Question

Capital versus Revenue Expenditures On January 1, 2014, Jose Company purchased a building for $213,000 and a delivery truck for $18,000. The following expenditures have

Capital versus Revenue Expenditures

On January 1, 2014, Jose Company purchased a building for $213,000 and a delivery truck for $18,000. The following expenditures have been incurred during 2016:

The building was painted at a cost of $5,500.

To prevent leaking, new windows were installed in the building at a cost of $9,900.

To improve production, a new conveyor system was installed at a cost of $41,800.

The delivery truck was repainted with a new company logo at a cost of $1,000.

To allow better handling of large loads, a hydraulic lift system was installed on the truck at a cost of $5,200.

The truck's engine was overhauled at a cost of $3,900.

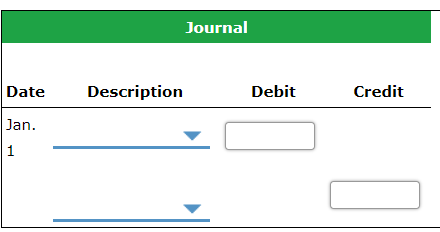

1. Prepare the journal entry to capitalize the conveyor system. How does this entry affect the accounting equation?

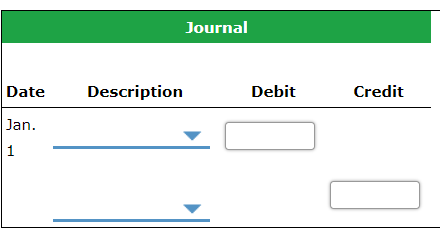

2. Prepare the journal entry to capitalize the hydraulic lift. How does this entry affect the accounting equation?

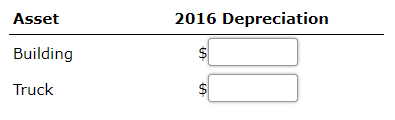

3. Determine the amount of depreciation for the year 2016. The company uses the straight-line method and depreciates the building over 25 years and the truck over six years. Assume zero residual value for all assets. Round your intermediate calculations and answers to the nearest whole dollar.

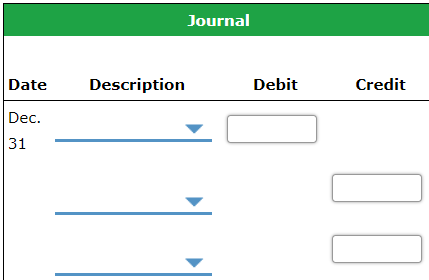

4. Prepare the journal entry to record depreciation: How does this entry affect the accounting equation?

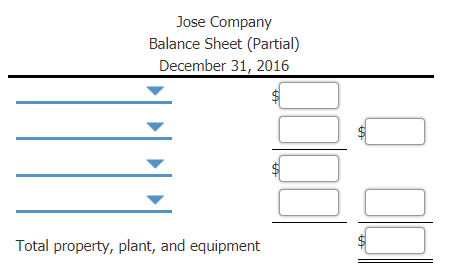

5. Prepare a partial Balance Sheet to show how would the assets appear December 31, 2016

Its not too much work, please finish all if you choose to answer. thanks

Journal Date Description Debit Credit JanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started