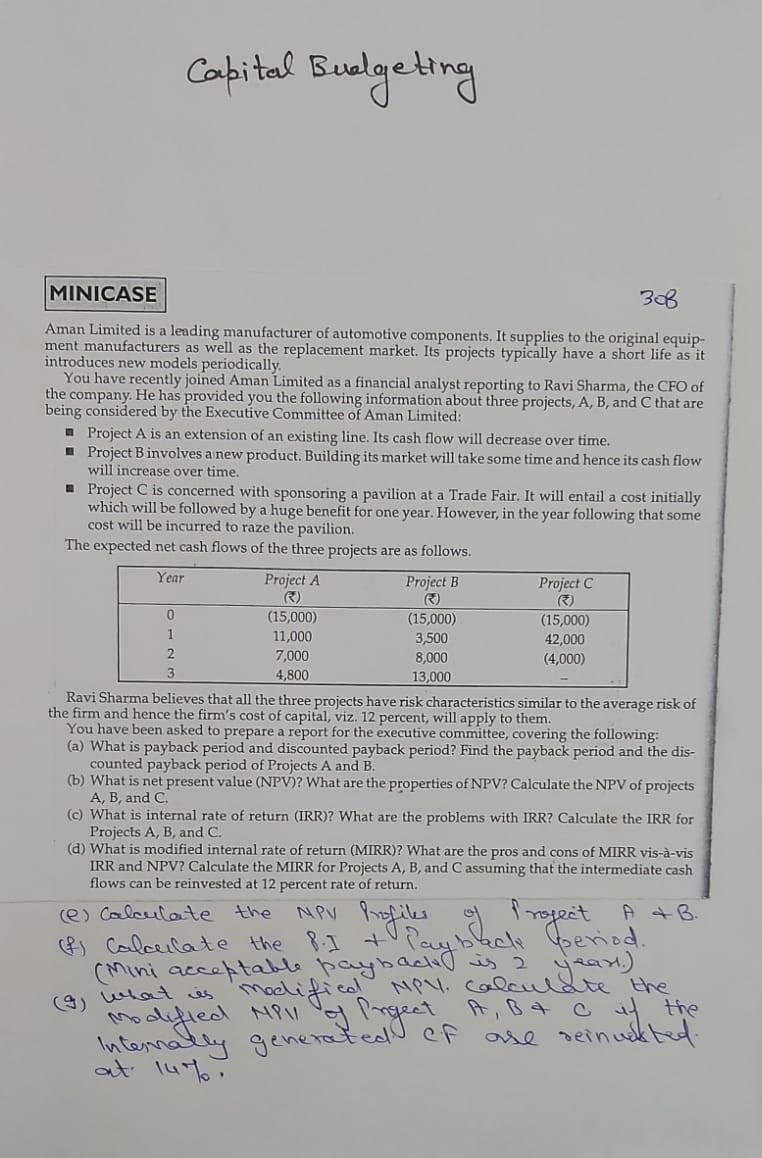

Capital Budgeting MINICASE 308 Aman Limited is a leading manufacturer of automotive components. It supplies to the original equip- ment manufacturers as well as the replacement market. Its projects typically have a short life as it introduces new models periodically. You have recently joined Aman Limited as a financial analyst reporting to Ravi Sharma, the CFO of the company. He has provided you the following information about three projects, A, B, and C that are being considered by the Executive Committee of Aman Limited: m Project A is an extension of an existing line. Its cash flow will decrease over time. Project B involves a new product. Building its market will take some time and hence its cash flow will increase over time. Project C is concerned with sponsoring a pavilion at a Trade Fair. It will entail a cost initially which will be followed by a huge benefit for one year. However, in the year following that some cost will be incurred to raze the pavilion The expected net cash flows of the three projects are as follows. Year Project A Project B Project C 0 (15,000) (15,000) (15,000) 1 11,000 3,500 42,000 2 7,000 8,000 (4,000) 3 4,800 13,000 Ravi Sharma believes that all the three projects have risk characteristics similar to the average risk of the firm and hence the firm's cost of capital, viz. 12 percent, will apply to them. You have been asked to prepare a report for the executive committee, covering the following: (a) What is payback period and discounted payback period? Find the payback period and the dis- counted payback period of Projects A and B. (b) What is net present value (NPV)? What are the properties of NPV? Calculate the NPV of projects A, B, and C. (C) What is internal rate of return (IRR)? What are the problems with IRR? Calculate the IRR for Projects A, B, and C. (d) What is modified internal rate of return (MIRR)? What are the pros and cons of MIRR vis--vis IRR and NPV? Calculate the MIRR for Projects A, B, and C assuming that the intermediate cash flows can be reinvested at 12 percent rate of return. (e) Calculate the (f) Calculate the 8. I (Mini acceptable paybaccybe Iroject A & B. Modi Mey. Calculate the MPV Profiles A back Geriod. (9) what is Modified Mpii of ingect A, B+ o ich the Internally generated of are deinusted rolific at 14%. Capital Budgeting MINICASE 308 Aman Limited is a leading manufacturer of automotive components. It supplies to the original equip- ment manufacturers as well as the replacement market. Its projects typically have a short life as it introduces new models periodically. You have recently joined Aman Limited as a financial analyst reporting to Ravi Sharma, the CFO of the company. He has provided you the following information about three projects, A, B, and C that are being considered by the Executive Committee of Aman Limited: m Project A is an extension of an existing line. Its cash flow will decrease over time. Project B involves a new product. Building its market will take some time and hence its cash flow will increase over time. Project C is concerned with sponsoring a pavilion at a Trade Fair. It will entail a cost initially which will be followed by a huge benefit for one year. However, in the year following that some cost will be incurred to raze the pavilion The expected net cash flows of the three projects are as follows. Year Project A Project B Project C 0 (15,000) (15,000) (15,000) 1 11,000 3,500 42,000 2 7,000 8,000 (4,000) 3 4,800 13,000 Ravi Sharma believes that all the three projects have risk characteristics similar to the average risk of the firm and hence the firm's cost of capital, viz. 12 percent, will apply to them. You have been asked to prepare a report for the executive committee, covering the following: (a) What is payback period and discounted payback period? Find the payback period and the dis- counted payback period of Projects A and B. (b) What is net present value (NPV)? What are the properties of NPV? Calculate the NPV of projects A, B, and C. (C) What is internal rate of return (IRR)? What are the problems with IRR? Calculate the IRR for Projects A, B, and C. (d) What is modified internal rate of return (MIRR)? What are the pros and cons of MIRR vis--vis IRR and NPV? Calculate the MIRR for Projects A, B, and C assuming that the intermediate cash flows can be reinvested at 12 percent rate of return. (e) Calculate the (f) Calculate the 8. I (Mini acceptable paybaccybe Iroject A & B. Modi Mey. Calculate the MPV Profiles A back Geriod. (9) what is Modified Mpii of ingect A, B+ o ich the Internally generated of are deinusted rolific at 14%