Answered step by step

Verified Expert Solution

Question

1 Approved Answer

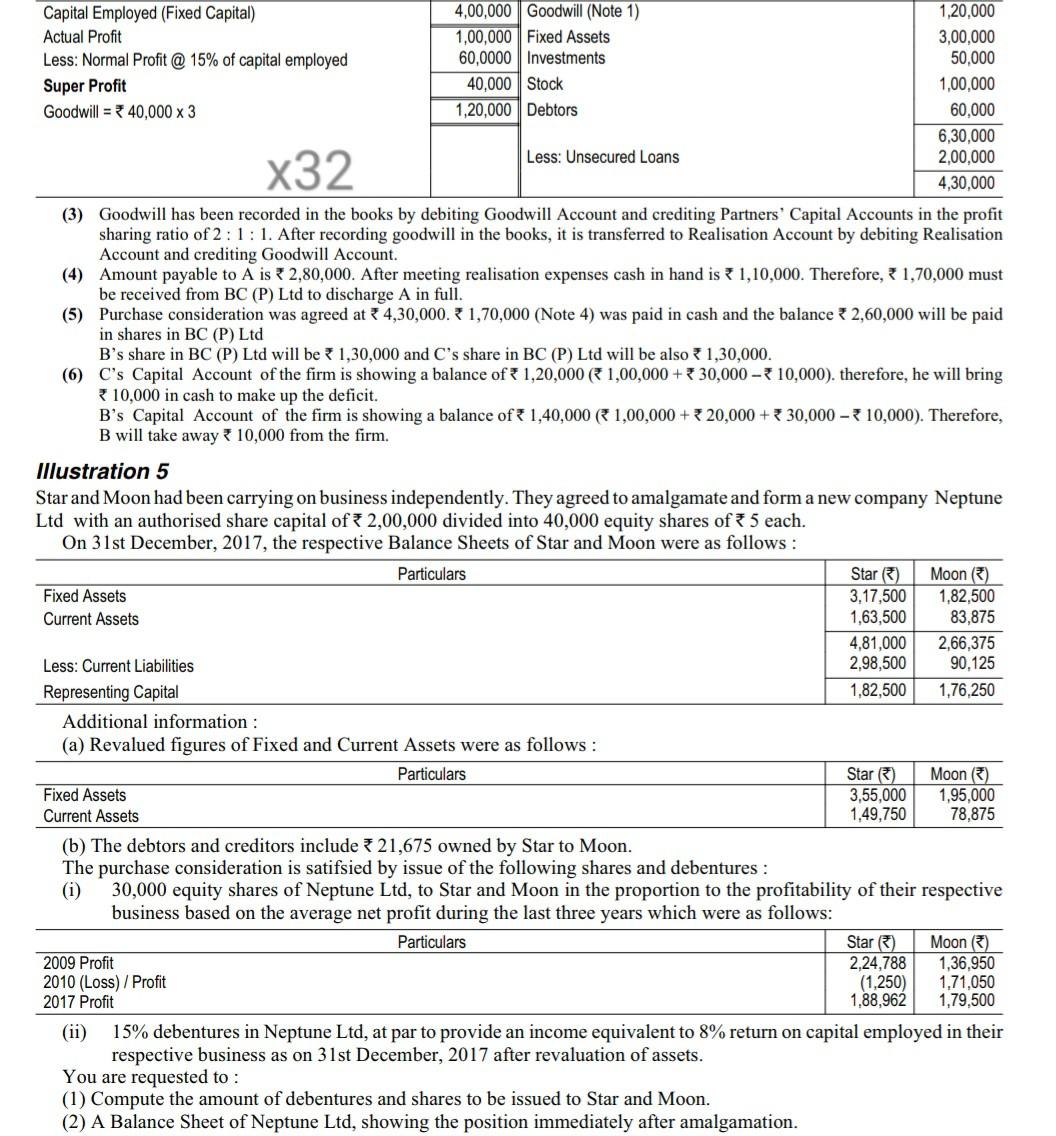

Capital Employed (Fixed Capital) Actual Profit Less: Normal Profit @ 15% of capital employed Super Profit Goodwill = 340,000 x 3 4,00,000 Goodwill (Note 1)

Capital Employed (Fixed Capital) Actual Profit Less: Normal Profit @ 15% of capital employed Super Profit Goodwill = 340,000 x 3 4,00,000 Goodwill (Note 1) 1,00,000 Fixed Assets 60,0000 Investments 40,000 Stock 1,20,000 Debtors 1,20,000 3,00.000 50,000 1,00,000 60,000 6,30,000 2,00,000 4,30,000 Less: Unsecured Loans x32 (3) Goodwill has been recorded in the books by debiting Goodwill Account and crediting Partners' Capital Accounts in the profit sharing ratio of 2:1:1. After recording goodwill in the books, it is transferred to Realisation Account by debiting Realisation Account and crediting Goodwill Account. (4) Amount payable to A is * 2,80,000. After meeting realisation expenses cash in hand is 1,10,000. Therefore, 1,70,000 must be received from BC (P) Ltd to discharge A in full. (5) Purchase consideration was agreed at 4,30,000. 1,70,000 (Note 4) was paid in cash and the balance * 2,60,000 will be paid in shares in BC (P) Ltd B's share in BC (P) Ltd will be 1,30,000 and C's share in BC (P) Ltd will be also 1,30,000. (6) C's Capital Account of the firm is showing a balance of 1,20,000 1,00,000 + 30,000 - 10,000). therefore, he will bring 10,000 in cash to make up the deficit. B's Capital Account of the firm is showing a balance of 1,40,000 1,00,000 + 20,000+ *30,000 - 10,000). Therefore, B will take away 10,000 from the firm. Illustration 5 Star and Moon had been carrying on business independently. They agreed to amalgamate and form a new company Neptune Ltd with an authorised share capital of 2,00,000 divided into 40,000 equity shares of 5 each. On 31st December, 2017, the respective Balance Sheets of Star and Moon were as follows: Particulars Star) Moon (3) Fixed Assets 3,17,500 1,82,500 Current Assets 1,63,500 83,875 4,81,000 2,66,375 Less: Current Liabilities 2,98,500 90.125 Representing Capital 1,82,500 1,76,250 Additional information: (a) Revalued figures of Fixed and Current Assets were as follows: Particulars Star) Moon) Fixed Assets 3,55,000 1,95,000 Current Assets 1,49,750 78,875 (b) The debtors and creditors include 21,675 owned by Star to Moon. The purchase consideration is satifsied by issue of the following shares and debentures : (i) 30,000 equity shares of Neptune Ltd, to Star and Moon in the proportion to the profitability of their respective business based on the average net profit during the last three years which were as follows: Particulars Star (5) Moon() 2009 Profit 2,24,788 1,36,950 2010 (Loss) / Profit (1,250) 1,71.050 2017 Profit 1,88,962 1,79,500 (ii) 15% debentures in Neptune Ltd, at par to provide an income equivalent to 8% return on capital employed in their respective business as on 31st December, 2017 after revaluation of assets. You are requested to: (1) Compute the amount of debentures and shares to be issued to Star and Moon. (2) A Balance Sheet of Neptune Ltd, showing the position immediately after amalgamation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started