Question

Capital mandates In this section, we discuss the mandates that we will use to compute the total investment cost (TIC), or I for short. Recall

Capital mandates

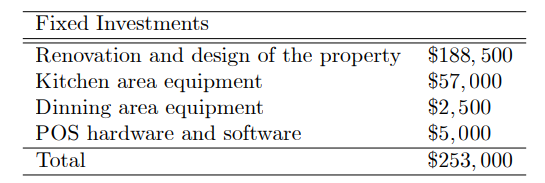

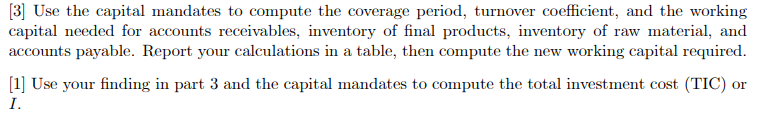

In this section, we discuss the mandates that we will use to compute the total investment cost (TIC), or I for short. Recall that TIC or= I = F C + NWC; where FC is fixed capital, which is the sum of xed investments and pre-production capital costs, and NW C is the net working capital. 2 Fixed Capital consists of xed investments and pre-production capital costs. The xed investments in our project consist of 4 categories: renovation and design of the property, kitchen area equipment, dinning are equipment and a retail point of sale (POS) system. The renovation and design of the property cost a minimum of CAD$85 per square foot and a maximum of CAD$250 per square foot (Build it, 2017). The geometric mean is $CAD145 per square foot approximately; that is, p 85 250 $145: Total renovation and design of the property is, therefore, $145 per square foot 1300 feet = $188; 500: The projections of all other items in xed investments are explained in Appendix A. Below is a summary of the xed investments costs

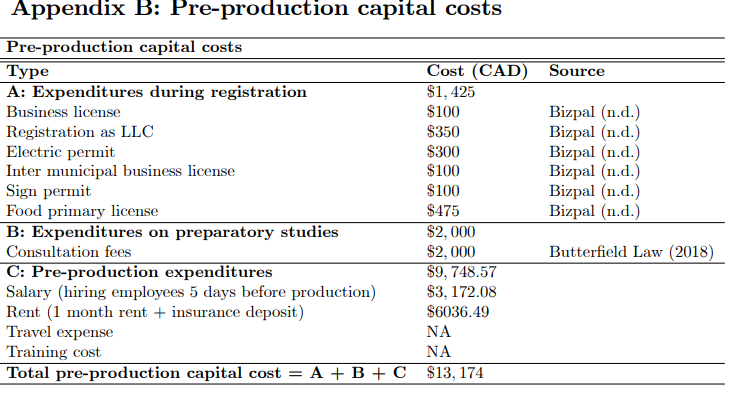

Pre-production capital costs include expenditures during registration and formation, expenditure for preparatory studies, and pre-production expenditures. For opening a small burger restaurant in BC, we need several licences and registration fees, e.g., Limited Liability Company (LLC) registration, electric permit, municipal business licence, and other pre-production expenses. The total of all these expenditures is CAD$13; 174 (see Appendix B).

As for the estimation of the net working capital, we entertain the following assumptions. In the retail business, the main payment methods are cash, debit and credit cards. According to a recent report issued by the Bank of Canada (Henry et al., 2018), approximately 67% of the total value of transactions are paid by credit card in BC. We will use this estimate to project the percentage of total revenue in eq. (7) that is paid by credit cards. This value is to be taken as the annual cost of operations in the net working capital calculations. Credit card payment creates accounts receivables, which cover the gap between selling products and receiving funds from the bank. The coverage period for credit card payments varies between two or three business days. In this project, we will assume 3 days as the coverage period for account receivables. We will entertain the assumption that the fast-food industry follows the make-to-order production strategy. This implies that companies in this industry do not hold inventory and, therefore, no capital is needed to nance inventory of nal products. As for the inventory of raw materials, because most of the food items are perishable goods, we will use a 1 week coverage period for the inventory of raw materials. The annual cost of raw materials is assumed to be 30% of total revenue. Finally, we assume 1 month coverage period for accounts payable.

Questions:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started