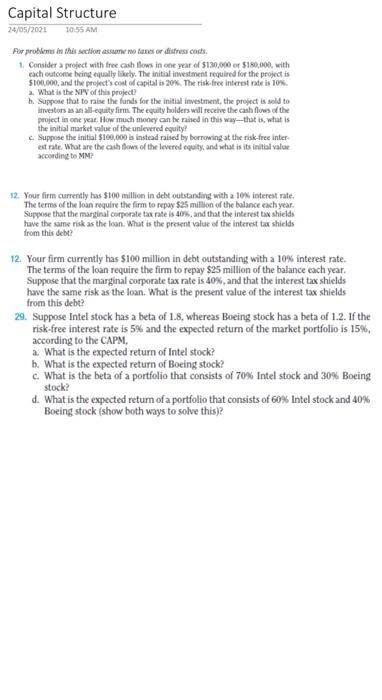

Capital Structure 24/05/2021 10:55 AM Por problems in the section assume no fases or distress costs. 1. Consider a project with free cash flows in one year of $130,000 or $180,000, with each outcome being equally likely. The initial investment required for the project is $100,000, and the project's cost of capital is 20% The risk free interest rate is 10% 2. What is the NPV of this project! Suppose that to raise the funds for the initial investment, the project is sold to itvestors as an all-equity firm. The equity holders will receive the cash flow of the project in one year. How much money can be raised in this way--that is what is the initial market value of the unlevered equity? Suppose the initial $100,000 is instead raised by borrowing at the risk-free inter est rate. What are the cash flow of the levered equity, and what is its initial valor according to MM 12. Your firm currently has $100 million in debt outstanding with a 10% interest rate. The terms of the loan require the firm to repay $25 million of the balance each year. Suppose that the marginal corporate tax rate is 40%, and that the interest tax shields have the same risk as the loan. What is the present value of the interest tax shields from this debt? 12. Your firm currently has $100 million in debt outstanding with a 10% interest rate. The terms of the loan require the firm to repay $25 million of the balance each year. Suppose that the marginal corporate tax rate is 40%, and that the interest tax shields have the same risk as the loan. What is the present value of the interest tax shields from this debt? 29. Suppose Intel stock has a beta of 1.8, whereas Boeing stock has a beta of 1.2. If the risk-free interest rate is 5% and the expected return of the market portfolio is 15%, according to the CAPM a. What is the expected return of Intel stock? b. What is the expected return of Boeing stock? c. What is the beta of a portfolio that consists of 70% Intel stock and 30% Boeing stock? d. What is the expected return of a portfolio that consists of 60% Intel stock and 40% Boeing stock (show both ways to solve this)