capsim class Please help me out i am not sure im doing right or wrong please help me

capsim class Please help me out i am not sure im doing right or wrong please help me

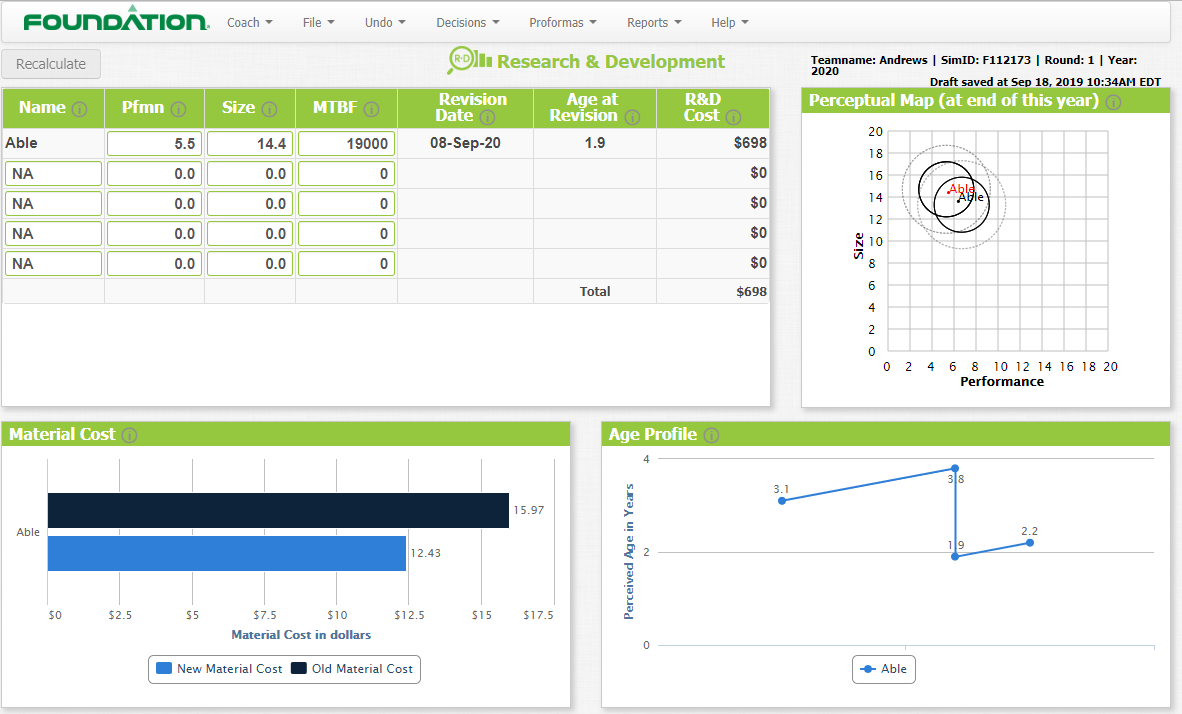

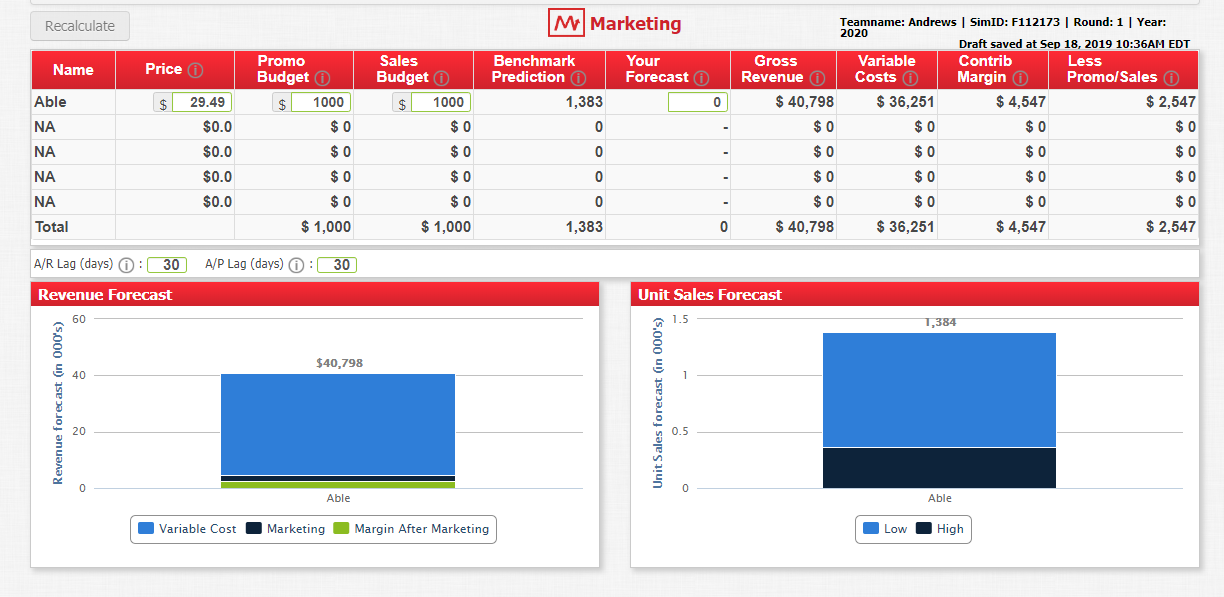

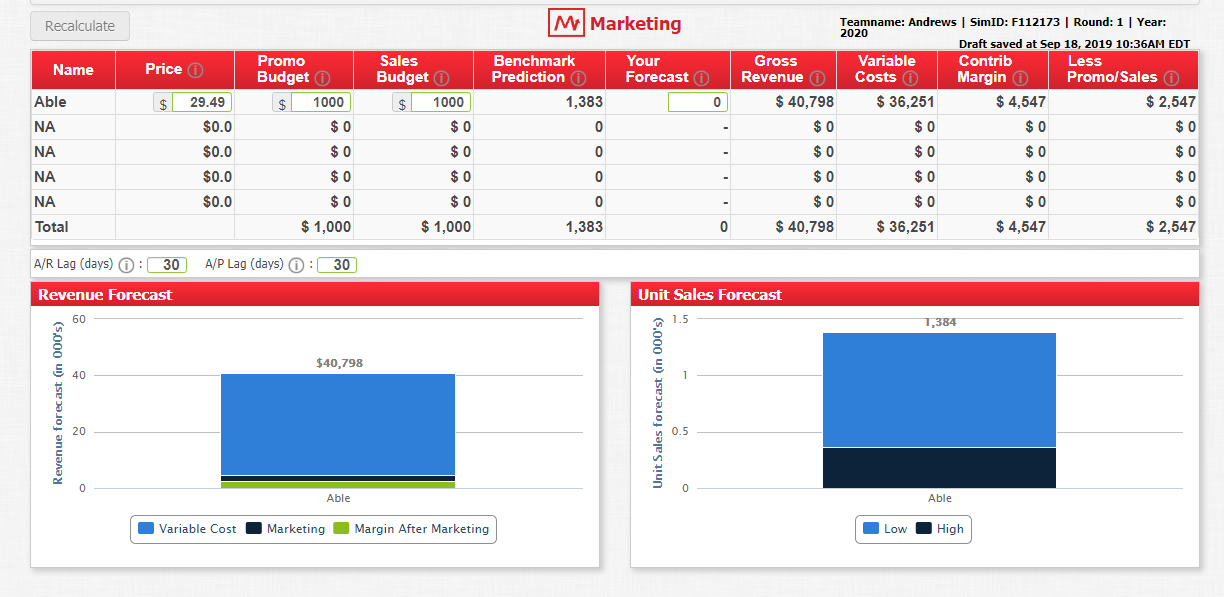

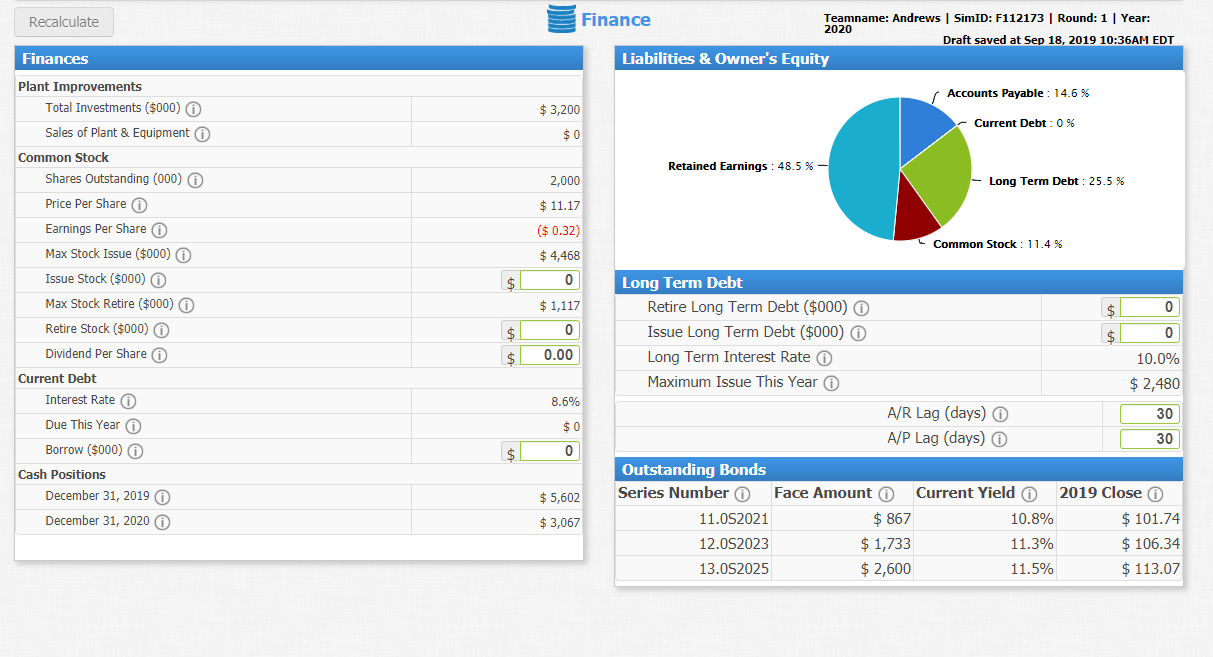

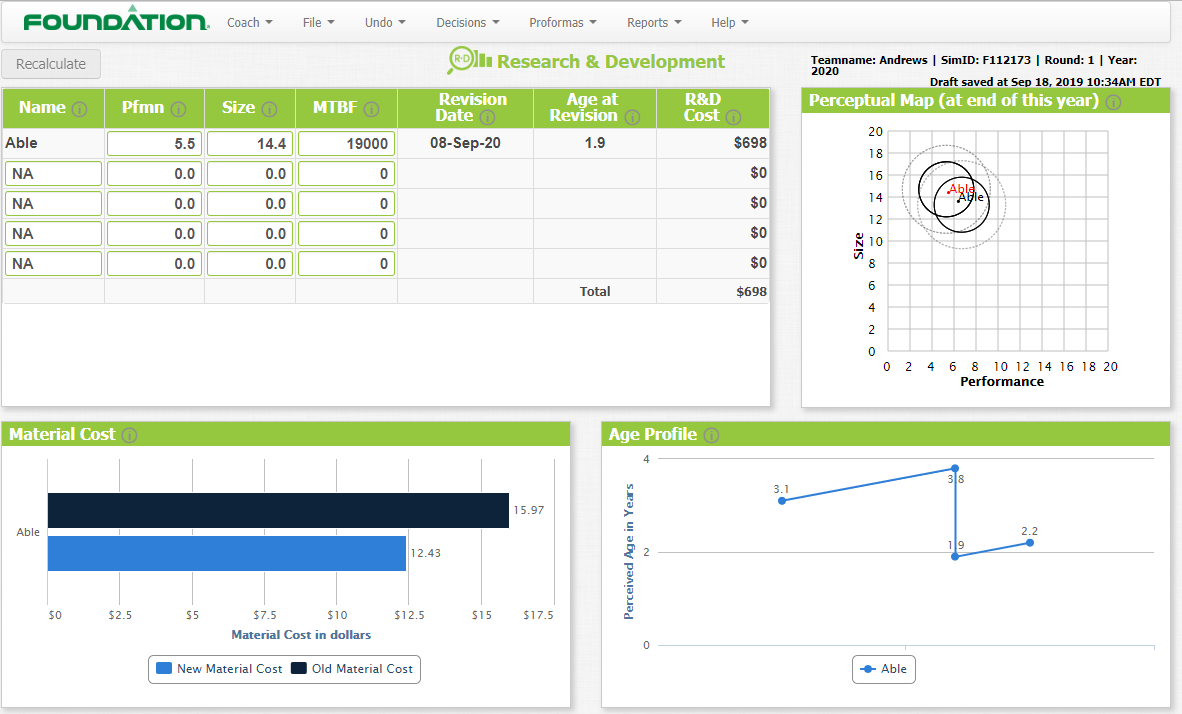

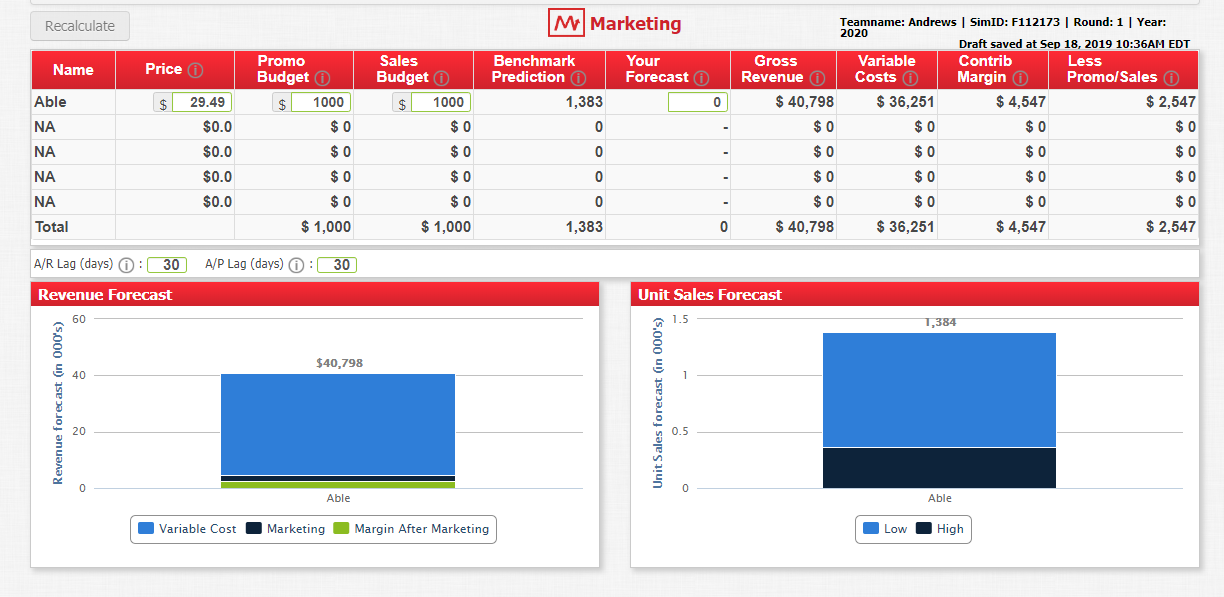

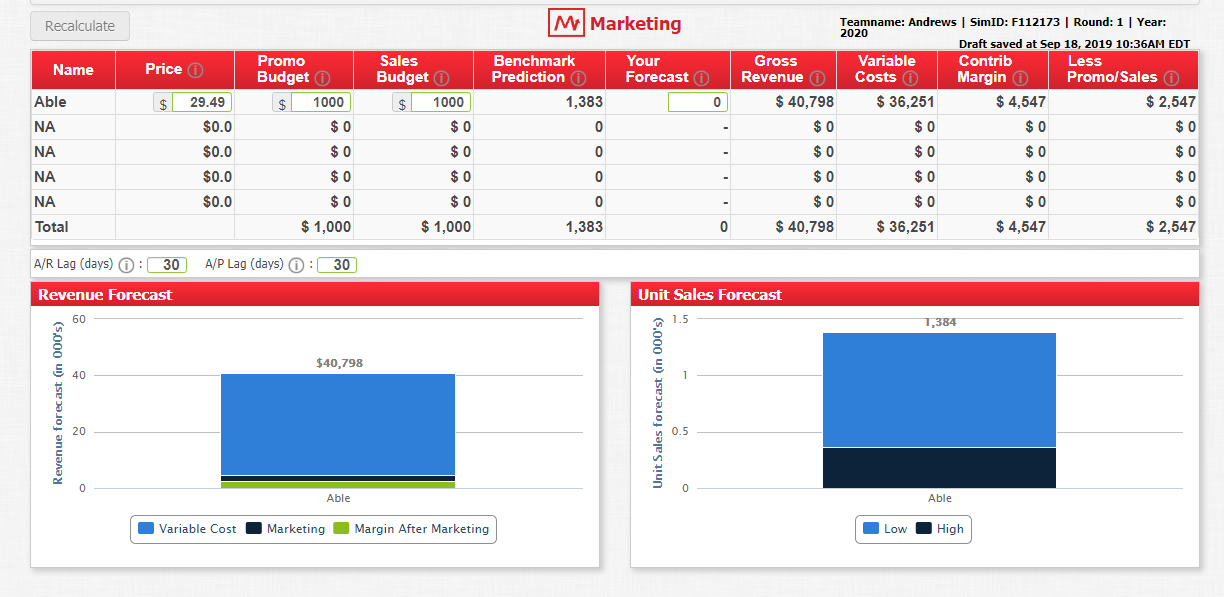

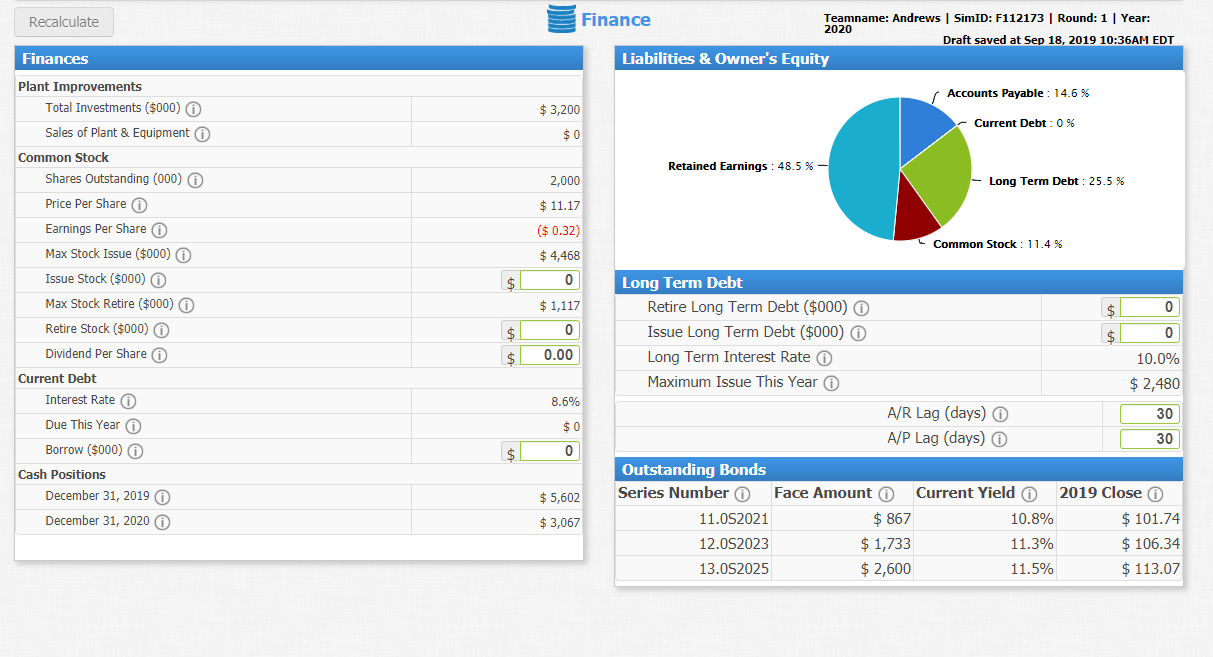

FOUNDATION Reports Coach File Undo Proformas Help Decisions RDI Research & Development Teamname: And rews | SimID: F112173 | Round: 1 Year: 2020 Recalculate Draft saved at Sep 18, 2019 10:34AM EDT R&D Cost Age at Revision Revision Date Perceptual Map (at end of this year) Pfmn Name MTBF Size 20 08-Sep-20 $698 Able 1.9 5.5 14.4 19000 18 $0 0 NA 0.0 0.0 16 14 $0 NA 0.0 0.0 0 12 $0 NA 0.0 0.0 10 $0 NA 0.0 0.0 0 8 6 Total $698 4 2 0 0 2 4 6 8 10 12 14 16 18 20 Performance Material Cost Age Profile 3.1 15.97 2.2 Able 9 12.43 $0 $2.5 $7.5 $10 $12.5 $17.5 $5 $15 Material Cost in dollars New Material Cost Old Material Cost Able Perceived Age in Years M Marketing Teamname: Andrews | SimID: F112173 | Round: 1 | Year: 2020 Recalculate Draft saved at Sep 18, 2019 10:36AM EDT Variable Costs Less Promo/Sales i) Promo Budget Sales Benchmark Your Gross Contrib Price Name Predictioni Budget Forecast Revenue Margin $ 2,547 $ 40,798 36,251 $4,547 Able 1,383 29.49 1000 1000 0 $ 0 $ 0 $ 0 $0.0 $0 NA $ 0 $0.0 $0 NA 0 $ 0 $ 0 $ 0 $0.0 0 $0 NA 0 $ 0 $ 0 $0.0 0 0 NA 0 $ 36,251 $1,000 $1,000 0 40,798 $ 4,547 $2,547 Total 1,383 A/P Lag (days):30 A/R Lag (days) O: 30 Unit Sales Forecast Revenue Forecast 1,384 $40,798 1 20 Able Able Variable Cost Marketing Margin After Marketing Low High Revenue fore ast (in 000's) 40 Jnit S ales forecast (in 000's) M Marketing Teamname: Andrews | SimID: F112173 | Round: 1 | Year: 2020 Recalculate Draft saved at Sep 18, 2019 10:36AM EDT Variable Costs Less Promo/Sales i) Promo Budget Sales Benchmark Your Gross Contrib Price Name Predictioni Budget Forecast Revenue Margin $ 2,547 $ 40,798 36,251 $4,547 Able 1,383 29.49 1000 1000 0 $ 0 $ 0 $ 0 $0.0 $0 NA $ 0 $0.0 $0 NA 0 $ 0 $ 0 $ 0 $0.0 0 $0 NA 0 $ 0 $ 0 $0.0 0 0 NA 0 $ 36,251 $1,000 $1,000 0 40,798 $ 4,547 $2,547 Total 1,383 A/P Lag (days):30 A/R Lag (days) O: 30 Unit Sales Forecast Revenue Forecast 1,384 $40,798 1 20 Able Able Variable Cost Marketing Margin After Marketing Low High Revenue fore ast (in 000's) 40 Jnit S ales forecast (in 000's) Teamname: Andrews | SimID: F112173 | Round: 1 | Year: 2020 Finance Recalculate Draft saved at Sep 18, 2019 10:36AM EDT Liabilities & Owner's Equity Finances Plant Improvements Accounts Payable 14.6% Total Investments ($000) $ 3,200 Current Debt 0 % Sales of Plant & Equipment $0 Common Stock Retained Earnings 48.5 %- Shares Outstanding (000) Long Term Debt 25.5 % 2,000 Price Per Share $11.17 Earnings Per Share ($ 0.32) Common Stock: 11.4 % Max Stock Issue ($000) $4,468 Issue Stock ($000) 0 $ Long Term Debt Max Stock Retire ($000) Retire Long Term Debt ($000) $1,117 0 S Retire Stock ($000) Issue Long Term Debt ($000) 0 Dividend Per Share 0.00 Long Term Interest Rate $ 10.0% Current Debt Maximum Issue This Year $ 2,480 Interest Rate (O 8.6% A/R Lag (days) 30 Due This Year $ 0 A/P Lag (days) 30 Borrow ($000) 0 $ Outstanding Bonds Cash Positions Face Amount 2019 Close Series Number Current Yield December 31, 2019 $5,602 $ 867 $101.74 11.0S2021 10.8% December 31, 2020 $3,067 $106.34 12.0S2023 $1,733 11.3% $ 2,600 $113.07 13.0S2025 11.5% FOUNDATION Reports Coach File Undo Proformas Help Decisions RDI Research & Development Teamname: And rews | SimID: F112173 | Round: 1 Year: 2020 Recalculate Draft saved at Sep 18, 2019 10:34AM EDT R&D Cost Age at Revision Revision Date Perceptual Map (at end of this year) Pfmn Name MTBF Size 20 08-Sep-20 $698 Able 1.9 5.5 14.4 19000 18 $0 0 NA 0.0 0.0 16 14 $0 NA 0.0 0.0 0 12 $0 NA 0.0 0.0 10 $0 NA 0.0 0.0 0 8 6 Total $698 4 2 0 0 2 4 6 8 10 12 14 16 18 20 Performance Material Cost Age Profile 3.1 15.97 2.2 Able 9 12.43 $0 $2.5 $7.5 $10 $12.5 $17.5 $5 $15 Material Cost in dollars New Material Cost Old Material Cost Able Perceived Age in Years M Marketing Teamname: Andrews | SimID: F112173 | Round: 1 | Year: 2020 Recalculate Draft saved at Sep 18, 2019 10:36AM EDT Variable Costs Less Promo/Sales i) Promo Budget Sales Benchmark Your Gross Contrib Price Name Predictioni Budget Forecast Revenue Margin $ 2,547 $ 40,798 36,251 $4,547 Able 1,383 29.49 1000 1000 0 $ 0 $ 0 $ 0 $0.0 $0 NA $ 0 $0.0 $0 NA 0 $ 0 $ 0 $ 0 $0.0 0 $0 NA 0 $ 0 $ 0 $0.0 0 0 NA 0 $ 36,251 $1,000 $1,000 0 40,798 $ 4,547 $2,547 Total 1,383 A/P Lag (days):30 A/R Lag (days) O: 30 Unit Sales Forecast Revenue Forecast 1,384 $40,798 1 20 Able Able Variable Cost Marketing Margin After Marketing Low High Revenue fore ast (in 000's) 40 Jnit S ales forecast (in 000's) M Marketing Teamname: Andrews | SimID: F112173 | Round: 1 | Year: 2020 Recalculate Draft saved at Sep 18, 2019 10:36AM EDT Variable Costs Less Promo/Sales i) Promo Budget Sales Benchmark Your Gross Contrib Price Name Predictioni Budget Forecast Revenue Margin $ 2,547 $ 40,798 36,251 $4,547 Able 1,383 29.49 1000 1000 0 $ 0 $ 0 $ 0 $0.0 $0 NA $ 0 $0.0 $0 NA 0 $ 0 $ 0 $ 0 $0.0 0 $0 NA 0 $ 0 $ 0 $0.0 0 0 NA 0 $ 36,251 $1,000 $1,000 0 40,798 $ 4,547 $2,547 Total 1,383 A/P Lag (days):30 A/R Lag (days) O: 30 Unit Sales Forecast Revenue Forecast 1,384 $40,798 1 20 Able Able Variable Cost Marketing Margin After Marketing Low High Revenue fore ast (in 000's) 40 Jnit S ales forecast (in 000's) Teamname: Andrews | SimID: F112173 | Round: 1 | Year: 2020 Finance Recalculate Draft saved at Sep 18, 2019 10:36AM EDT Liabilities & Owner's Equity Finances Plant Improvements Accounts Payable 14.6% Total Investments ($000) $ 3,200 Current Debt 0 % Sales of Plant & Equipment $0 Common Stock Retained Earnings 48.5 %- Shares Outstanding (000) Long Term Debt 25.5 % 2,000 Price Per Share $11.17 Earnings Per Share ($ 0.32) Common Stock: 11.4 % Max Stock Issue ($000) $4,468 Issue Stock ($000) 0 $ Long Term Debt Max Stock Retire ($000) Retire Long Term Debt ($000) $1,117 0 S Retire Stock ($000) Issue Long Term Debt ($000) 0 Dividend Per Share 0.00 Long Term Interest Rate $ 10.0% Current Debt Maximum Issue This Year $ 2,480 Interest Rate (O 8.6% A/R Lag (days) 30 Due This Year $ 0 A/P Lag (days) 30 Borrow ($000) 0 $ Outstanding Bonds Cash Positions Face Amount 2019 Close Series Number Current Yield December 31, 2019 $5,602 $ 867 $101.74 11.0S2021 10.8% December 31, 2020 $3,067 $106.34 12.0S2023 $1,733 11.3% $ 2,600 $113.07 13.0S2025 11.5%

capsim class Please help me out i am not sure im doing right or wrong please help me

capsim class Please help me out i am not sure im doing right or wrong please help me