Capital University recently purchased new computing equipment for its business school on March 1, 2020. Use the following information to determine dollar amount that

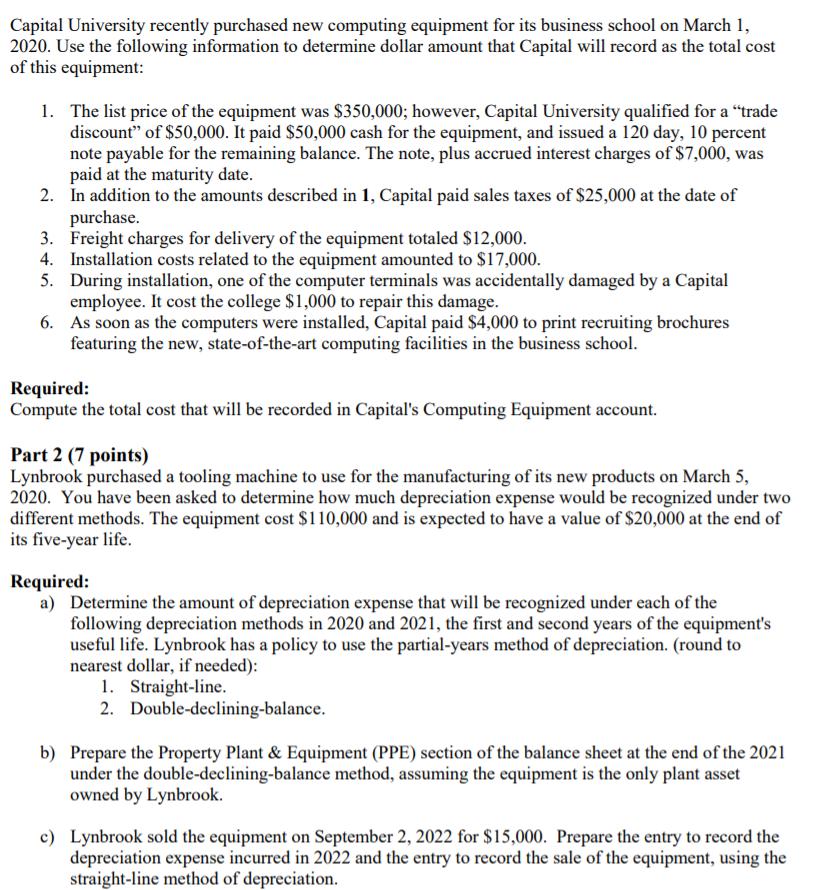

Capital University recently purchased new computing equipment for its business school on March 1, 2020. Use the following information to determine dollar amount that Capital will record as the total cost of this equipment: 1. The list price of the equipment was $350,000; however, Capital University qualified for a "trade discount" of $50,000. It paid $50,000 cash for the equipment, and issued a 120 day, 10 percent note payable for the remaining balance. The note, plus accrued interest charges of $7,000, was paid at the maturity date. 2. In addition to the amounts described in 1, Capital paid sales taxes of $25,000 at the date of purchase. 3. Freight charges for delivery of the equipment totaled $12,000. 4. Installation costs related to the equipment amounted to $17,000. 5. During installation, one of the computer terminals was accidentally damaged by a Capital employee. It cost the college $1,000 to repair this damage. 6. As soon as the computers were installed, Capital paid $4,000 to print recruiting brochures featuring the new, state-of-the-art computing facilities in the business school. Required: Compute the total cost that will be recorded in Capital's Computing Equipment account. Part 2 (7 points) Lynbrook purchased a tooling machine to use for the manufacturing of its new products on March 5, 2020. You have been asked to determine how much depreciation expense would be recognized under two different methods. The equipment cost $110,000 and is expected to have a value of $20,000 at the end of its five-year life. Required: a) Determine the amount of depreciation expense that will be recognized under each of the following depreciation methods in 2020 and 2021, the first and second years of the equipment's useful life. Lynbrook has a policy to use the partial-years method of depreciation. (round to nearest dollar, if needed): 1. Straight-line. 2. Double-declining-balance. b) Prepare the Property Plant & Equipment (PPE) section of the balance sheet at the end of the 2021 under the double-declining-balance method, assuming the equipment is the only plant asset owned by Lynbrook. c) Lynbrook sold the equipment on September 2, 2022 for $15,000. Prepare the entry to record the depreciation expense incurred in 2022 and the entry to record the sale of the equipment, using the straight-line method of depreciation.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Total cost that will recorded in Capitals Computing Equipment account 354000 List pric...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started