Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Capital Investments Analysis St. Francis Hospital is considering several capital investment projects that you must analyze. There are three major investment proposals, as described below.

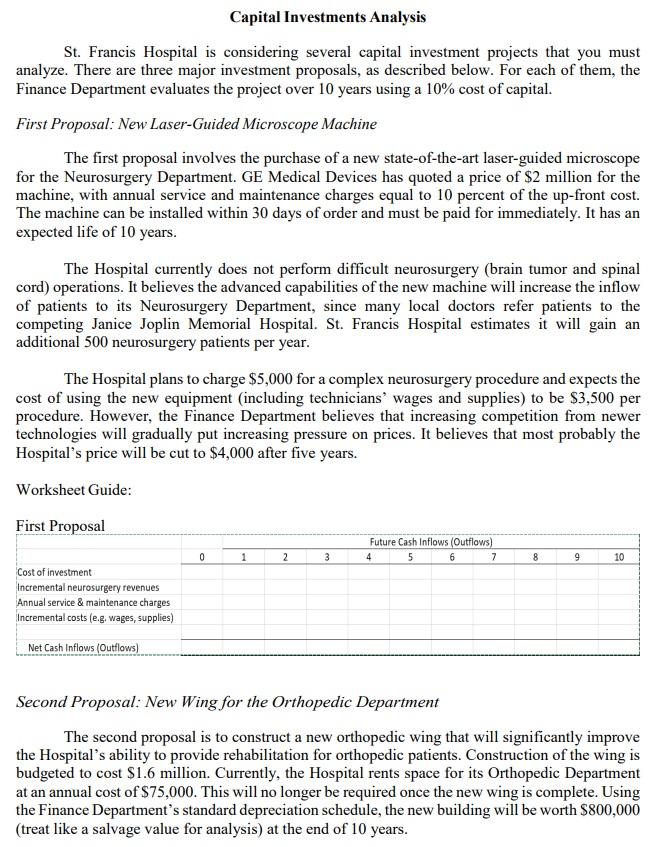

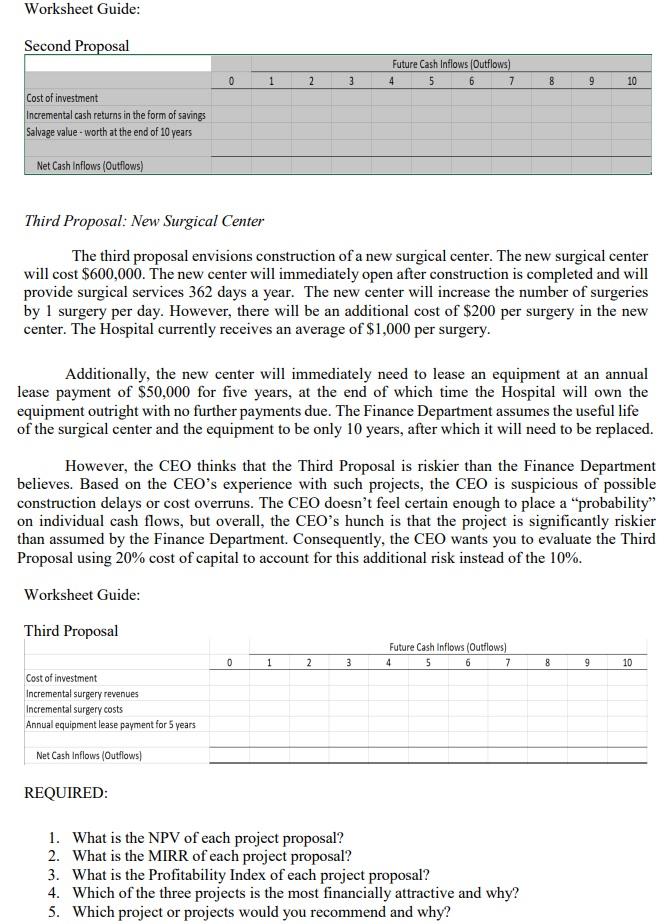

Capital Investments Analysis St. Francis Hospital is considering several capital investment projects that you must analyze. There are three major investment proposals, as described below. For each of them, the Finance Department evaluates the project over 10 years using a 10% cost of capital. First Proposal: New Laser-Guided Microscope Machine The first proposal involves the purchase of a new state-of-the-art laser-guided microscope for the Neurosurgery Department. GE Medical Devices has quoted a price of $2 million for the machine, with annual service and maintenance charges equal to 10 percent of the up-front cost. The machine can be installed within 30 days of order and must be paid for immediately. It has an expected life of 10 years. The Hospital currently does not perform difficult neurosurgery (brain tumor and spinal cord) operations. It believes the advanced capabilities of the new machine will increase the inflow of patients to its Neurosurgery Department, since many local doctors refer patients to the competing Janice Joplin Memorial Hospital. St. Francis Hospital estimates it will gain an additional 500 neurosurgery patients per year. The Hospital plans to charge $5,000 for a complex neurosurgery procedure and expects the cost of using the new equipment (including technicians' wages and supplies) to be $3,500 per procedure. However, the Finance Department believes that increasing competition from newer technologies will gradually put increasing pressure on prices. It believes that most probably the Hospital's price will be cut to $4,000 after five years. Worksheet Guide: Second Proposal: New Wing for the Orthopedic Department The second proposal is to construct a new orthopedic wing that will significantly improve the Hospital's ability to provide rehabilitation for orthopedic patients. Construction of the wing is budgeted to cost $1.6 million. Currently, the Hospital rents space for its Orthopedic Department at an annual cost of $75,000. This will no longer be required once the new wing is complete. Using the Finance Department's standard depreciation schedule, the new building will be worth $800,000 (treat like a salvage value for analysis) at the end of 10 years. Worksheet Guide: Sarand Dmennal Third Proposal: New Surgical Center The third proposal envisions construction of a new surgical center. The new surgical center will cost $600,000. The new center will immediately open after construction is completed and will provide surgical services 362 days a year. The new center will increase the number of surgeries by 1 surgery per day. However, there will be an additional cost of $200 per surgery in the new center. The Hospital currently receives an average of $1,000 per surgery. Additionally, the new center will immediately need to lease an equipment at an annual lease payment of $50,000 for five years, at the end of which time the Hospital will own the equipment outright with no further payments due. The Finance Department assumes the useful life of the surgical center and the equipment to be only 10 years, after which it will need to be replaced. However, the CEO thinks that the Third Proposal is riskier than the Finance Department believes. Based on the CEO's experience with such projects, the CEO is suspicious of possible construction delays or cost overruns. The CEO doesn't feel certain enough to place a "probability" on individual cash flows, but overall, the CEO's hunch is that the project is significantly riskier than assumed by the Finance Department. Consequently, the CEO wants you to evaluate the Third Proposal using 20% cost of capital to account for this additional risk instead of the 10%. Worksheet Guide: REQUIRED: 1. What is the NPV of each project proposal? 2. What is the MIRR of each project proposal? 3. What is the Profitability Index of each project proposal? 4. Which of the three projects is the most financially attractive and why? 5. Which project or projects would you recommend and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started