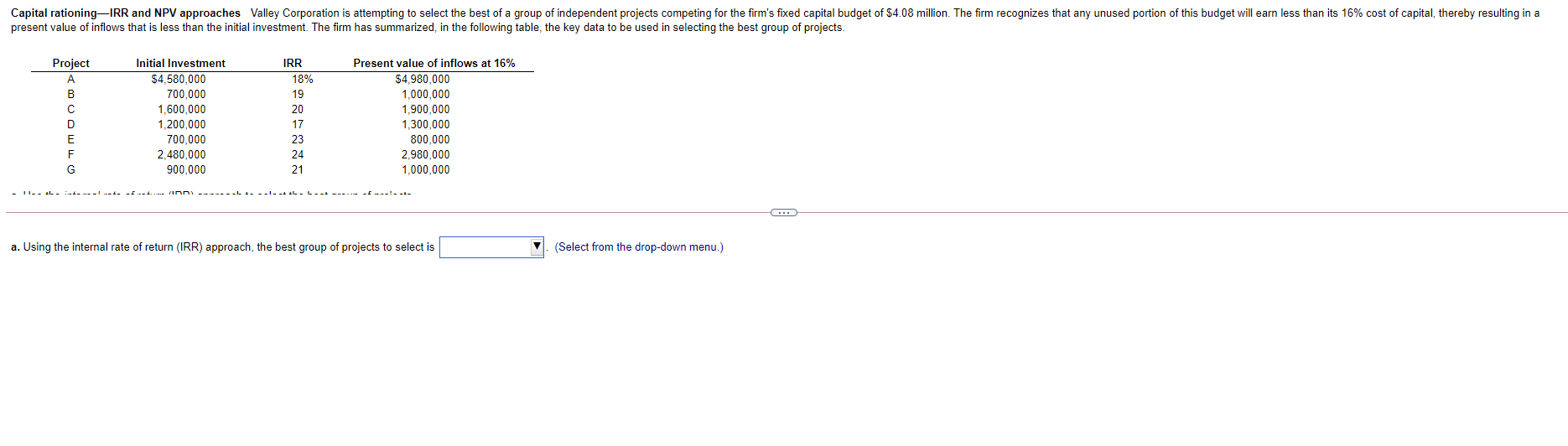

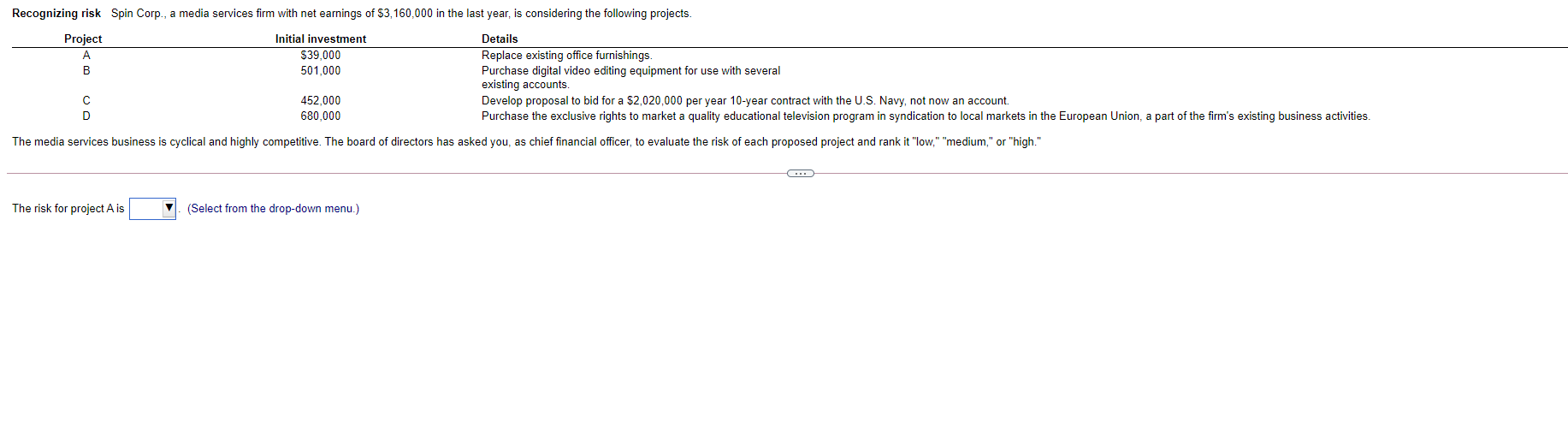

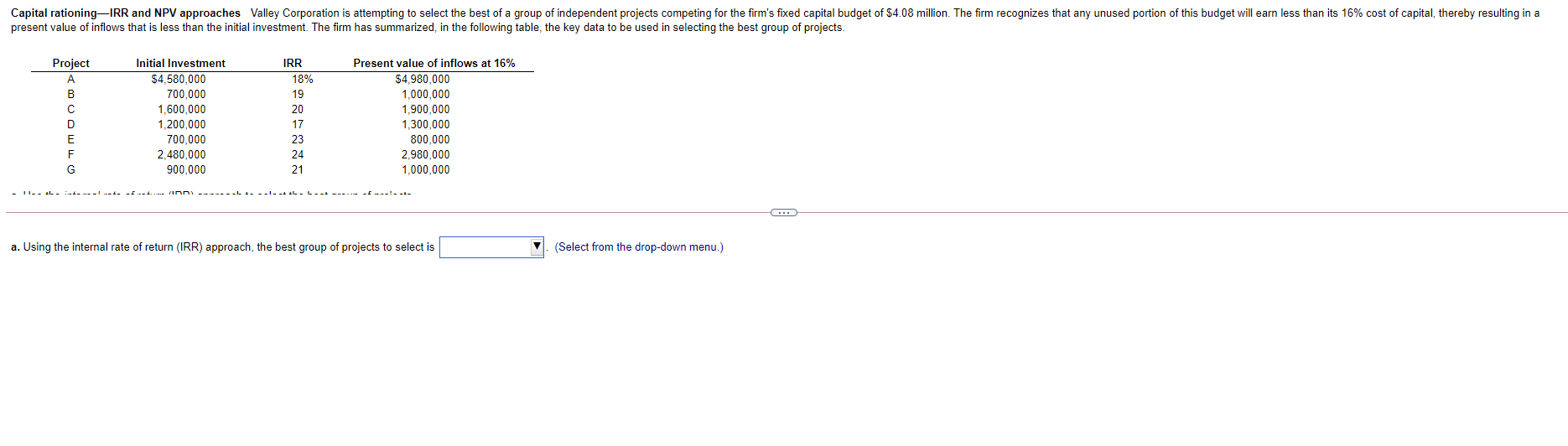

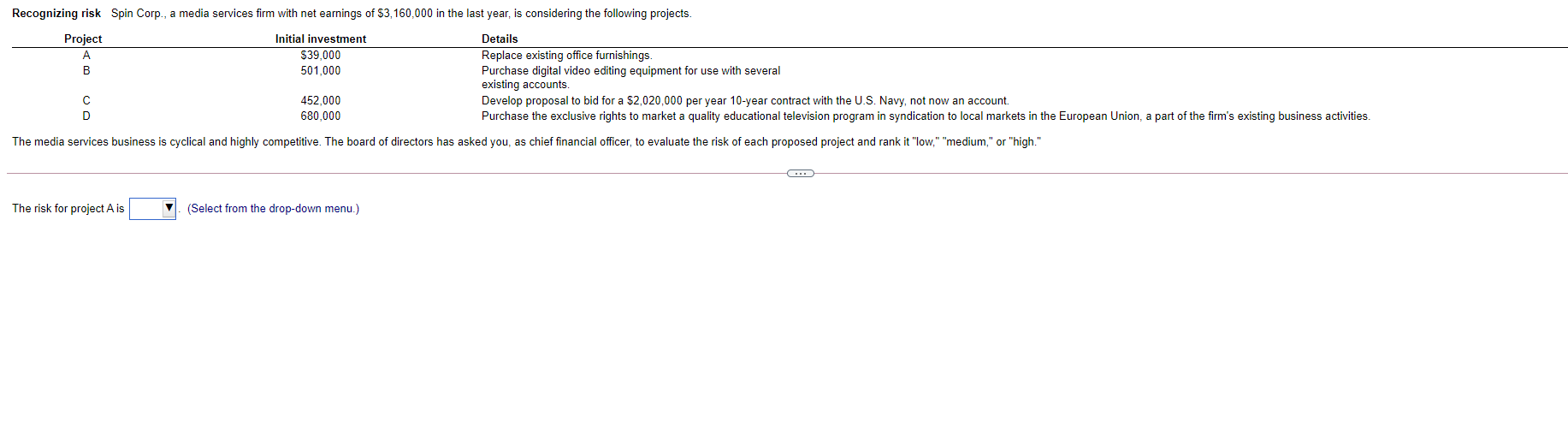

Capital rationing-IRR and NPV approaches Valley Corporation is attempting to select the best of a group of independent projects competing for the firm's fixed capital budget of $4.08 million. The firm recognizes that any unused portion of this budget will earn less than its 16% cost of capital, thereby resulting in a present value of inflows that is less than the initial investment. The firm has summarized in the following table, the key data to be used in selecting the best group of projects. Project B D E F G Initial Investment $4,580,000 700,000 1,600,000 1,200,000 700.000 2.480,000 900,000 IRR 18% 19 20 17 23 24 21 Present value of inflows at 16% $4.980.000 1,000,000 1,900,000 1,300,000 800,000 2,980,000 1.000.000 a. Using the internal rate of return (IRR) approach, the best group of projects to select is (Select from the drop-down menu.) Recognizing risk Spin Corp., a media services firm with net earnings of $3,160,000 in the last year, is considering the following projects. Project Initial investment Details A $39,000 Replace existing office furnishings. B 501,000 Purchase digital video editing equipment for use with several existing accounts. C 452,000 Develop proposal to bid for a $2,020,000 per year 10-year contract with the U.S. Navy, not now an account. D 680,000 Purchase the exclusive rights to market a quality educational television program in syndication to local markets in the European Union, a part of the firm's existing business activities. The media services business is cyclical and highly competitive. The board of directors has asked you, as chief financial officer, to evaluate the risk of each proposed project and rank it "low," "medium," or "high." G. The risk for project A is (Select from the drop-down menu.) Capital rationing-IRR and NPV approaches Valley Corporation is attempting to select the best of a group of independent projects competing for the firm's fixed capital budget of $4.08 million. The firm recognizes that any unused portion of this budget will earn less than its 16% cost of capital, thereby resulting in a present value of inflows that is less than the initial investment. The firm has summarized in the following table, the key data to be used in selecting the best group of projects. Project B D E F G Initial Investment $4,580,000 700,000 1,600,000 1,200,000 700.000 2.480,000 900,000 IRR 18% 19 20 17 23 24 21 Present value of inflows at 16% $4.980.000 1,000,000 1,900,000 1,300,000 800,000 2,980,000 1.000.000 a. Using the internal rate of return (IRR) approach, the best group of projects to select is (Select from the drop-down menu.) Recognizing risk Spin Corp., a media services firm with net earnings of $3,160,000 in the last year, is considering the following projects. Project Initial investment Details A $39,000 Replace existing office furnishings. B 501,000 Purchase digital video editing equipment for use with several existing accounts. C 452,000 Develop proposal to bid for a $2,020,000 per year 10-year contract with the U.S. Navy, not now an account. D 680,000 Purchase the exclusive rights to market a quality educational television program in syndication to local markets in the European Union, a part of the firm's existing business activities. The media services business is cyclical and highly competitive. The board of directors has asked you, as chief financial officer, to evaluate the risk of each proposed project and rank it "low," "medium," or "high." G. The risk for project A is (Select from the drop-down menu.)