Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Budgeting Your division is considering two projects. Its WACC is 1 0 percent, and the projects' after - tax cash flows ( in millions

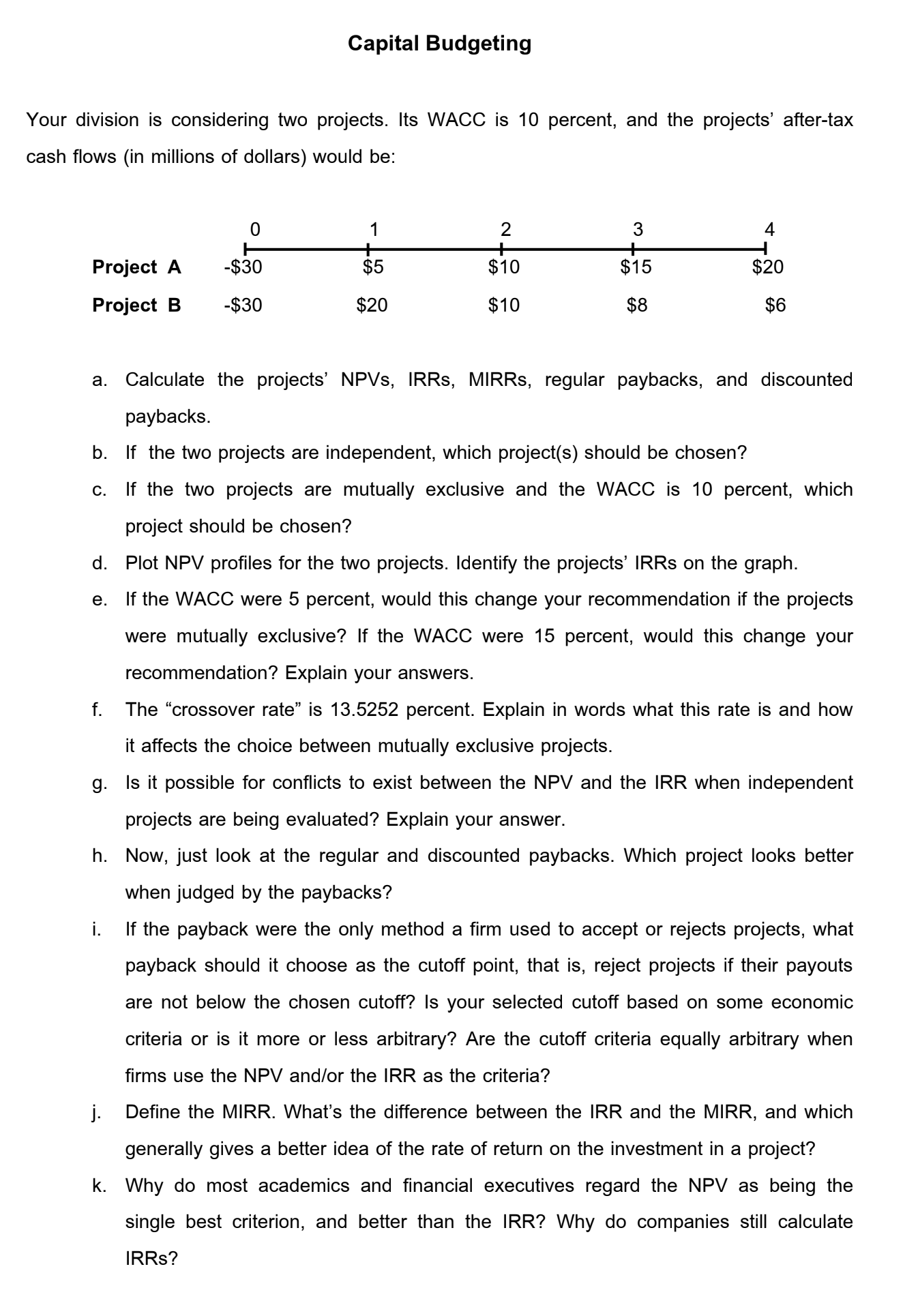

Capital Budgeting

Your division is considering two projects. Its WACC is percent, and the projects' aftertax

cash flows in millions of dollars would be:

a Calculate the projects' NPVs IRRs, MIRRs, regular paybacks, and discounted

paybacks.

b If the two projects are independent, which projects should be chosen?

c If the two projects are mutually exclusive and the WACC is percent, which

project should be chosen?

d Plot NPV profiles for the two projects. Identify the projects' IRRs on the graph.

e If the WACC were percent, would this change your recommendation if the projects

were mutually exclusive? If the WACC were percent, would this change your

recommendation? Explain your answers.

f The "crossover rate" is percent. Explain in words what this rate is and how

it affects the choice between mutually exclusive projects.

g Is it possible for conflicts to exist between the NPV and the IRR when independent

projects are being evaluated? Explain your answer.

h Now, just look at the regular and discounted paybacks. Which project looks better

when judged by the paybacks?

i If the payback were the only method a firm used to accept or rejects projects, what

payback should it choose as the cutoff point, that is reject projects if their payouts

are not below the chosen cutoff? Is your selected cutoff based on some economic

criteria or is it more or less arbitrary? Are the cutoff criteria equally arbitrary when

firms use the NPV andor the IRR as the criteria?

j Define the MIRR. What's the difference between the IRR and the MIRR, and which

generally gives a better idea of the rate of return on the investment in a project?

k Why do most academics and financial executives regard the NPV as being the

single best criterion, and better than the IRR? Why do companies still calculate

IRRs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started