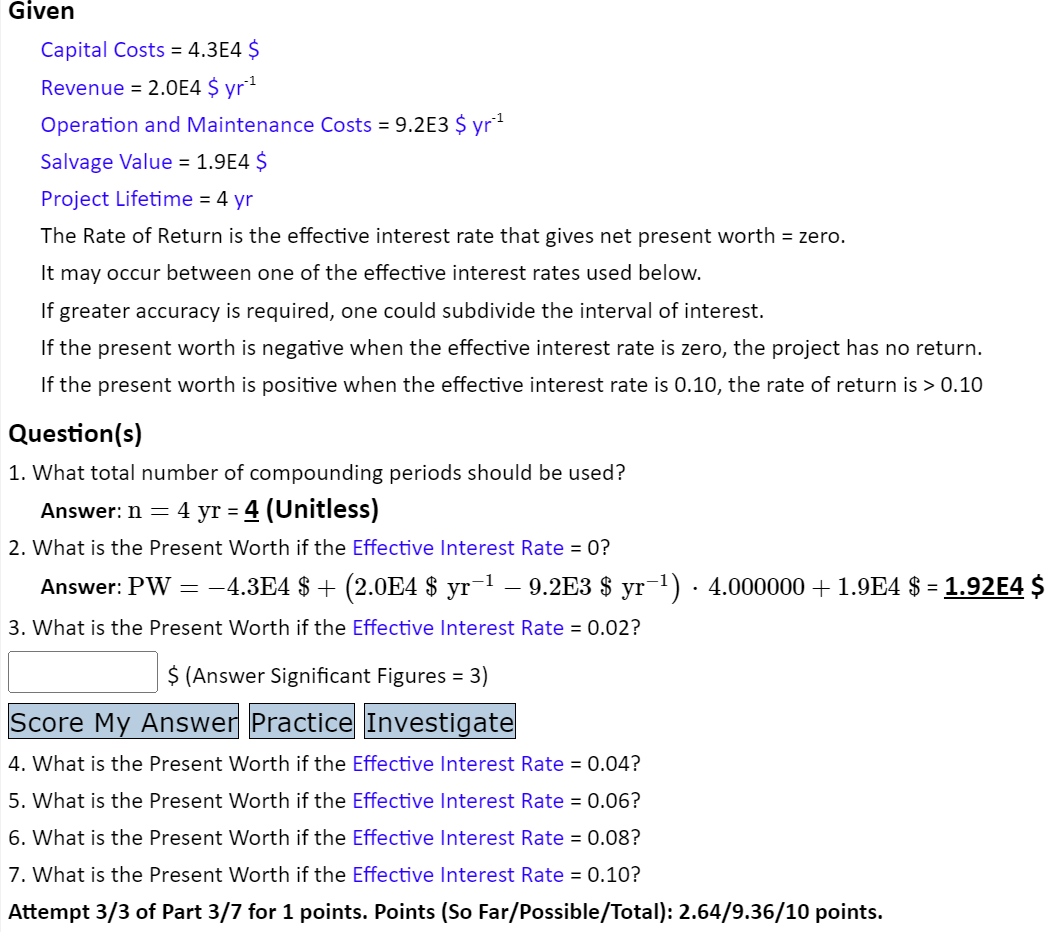

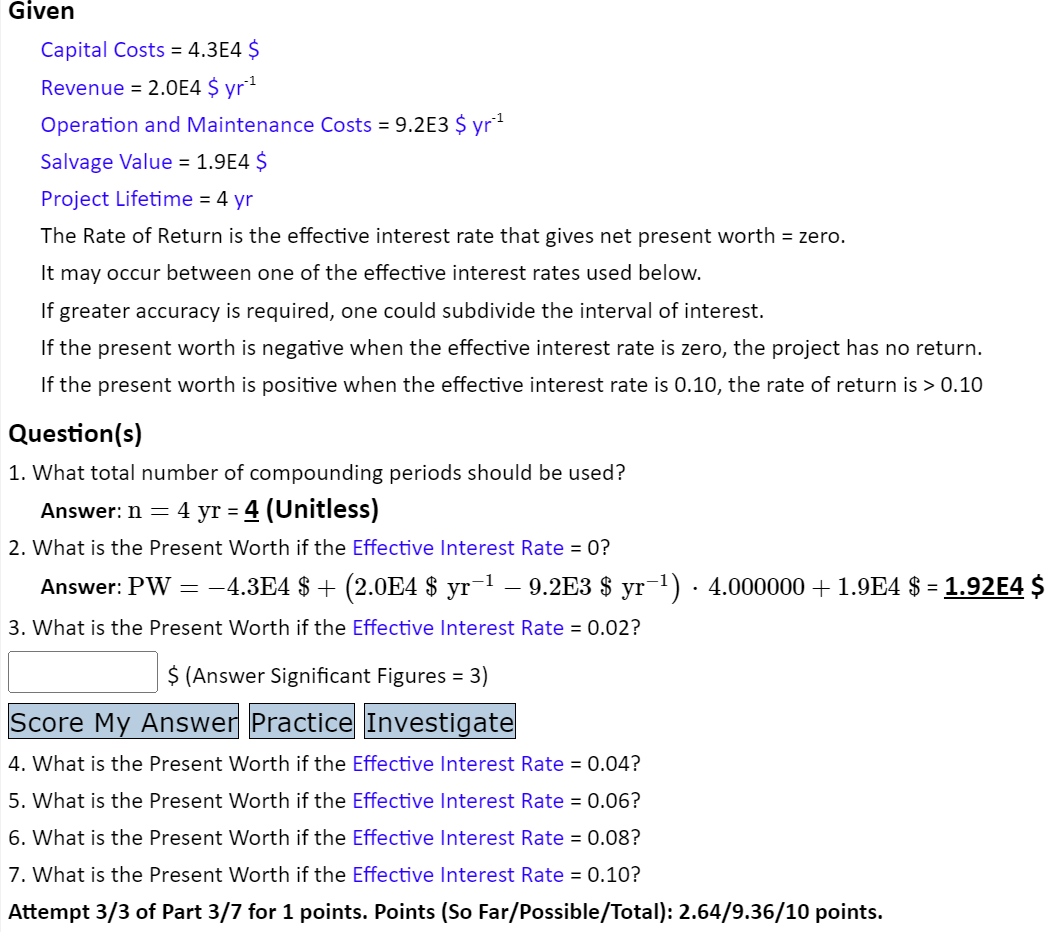

Capital Costs =4.3E4$ Revenue =2.0E4$yr1 Operation and Maintenance Costs =9.2E3$yr1 Salvage Value =1.9E4$ Project Lifetime =4yr The Rate of Return is the effective interest rate that gives net present worth = zero. It may occur between one of the effective interest rates used below. If greater accuracy is required, one could subdivide the interval of interest. If the present worth is negative when the effective interest rate is zero, the project has no return. If the present worth is positive when the effective interest rate is 0.10, the rate of return is >0.10 Question(s) 1. What total number of compounding periods should be used? Answer: n=4yr=4 (Unitless) 2. What is the Present Worth if the Effective Interest Rate =0 ? Answer: PW=4.3E4$+(2.0E4$yr19.2E3$yr1)4.000000+1.9E4$=1.92E4 \$ 3. What is the Present Worth if the Effective Interest Rate =0.02 ? $ (Answer Significant Figures = 3) 4. What is the Present Worth if the Effective Interest Rate =0.04 ? 5. What is the Present Worth if the Effective Interest Rate =0.06 ? 6. What is the Present Worth if the Effective Interest Rate =0.08 ? 7. What is the Present Worth if the Effective Interest Rate =0.10 ? Attempt 3/3 of Part 3/7 for 1 points. Points (So Far/Possible/Total): 2.64/9.36/10 points. Capital Costs =4.3E4$ Revenue =2.0E4$yr1 Operation and Maintenance Costs =9.2E3$yr1 Salvage Value =1.9E4$ Project Lifetime =4yr The Rate of Return is the effective interest rate that gives net present worth = zero. It may occur between one of the effective interest rates used below. If greater accuracy is required, one could subdivide the interval of interest. If the present worth is negative when the effective interest rate is zero, the project has no return. If the present worth is positive when the effective interest rate is 0.10, the rate of return is >0.10 Question(s) 1. What total number of compounding periods should be used? Answer: n=4yr=4 (Unitless) 2. What is the Present Worth if the Effective Interest Rate =0 ? Answer: PW=4.3E4$+(2.0E4$yr19.2E3$yr1)4.000000+1.9E4$=1.92E4 \$ 3. What is the Present Worth if the Effective Interest Rate =0.02 ? $ (Answer Significant Figures = 3) 4. What is the Present Worth if the Effective Interest Rate =0.04 ? 5. What is the Present Worth if the Effective Interest Rate =0.06 ? 6. What is the Present Worth if the Effective Interest Rate =0.08 ? 7. What is the Present Worth if the Effective Interest Rate =0.10 ? Attempt 3/3 of Part 3/7 for 1 points. Points (So Far/Possible/Total): 2.64/9.36/10 points