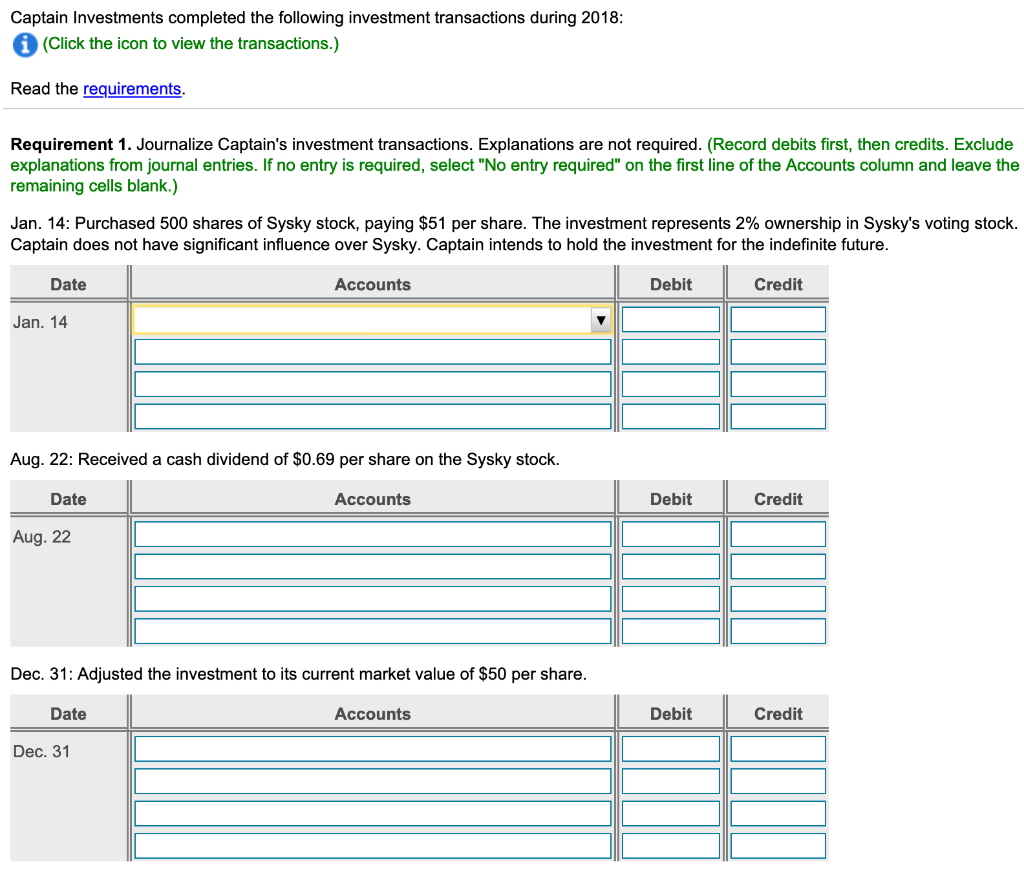

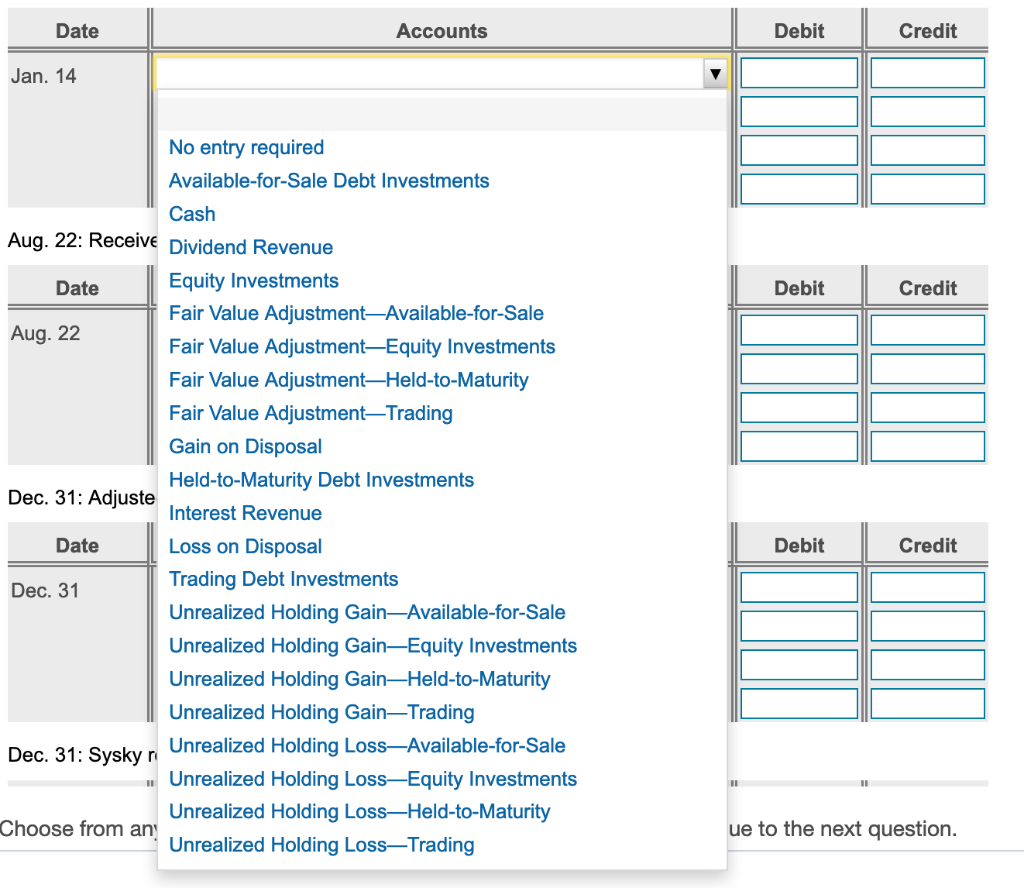

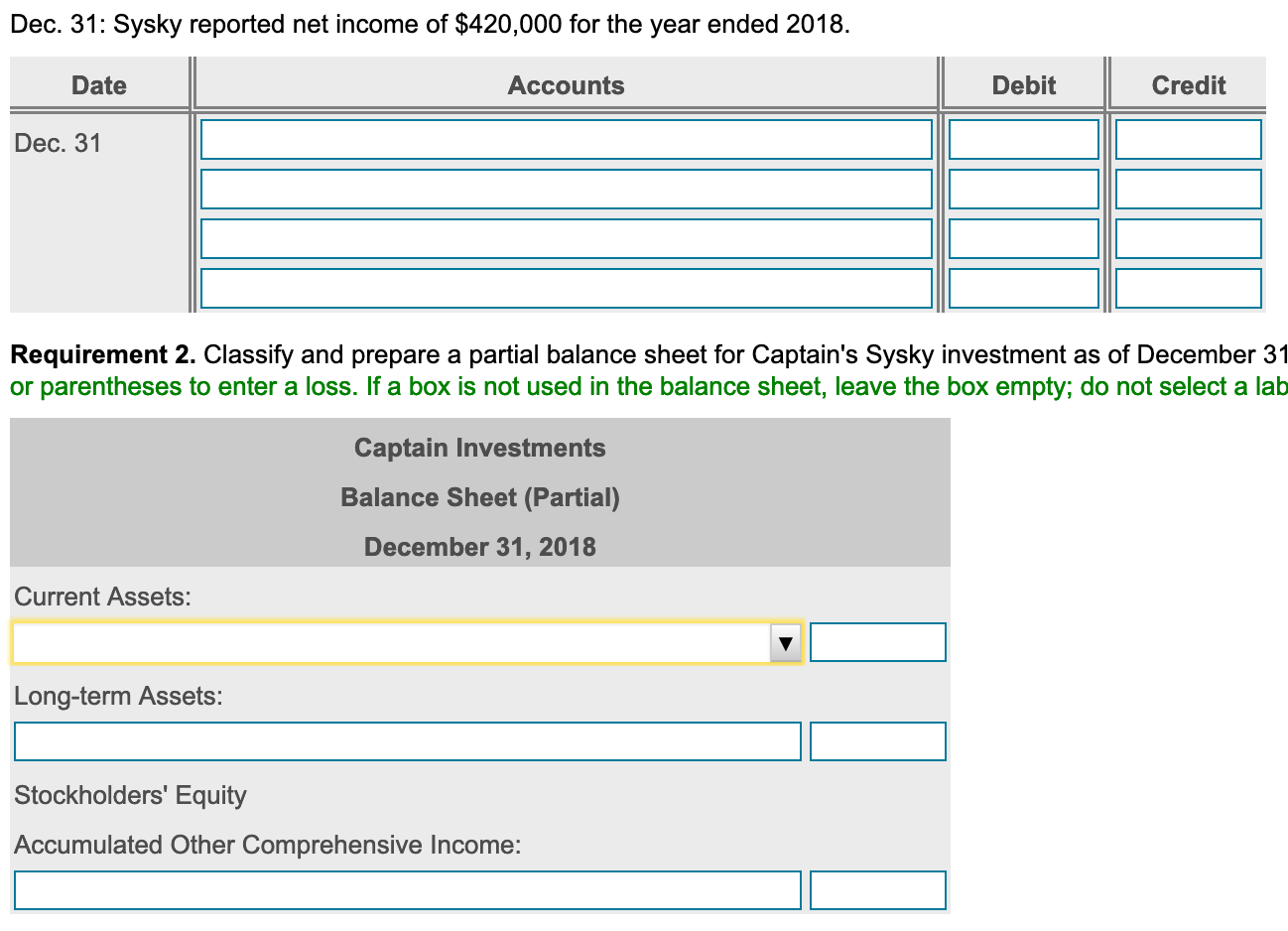

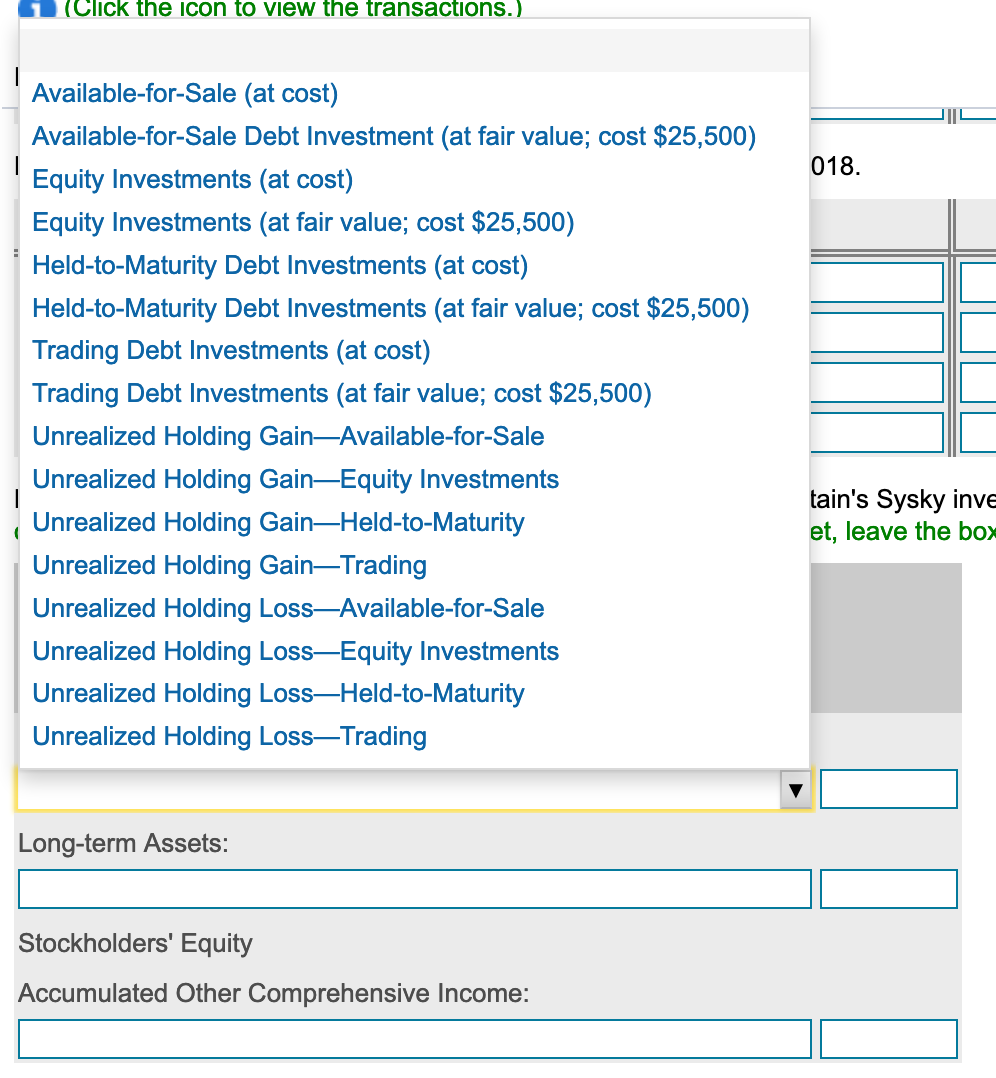

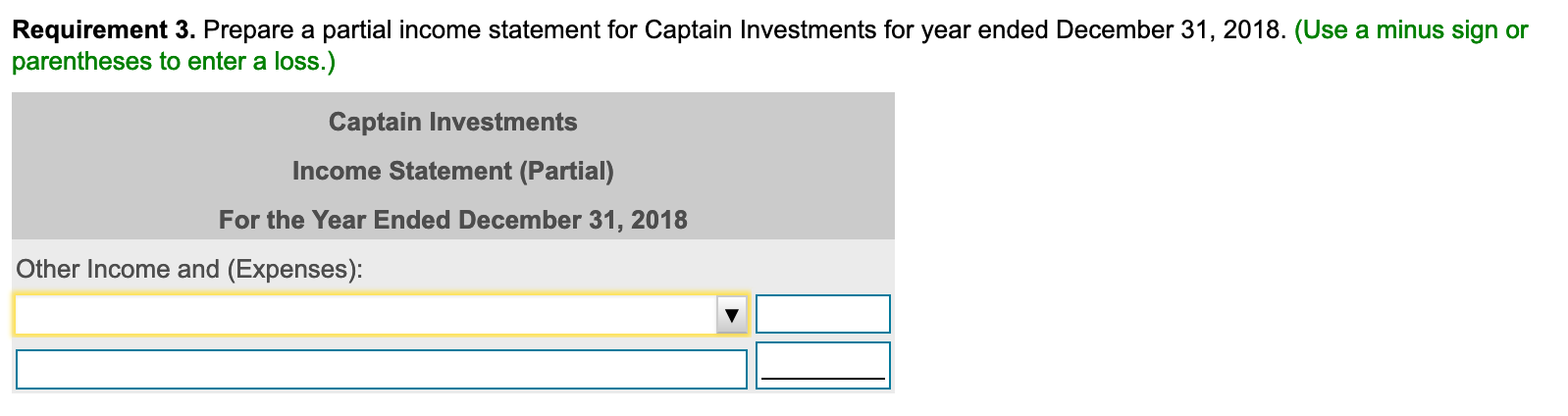

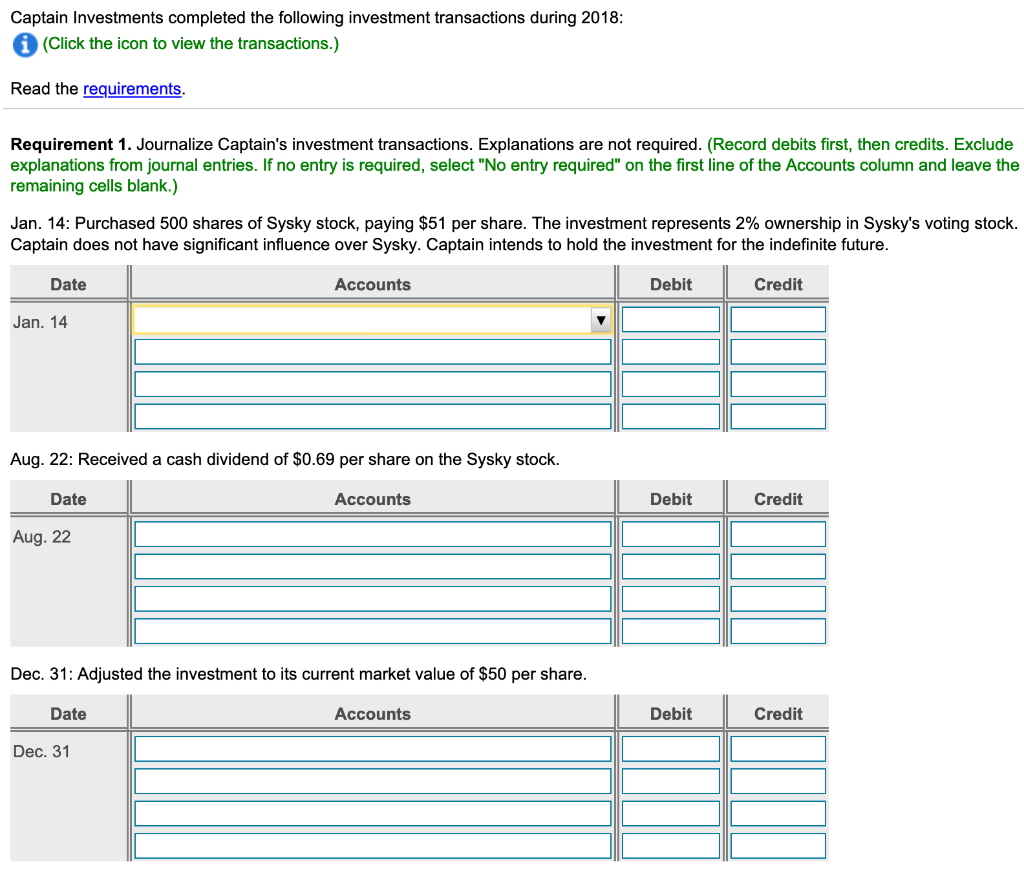

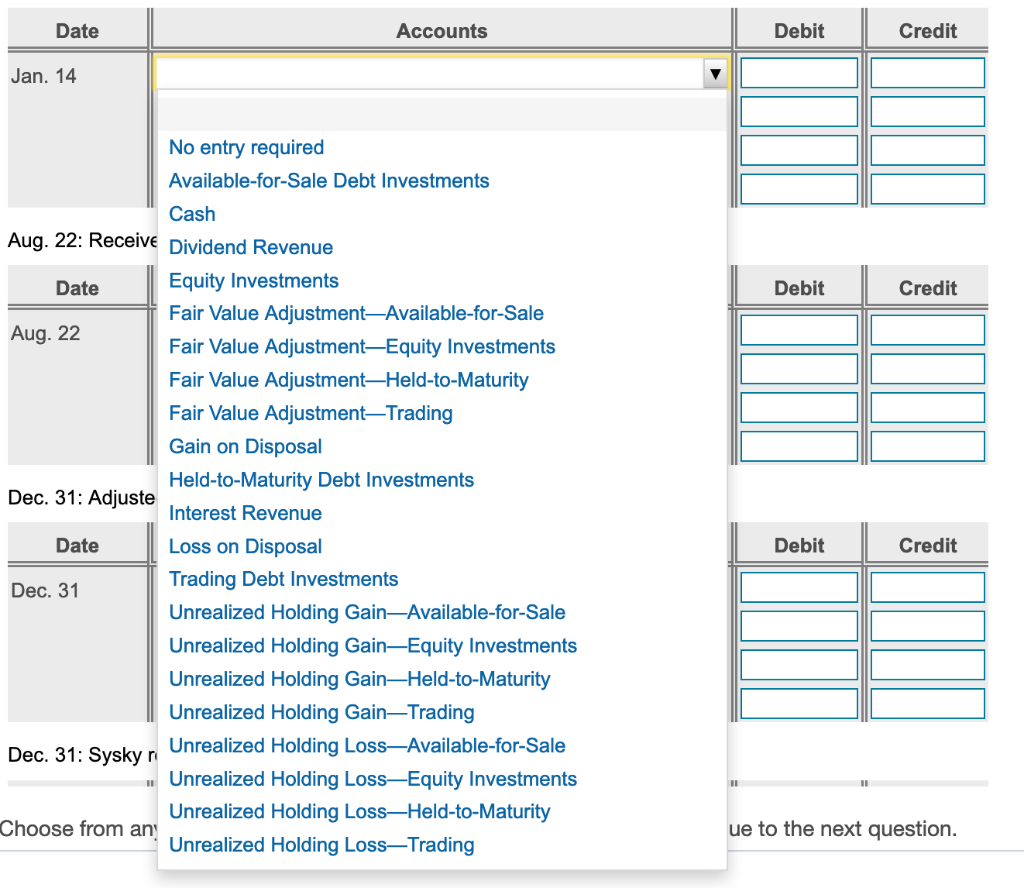

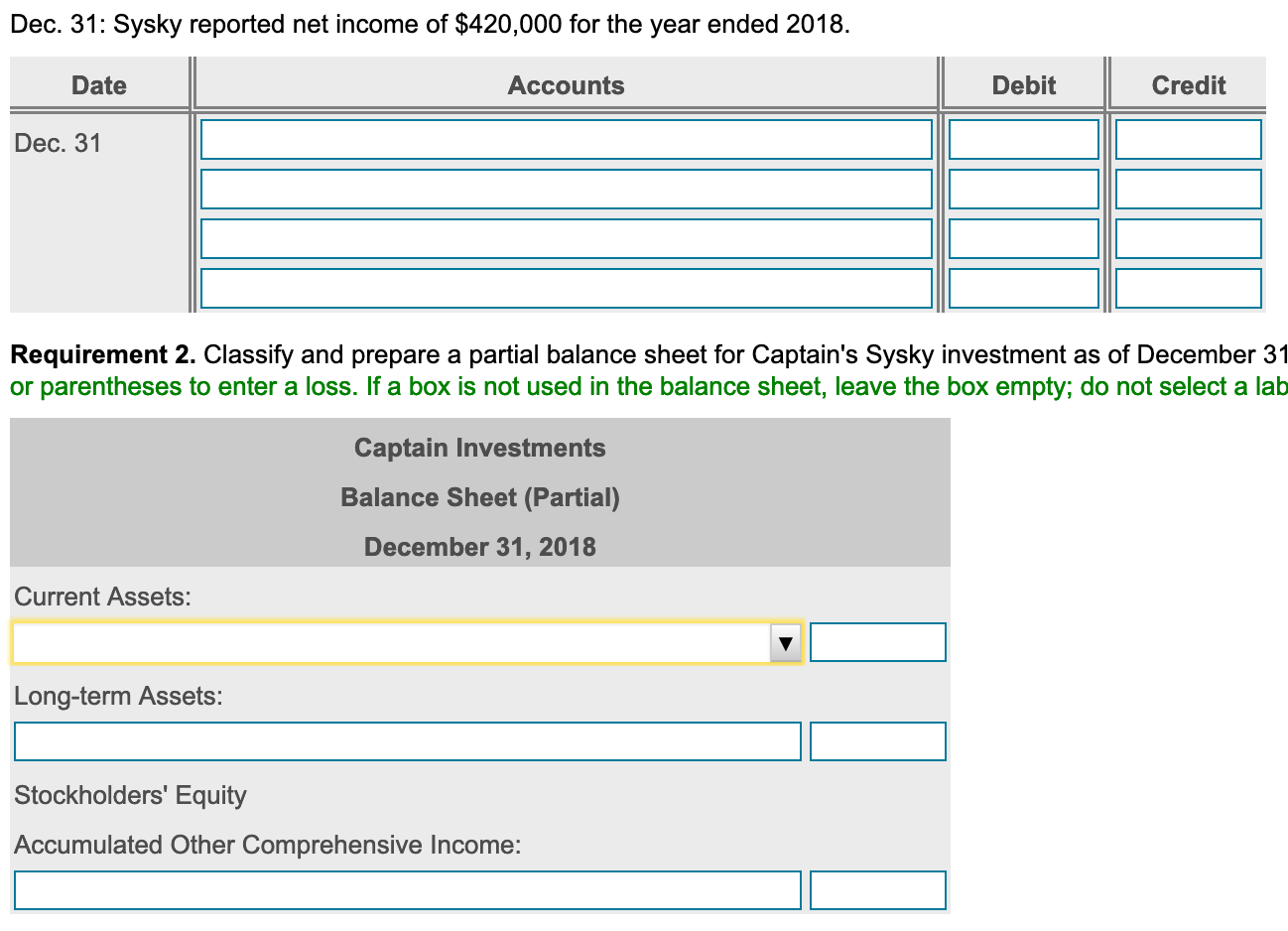

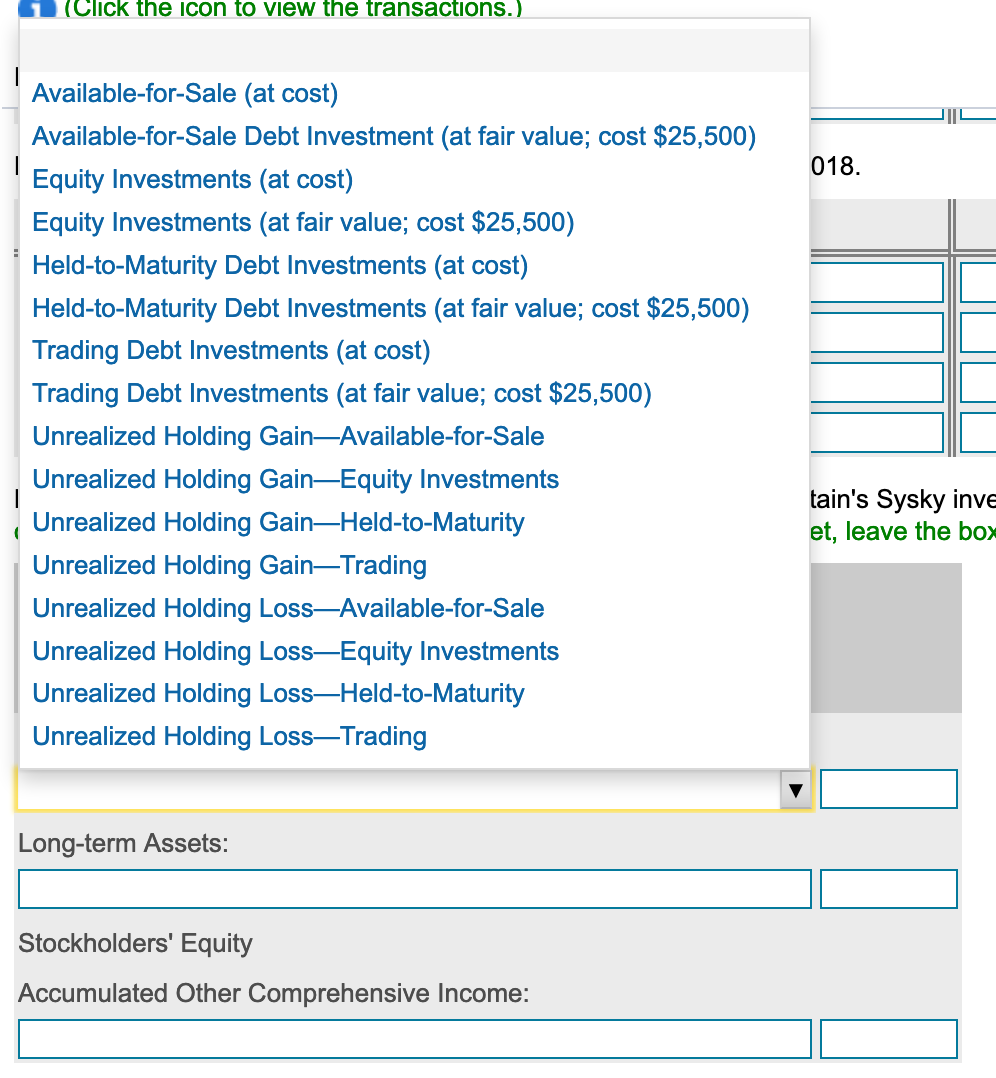

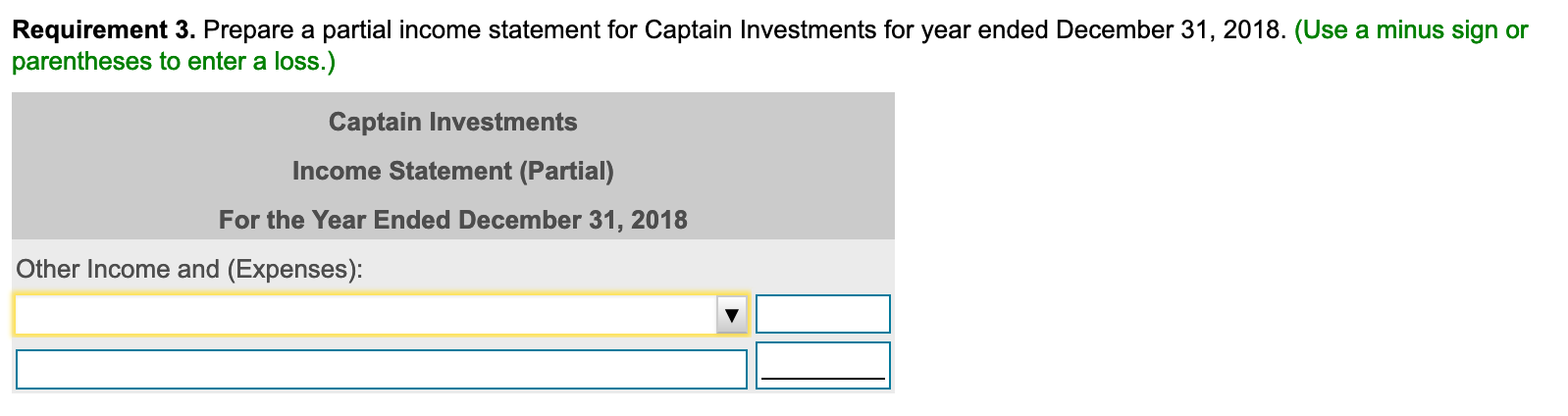

Captain Investments completed the following investment transactions during 2018: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Journalize Captain's investment transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. If no entry is required, select "No entry required" on the first line of the Accounts column and leave the remaining cells blank.) Jan. 14: Purchased 500 shares of Sysky stock, paying $51 per share. The investment represents 2% ownership in Sysky's voting stock. Captain does not have significant influence over Sysky. Captain intends to hold the investment for the indefinite future. Date Accounts Debit Credit Jan. 14 7 Aug. 22: Received a cash dividend of $0.69 per share on the Sysky stock. Date Accounts Debit Credit Aug. 22 Dec. 31: Adjusted the investment to its current market value of $50 per share. Date Accounts Debit Credit Dec. 31 Date Accounts Debit Credit Jan. 14 Debit Credit No entry required Available-for-Sale Debt Investments Cash Aug. 22: Receive Dividend Revenue Date Equity Investments Fair Value Adjustment-Available-for-Sale Aug. 22 Fair Value Adjustment-Equity Investments Fair Value AdjustmentHeld-to-Maturity Fair Value AdjustmentTrading Gain on Disposal Held-to-Maturity Debt Investments Dec. 31: Adjuste Interest Revenue Date Loss on Disposal Trading Debt Investments Dec. 31 Unrealized Holding GainAvailable-for-Sale Unrealized Holding GainEquity Investments Unrealized Holding GainHeld-to-Maturity Unrealized Holding Gain-Trading Dec. 31: Syskyr Unrealized Holding Loss-Available-for-Sale Unrealized Holding Loss-Equity Investments Unrealized Holding LossHeld-to-Maturity Choose from an Unrealized Holding Loss-Trading Debit Credit IL 11 ue to the next question. Dec. 31: Sysky reported net income of $420,000 for the year ended 2018. Date Accounts Debit Credit Dec. 31 Requirement 2. Classify and prepare a partial balance sheet for Captain's Sysky investment as of December 31 or parentheses to enter a loss. If a box is not used in the balance sheet, leave the box empty; do not select a lab Captain Investments Balance Sheet (Partial) December 31, 2018 Current Assets: Long-term Assets: Stockholders' Equity Accumulated Other Comprehensive Income: 1 (Click the icon to view the transactions.) 018. Available-for-Sale (at cost) Available-for-Sale Debt Investment (at fair value; cost $25,500) Equity Investments (at cost) Equity Investments (at fair value; cost $25,500) Held-to-Maturity Debt Investments (at cost) Held-to-Maturity Debt Investments (at fair value; cost $25,500) Trading Debt Investments (at cost) Trading Debt Investments (at fair value; cost $25,500) Unrealized Holding GainAvailable-for-Sale Unrealized Holding GainEquity Investments Unrealized Holding GainHeld-to-Maturity Unrealized Holding GainTrading Unrealized Holding LossAvailable-for-Sale Unrealized Holding LossEquity Investments Unrealized Holding LossHeld-to-Maturity Unrealized Holding LossTrading tain's Sysky inve et, leave the box Long-term Assets: Stockholders' Equity Accumulated Other Comprehensive Income: Requirement 3. Prepare a partial income statement for Captain Investments for year ended December 31, 2018. (Use a minus sign or parentheses to enter a loss.) Captain Investments Income Statement (Partial) For the Year Ended December 31, 2018 Other Income and (Expenses)