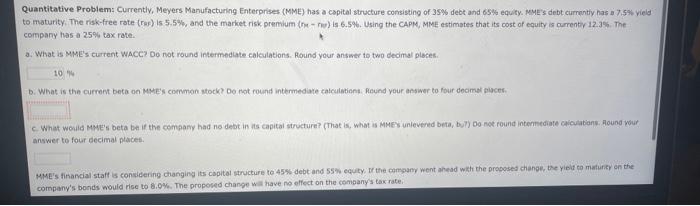

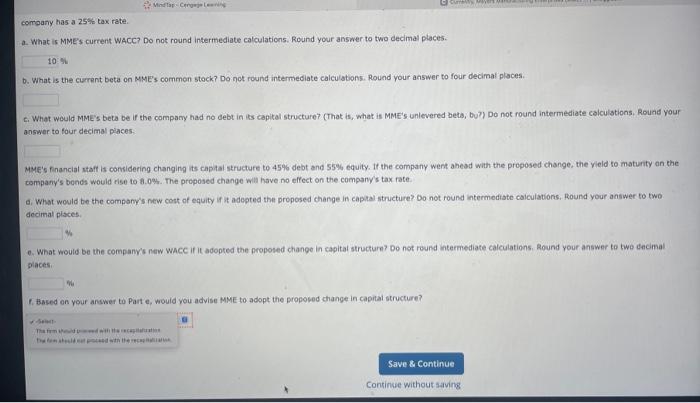

capital first as spontaneous credit, then of 195 , then other debt, and finally new common stock, Finuly, when a compary's stock is seling for a peice aiferent than its intrimic value, the firm's managers con adjust the firm's capital structure to take advantage of the maicpricing. Thus, the firm's managers take advantage of windows of opportunity: Quantitative Problem: Currentty, Meyers Manufacturing Enterprises (MME) has a capital structure consirting of 35% debt and 65% equity, MuE's debt currently has a 7.5% yield to maturity. The rakefree rate (hic) is 5.5%, and the market risk premium (he - he) is 6.5%. Using the CupM, MME estimstes that ite cost of equity is currenty 12.36. The company has a 25% tax rate. a. What is MME's current wMCCz Do not round intermedate calculations. Round your answer to two deciman places. b. Whot is the current beta on MMEY coenmon stock? Do not round intermesiate calculatens. Round your answer to four decimal placet. 5. What would MME's beta be if the company had no debt in its captal structure? (That is, what is Mue's unievered beta, bu'?) Do not round intermediate calculations. Round your answer to four decimal places, MME's financial staff is considering changing its capital structure to 45% debt and 55% equ ty. If the cimpany went ahaad wath the propeted change, the yeld to maturity on the coenpany's bonds would rise to 8.0%. The proposed change will have no effect on the companys tax rate. d. What wauld be the company's new cost of equi ty if it adopted the proposed change in cagital structure? Do not round istermedste calculations. Round your antwer to two decimal places e. What would be the company's new Wace if it adopted the proposed change in capitai structure? Do not rovind intermesute caliutations. Mound your answer to twe decimal piaces. f. Based on your answer to Part e, would you advise MYE to acopt the peoposed change in capital structure? to maturity. The risk-free rate (raf) is 5.5%, and the market risk, premium (rmn0) is 6.5%. Using the CAPM, MME estimates that its cost of equity is currenter 12.35. The company has a 25% tax rote. a. What is MME's curtent WACC? Do not round intermedate calculations. Round your answer to two dedimal ploces. b. What is the current beta on MYE's corrmon stock? Do rot round intermediate calculations. fleund your assiver to four decimel bisces. answer to four decimal places. company's bonds would rise to 8.0%. The proposed change wi h have ne elfect on the combany's tax rate: a. What is MME's current WACC? Do not round intermediate calculations. Round your answer to two decimal places. b. What is the curent beta on MME's commen stock? Do not round intermediate calculations. Round your answer to four decimal places. 5. What weuld MME's beta be if the company had no debt in its capital structure? (That is, what is MME's unlevered bets, bu?) Do not round intermediate calculations. Round your answer to four decimal piaces. MME's financial staff is considering changing its capital structure to 45% debt and 55% equity. If the company went anead with the proposed change, the vield to maturity an the company's bends would rise to f.0%. The proposed change will have no effect on the company's tax rate. a. What would be the compony's new cost of equity if it adepted the proposed change in capital structure? Do not round intermediate calculations, Round your answer to two decimal places, 0. What would be the company's new Wacc if it adopted the proposed change in capital structurn? Do not reund intermediate calculations, Round your answer te twe dacimal placets. 1. Based on your answer to Part e, would you advise MME to adopt the proposed change in capital structure