Answered step by step

Verified Expert Solution

Question

1 Approved Answer

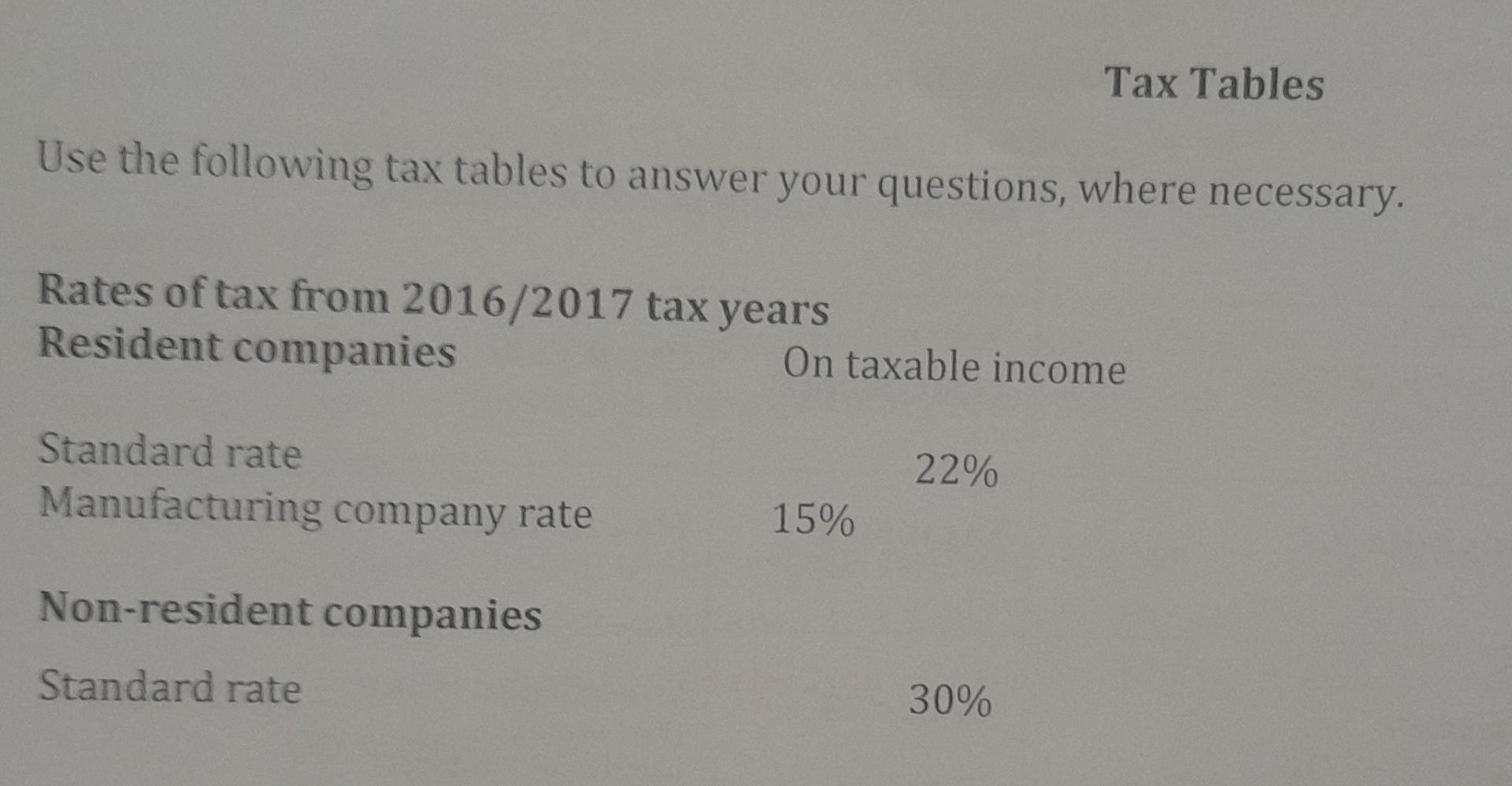

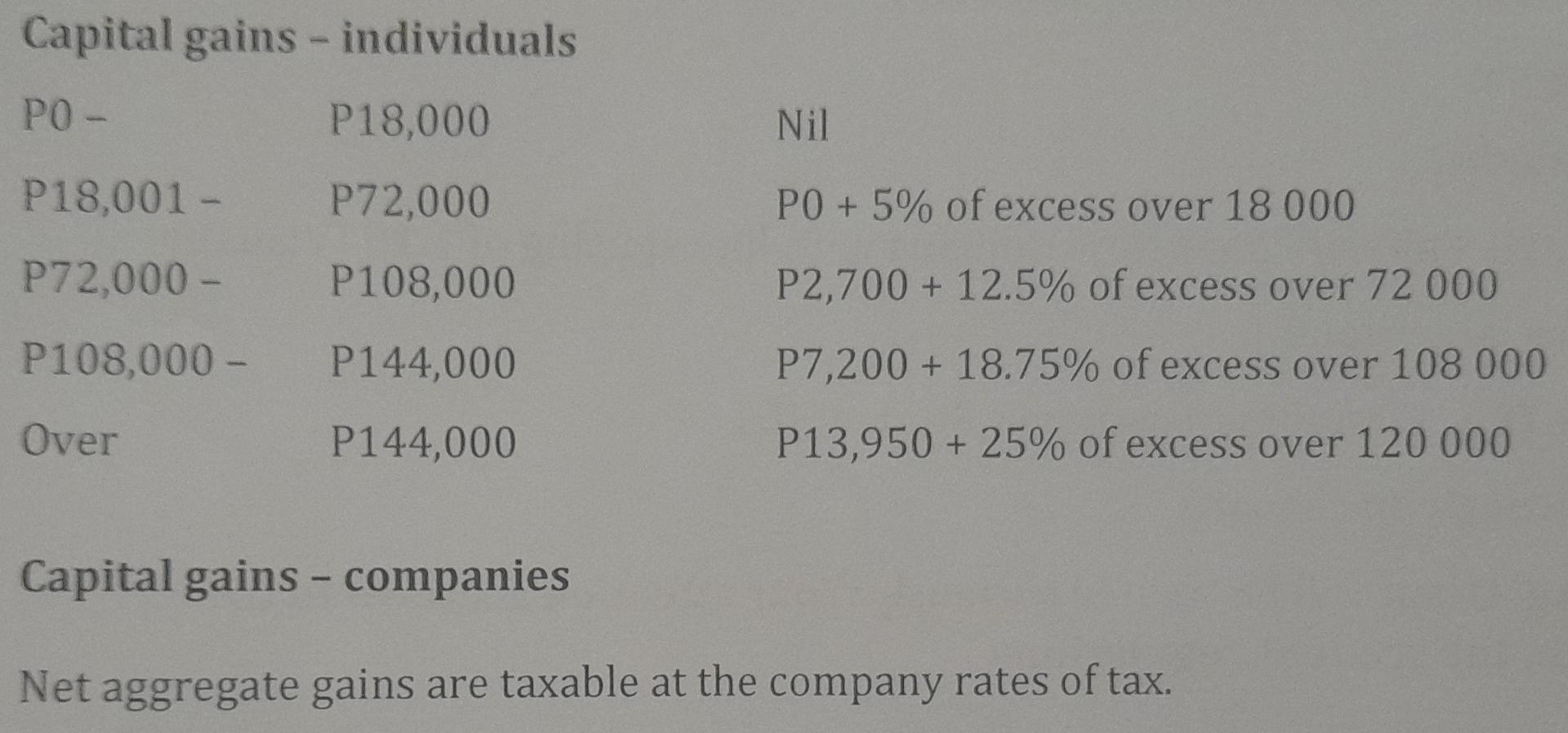

Capital gains - companies Net aggregate gains are taxable at the company rates of tax. Tax on Foreign dividend Basis of valuation of benefits Individuals'

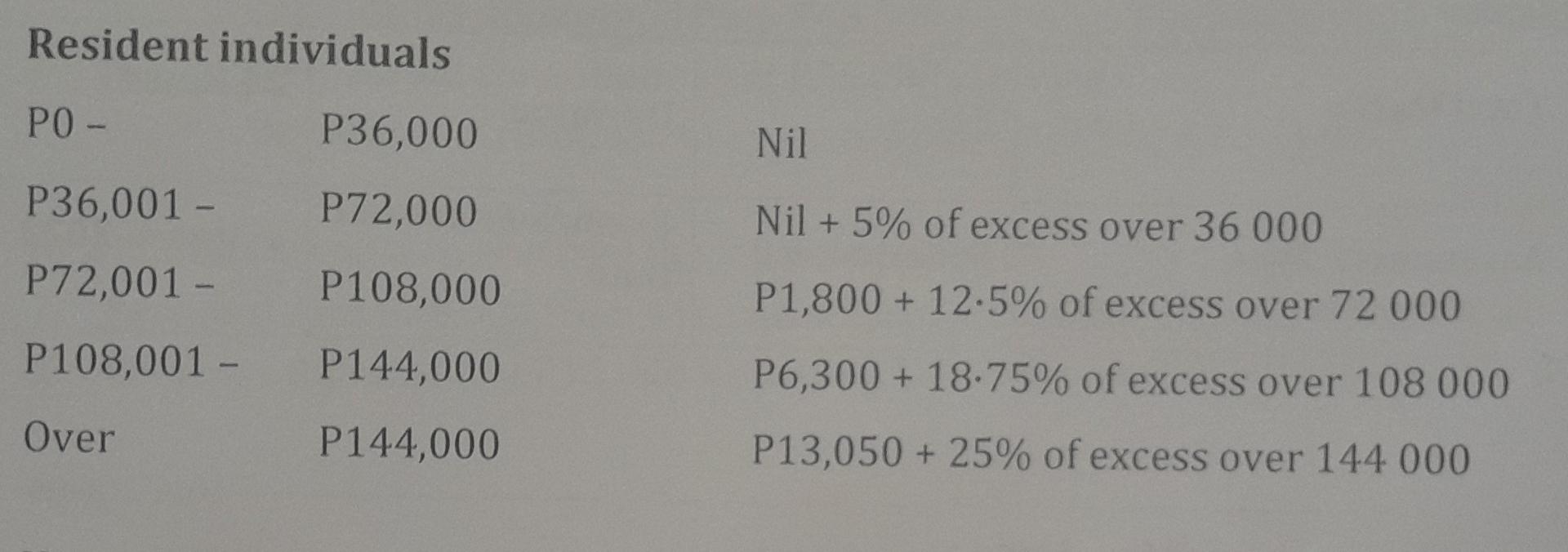

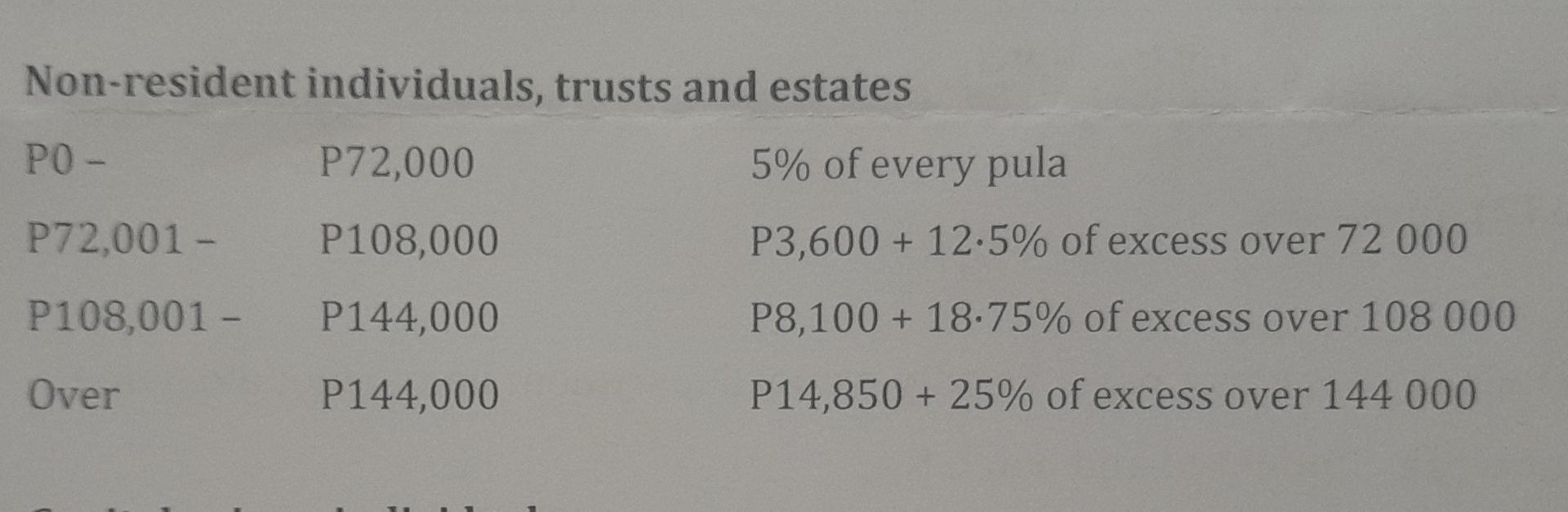

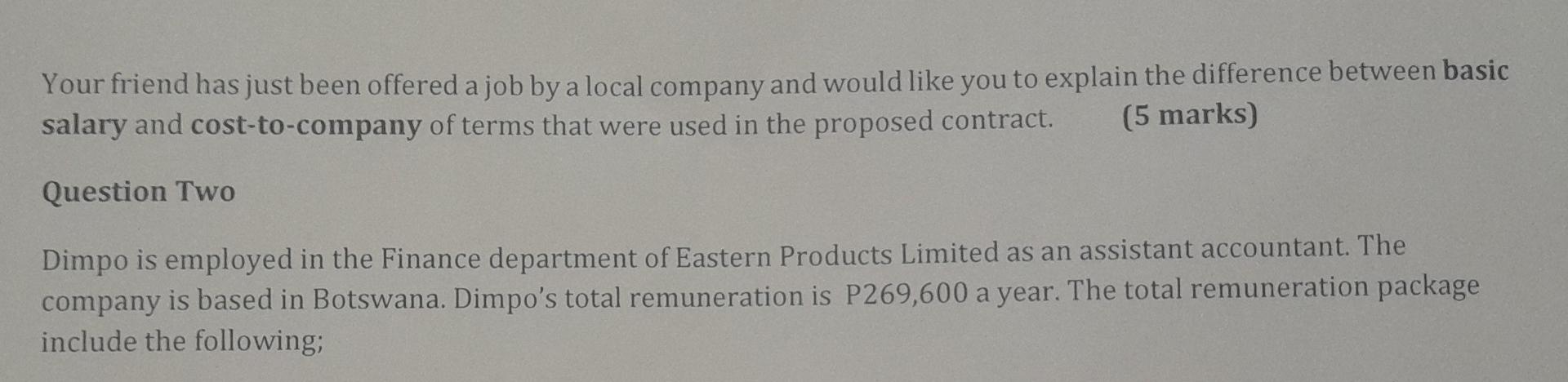

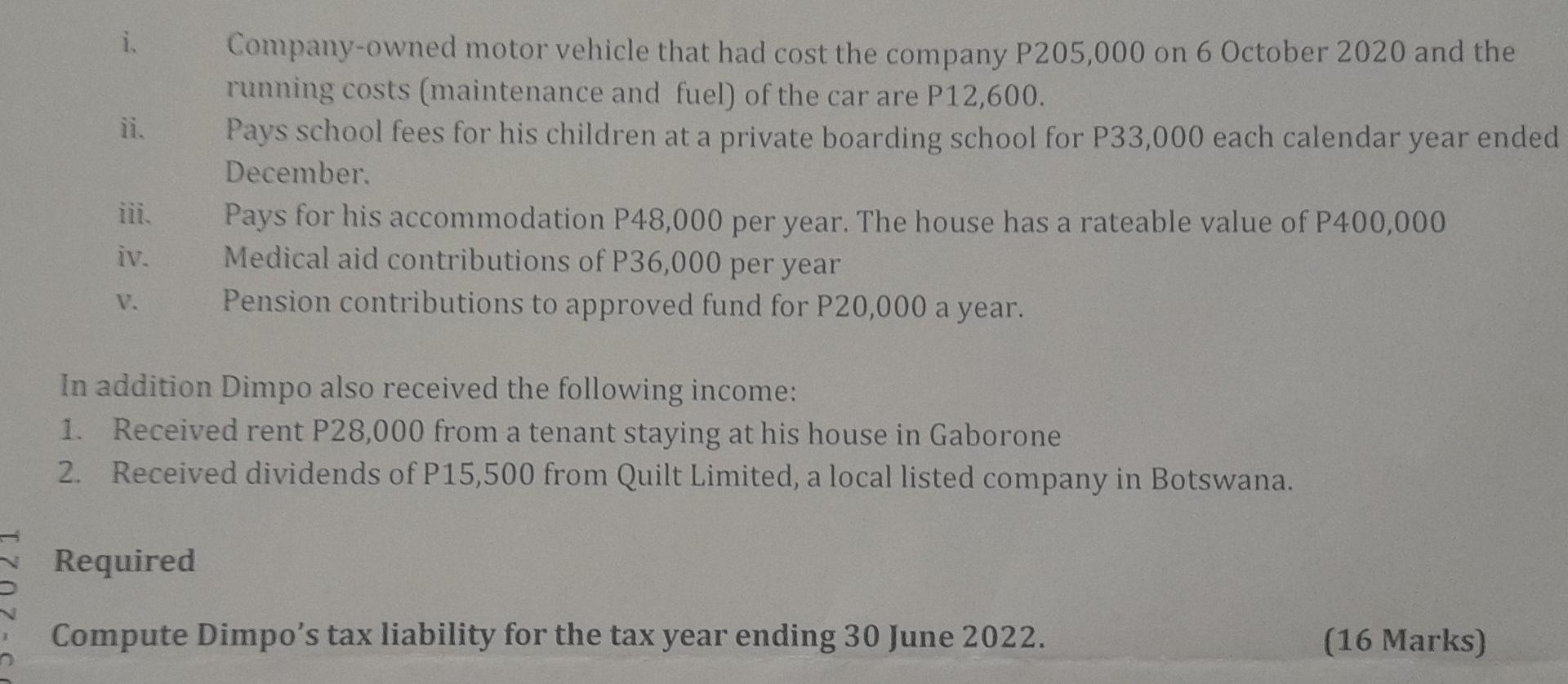

Capital gains - companies Net aggregate gains are taxable at the company rates of tax. Tax on Foreign dividend Basis of valuation of benefits Individuals' vehicle benefit Use the following tax tables to answer your questions, where necessary. Resident individuals P0P36,001P72,001P108,001-OverP36,000P72,000P108,000P144,000P144,000NilNil+5%ofexcessover36000P1,800+125%ofexcessover72000P6,300+1875%ofexcessover108000P13,050+25%ofexcessover144000 Non-resident individuals, trusts and estates P0P72,001P108,001OverP72,000P108,000P144,000P144,0005%ofeverypulaP3,600+125%ofexcessover72000P8,100+1875%ofexcessover108000P14,850+25%ofexcessover144000 Your friend has just been offered a job by a local company and would like you to explain the difference between basic salary and cost-to-company of terms that were used in the proposed contract. (5 marks) Question Two Dimpo is employed in the Finance department of Eastern Products Limited as an assistant accountant. The company is based in Botswana. Dimpo's total remuneration is P269,600 a year. The total remuneration package include the following; i. Company-owned motor vehicle that had cost the company P205,000 on 6 October 2020 and the running costs (maintenance and fuel) of the car are P12,600. ii. Pays school fees for his children at a private boarding school for P33,000 each calendar year ended December. iii. Pays for his accommodation P48,000 per year. The house has a rateable value of P400,000 iv. Medical aid contributions of P36,000 per year v. Pension contributions to approved fund for P20,000 a year. In addition Dimpo also received the following income: 1. Received rent P28,000 from a tenant staying at his house in Gaborone 2. Received dividends of P15,500 from Quilt Limited, a local listed company in Botswana. Required Compute Dimpo's tax liability for the tax year ending 30 June 2022. (16 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started