Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Gain Tax - Question 3 Question 1 (30 marks) Read the case study below and answer the questions that follow: Abel died on 31

Capital Gain Tax - Question 3

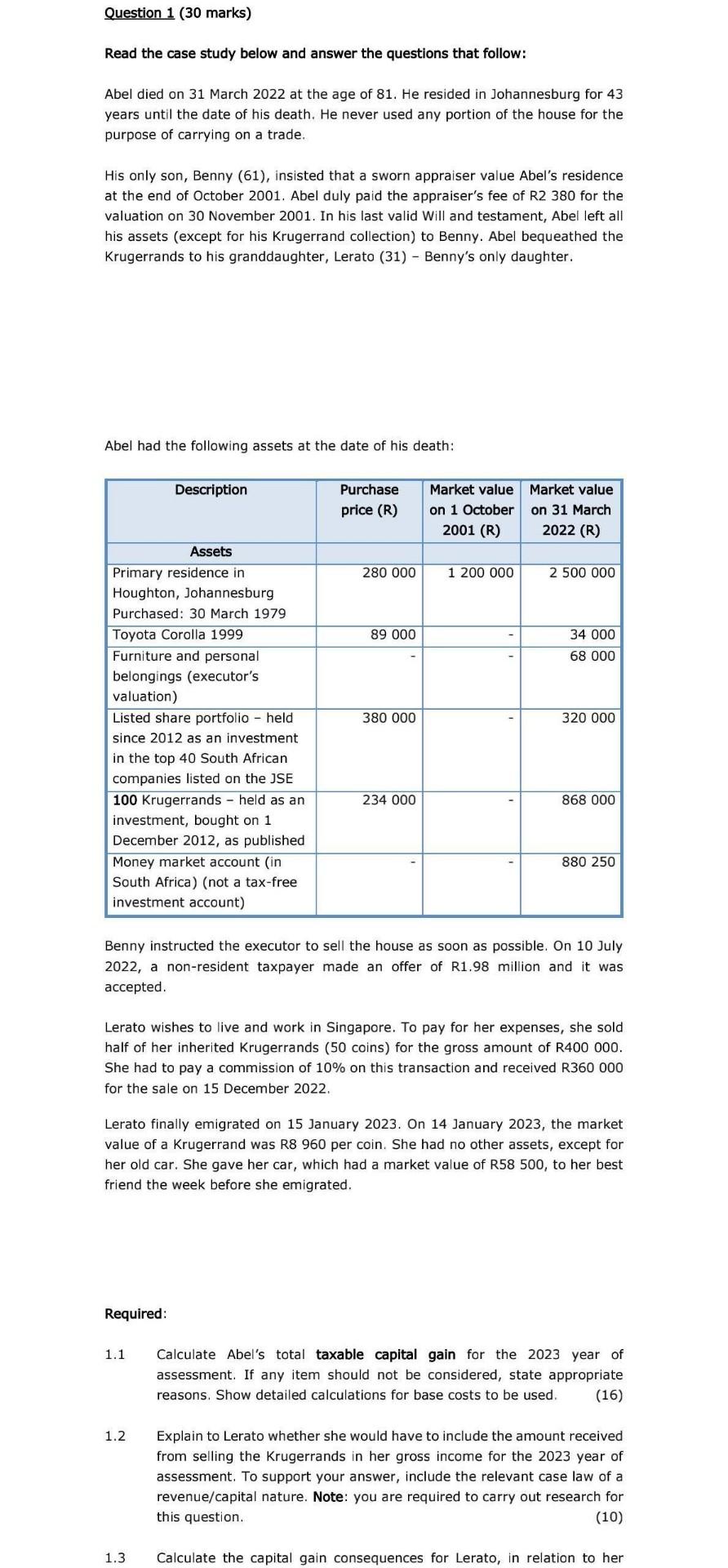

Question 1 (30 marks) Read the case study below and answer the questions that follow: Abel died on 31 March 2022 at the age of 81 . He resided in Johannesburg for 43 years until the date of his death. He never used any portion of the house for the purpose of carrying on a trade. His only son, Benny (61), insisted that a sworn appraiser value Abel's residence at the end of October 2001. Abel duly paid the appraiser's fee of R2 380 for the valuation on 30 November 2001. In his last valid Will and testament, Abel left all his assets (except for his Krugerrand collection) to Benny. Abel bequeathed the Krugerrands to his granddaughter, Lerato (31) - Benny's only daughter. Abel had the following assets at the date of his death: Benny instructed the executor to sell the house as soon as possible. On 10 July 2022, a non-resident taxpayer made an offer of R1.98 million and it was accepted. Lerato wishes to live and work in Singapore. To pay for her expenses, she sold half of her inherited Krugerrands (50 coins) for the gross amount of R400 000 . She had to pay a commission of \10 on this transaction and received R360 000 for the sale on 15 December 2022. Lerato finally emigrated on 15 January 2023. On 14 January 2023, the market value of a Krugerrand was R8 960 per coin. She had no other assets, except for her old car. She gave her car, which had a market value of R58 500, to her best friend the week before she emigrated. Required: 1.1 Calculate Abel's total taxable capital gain for the 2023 year of assessment. If any item should not be considered, state appropriate reasons. Show detailed calculations for base costs to be used. (16) 1.2 Explain to Lerato whether she would have to include the amount received from selling the Krugerrands in her gross income for the 2023 year of assessment. To support your answer, include the relevant case law of a revenue/capital nature. Note: you are required to carry out research for thisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started