Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Car expenses EXERCISE 2: STATEMENTS OF INCOME AND RETURN ON REVENUE Nick Strizzi owns and operates a pizza delivery and take-out restaurant. In 2003 sold

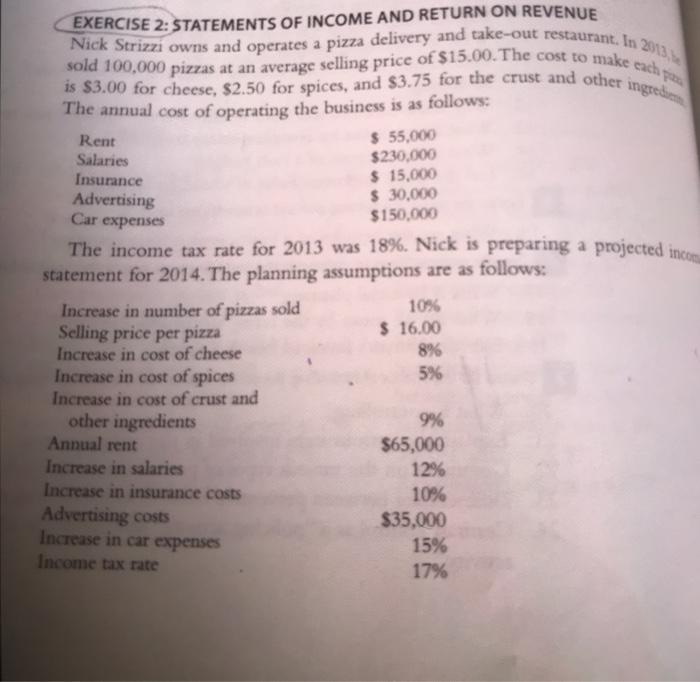

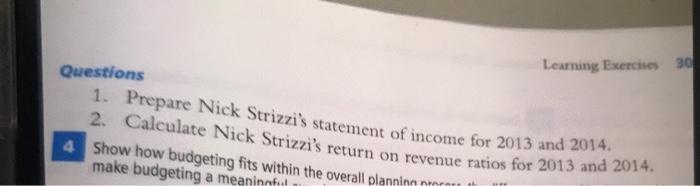

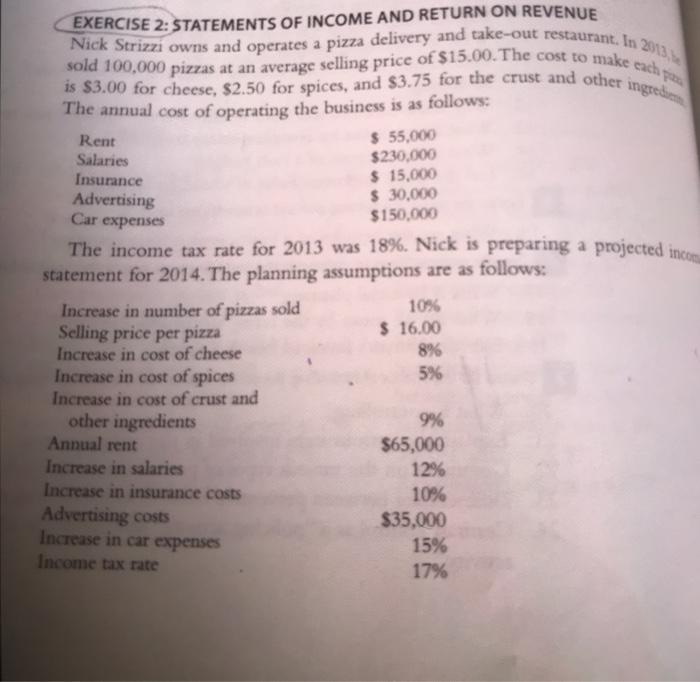

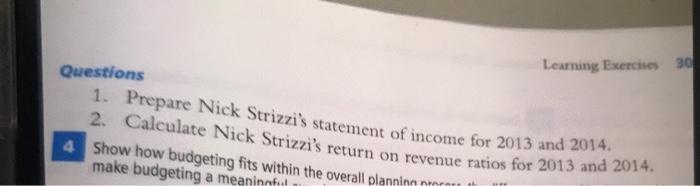

Car expenses EXERCISE 2: STATEMENTS OF INCOME AND RETURN ON REVENUE Nick Strizzi owns and operates a pizza delivery and take-out restaurant. In 2003 sold 100,000 pizzas at an average selling price of $15.00. The cost to make each is $3.00 for cheese, $2.50 for spices, and $3.75 for the crust and other ingredie The annual cost of operating the business is as follows: Rent $ 55,000 Salaries $230,000 Insurance $ 15,000 Advertising $ 30,000 $150,000 The income tax rate for 2013 was 18%. Nick is preparing a projected incom statement for 2014. The planning assumptions are as follows: Increase in number of pizzas sold 10% Selling price per pizza $ 16.00 Increase in cost of cheese 8% Increase in cost of spices 5% Increase in cost of crust and other ingredients 9% $65,000 Increase in salaries 12% Increase in insurance costs 10% Advertising costs $35,000 15% 17% Annual rent Increase in car expenses Income tax rate Learning Exercises 30 Questions 1. Prepare Nick Strizzi's statement of income for 2013 and 2014. 2. Calculate Nick Strizzi's return on revenue ratios for 2013 and 2014. 4 Show how budgeting fits within the overall planning mot make budgeting a meaningful

Car expenses EXERCISE 2: STATEMENTS OF INCOME AND RETURN ON REVENUE Nick Strizzi owns and operates a pizza delivery and take-out restaurant. In 2003 sold 100,000 pizzas at an average selling price of $15.00. The cost to make each is $3.00 for cheese, $2.50 for spices, and $3.75 for the crust and other ingredie The annual cost of operating the business is as follows: Rent $ 55,000 Salaries $230,000 Insurance $ 15,000 Advertising $ 30,000 $150,000 The income tax rate for 2013 was 18%. Nick is preparing a projected incom statement for 2014. The planning assumptions are as follows: Increase in number of pizzas sold 10% Selling price per pizza $ 16.00 Increase in cost of cheese 8% Increase in cost of spices 5% Increase in cost of crust and other ingredients 9% $65,000 Increase in salaries 12% Increase in insurance costs 10% Advertising costs $35,000 15% 17% Annual rent Increase in car expenses Income tax rate Learning Exercises 30 Questions 1. Prepare Nick Strizzi's statement of income for 2013 and 2014. 2. Calculate Nick Strizzi's return on revenue ratios for 2013 and 2014. 4 Show how budgeting fits within the overall planning mot make budgeting a meaningful

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started