Question

Capstick Muffler - Cash Budgeting On February 25, 1990, Gerald Capstick, proprietor of Capstick Muffler, was planning the relocation of his muffler shop to the

Capstick Muffler - Cash Budgeting On February 25, 1990, Gerald Capstick, proprietor of Capstick Muffler, was planning the relocation of his muffler shop to the Northside Industrial Park, North Sydney, Nova Scotia. The relocation was scheduled for May 1st. In particular, Capstick was preparing monthly cash budgets for the first year of operation at the new location to determine operating line of credit requirements. The Northside Muffler Market As part of the relocation decision, Capstick conducted a market study of the size and nature of the Northside replacement muffler market. In particular, Capstick analyzed Department of Motor Vehicle registrations for the Northside, population statistics provided by the Northside Economic Development Assistance Corporation (NEDAC), and the results of a telephone survey of muffler purchasing practices of 200 randomly selected Northside residents. Market Size NEDAC figures showed the population of the Northside to be about 25,600, with Sydney Mines accounting for 8,510, North Sydney 7,815, and the remainder in rural areas. These residents owned about 10,800 passenger and commercial vehicles which would normally require a replacement muffler every eighteen months. Hence, Capstick estimated an annual requirement of 7,200 muffler jobs worth about $612,000 to $720,000 per year. Current Market Shares and Muffler Choice Factors The Northside muffler market is served by Capstick Muffler (15.5%), Canadian Tire (20.0%), service stations (18.5%), Ideal Muffler (3.5%), the Sydney shops (including Midas, Speedy, and Thruway (32%), car dealerships (6%), and Do-it-Yourselfers (4.5%). When choosing their muffler repair shop, most Northside automobile owners (36%) rated service (good work done in a timely fashion) as being most important, while location (27.5%) and warranty (27%) were also seen as being very important. Price seemed a lesser consideration as only 9.5% of the surveyed muffler buyers cited price as the most important factor in the muffler purchase decision. Competitive Advantages and Disadvantages Comparison of the customer's preferred muffler shop with the customer's preferred product feature showed muffler shop choice to vary according to what the customer viewed as being most important in the muffler purchase decision. Capstick seemed to be serving more customers who stressed location and price, and fewer customers who stressed service and warranty. Likewise, Canadian Tire seemed to obtain more customers based on service, price, and location, and fewer customers who valued muffler warranties. Customers chose service stations on the basis of service and location, while service stations lost customers on the basis of price and warranty features. The Sydney shops attracted their Northside customers mostly on the basis of their muffler warranty but lost them because of location and, to a lesser degree, price and service. Finally, car dealerships got their Northside customers on warranty considerations but lost them on service and location grounds.

The New Facility and Capstick Muffler's Competitive Edge Capstick Muffler's new facility and increased staff would provide faster service in a more attractive setting. The company's more central location on the main artery between Sydney Mines and North Sydney would enhance awareness levels and be more convenient for Northside customers. The company's product quality and warranties (lifetime on muffler) were already competitive but needed to be brought to the customer's attention by an aggressive advertising program. Advertising Message Good product, good service, and good advertising are key components for success in the muffler business (Advertising Age, May 16, 1985). Capstick Muffler's advertising message would be directed at increasing customer awareness of personal and quality service and guaranteed good products. The company also intended to target female buyers because of the growing importance of this segment of the market. The advertising message would be directed at the Northside market through newspaper advertising, local team sponsorship, household flyers, calendars, pens, & other novelty items. Following is a sample Capstick Muffler message: "Your neighbours at Capstick Muffler guarantee their mufflers for as long as you own your car. You get a firm estimate before work begins. Free inspection and free installation. Even free coffee. We offer a pleasant waiting room with a play area available for toddlers. Capstick's prices are fully competitive." The company would also use its location to maximum advertising advantage by using large back-lit signs, attractive premises, lawns, and entrances. Target Market Share and Projected Cash Receipts Capstick was targeting one-third (33%) of the Northside muffler market - about double its current share of 15.5%. To capture the additional market, the company would rely on increased customer awareness through increased advertising of product quality and superior location. The company would push its product warrantee to take about 9% more of the market from other Northside competitors (who held 42%). It would push its service, location, and good price features to take 9% more of the market from the Sydney shops (who held 32% of the Northside market). Capstick's target of 33% of the Northside replacement muffler market (estimated at $666,000 in 1989) supported a projected base sales level of $219,780 plus an inflation increase for his first year of operations. (See Exhibit 1) There would be substantial variation in monthly sales revenues because of seasonality in muffler demand - the peak months are April, May (heavy), June (heavy), July, and August. (See Table 1) Table I Percentage of Yearly Sales by Month |

Month | % | Month | % | Month | % |

May | 11.6 | September | 7.3 | January | 6.2 |

June | 11.9 | October | 6.5 | February | 7.3 |

July | 9.2 | November | 7.3 | March | 8.8 |

August | 9.7 | December | 4.2 | April | 10.0 |

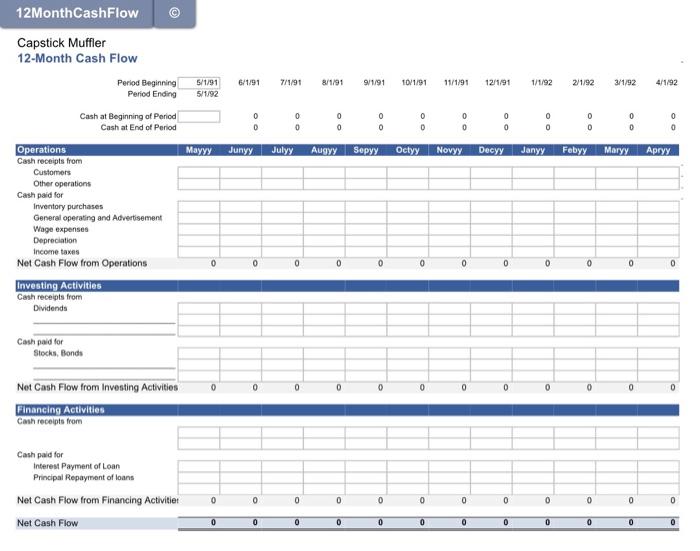

Source: Company Records Finally, in forecasting his new facility's first-year sales, Capstick projected a 5% inflation rate base, increase in prices to take effect on May 1st. Capstick felt that general inflation-rate-induced increases in costs could be passed on through corresponding increases in sales prices. Projected Cash Expenditures Capstick based his expense projections for the year (see Exhibit 1) on (1) his previous years' experience, with adjustments where necessary for increased costs due to the new larger shop, (2) his in-town location, (3) his use of debt financing to establish his new shop, (4) the implementation of a new promotion strategy, and (5) the current inflation rate. Production supplies were a major expense for the muffler shop: the cost of mufflers was 38% of sales and the cost of welding supplies was 4% of sales. Although the cost of mufflers could vary somewhat, Capstick expected no change in the percentage cost of welding supplies. The mufflers and welding supplies were purchased on 30-day terms in the month preceding the sale. Wages, also a major expense, were paid out equally over the year. Another major expense was the financing charges on the $121,500 bank loan being negotiated by Capstick to finance the new shop. Interest and bank charges were to be paid monthly, with interest calculated on the outstanding loan balance at a floating rate of interest of prime (currently 12%) plus 1%. A $1,012.50 principal repayment on the loan was also payable monthly. Bank charges were estimated to be $50 per month (net of inflation). Capstick's new promotion strategy was also expected to result in substantial cash expenditures. To launch his new muffler shop, Capstick intended to spend about 20% of his yearly advertising budget in April on "Opening Soon" messages and 30% in May on 'Now Open" messages. This heavy up-front expenditure was also intended to impress Capstick's quality and accessibility on the market right at the start of the peak season period. The remainder of the advertising budget was being spent equally over the remaining ten months to sustain customer awareness levels. Advertising purchases were made on 30-day terms. Capstick's depreciation expense was also expected to increase to about $5,400 because of the acquisition of new capital assets.1 The remainder of Capstick's expenses (with the exception of income taxes) were expected to be incurred, and paid for, equally over the year. Finally, because Capstick planned to incorporate his new muffler shop, it would have to pay income taxes at the rate of 22%.2 Although this expense would be paid after the company's fiscal year-end, Capstick planned to include it in his projected April 1991 cash disbursements to assist in cash flow planning. Other Information : To handle unexpected purchases and minor acquisitions, Capstick wanted to have about $10,000 available at all times preferably in cash but alternatively, in standby lines of credit, or a combination of cash and standby lines of credit. 1Capstick Muffler records depreciation expense at its maximum allowable Capital Cost Allowance under the Income Tax Act. 2Capstick Muffler Limited will be a Canadian-controlled private corporation eligible for the small business deduction. Required For Assignment 2 Prepare monthly cash flow statements for Capstick Muffler for the year beginning May 1, 1990, to determine operating line of credit requirements. I have included a monthly Cash Flow statement template which should preform most calculations for you. A superior answer will include a sensitivity analysis on the principal assumptions used to construct the cash budget (Probability of insufficient cash flows estimate? Include Ratios when appropriate), Additionally, justify your proportions of Cash vs Standby Line of credit for the $10,000 Capstick wants to have available at all times. Lastly, Calculate Capsticks average monthly Cash budget |

Exhibit 1 Capstick Muffler Limited Projected Income Statement For Year Ended April 30, 1991 |

Sales (219,780 * 1.05) |

| $230,769 | |

Cost of Mufflers Sold |

| 87,692 | |

Gross Profit |

| $143,077 | |

|

|

|

|

Expenses |

|

|

|

| Accounting & Legal | $1,575 |

|

| Advertising & Promotion | 12,600 |

|

| Insurance | 4,200 |

|

| Interest & Bank Charges | 15,701 |

|

| Miscellaneous | 263 |

|

| Welding Supplies | 9,231 |

|

| Civic Taxes | 1,050 |

|

| Utilities | 6,300 |

|

| Vehicle | 2,100 |

|

| Wages & Benefits | 57,645 | 110,665 |

Net Income before Depreciation |

| 32,412 | |

Depreciation |

| 5,400 | |

Net Income before Income Taxes |

| 27,012 | |

Income Taxes |

| 5,943 | |

Net Income |

| $21,069 | |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started