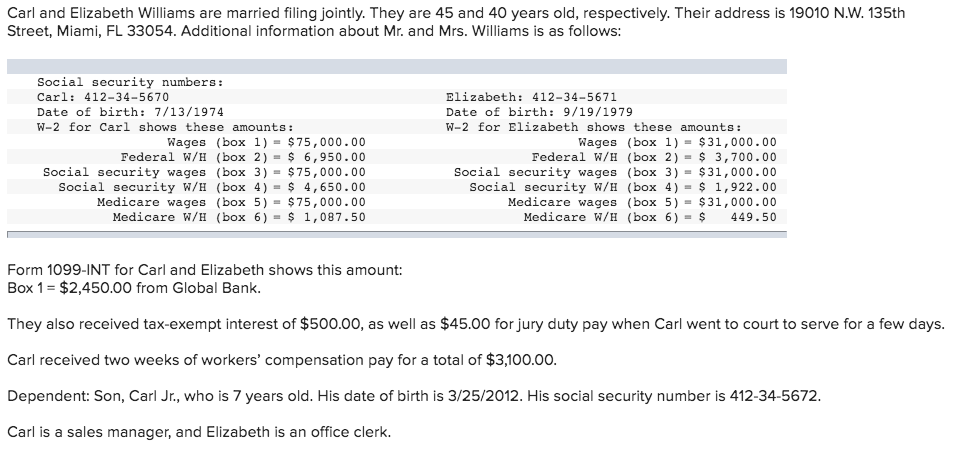

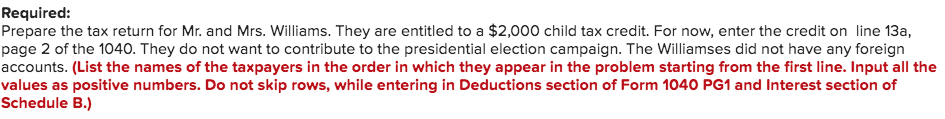

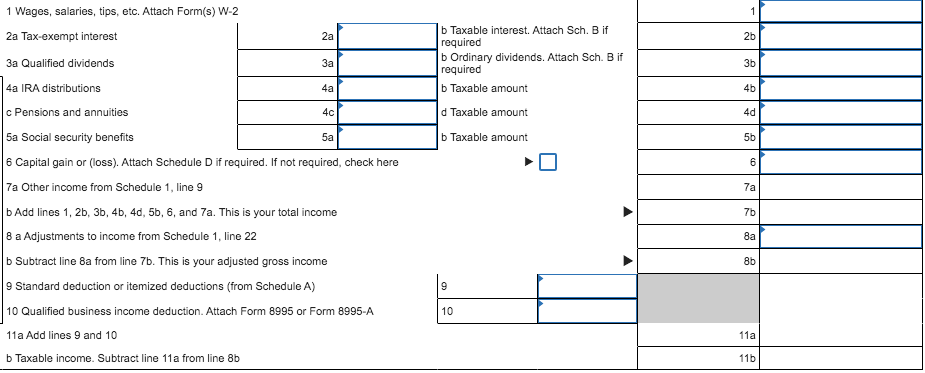

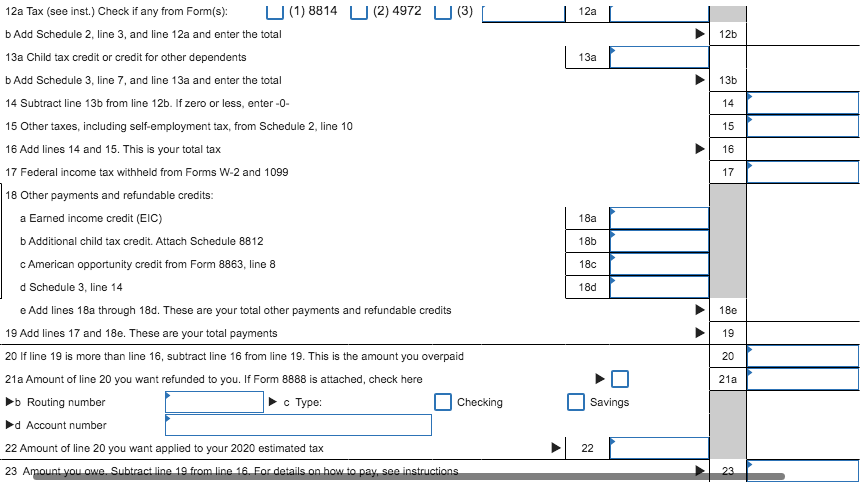

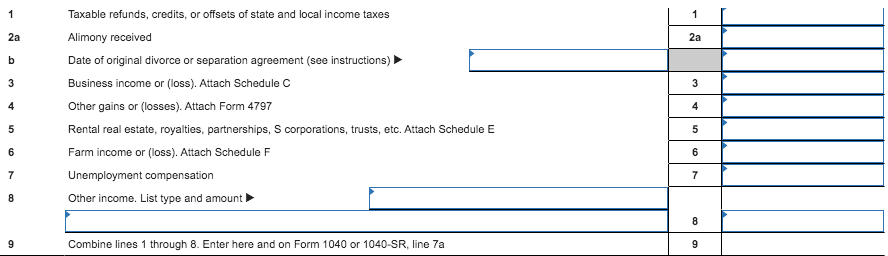

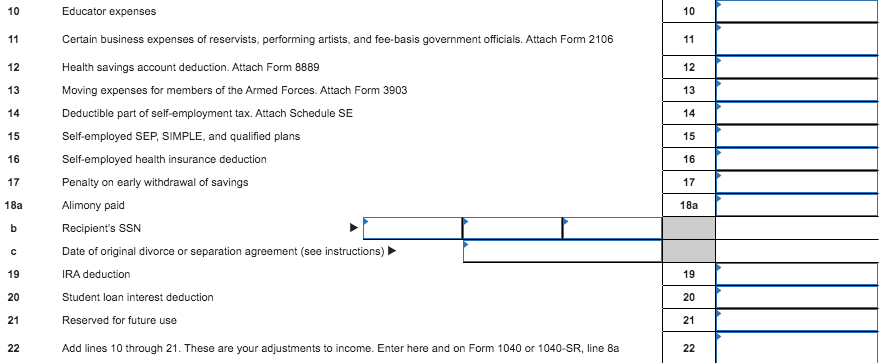

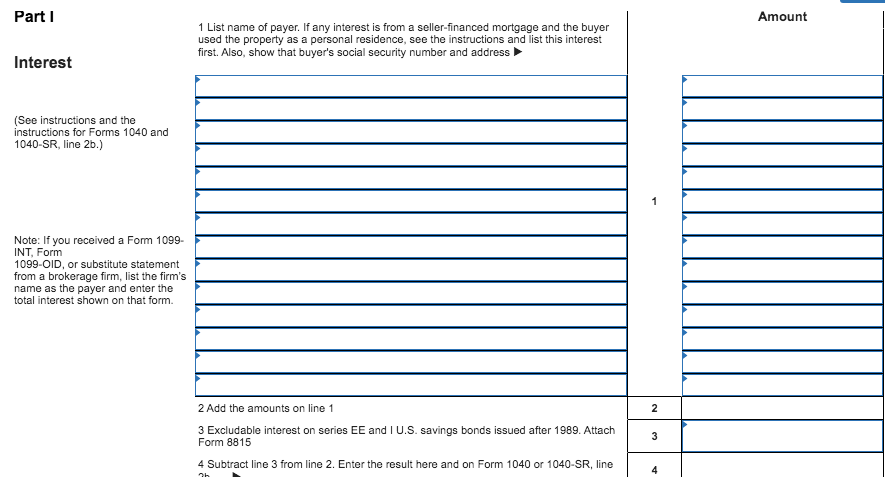

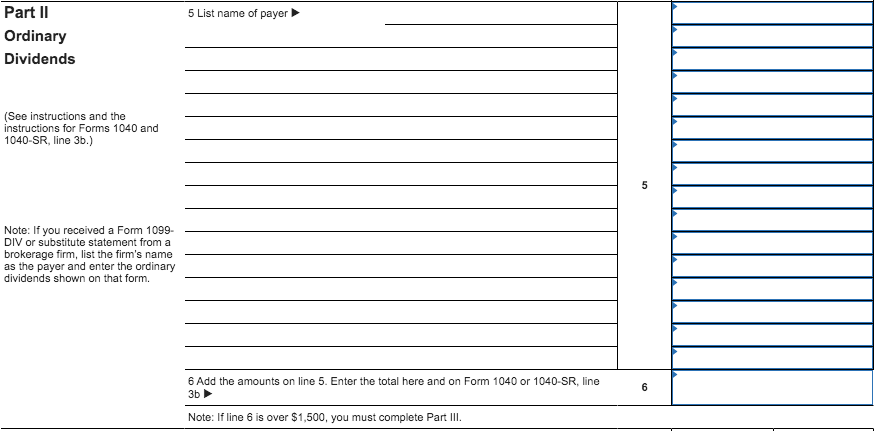

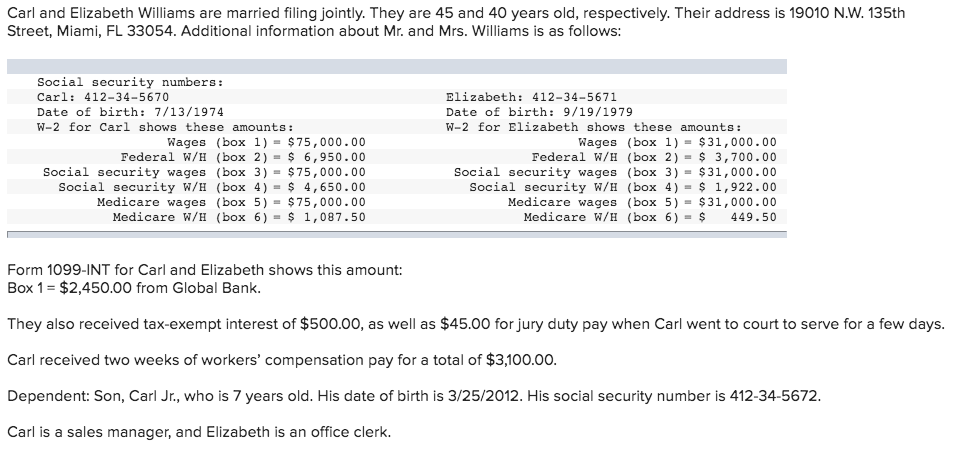

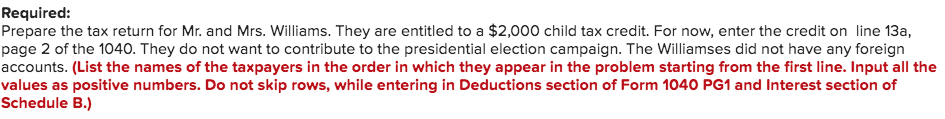

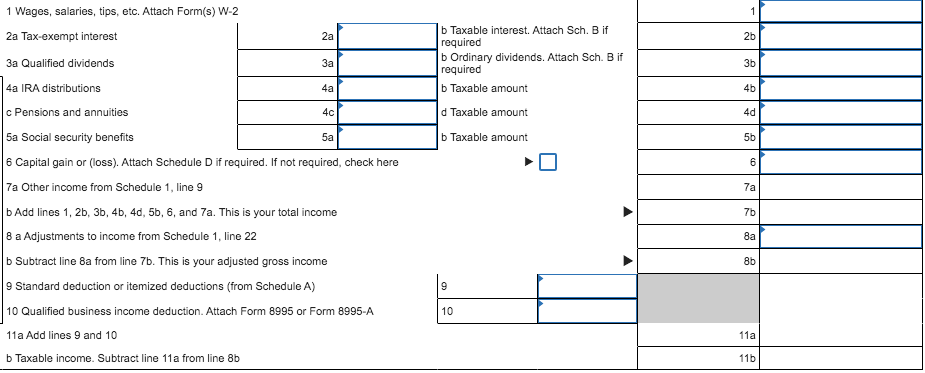

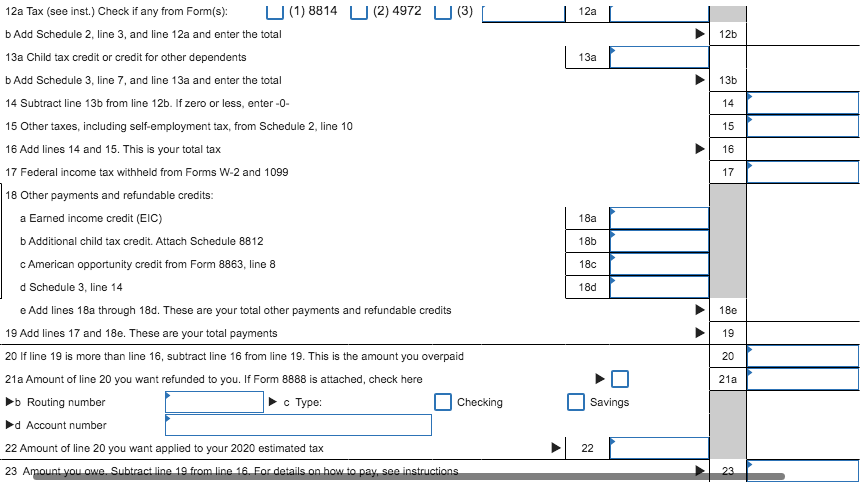

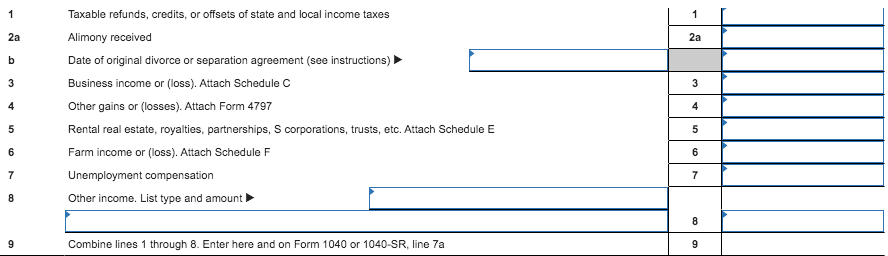

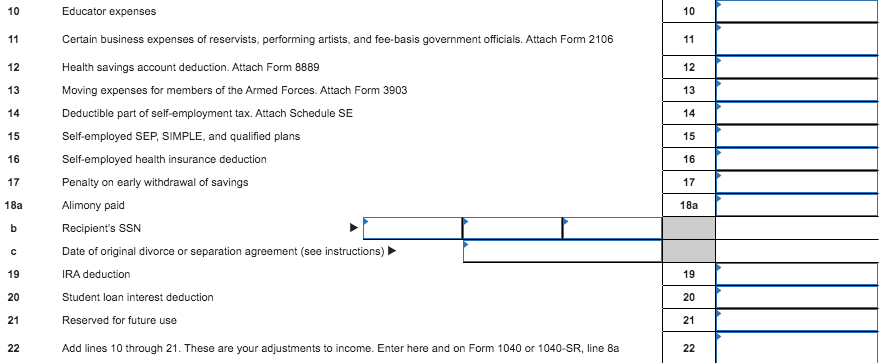

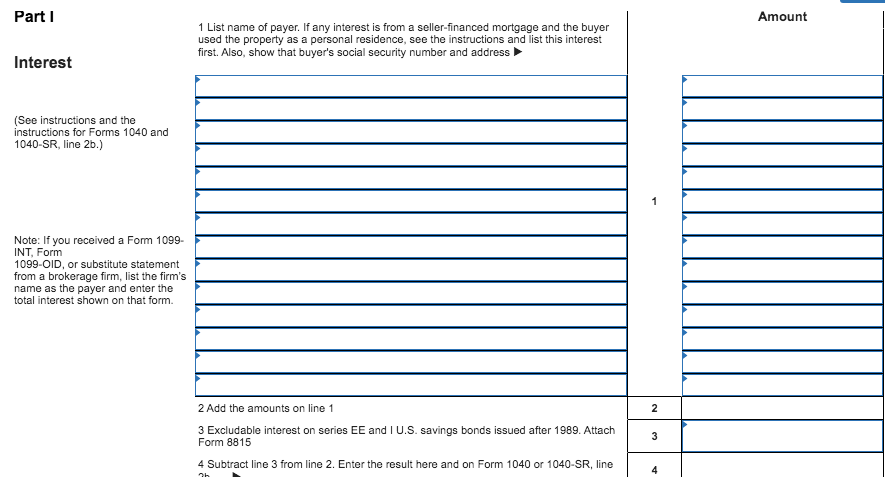

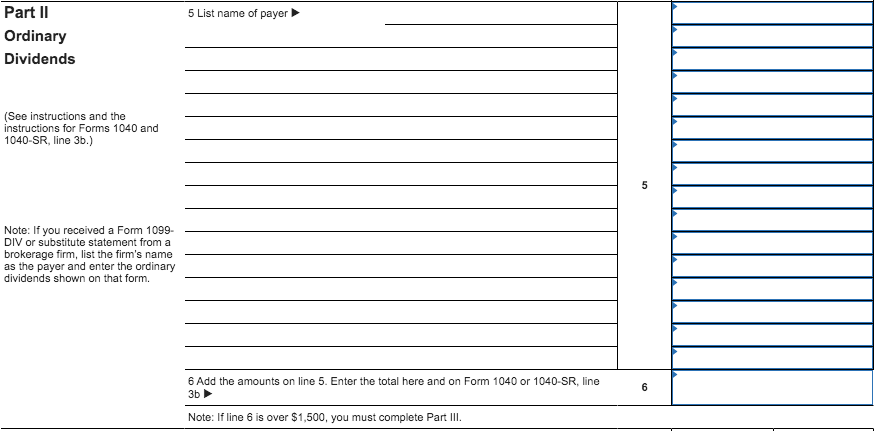

Carl and Elizabeth Williams are married filing jointly. They are 45 and 40 years old, respectively. Their address is 19010 N.W. 135th Street, Miami, FL 33054. Additional information about Mr. and Mrs. Williams is as follows: Social security numbers: Carl: 412-34-5670 Date of birth: 7/13/1974 W-2 for Carl shows these amounts: Wages (box 1) = $ 75,000.00 Federal W/H (box 2) = $ 6,950.00 Social security wages (box 3) = $75,000.00 Social security W/H (box 4) = $ 4,650.00 Medicare wages (box 5) = $ 75,000.00 Medicare W/H (box 6) = $ 1,087.50 Elizabeth: 412-34-5671 Date of birth: 9/19/1979 W-2 for Elizabeth shows these amounts: Wages (box 1) = $31,000.00 Federal W/H (box 2) = $ 3,700.00 Social security wages (box 3) = $31,000.00 Social security W/H (box 4) = $ 1,922.00 Medicare wages (box 5) = $31,000.00 Medicare w/H (box 6) = $ 449.50 Form 1099-INT for Carl and Elizabeth shows this amount: Box 1 = $2,450.00 from Global Bank. They also received tax-exempt interest of $500.00, as well as $45.00 for jury duty pay when Carl went to court to serve for a few days. Carl received two weeks of workers' compensation pay for a total of $3,100.00. Dependent: Son, Carl Jr., who is 7 years old. His date of birth is 3/25/2012. His social security number is 412-34-5672. Carl is a sales manager, and Elizabeth is an office clerk. Required: Prepare the tax return for Mr. and Mrs. Williams. They are entitled to a $2,000 child tax credit. For now, enter the credit on line 13a, page 2 of the 1040. They do not want to contribute to the presidential election campaign. The Williamses did not have any foreign accounts. (List the names of the taxpayers in the order in which they appear in the problem starting from the first line. Input all the values as positive numbers. Do not skip rows, while entering in Deductions section of Form 1040 PG1 and Interest section of Schedule B.) 1 2b 3a 3b 1 Wages, salaries, tips, etc. Attach Form(s) W-2 2a Tax-exempt interest 2a 3a Qualified dividends 4a IRA distributions C Pensions and annuities 5a Social security benefits 5a 6 Capital gain or loss). Attach Schedule Dif required. If not required, check here 4a b Taxable interest. Attach Sch. Bif required b Ordinary dividends. Attach Sch. Bif required Taxable amount d Taxable amount b Taxable amount 4b 4c 4d 5b 6 7a Other income from Schedule 1, line 9 7a 7b Ba 8b Add lines 1, 2b, 36, 4b, 40, 56, 6, and 7a. This is your total income 8 a Adjustments to income from Schedule 1, line 22 Subtract line 8a from line 76. This is your adjusted gross income 9 Standard deduction or itemized deductions (from Schedule A) 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A 11a Add lines 9 and 10 b Taxable income. Subtract line 11a from line 86 9 10 11a 11b 12a 12b 13a 13b 14 15 A 16 17 18a 12a Tax (see inst.) Check if any from Form(s): U (1) 8814 (2) 4972 (3) b Add Schedule 2, line 3, and line 12a and enter the total 13a Child tax credit or credit for other dependents b Add Schedule 3, line 7, and line 13a and enter the total 14 Subtract line 136 from line 12b. If zero or less, enter-O- 15 Other taxes, including self-employment tax, from Schedule 2, line 10 16 Add lines 14 and 15. This is your total tax 17 Federal income tax withheld from Forms W-2 and 1099 18 Other payments and refundable credits: a Earned income credit (EIC) b Additional child tax credit. Attach Schedule 8812 c American opportunity credit from Form 8863, line 8 d Schedule 3, line 14 e Add lines 18a through 18d. These are your total other payments and refundable credits 19 Add lines 17 and 18e. These are your total payments 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here b Routing number c Type: Checking Account number 22 Amount of line 20 you want applied to your 2020 estimated tax 23 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions 18b 18c 18d 18e 19 20 21a Savings 22 23 1 1 2a 2a b 3 3 4 Taxable refunds, credits, or offsets of state and local income taxes Alimony received Date of original divorce or separation agreement (see instructions) Business income or (loss). Attach Schedule C Other gains or losses). Attach Form 4797 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or loss). Attach Schedule F Unemployment compensation Other income. List type and amount 4 5 5 6 6 7 7 8 8 9 Combine lines 1 through 8. Enter here and on Form 1040 or 1040-SR, line 7a 9 10 Educator expenses 10 11 11 12 12 13 13 14 14 15 15 16 16 17 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 Health savings account deduction. Attach Form 8889 Moving expenses for members of the Armed Forces. Attach Form 3903 Deductible part of self-employment tax. Attach Schedule SE Self-employed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction Penalty on early withdrawal of savings Alimony paid Recipient's SSN Date of original divorce or separation agreement (see instructions) IRA deduction Student loan interest deduction Reserved for future use 17 18a 18a b 19 19 20 20 21 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 8a 22 5 List name of payer Part 11 Ordinary Dividends (See instructions and the instructions for Forms 1040 and 1040-SR, line 3b.) 5 Note: If you received a Form 1099- DIV or substitute statement from a brokerage firm, list the firm's name as the payer and enter the ordinary dividends shown on that form. 6 Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR, line 6 3b Note: If line 6 is over $1,500, you must complete Part III. Carl and Elizabeth Williams are married filing jointly. They are 45 and 40 years old, respectively. Their address is 19010 N.W. 135th Street, Miami, FL 33054. Additional information about Mr. and Mrs. Williams is as follows: Social security numbers: Carl: 412-34-5670 Date of birth: 7/13/1974 W-2 for Carl shows these amounts: Wages (box 1) = $ 75,000.00 Federal W/H (box 2) = $ 6,950.00 Social security wages (box 3) = $75,000.00 Social security W/H (box 4) = $ 4,650.00 Medicare wages (box 5) = $ 75,000.00 Medicare W/H (box 6) = $ 1,087.50 Elizabeth: 412-34-5671 Date of birth: 9/19/1979 W-2 for Elizabeth shows these amounts: Wages (box 1) = $31,000.00 Federal W/H (box 2) = $ 3,700.00 Social security wages (box 3) = $31,000.00 Social security W/H (box 4) = $ 1,922.00 Medicare wages (box 5) = $31,000.00 Medicare w/H (box 6) = $ 449.50 Form 1099-INT for Carl and Elizabeth shows this amount: Box 1 = $2,450.00 from Global Bank. They also received tax-exempt interest of $500.00, as well as $45.00 for jury duty pay when Carl went to court to serve for a few days. Carl received two weeks of workers' compensation pay for a total of $3,100.00. Dependent: Son, Carl Jr., who is 7 years old. His date of birth is 3/25/2012. His social security number is 412-34-5672. Carl is a sales manager, and Elizabeth is an office clerk. Required: Prepare the tax return for Mr. and Mrs. Williams. They are entitled to a $2,000 child tax credit. For now, enter the credit on line 13a, page 2 of the 1040. They do not want to contribute to the presidential election campaign. The Williamses did not have any foreign accounts. (List the names of the taxpayers in the order in which they appear in the problem starting from the first line. Input all the values as positive numbers. Do not skip rows, while entering in Deductions section of Form 1040 PG1 and Interest section of Schedule B.) 1 2b 3a 3b 1 Wages, salaries, tips, etc. Attach Form(s) W-2 2a Tax-exempt interest 2a 3a Qualified dividends 4a IRA distributions C Pensions and annuities 5a Social security benefits 5a 6 Capital gain or loss). Attach Schedule Dif required. If not required, check here 4a b Taxable interest. Attach Sch. Bif required b Ordinary dividends. Attach Sch. Bif required Taxable amount d Taxable amount b Taxable amount 4b 4c 4d 5b 6 7a Other income from Schedule 1, line 9 7a 7b Ba 8b Add lines 1, 2b, 36, 4b, 40, 56, 6, and 7a. This is your total income 8 a Adjustments to income from Schedule 1, line 22 Subtract line 8a from line 76. This is your adjusted gross income 9 Standard deduction or itemized deductions (from Schedule A) 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A 11a Add lines 9 and 10 b Taxable income. Subtract line 11a from line 86 9 10 11a 11b 12a 12b 13a 13b 14 15 A 16 17 18a 12a Tax (see inst.) Check if any from Form(s): U (1) 8814 (2) 4972 (3) b Add Schedule 2, line 3, and line 12a and enter the total 13a Child tax credit or credit for other dependents b Add Schedule 3, line 7, and line 13a and enter the total 14 Subtract line 136 from line 12b. If zero or less, enter-O- 15 Other taxes, including self-employment tax, from Schedule 2, line 10 16 Add lines 14 and 15. This is your total tax 17 Federal income tax withheld from Forms W-2 and 1099 18 Other payments and refundable credits: a Earned income credit (EIC) b Additional child tax credit. Attach Schedule 8812 c American opportunity credit from Form 8863, line 8 d Schedule 3, line 14 e Add lines 18a through 18d. These are your total other payments and refundable credits 19 Add lines 17 and 18e. These are your total payments 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here b Routing number c Type: Checking Account number 22 Amount of line 20 you want applied to your 2020 estimated tax 23 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions 18b 18c 18d 18e 19 20 21a Savings 22 23 1 1 2a 2a b 3 3 4 Taxable refunds, credits, or offsets of state and local income taxes Alimony received Date of original divorce or separation agreement (see instructions) Business income or (loss). Attach Schedule C Other gains or losses). Attach Form 4797 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or loss). Attach Schedule F Unemployment compensation Other income. List type and amount 4 5 5 6 6 7 7 8 8 9 Combine lines 1 through 8. Enter here and on Form 1040 or 1040-SR, line 7a 9 10 Educator expenses 10 11 11 12 12 13 13 14 14 15 15 16 16 17 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 Health savings account deduction. Attach Form 8889 Moving expenses for members of the Armed Forces. Attach Form 3903 Deductible part of self-employment tax. Attach Schedule SE Self-employed SEP, SIMPLE, and qualified plans Self-employed health insurance deduction Penalty on early withdrawal of savings Alimony paid Recipient's SSN Date of original divorce or separation agreement (see instructions) IRA deduction Student loan interest deduction Reserved for future use 17 18a 18a b 19 19 20 20 21 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 8a 22 5 List name of payer Part 11 Ordinary Dividends (See instructions and the instructions for Forms 1040 and 1040-SR, line 3b.) 5 Note: If you received a Form 1099- DIV or substitute statement from a brokerage firm, list the firm's name as the payer and enter the ordinary dividends shown on that form. 6 Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR, line 6 3b Note: If line 6 is over $1,500, you must complete Part