Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Caravans Limited is a manufacturer of caravans and trailers. The company sells to big retail outlets and has a factory shop on site selling directly

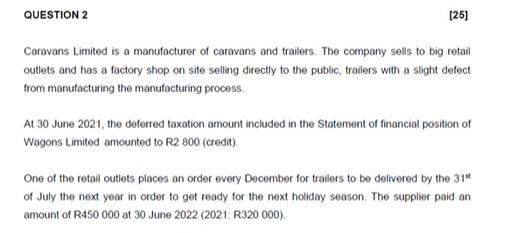

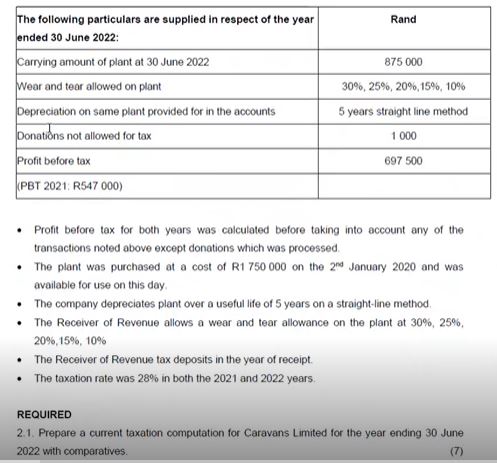

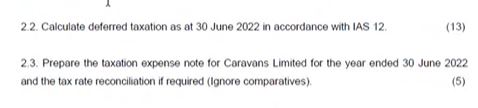

Caravans Limited is a manufacturer of caravans and trailers. The company sells to big retail outlets and has a factory shop on site selling directly to the public, trailers with a slight defect from manufacturing the manufacturing process. At 30 June 2021, the deferred taxation amount included in the Statement of financial position of Wagons Limited amounted to R2 800 (credit). One of the retail outlets places an order every December for trallers to be delivered by the 31st of July the next year in order to get ready for the next holiday season. The supplier paid an amount of R450 000 at 30 June 2022 (2021: R320 000). - Profit before tax for both years was calculated before taking into account any of the transactions noted above except donations which was processed. - The plant was purchased at a cost of R1 750000 on the 2nd January 2020 and was available for use on this day. - The company depreciates plant over a useful life of 5 years on a straight-line method. - The Receiver of Revenue allows a wear and tear allowance on the plant at 30%,25%, 20%,15%,10% - The Receiver of Revenue tax deposits in the year of receipt. - The taxation rate was 28% in both the 2021 and 2022 years. REQUIRED 2.1. Prepare a current taxation computation for Caravans Limited for the year ending 30 June 2022 with comparatives. 2.2. Calculate deferred taxation as at 30 June 2022 in accordance with IAS 12 2.3. Prepare the taxation expense note for Caravans Limited for the year ended 30 June 2022 and the tax rate reconciliation if required (Ignore comparatives)

Caravans Limited is a manufacturer of caravans and trailers. The company sells to big retail outlets and has a factory shop on site selling directly to the public, trailers with a slight defect from manufacturing the manufacturing process. At 30 June 2021, the deferred taxation amount included in the Statement of financial position of Wagons Limited amounted to R2 800 (credit). One of the retail outlets places an order every December for trallers to be delivered by the 31st of July the next year in order to get ready for the next holiday season. The supplier paid an amount of R450 000 at 30 June 2022 (2021: R320 000). - Profit before tax for both years was calculated before taking into account any of the transactions noted above except donations which was processed. - The plant was purchased at a cost of R1 750000 on the 2nd January 2020 and was available for use on this day. - The company depreciates plant over a useful life of 5 years on a straight-line method. - The Receiver of Revenue allows a wear and tear allowance on the plant at 30%,25%, 20%,15%,10% - The Receiver of Revenue tax deposits in the year of receipt. - The taxation rate was 28% in both the 2021 and 2022 years. REQUIRED 2.1. Prepare a current taxation computation for Caravans Limited for the year ending 30 June 2022 with comparatives. 2.2. Calculate deferred taxation as at 30 June 2022 in accordance with IAS 12 2.3. Prepare the taxation expense note for Caravans Limited for the year ended 30 June 2022 and the tax rate reconciliation if required (Ignore comparatives) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started