Answered step by step

Verified Expert Solution

Question

1 Approved Answer

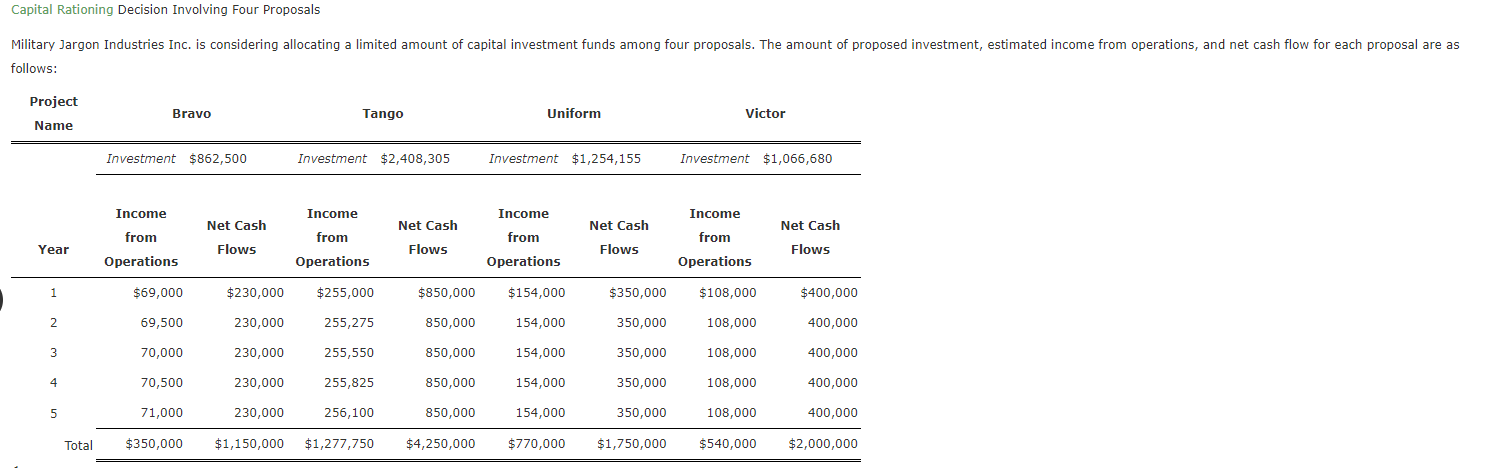

Capital Rationing Decision Involving Four Proposals follows: 1. Present Value of $1 at Compound Interest begin{tabular}{cccccc} hline Year & 6% & 10% & 12% &

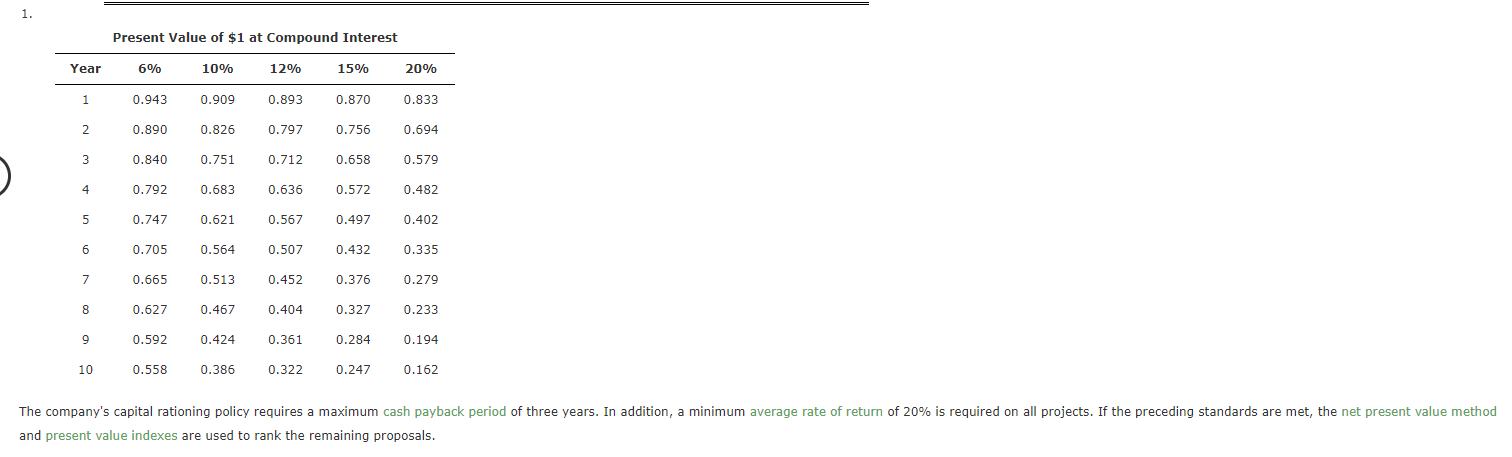

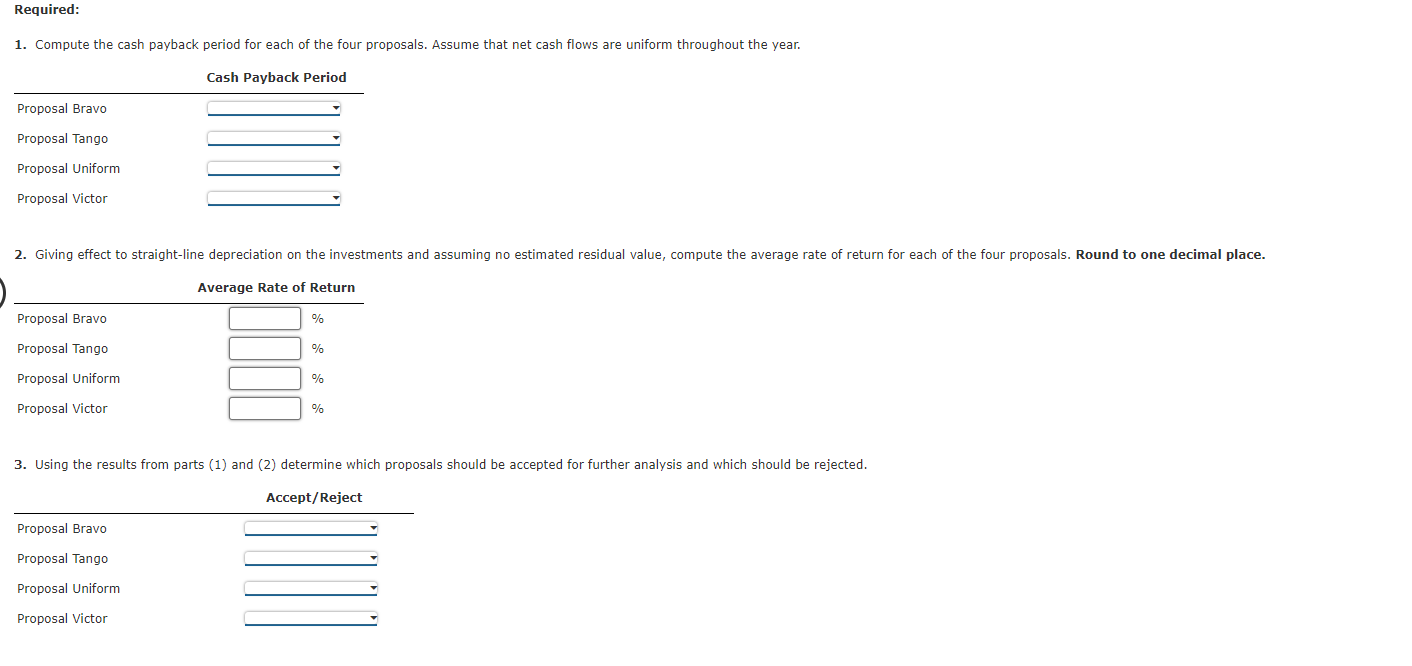

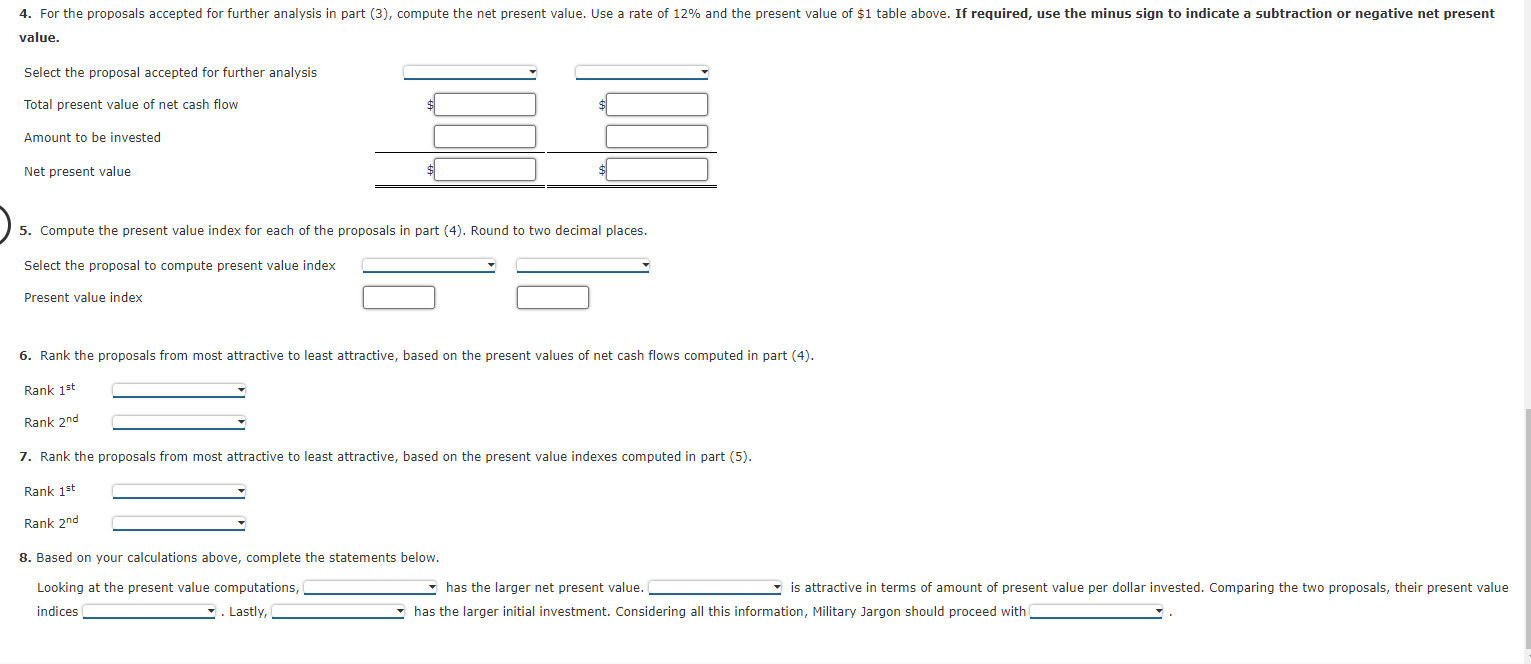

Capital Rationing Decision Involving Four Proposals follows: 1. Present Value of $1 at Compound Interest \begin{tabular}{cccccc} \hline Year & 6% & 10% & 12% & 15% & 20% \\ \hline 1 & 0.943 & 0.909 & 0.893 & 0.870 & 0.833 \\ 2 & 0.890 & 0.826 & 0.797 & 0.756 & 0.694 \\ 3 & 0.840 & 0.751 & 0.712 & 0.658 & 0.579 \\ 4 & 0.792 & 0.683 & 0.636 & 0.572 & 0.482 \\ 5 & 0.747 & 0.621 & 0.567 & 0.497 & 0.402 \\ 6 & 0.705 & 0.564 & 0.507 & 0.432 & 0.335 \\ 7 & 0.665 & 0.513 & 0.452 & 0.376 & 0.279 \\ 8 & 0.627 & 0.467 & 0.404 & 0.327 & 0.233 \\ 9 & 0.592 & 0.424 & 0.361 & 0.284 & 0.194 \\ 10 & 0.558 & 0.386 & 0.322 & 0.247 & 0.162 \end{tabular} and present value indexes are used to rank the remaining proposals. 1. Compute the cash payback period for each of the four proposals. Assume that net cash flows are uniform throughout the year. value. 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places. 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). Rank 1st Rank 2nd 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Rank 1st Rank 2nd 8. Based on your calculations above, complete the statements below. Looking at the present value computations, has the larger net present value. is attractive in terms of amount of present value per dollar invested. Comparing the two proposals, their present value indices . Lastly, has the larger initial investment. Considering all this information, Military Jargon should proceed with

Capital Rationing Decision Involving Four Proposals follows: 1. Present Value of $1 at Compound Interest \begin{tabular}{cccccc} \hline Year & 6% & 10% & 12% & 15% & 20% \\ \hline 1 & 0.943 & 0.909 & 0.893 & 0.870 & 0.833 \\ 2 & 0.890 & 0.826 & 0.797 & 0.756 & 0.694 \\ 3 & 0.840 & 0.751 & 0.712 & 0.658 & 0.579 \\ 4 & 0.792 & 0.683 & 0.636 & 0.572 & 0.482 \\ 5 & 0.747 & 0.621 & 0.567 & 0.497 & 0.402 \\ 6 & 0.705 & 0.564 & 0.507 & 0.432 & 0.335 \\ 7 & 0.665 & 0.513 & 0.452 & 0.376 & 0.279 \\ 8 & 0.627 & 0.467 & 0.404 & 0.327 & 0.233 \\ 9 & 0.592 & 0.424 & 0.361 & 0.284 & 0.194 \\ 10 & 0.558 & 0.386 & 0.322 & 0.247 & 0.162 \end{tabular} and present value indexes are used to rank the remaining proposals. 1. Compute the cash payback period for each of the four proposals. Assume that net cash flows are uniform throughout the year. value. 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places. 6. Rank the proposals from most attractive to least attractive, based on the present values of net cash flows computed in part (4). Rank 1st Rank 2nd 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5). Rank 1st Rank 2nd 8. Based on your calculations above, complete the statements below. Looking at the present value computations, has the larger net present value. is attractive in terms of amount of present value per dollar invested. Comparing the two proposals, their present value indices . Lastly, has the larger initial investment. Considering all this information, Military Jargon should proceed with Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started