Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital budgeting Tapper Rat is examining a proposal for replacing an existing rat sorting machine with a new, more efficient machine. The old machine is

Capital budgeting

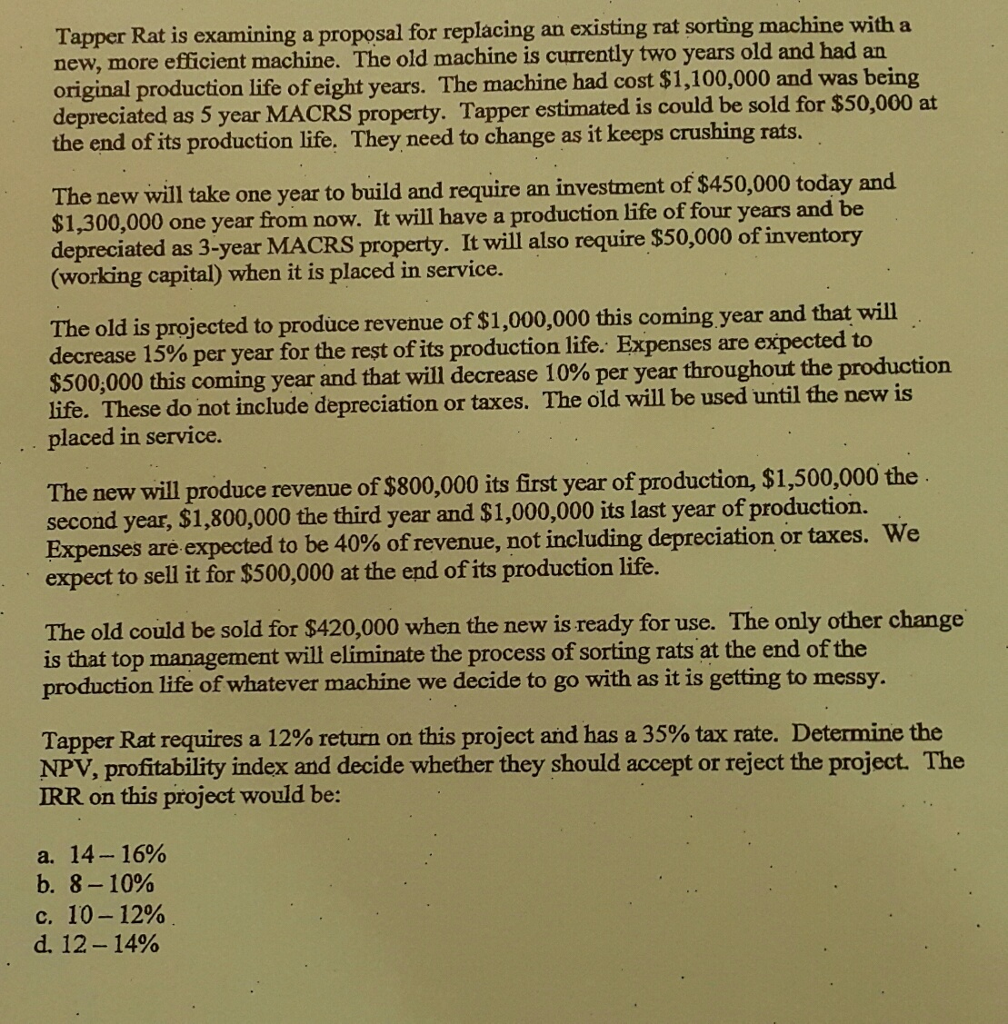

Tapper Rat is examining a proposal for replacing an existing rat sorting machine with a new, more efficient machine. The old machine is currently two years old and had an original production life of eight years. The machine had cost $1, 100,000 and was being depreciated as 5 year MACRS property. Tapper estimated is could be sold for $50,000 at the end of its production life. They need to change as it keeps crushing rats. The new will take one year to build and require an investment of $450,000 today and $1, 300,000 one year from now. It will have a production life of four years and be depreciated as 3-year MACRS property. It will also require $50,000 of inventory (working capital) when it is placed in service. The old is projected to produce revenue of $1,000,000 this coming year and that will decrease 15% per year for the rest of its production life. Expenses are expected to $500,000 this coming year and that will decrease 10% per year throughout the production life. These do not include depreciation or taxes. The old will be used until the new is placed in service. The new will produce revenue of $800,000 its first year of production, $1, 500,000 the second year, $1, 800,000 the third year and $1,000,000 its last year of production. Expenses are expected to be 40% of revenue, not including depreciation or taxes. We expect to sell it for $500,000 at the end of its production life. The old could be sold for $420,000 when the new is ready for use. The only other change is that top management will eliminate the process of sorting rats at the end of the production life of whatever machine we decide to go with as it is getting to messy. Tapper Rat requires a 12% return on this project and has a 35% tax rate. Determine the NPV, profitability index and decide whether they should accept or reject the project The IRR on this project would be: a. 14 - 16% b. 8 - 10% c. 10 - 12% d. 12 - 14%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started