Carl Corp. Prepares its financial statements under U.S. GAAP

Ellie prepares its financial statements under IFRS

You have gained the following insights:

Carl and Ellie are the same company except they use different accounting standards. You are tasked with maintaining the financial statements for both standards and periodically reconciling certain account balances.

For year 2016 you acquire the following additional information:

- 60% of the R&D expenses are classified as development expenses that will begin to amortize over 5 years beginning 1/1/17

- A year-end impairment test is performed on the machine and the following is noted:

Book Value $192,000

Sales Price (if sold) $180,000

Selling Costs $5,000

NPV $180,000

Future Cash Flows (undiscounted) $200,000

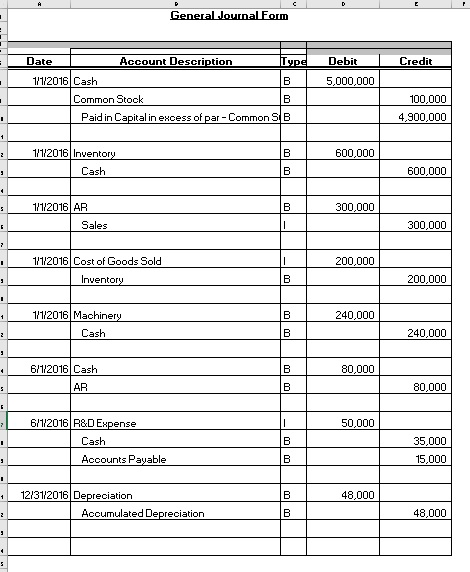

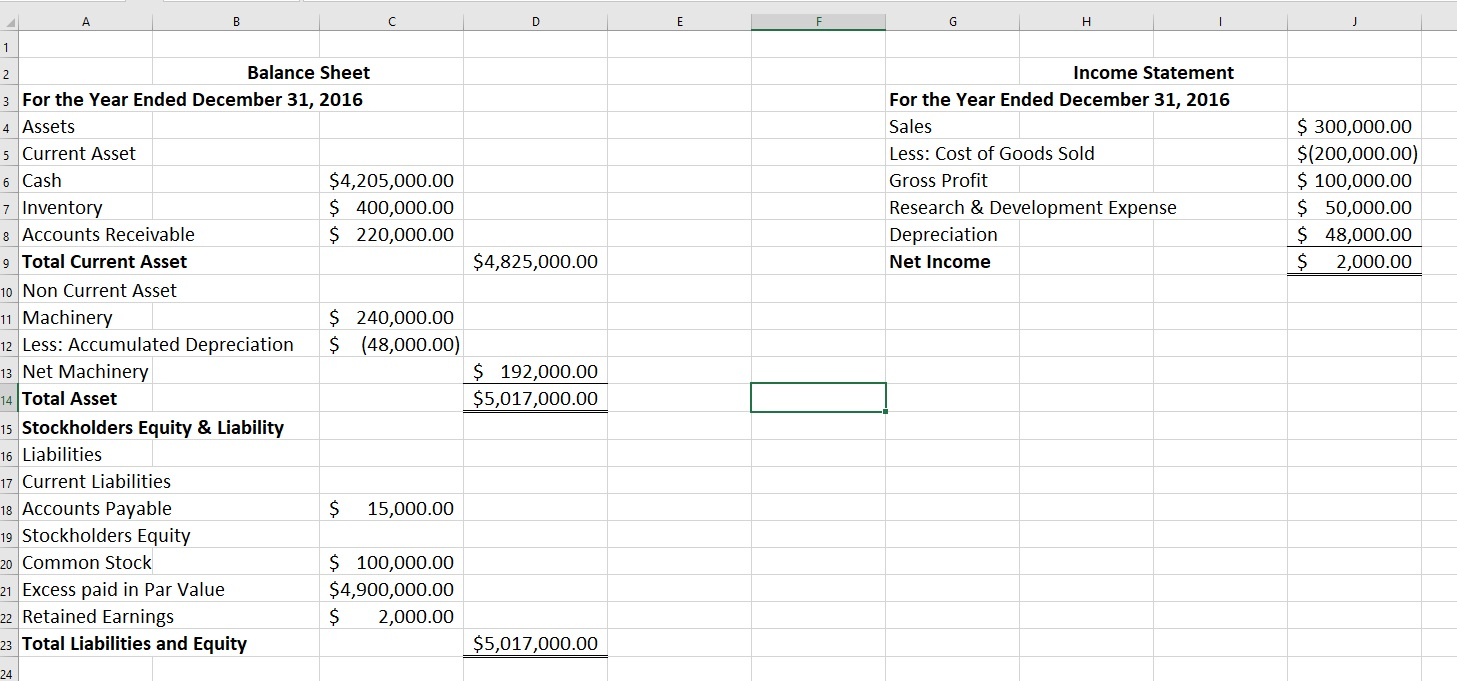

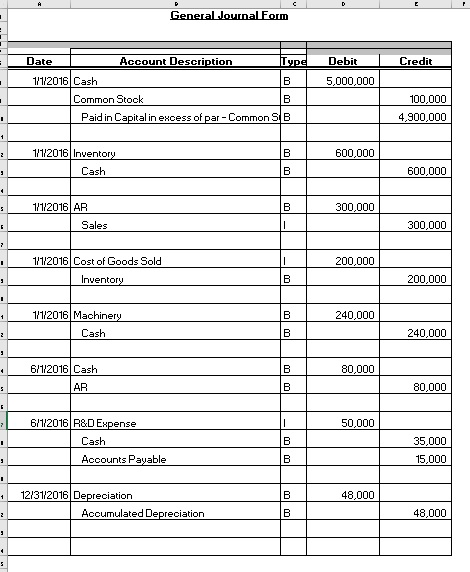

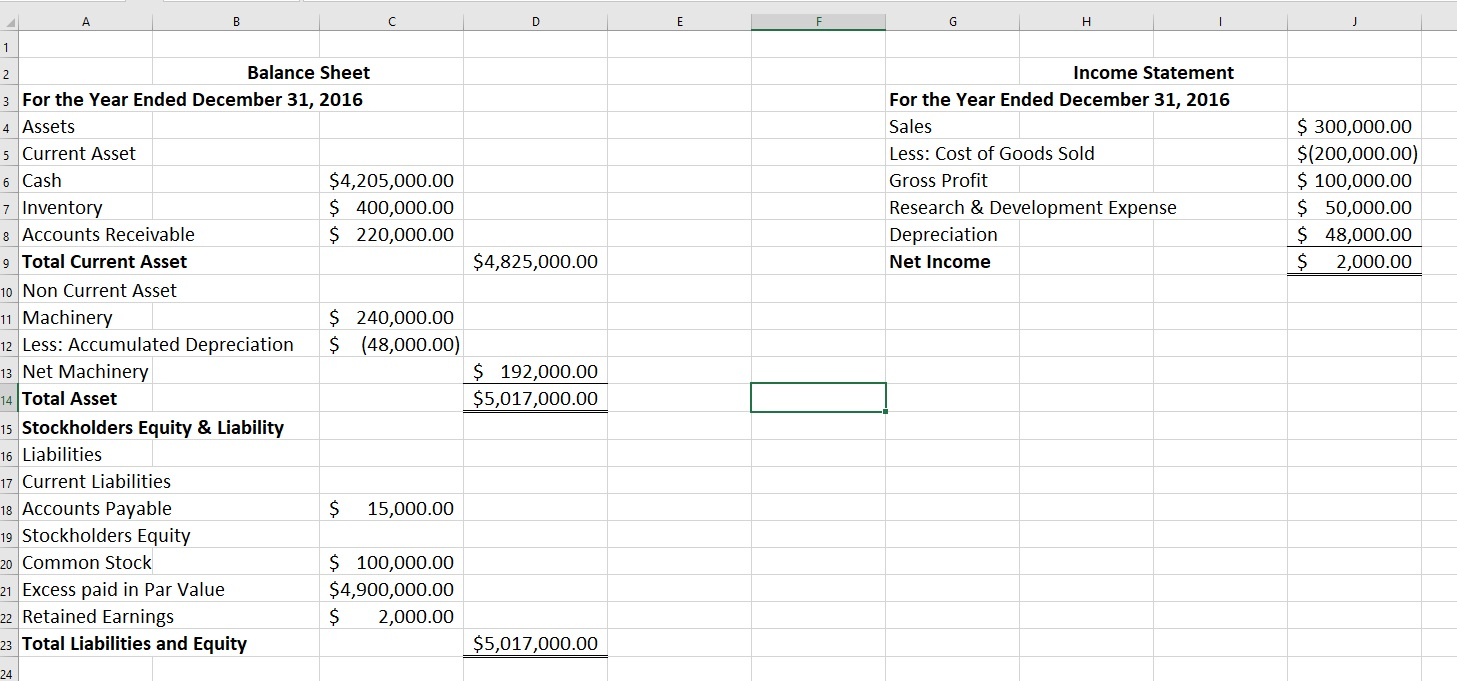

Using the above information, prepare the financial statement and journal entries for Ellie (under IFRS) for the year ending 12/31/16. Carl's financials under GAAP are given below

General Journal Form Credit Debit 5,000,000 Date Account Description Type 112016 Cash Common Stock Paid in Capital in excess of par - Common S B 100,000 4,900,000 3 1 1/2016 Inventory Cash B B 600,000 600,000 B 300,000 11/2016 AR Sales 300,000 200,000 1/1/2016 Cost of Goods Sold Inventory B 200,000 B 240,000 1/1/2016 Machinery CashB 240,000 B 80,000 6/1/2016 Cash ARB 80,000 50,000 6/1/2016 R&D Expense Cash Accounts Payable 35,000 B 1 15,000 48.000 12/31/2016 Depreciation Accumulated Depreciation B 48.000 Income Statement For the Year Ended December 31, 2016 Sales Less: Cost of Goods Sold Gross Profit Research & Development Expense Depreciation Net Income $ 300,000.00 $(200,000.00) $ 100,000.00 $ 50,000.00 $ 48,000.00 $ 2,000.00 $4,825,000.00 Balance Sheet 3 For the Year Ended December 31, 2016 4 Assets 5 Current Asset 6 Cash $4,205,000.00 7 Inventory $ 400,000.00 8 Accounts Receivable $ 220,000.00 9 Total Current Asset 10 Non Current Asset 11 Machinery $ 240,000.00 12 Less: Accumulated Depreciation $ (48,000.00) 13 Net Machinery 14 Total Asset 15 Stockholders Equity & Liability 16 Liabilities 17 Current Liabilities 18 Accounts Payable $ 15,000.00 19 Stockholders Equity 20 Common Stock $ 100,000.00 21 Excess paid in Par Value $4,900,000.00 22 Retained Earnings $ 2,000.00 23 Total Liabilities and Equity $ 192,000.00 $5,017,000.00 $5,017,000.00 General Journal Form Credit Debit 5,000,000 Date Account Description Type 112016 Cash Common Stock Paid in Capital in excess of par - Common S B 100,000 4,900,000 3 1 1/2016 Inventory Cash B B 600,000 600,000 B 300,000 11/2016 AR Sales 300,000 200,000 1/1/2016 Cost of Goods Sold Inventory B 200,000 B 240,000 1/1/2016 Machinery CashB 240,000 B 80,000 6/1/2016 Cash ARB 80,000 50,000 6/1/2016 R&D Expense Cash Accounts Payable 35,000 B 1 15,000 48.000 12/31/2016 Depreciation Accumulated Depreciation B 48.000 Income Statement For the Year Ended December 31, 2016 Sales Less: Cost of Goods Sold Gross Profit Research & Development Expense Depreciation Net Income $ 300,000.00 $(200,000.00) $ 100,000.00 $ 50,000.00 $ 48,000.00 $ 2,000.00 $4,825,000.00 Balance Sheet 3 For the Year Ended December 31, 2016 4 Assets 5 Current Asset 6 Cash $4,205,000.00 7 Inventory $ 400,000.00 8 Accounts Receivable $ 220,000.00 9 Total Current Asset 10 Non Current Asset 11 Machinery $ 240,000.00 12 Less: Accumulated Depreciation $ (48,000.00) 13 Net Machinery 14 Total Asset 15 Stockholders Equity & Liability 16 Liabilities 17 Current Liabilities 18 Accounts Payable $ 15,000.00 19 Stockholders Equity 20 Common Stock $ 100,000.00 21 Excess paid in Par Value $4,900,000.00 22 Retained Earnings $ 2,000.00 23 Total Liabilities and Equity $ 192,000.00 $5,017,000.00 $5,017,000.00