Question

Capital Weightings and WACC Calculation The market values of KOs common stock, preferred stock, and debt are $211,296 million, $101 million, and $44,910 million. Question

Capital Weightings and WACC Calculation

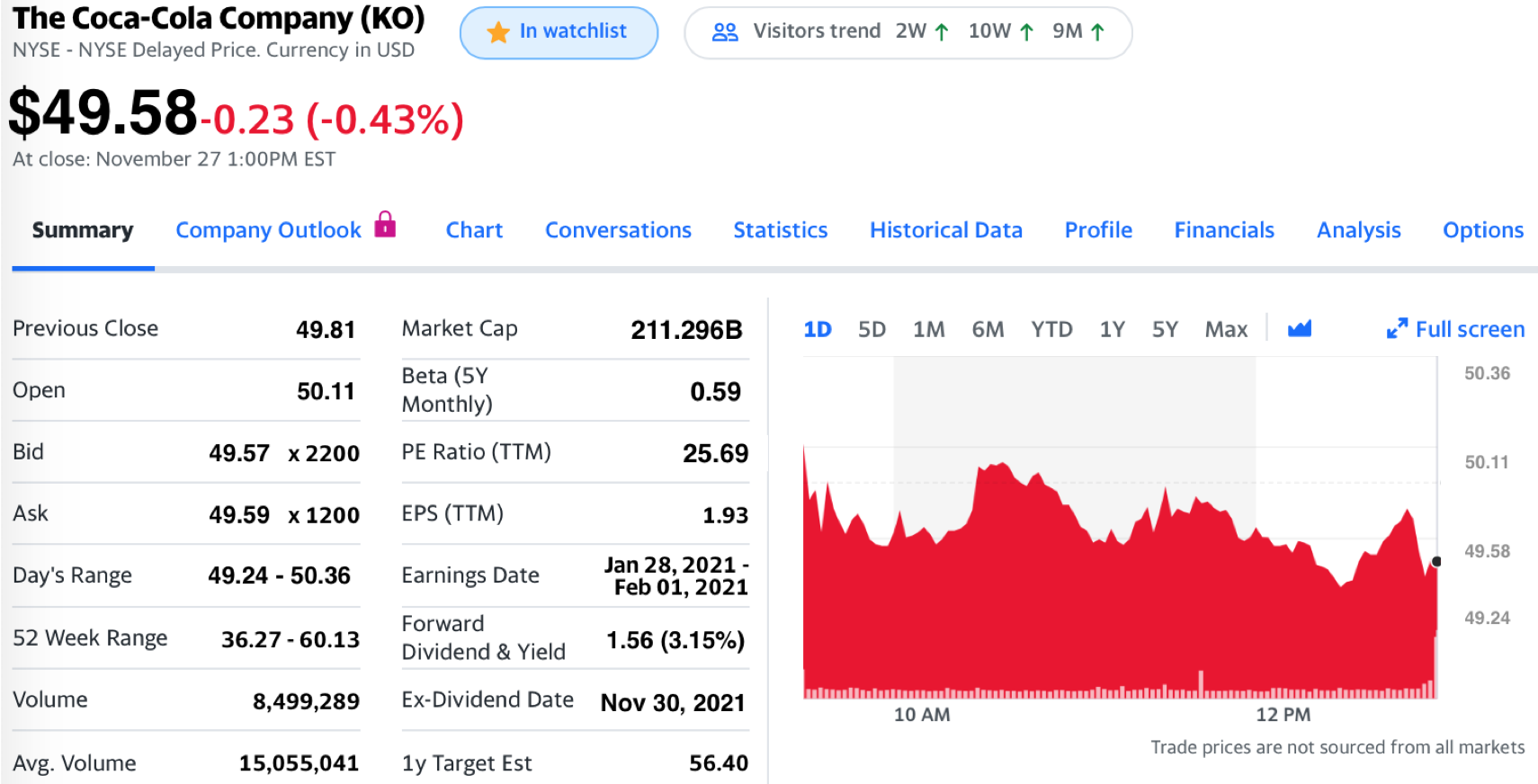

The market values of KOs common stock, preferred stock, and debt are $211,296 million, $101 million, and $44,910 million.

Question 5) KOs common equity weighting is ______________%

KOs preferred equity weighting is ______________%

KOs debt weighting is ______________%

Calculate Coca-Colas weighted average cost of capital (WACC) using the information you have collected thus far. Use of the cost of common equity capital determined using the constant dividend growth model (CDGM) approach in your calculation of WACC.

Question 6) KOs WACC is _____________________%

Final NPV Calculation

Calculate the NPV of the Coca-Cola YOU! project using the provided cash flows and the WACC you just calculated.

Question 7) Project NPV: $__________________________

The Coca-Cola Company (KO) NYSE - NYSE Delayed Price. Currency in USD In watchlist 89 Visitors trend 2w1 10W 1 9M 1 $49.58-0.23 (-0.43%) At close: November 27 1:00PM EST Summary Company Outlook Chart Conversations Statistics Historical Data Profile Financials Analysis Options Previous Close 49.81 Market Cap 211.296B 1D 5D 1M 6M YTD 1 5Y Max * Full screen 50.36 Open 50.11 Beta (5Y Monthly) 0.59 Bid 49.57 x 2200 PE Ratio (TTM) 25.69 50.11 Ask 49.59 x 1200 EPS (TTM) 1.93 49.58 Day's Range 49.24 - 50.36 Earnings Date Jan 28, 2021 - Feb 01, 2021 49.24 52 Week Range 36.27 -60.13 Forward Dividend & Yield 1.56 (3.15%) Volume 8,499,289 Ex-Dividend Date Nov 30, 2021 10 AM 12 PM Trade prices are not sourced from all markets Avg. Volume 15,055,041 1y Target Est 56.40 The Coca-Cola Company (KO) NYSE - NYSE Delayed Price. Currency in USD In watchlist 89 Visitors trend 2w1 10W 1 9M 1 $49.58-0.23 (-0.43%) At close: November 27 1:00PM EST Summary Company Outlook Chart Conversations Statistics Historical Data Profile Financials Analysis Options Previous Close 49.81 Market Cap 211.296B 1D 5D 1M 6M YTD 1 5Y Max * Full screen 50.36 Open 50.11 Beta (5Y Monthly) 0.59 Bid 49.57 x 2200 PE Ratio (TTM) 25.69 50.11 Ask 49.59 x 1200 EPS (TTM) 1.93 49.58 Day's Range 49.24 - 50.36 Earnings Date Jan 28, 2021 - Feb 01, 2021 49.24 52 Week Range 36.27 -60.13 Forward Dividend & Yield 1.56 (3.15%) Volume 8,499,289 Ex-Dividend Date Nov 30, 2021 10 AM 12 PM Trade prices are not sourced from all markets Avg. Volume 15,055,041 1y Target Est 56.40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started