Answered step by step

Verified Expert Solution

Question

1 Approved Answer

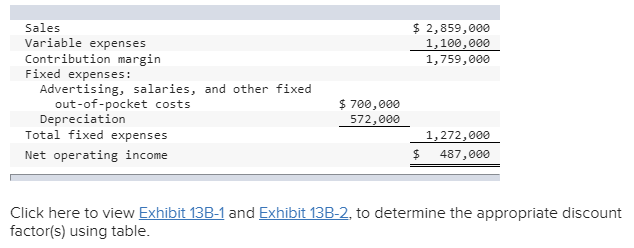

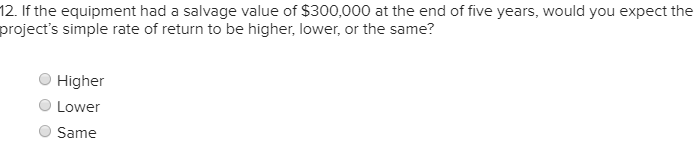

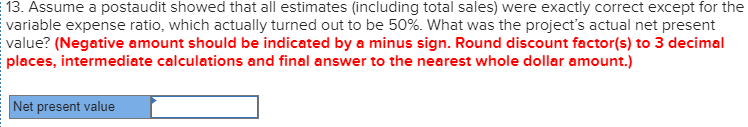

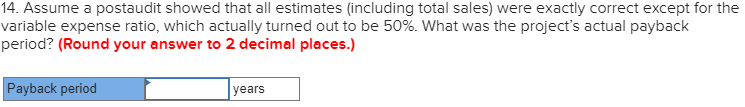

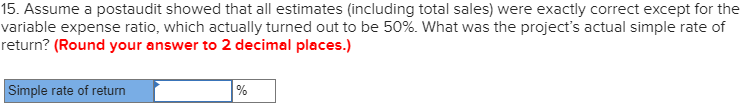

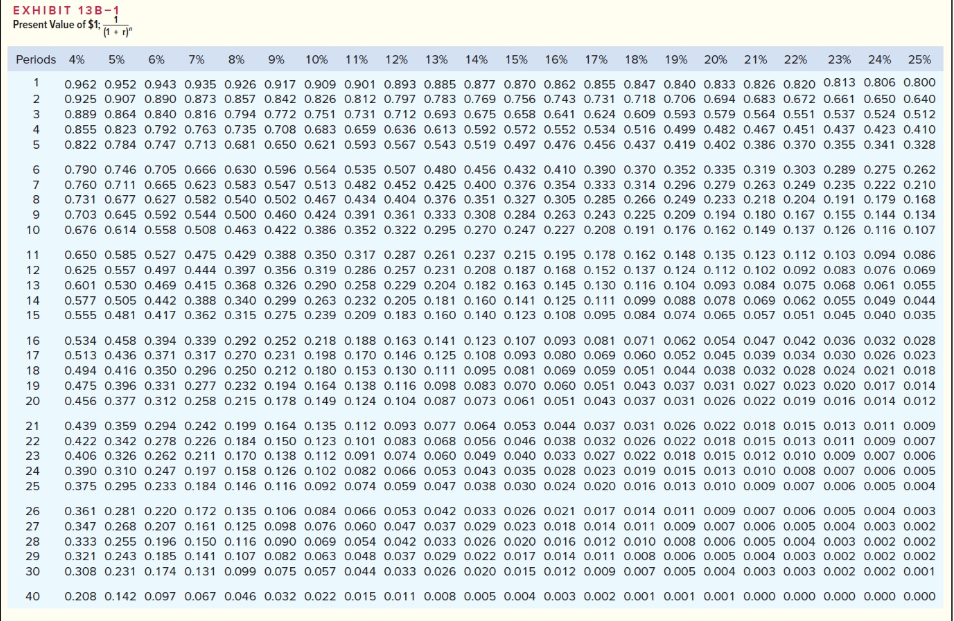

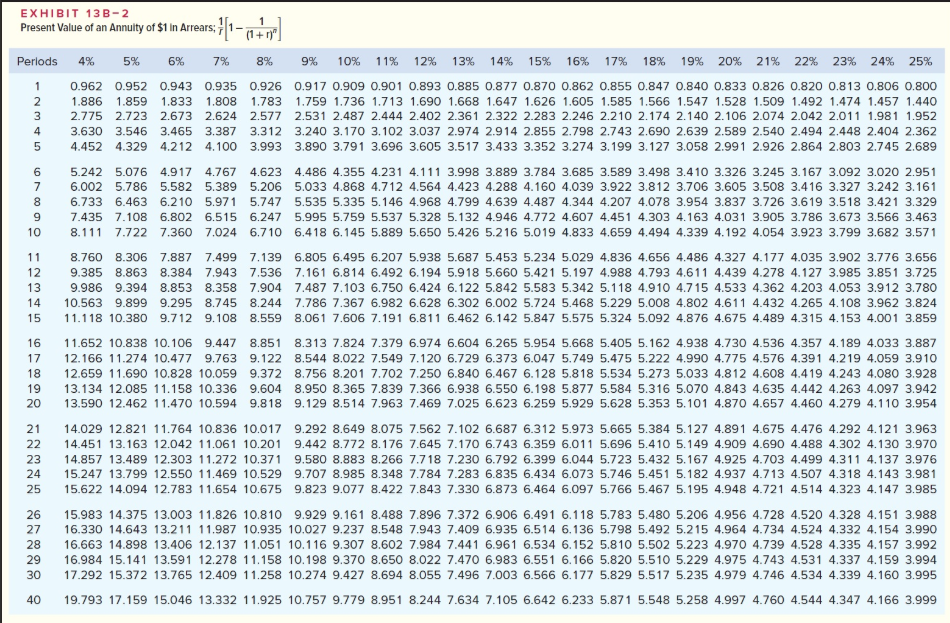

Cardinal Company is considering a five-year project that would require a $2,860,000 investment in equipment with a useful life of five years and no salvage

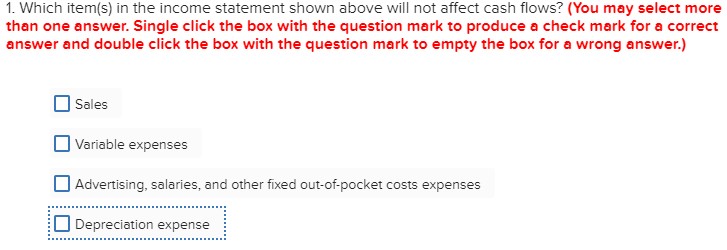

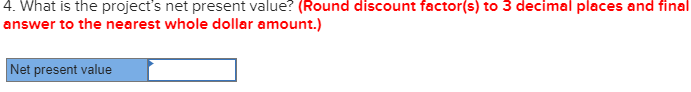

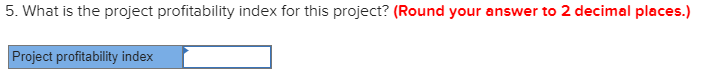

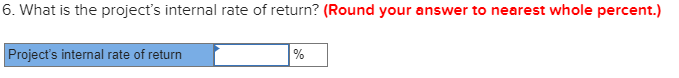

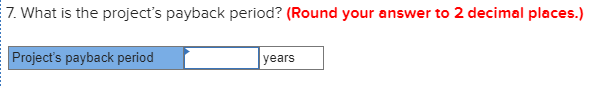

Cardinal Company is considering a five-year project that would require a $2,860,000 investment in equipment with a useful life of five years and no salvage value. The companys discount rate is 14%. The project would provide net operating income in each of five years as follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started