Question

Carl Conch and Mary Duval are married and file a joint return. They live at 1234 Mallory Sq. Apt. 64, Key West, FL 33040. Carl

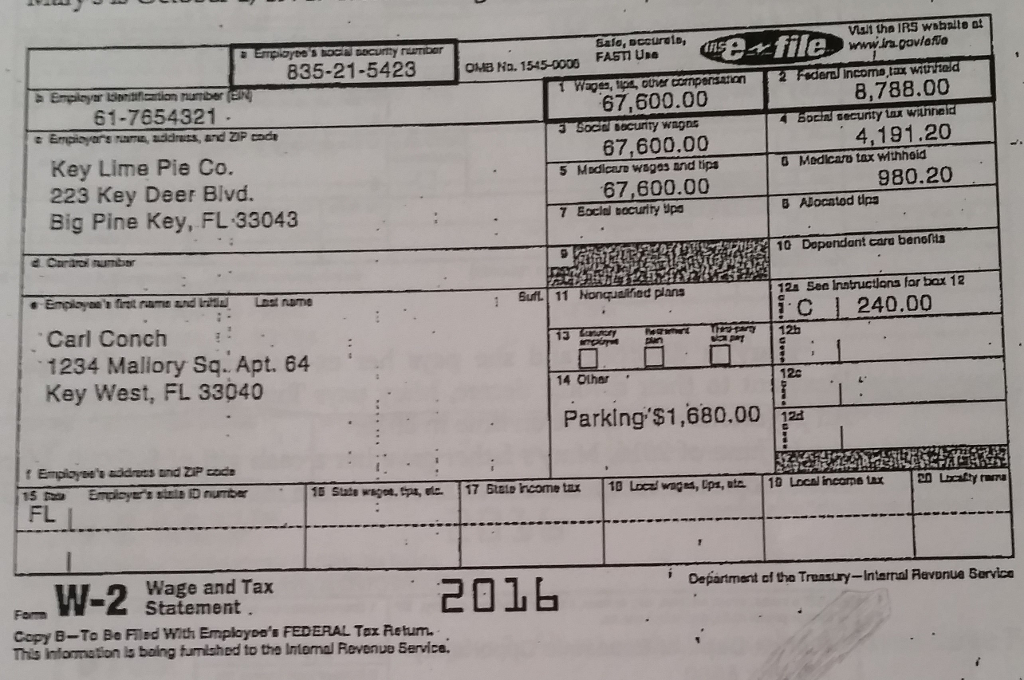

Carl Conch and Mary Duval are married and file a joint return. They live at 1234 Mallory Sq. Apt. 64, Key West, FL 33040. Carl works for the Key Lime Pie Company and Mary is a homemaker after losing her job in 2015. Marys Social Security number is 633-65-7912 and Carls is 835-21-5423. Carls birthdate is June 14, 1971 and Marys is October 2, 1971. Carls earnings are reported on the following Form W-2:

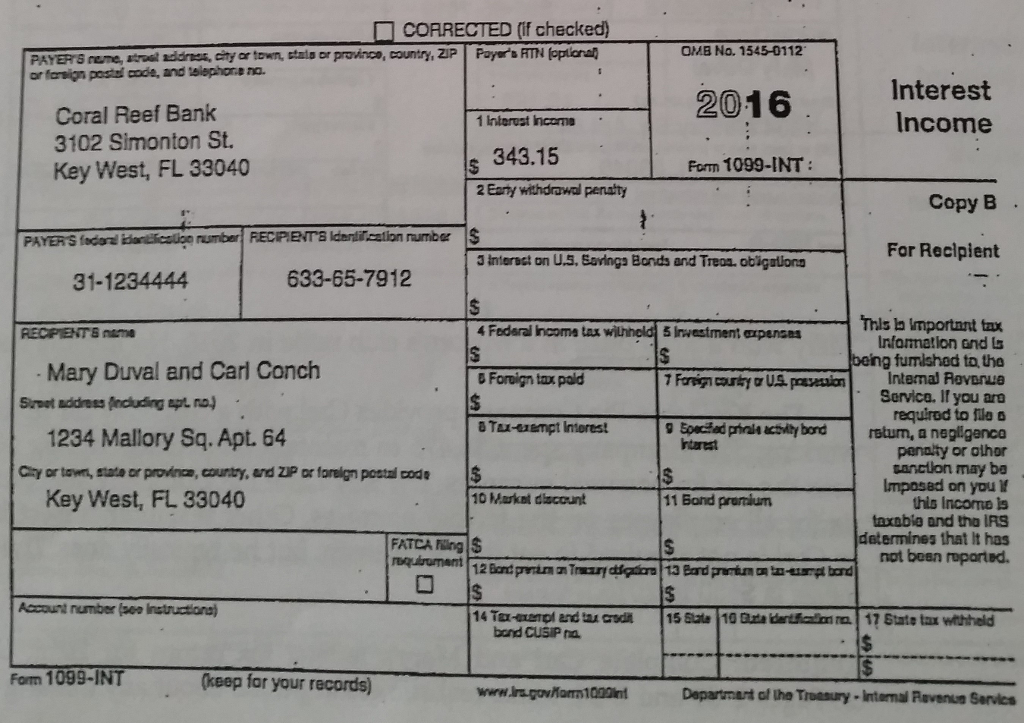

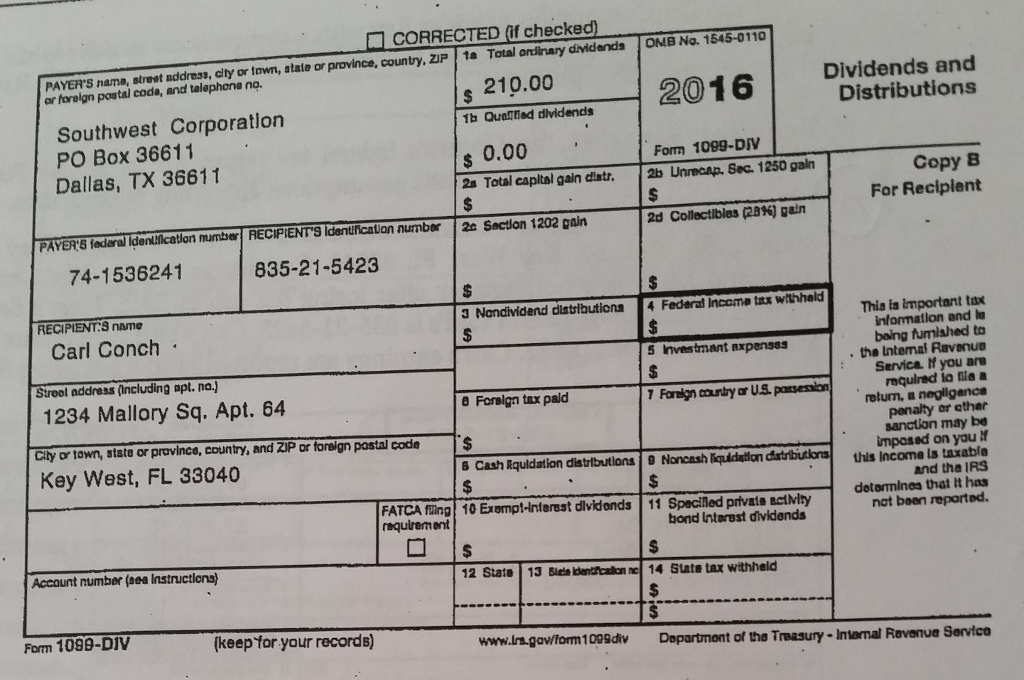

Carl and Mary received the following Form 1099s in 2016:

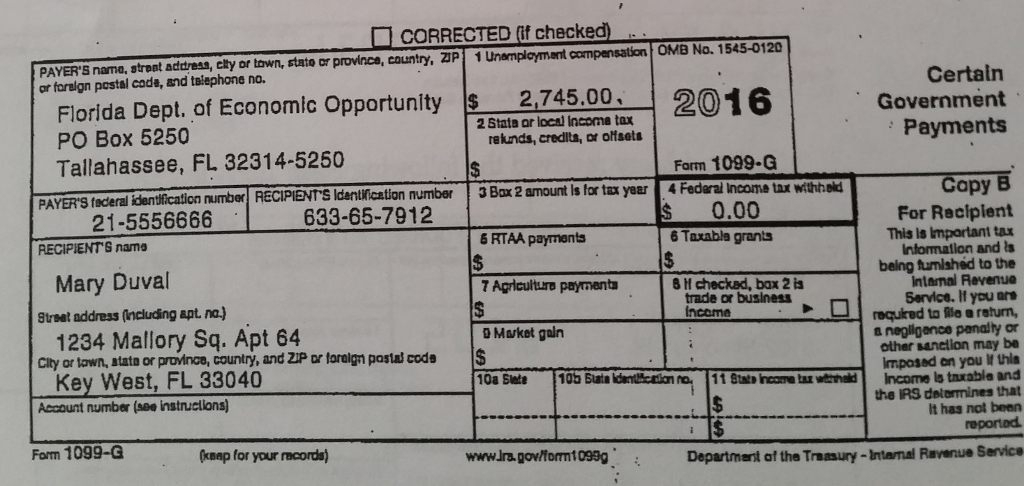

Mary is divorced and she pays her ex-husband (Tom Tortuga) child support. Pursuant to their divorce decree, Mary pays Tom $500 per month in child support. All payments were made on time in 2016. In June of 2016, Marys father gave her a cash gift of $75,000. Mary also received unemployment compensation as shown on the following form 1099-G:

Mary won a $750 prize in a womens club raffle in 2016. No income tax was withheld from the prize.

The Key Lime Pie Company provides Carl with a company car to drive while he is working. The Company spent $6,475 to maintain this vehicle during 2016. Carl never uses the car for personal purposes. The Key Lime Pie Company also provides a cafeteria for all employees on the factory premises. Other resturanet exist in the aera and so CArl is not required to eat in the Cafateria, but he typically does. The value of Carl's meals is $650 in 2016.

Required: Complete Carl and Marys federal tax return for 2016. Use Form 1040 on Pages 2-53 and 2-54. Make realistic assumptions about any missing data.

Visit tha IRS wabalte at file Salo, occurralo, 835-21-5423 osta No. 15.5oooo FASm Use 2 FoderDU incomo,tax withhold 8,788.00 67,600.00 61-7654321 4 Boch secunty Wunneid 4,191.20 Empienors raman addrass, and ZP coda 67,600.00 G Medlcato tax withheld Key Lime Pie Co. 5 Modicare wages and tips 980.20 67,600.00 223 Key Deer Blvd. B Nocatod tips 7 Eocial bocurity ups Big Pine Key, FL 33043 10 Dependant card benoMa d Cantine number 12a See instructions far bax 12 Nonqualified plans SufL 11 I. C 1 240.00 s Empiayan't firat rams und Lost name 12h Carl Conch 1234 Mallory Sq. Apt. 64 14, OLhar Key West, FL 33040 Parking $1,680.00 f Empiayee's address and ZIP code Local income tax 2nd Lbcatty mura 10 17 Etale income tax 15 State wagot. pa, 15 Empioyo's siste D number Department of the Treasury-Internal Aavunue 5ervica 2016 W-2 Wage and Tax Statement Copy B-To Be Fled Wnth Employoe's FEDERAL Tax Returm. This information is baing tumished to the Intomal Revenue ServiceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started