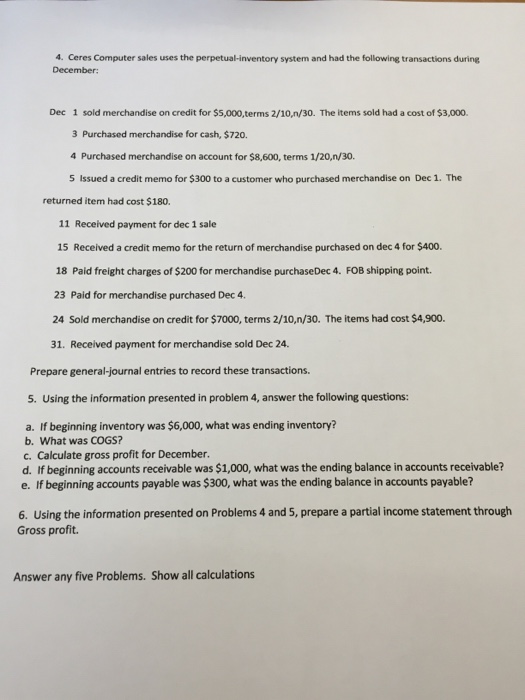

Cares Computer sales uses the perpetual-inventory system and had the following transactions during December: Dec 1 sold merchandise on credit for $5,000,terms 2/10,n/30. The items sold had a cost of $3,000 3 Purchased merchandise for cash, $720. 4 Purchased merchandise on account for $8,600, terms 1/20,n/30. 5 Issued a credit memo for $300 to a customer who purchased merchandise on Dec 1. The returned Item had cost $180. 11 Received payment for dec 1 sale 15 Received a credit memo for the return of merchandise purchased on dec 4 for $400. 18 Paid freight charges of $200 for merchandise purchaseDec 4. FOB shipping point. 23 Paid for merchandise purchased Dec 4. 24 Sold merchandise on credit for $7000, terms 2/10,n/30. The Items had cost $4,900 31, Received payment for merchandise sold Dec 24. Prepare general-journal entries to record these transactions. 5. Using the Information presented In problem 4, answer the following questions: a. If beginning Inventory was $6,000, what was ending inventory? b. What was COGS? c. Calculate gross profit for December. d. W beginning accounts receivable was $1,000, what was the ending balance in accounts receivable? e. If beginning accounts payable was $300, what was the ending balance in accounts payable? 6. Using the information presented on Problems 4 and 5, prepare a partial Income statement through Gross profit. Answer any five Problems. Show all calculations Cares Computer sales uses the perpetual-inventory system and had the following transactions during December: Dec 1 sold merchandise on credit for $5,000,terms 2/10,n/30. The items sold had a cost of $3,000 3 Purchased merchandise for cash, $720. 4 Purchased merchandise on account for $8,600, terms 1/20,n/30. 5 Issued a credit memo for $300 to a customer who purchased merchandise on Dec 1. The returned Item had cost $180. 11 Received payment for dec 1 sale 15 Received a credit memo for the return of merchandise purchased on dec 4 for $400. 18 Paid freight charges of $200 for merchandise purchaseDec 4. FOB shipping point. 23 Paid for merchandise purchased Dec 4. 24 Sold merchandise on credit for $7000, terms 2/10,n/30. The Items had cost $4,900 31, Received payment for merchandise sold Dec 24. Prepare general-journal entries to record these transactions. 5. Using the Information presented In problem 4, answer the following questions: a. If beginning Inventory was $6,000, what was ending inventory? b. What was COGS? c. Calculate gross profit for December. d. W beginning accounts receivable was $1,000, what was the ending balance in accounts receivable? e. If beginning accounts payable was $300, what was the ending balance in accounts payable? 6. Using the information presented on Problems 4 and 5, prepare a partial Income statement through Gross profit. Answer any five Problems. Show all calculations