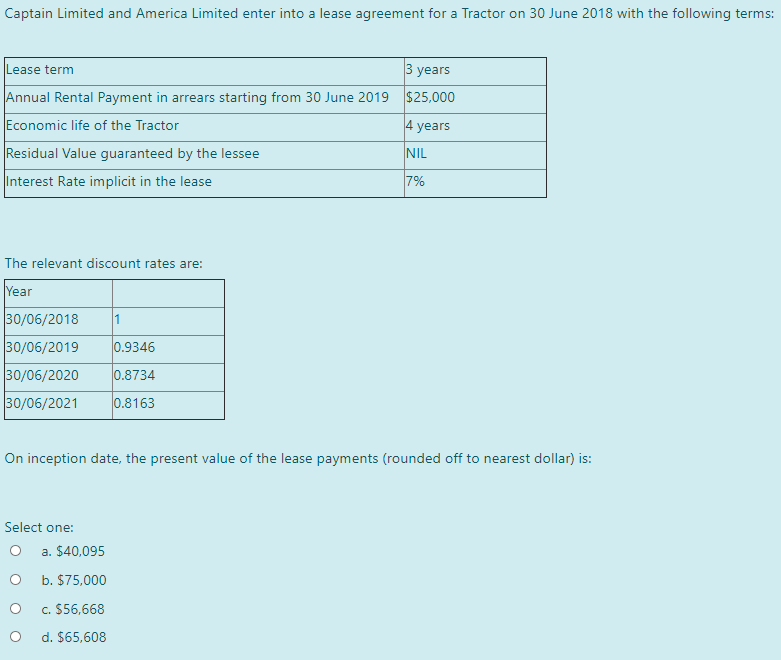

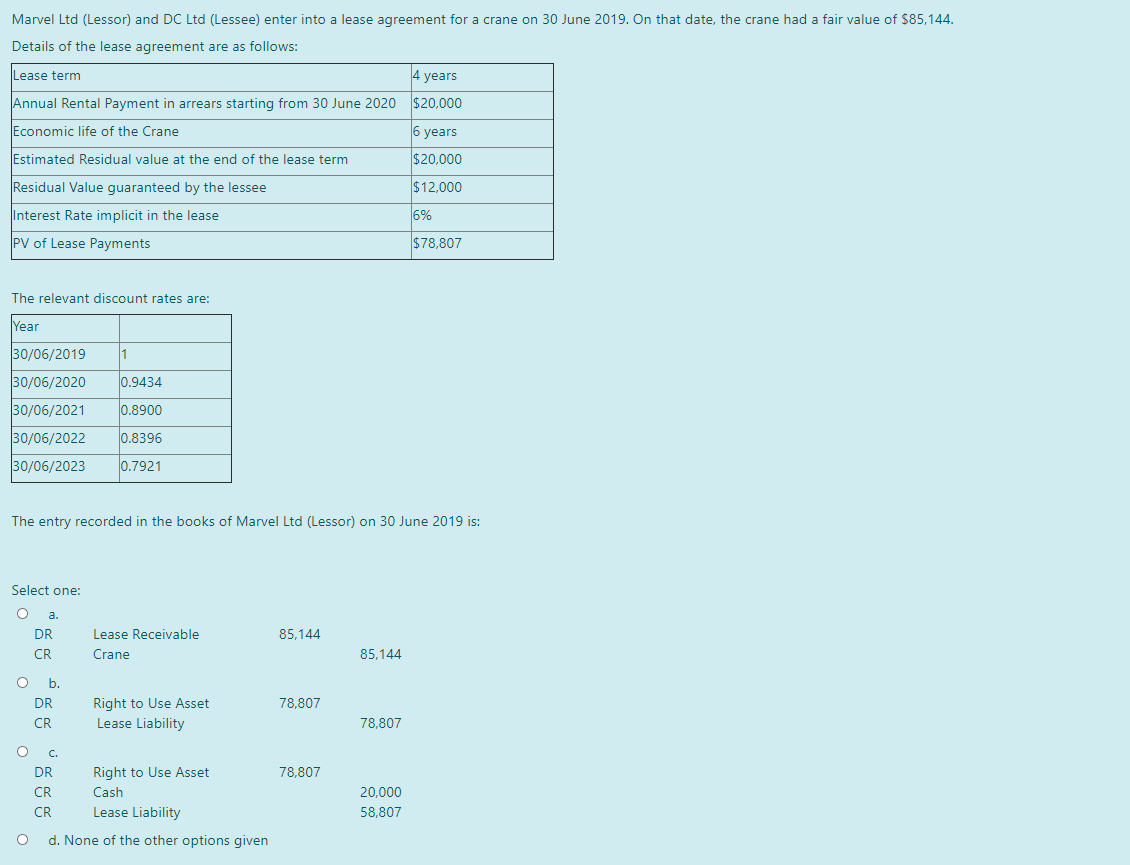

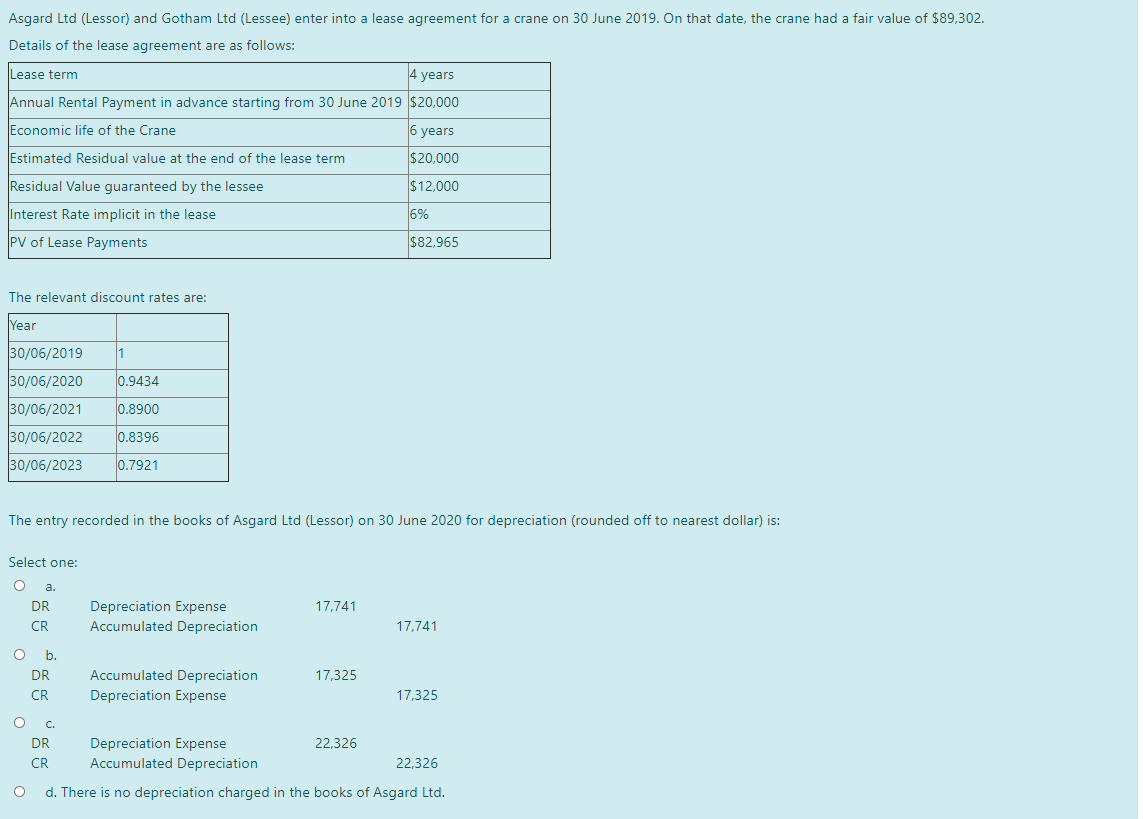

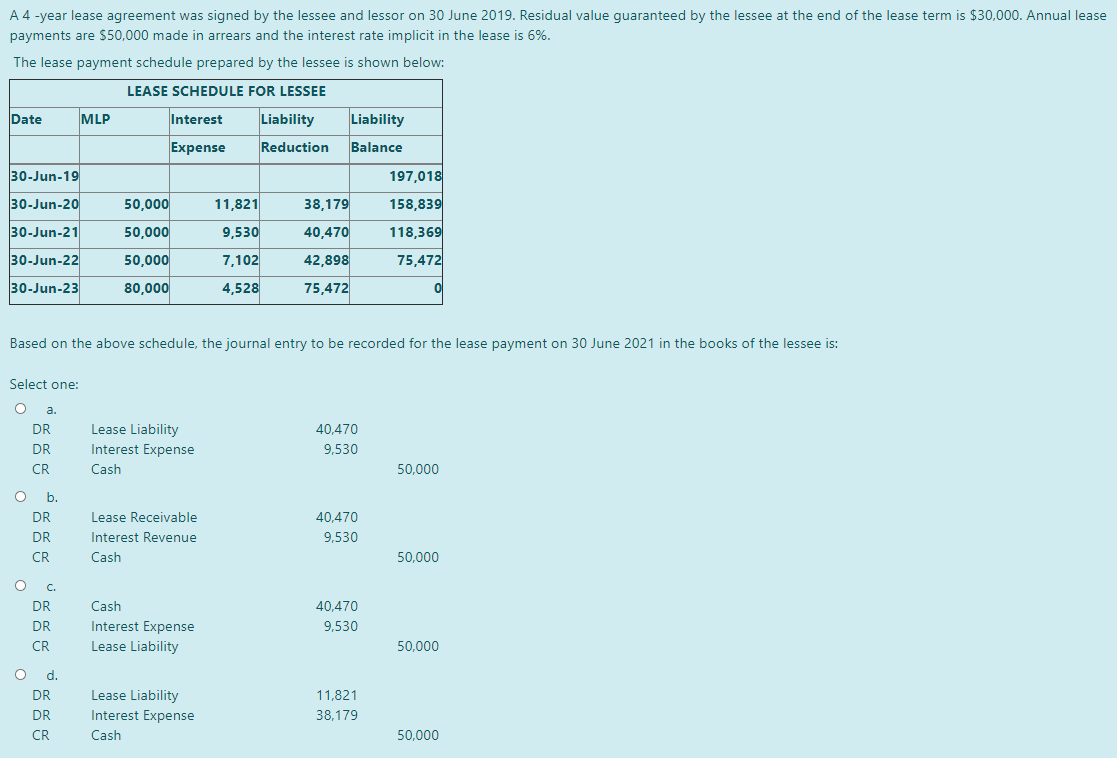

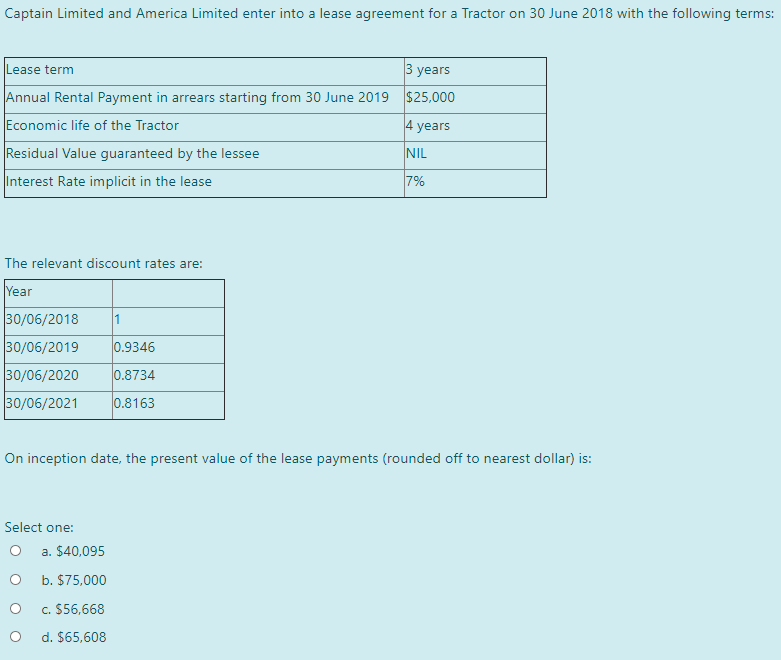

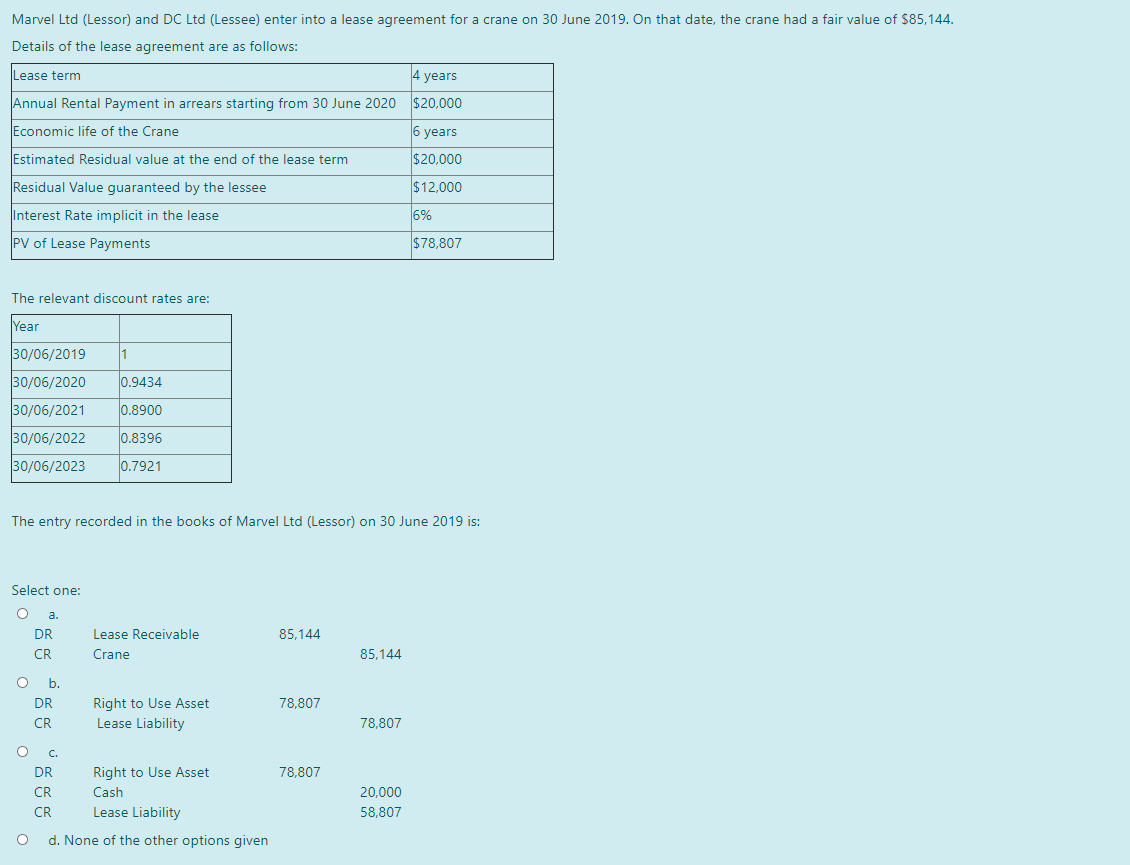

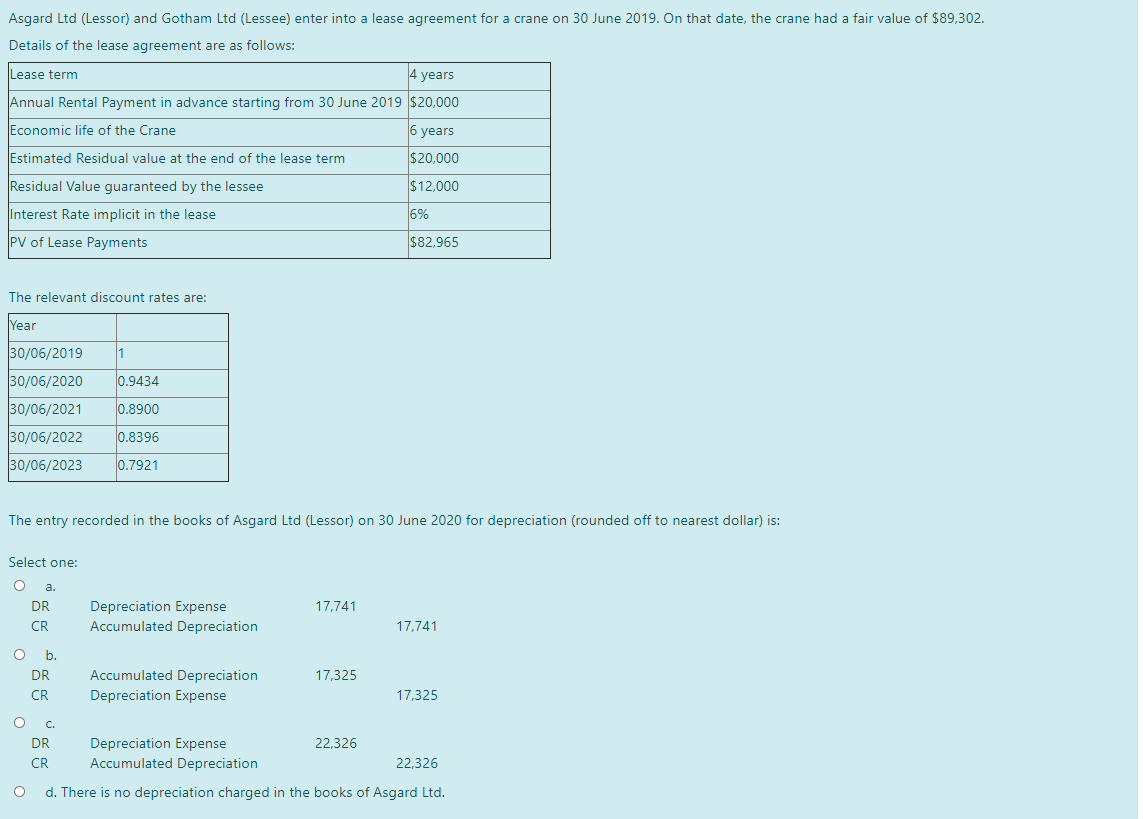

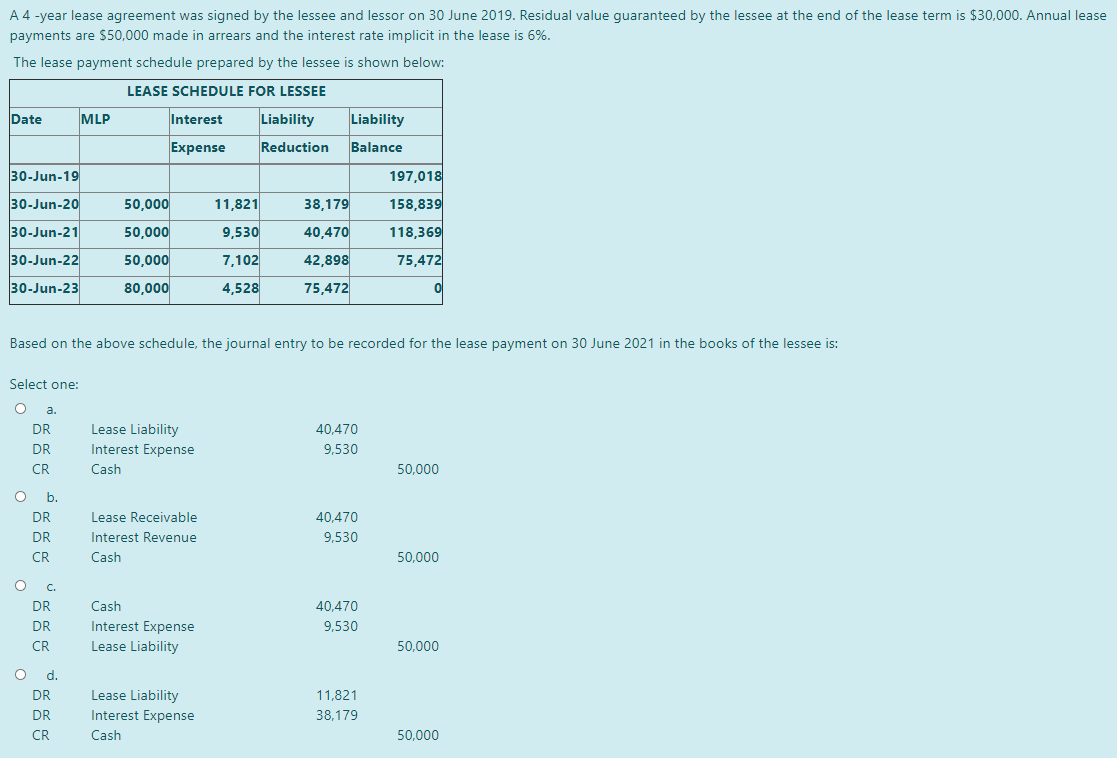

Captain Limited and America Limited enter into a lease agreement for a Tractor on 30 June 2018 with the following terms: Lease term 3 years Annual Rental Payment in arrears starting from 30 June 2019 $25,000 Economic life of the Tractor 4 years Residual Value guaranteed by the lessee NIL Interest Rate implicit in the lease 7% The relevant discount rates are: Year 1 30/06/2018 30/06/2019 0.9346 30/06/2020 0.8734 30/06/2021 0.8163 On inception date, the present value of the lease payments (rounded off to nearest dollar) is: Select one: O a. $40,095 b. $75,000 c. $56,668 O d. $65,608 Marvel Ltd (Lessor) and DC Ltd (Lessee) enter into a lease agreement for a crane on 30 June 2019. On that date, the crane had a fair value of $85,144. Details of the lease agreement are as follows: Lease term 4 years Annual Rental Payment in arrears starting from 30 June 2020 $20,000 Economic life of the Crane 6 years Estimated Residual value at the end of the lease term $20,000 $12,000 Residual Value guaranteed by the lessee Interest Rate implicit in the lease PV of Lease Payments 6% $78,807 The relevant discount rates are: Year 30/06/2019 1 30/06/2020 0.9434 30/06/2021 0.8900 30/06/2022 10.8396 30/06/2023 0.7921 The entry recorded in the books of Marvel Ltd (Lessor) on 30 June 2019 is: Select one: O a 85,144 DR CR Lease Receivable Crane 85,144 O b. DR CR 78,807 Right to Use Asset Lease Liability 78,807 O 78,807 c. DR CR CR Right to Use Asset Cash Lease Liability 20,000 58,807 O d. None of the other options given Asgard Ltd (Lessor) and Gotham Ltd (Lessee) enter into a lease agreement for a crane on 30 June 2019. On that date, the crane had a fair value of $89,302. Details of the lease agreement are as follows: Lease term 4 years Annual Rental Payment in advance starting from 30 June 2019 $20,000 Economic life of the Crane 6 years Estimated Residual value at the end of the lease term $20,000 Residual Value guaranteed by the lessee $12,000 Interest Rate implicit in the lease 16% PV of Lease Payments $82,965 The relevant discount rates are: Year 30/06/2019 30/06/2020 0.9434 30/06/2021 0.8900 30/06/2022 10.8396 30/06/2023 0.7921 The entry recorded in the books of Asgard Ltd (Lessor) on 30 June 2020 for depreciation (rounded off to nearest dollar) is: Select one: O a. DR CR 17,741 Depreciation Expense Accumulated Depreciation 17,741 O b. DR CR 17,325 Accumulated Depreciation Depreciation Expense 17,325 O c. DR Depreciation Expense 22,326 CR Accumulated Depreciation 22,326 d. There is no depreciation charged in the books of Asgard Ltd. O A 4-year lease agreement was signed by the lessee and lessor on 30 June 2019. Residual value guaranteed by the lessee at the end of the lease term is $30,000. Annual lease payments are $50,000 made in arrears and the interest rate implicit in the lease is 6%. The lease payment schedule prepared by the lessee is shown below: LEASE SCHEDULE FOR LESSEE Date MLP Interest Liability Liability Expense Reduction Balance 30-Jun-19 197,018 30-Jun-20 50,000 11,821 38,179 158,839 30-Jun-21 50,000 9,530 40,470 118,369 30-Jun-22 50,000 7,102 42,898 75,472 30-Jun-23 80,000 4,528 75,472 Based on the above schedule, the journal entry to be recorded for the lease payment on 30 June 2021 in the books of the lessee is: Select one: O a. DR DR CR Lease Liability Interest Expense Cash 40,470 9.530 50,000 O b. DR DR CR Lease Receivable Interest Revenue Cash 40,470 9,530 50,000 c. DR DR CR Cash Interest Expense Lease Liability 40,470 9,530 50,000 O d. DR DR CR Lease Liability Interest Expense Cash 11,821 38,179 50,000