Question

Carl Redmon decided to expand his business and begin selling accounting software, as well as providing consulting services. During January, Carl Redmon Consulting completed these

Carl Redmon decided to expand his business and begin selling accounting software, as well as providing consulting services. During January, Carl Redmon Consulting completed these transactions:

Jan ? 2 ? Completed a consulting engagement and received cash of $7,200.

? ? ? ? 2 ? Prepaid three months? office rent, $1,500.

? ? ? ? 7 ? Purchased software inventory on account, $3,900, plus freight in, $100.

? ? ? 15 ? Withdrew $500 for personal use.

? ? ? 18 ? Sold software on account, $1,100 (cost $700).

? ? ? 19 ? Consulted with a client for a fee of $900 on account.

? ? ? 20 ? Paid the secretary?s salary for the month.

? ? ? 21 ? Paid on account, $2,000.

? ? ? 24 ? Paid utilities, $300.

? ? ? 28 ? Sold software for cash, $600 (cost $400).

? ? ? 31 ? Recorded these adjusting entries:

? ? ? ? ? ? ? a) Accrued salary expense.

? ? ? ? ? ? ? ? b) Depreciation of computer and furniture.

? ? ? ? ? ? ? ? c) Expiration of prepaid rent.

? ? ? ? ? ? ? ? d) Expiration of prepaid insurance. ?

? ? ? ? ? ? ? ? e) Physical count of inventory, $2,800.

? ? ? ? ? ? ? ? f) ? Earned the remaining revenue from December 22.

? ? ? ? ? ? ? ? g) Redmon estimates that 3% of inventory sold will be returned

REQUIRED

1a) Prepare journal entries for the above transactions and post these entries to the ledger.

b) Prepare adjusting entries on January 31 and post to the ledger.

c) Prepare an adjusted trial balance, an income statement, a statement of owner?s equity, and a balance sheet as of / on January 31, 2018.

d) Prepare closing entries at January 31, 2018 and post to the ledger.

e) Prepare a post-closing trial balance on January 31, 2018.

f) Write a letter to the CEO explaining the financial position of the company.

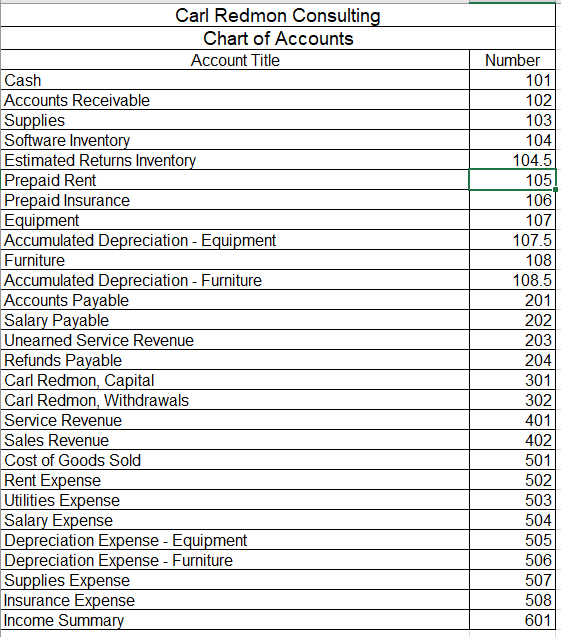

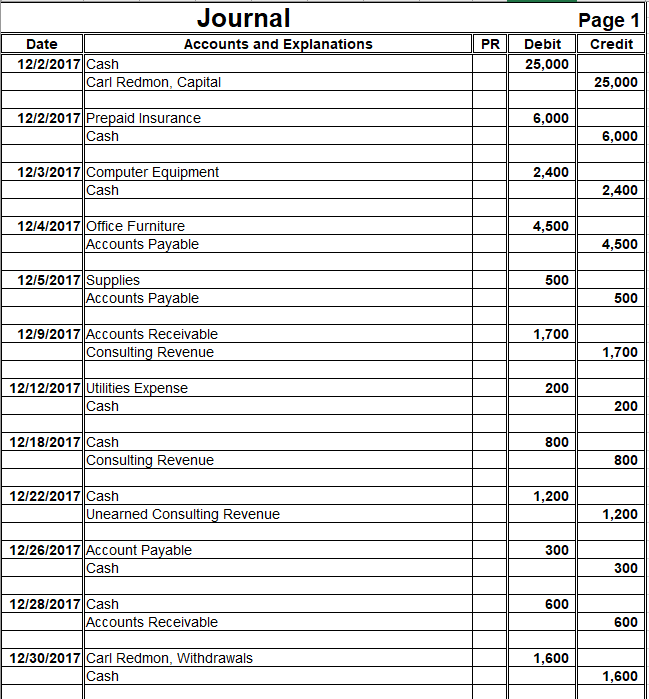

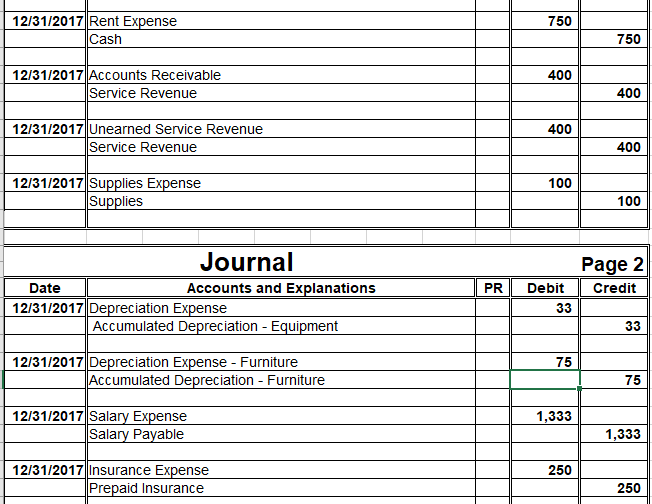

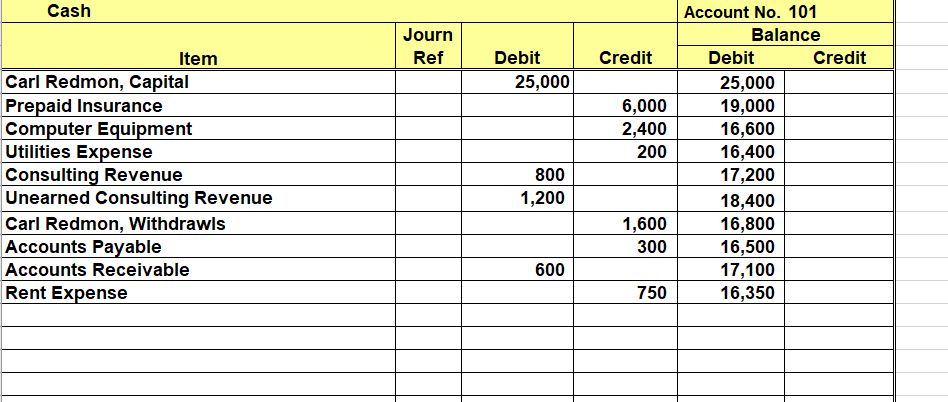

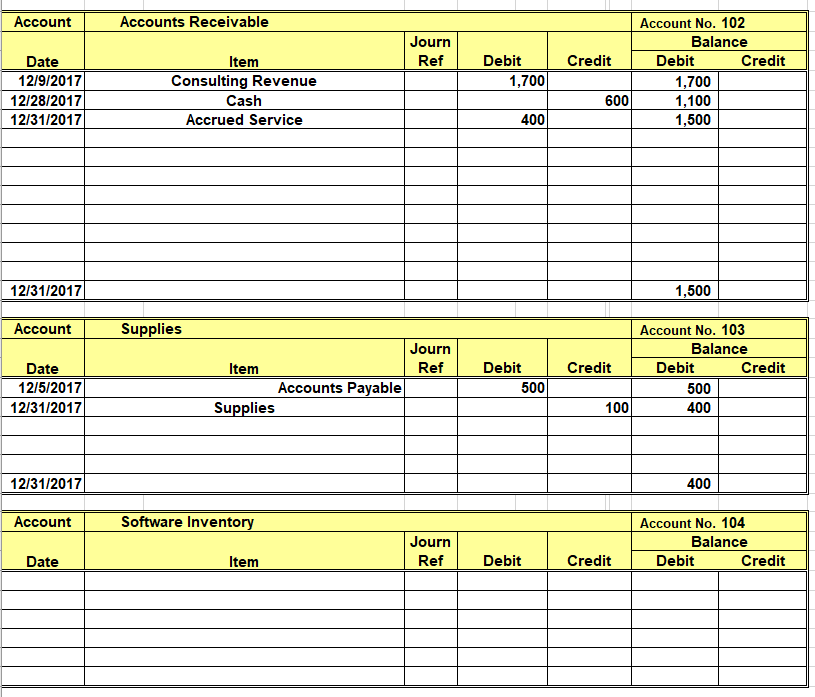

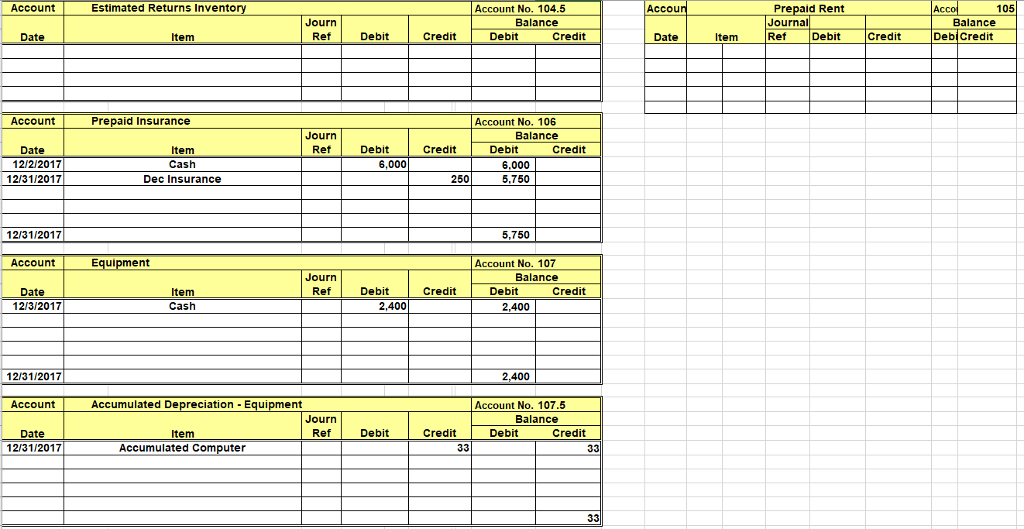

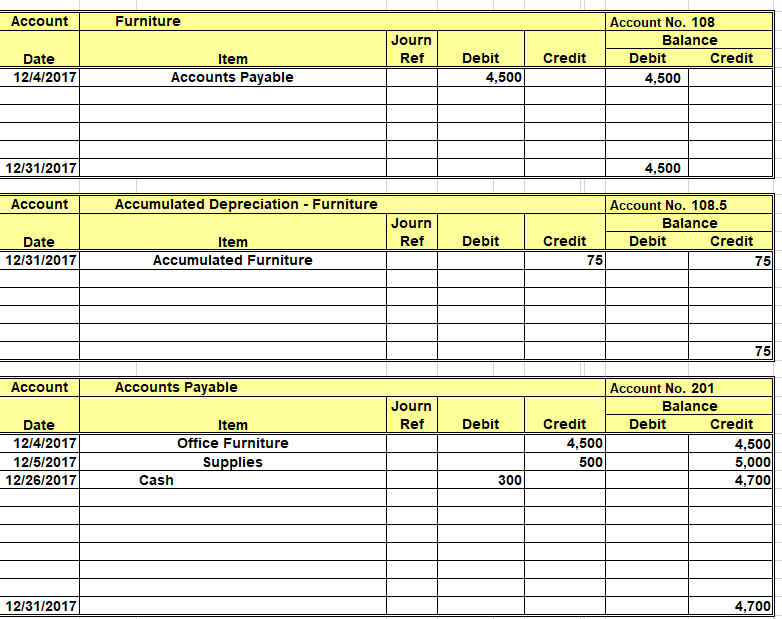

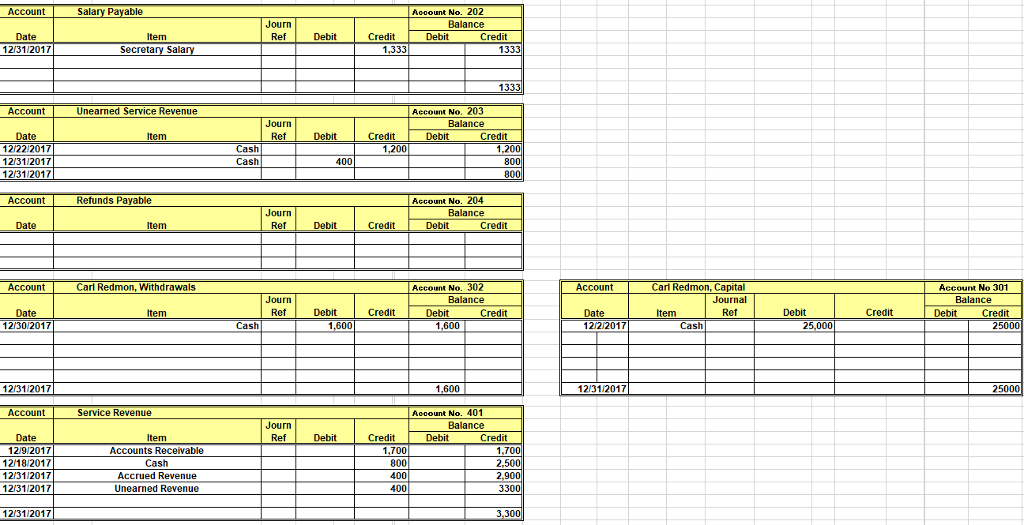

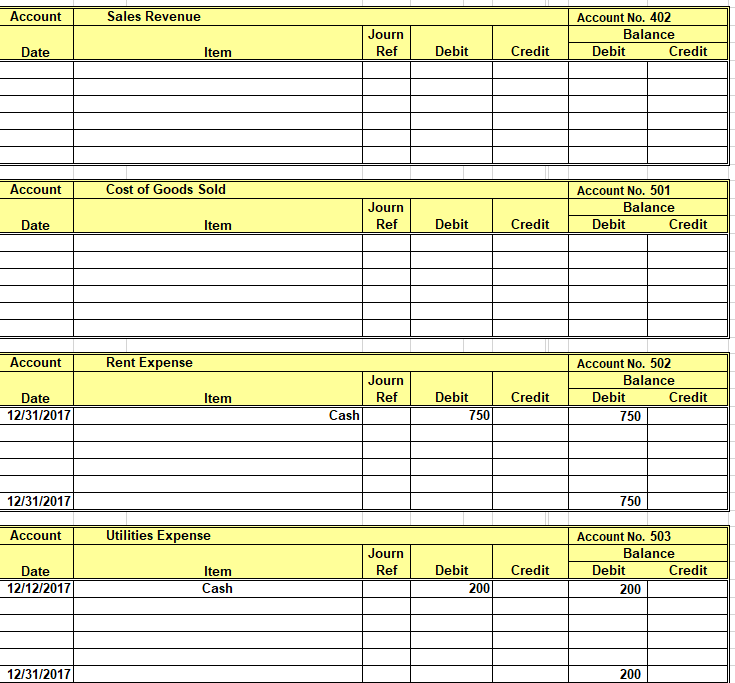

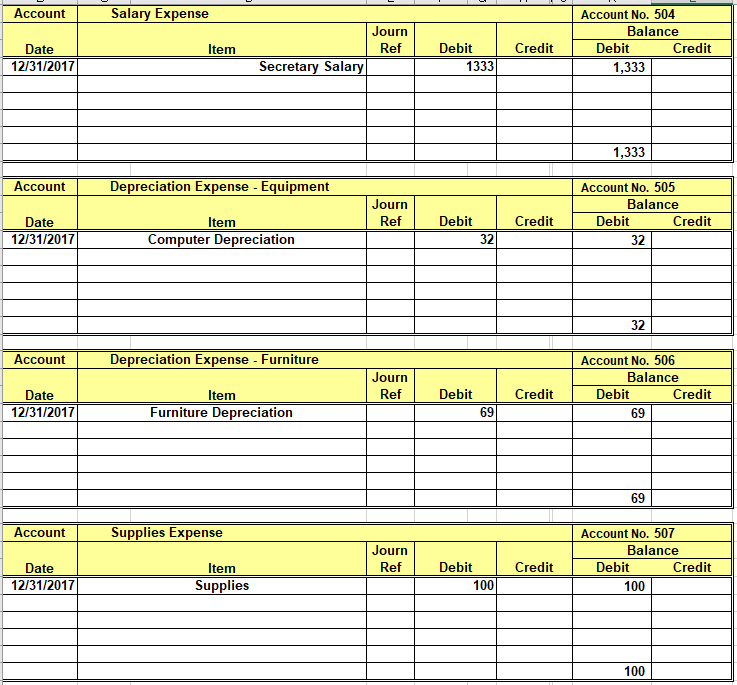

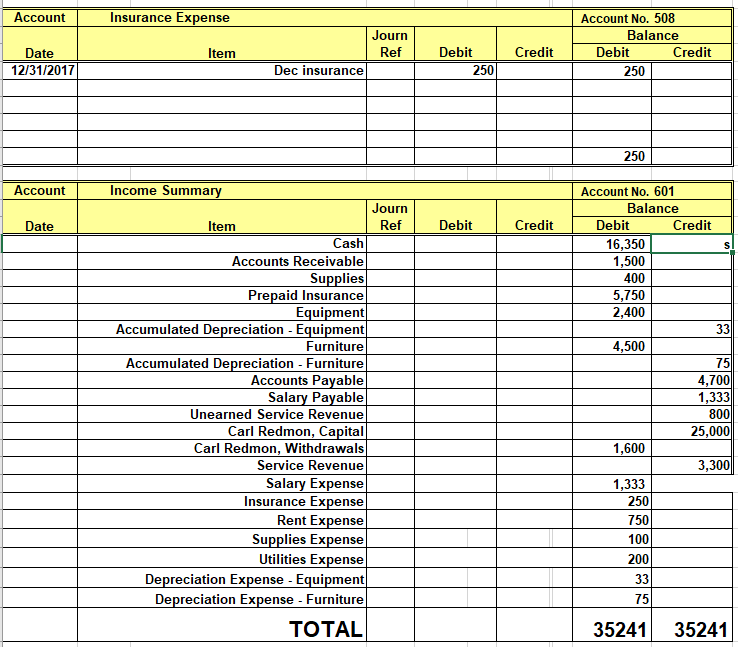

Carl Redmon Consulting Chart of Accounts Account Title Cash Accounts Receivable Supplies Software Inventory Estimated Returns Inventory Prepaid Rent Prepaid Insurance Equipment Accumulated Depreciation - Equipment Furniture Accumulated Depreciation - Furniture Accounts Payable Salary Payable Unearned Service Revenue Refunds Payable Carl Redmon, Capital Carl Redmon, Withdrawals Service Revenue Sales Revenue Cost of Goods Sold Rent Expense Utilities Expense Salary Expense Depreciation Expense - Equipment Depreciation Expense - Furniture Supplies Expense Insurance Expense Income Summary Number 101 102 103 104 104.5 105 106 107 107.5 108 108.5 201 202 203 204 301 302 401 402 501 502 503 504 505 506 507 508 601 Date 12/2/2017 Cash Carl Redmon, Capital 12/2/2017 Prepaid Insurance Cash 12/3/2017 Computer Equipment Cash Journal Accounts and Explanations 12/4/2017 Office Furniture Accounts Payable 12/5/2017 Supplies Accounts Payable 12/9/2017 Accounts Receivable Consulting Revenue 12/12/2017 Utilities Expense Cash 12/18/2017 Cash Consulting Revenue 12/22/2017 Cash Unearned Consulting Revenue 12/26/2017 Account Payable Cash 12/28/2017 Cash Accounts Receivable 12/30/2017 Carl Redmon, Withdrawals Cash PR Debit 25,000 6,000 2,400 4,500 500 1,700 200 800 1,200 300 600 1,600 Page 1 Credit 25,000 6,000 2,400 4,500 500 1,700 200 800 1,200 300 600 1,600 12/31/2017 Rent Expense Cash 12/31/2017 Accounts Receivable Service Revenue 12/31/2017 Unearned Service Revenue Service Revenue 12/31/2017 Supplies Expense Supplies Journal Accounts and Explanations Date 12/31/2017 Depreciation Expense Accumulated Depreciation - Equipment 12/31/2017 Depreciation Expense - Furniture Accumulated Depreciation - Furniture 12/31/2017 Salary Expense Salary Payable 12/31/2017 Insurance Expense Prepaid Insurance PR 750 400 400 100 Debit 33 75 1,333 250 750 400 400 100 Page 2 Credit 33 75 1,333 250 Cash Item Carl Redmon, Capital Prepaid Insurance Computer Equipment Utilities Expense Consulting Revenue Unearned Consulting Revenue Carl Redmon, Withdrawls Accounts Payable Accounts Receivable Rent Expense Journ Ref Debit 25,000 800 1,200 600 Credit 6,000 2,400 200 1,600 300 750 Account No. 101 Balance Debit 25,000 19,000 16,600 16,400 17,200 18,400 16,800 16,500 17,100 16,350 Credit Account Date 12/9/2017 12/28/2017 12/31/2017 12/31/2017 Account Date 12/5/2017 12/31/2017 12/31/2017 Account Date Accounts Receivable Item Consulting Revenue Cash Accrued Service Supplies Item Supplies Software Inventory Item Accounts Payable Journ Ref Journ Ref Journ Ref Debit 1,700 400 Debit 500 Debit Credit 600 Credit 100 Credit Account No. 102 Balance Debit 1,700 1,100 1,500 1,500 Account No. 103 Balance Debit 500 400 400 Credit Debit Credit Account No. 104 Balance Credit Account Date Account Date 12/2/2017 12/31/2017 12/31/2017 Account Date 12/3/2017 12/31/2017 Account Date 12/31/2017 Estimated Returns Inventory Item Prepaid Insurance Item Cash Dec Insurance Equipment Item Cash Accumulated Depreciation - Equipment Item Accumulated Computer Journ Ref Journ Ref Journ Ref Journ Ref Debit Debit 6,000 Debit 2,400 Debit Credit Credit 250 Credit Credit 33 Account No. 104.5 Balance Debit Account No. 106 Balance Debit 6,000 5.750 5,750 Debit Account No. 107 Balance 2,400 Credit 2,400 Credit Debit Credit Account No. 107.5 Balance Credit 33 33 Accoun Date Item Prepaid Rent Journal Ref Debit Credit Acco 105 Balance DebiCredit Account Date 12/4/2017 12/31/2017 Account Date 12/31/2017 Account Date 12/4/2017 12/5/2017 12/26/2017 12/31/2017 Furniture Item Accounts Payable Accumulated Depreciation - Furniture Item Accumulated Furniture Cash Accounts Payable Item Office Furniture Supplies Journ Ref Journ Ref Journ Ref Debit 4,500 Debit Debit 300 Credit Credit Credit 75 4,500 500 Account No. 108 Balance Debit 4,500 4,500 Account No. 108.5 Balance Debit Credit Debit Credit Account No. 201 Balance Credit 75 75 4,500 5,000 4,700 4,700 Account Date 12/31/2017 Account Date 12/22/2017 12/31/2017 12/31/2017 Account Date Account Date 12/30/2017 12/31/2017 Account Date 12/9/2017 12/18/2017 12/31/2017 12/31/2017 12/31/2017 Salary Payable Item Secretary Salary Unearned Service Revenue Item Refunds Payable Item Carl Redmon, Withdrawals Item Service Revenue Item Accounts Receivable Cash Accrued Revenue Unearned Revenue Cash Cash Cash Journ Ref Journ Ref Journ Ref Journ Ref Journ Ref Debit Debit 400 Debit Debit 1,600 Debit Credit 1,333 Credit 1,200 Credit Credit Credit 1,700 800 400 400 Account No. 202 Balance Debit Account No. 203 Balance Debit Debit Account No. 204 Balance Credit Debit 1,600 1,600 Account No. 302 Balance Debit Credit 1333 1333 Account No. 401 Balance Credit 1,200 800 800 Credit Credit 1,700 2,500 2,900 3300 3,300 Account Date 12/2/2017 12/31/2017 Carl Redmon, Capital Journal Ref Item Cash Debit 25,000 Credit Account No 301 Balance Debit Credit 25000 25000 Account Date Account Date Account Date 12/31/2017 12/31/2017 Account Date 12/12/2017 12/31/2017 Sales Revenue Item Cost of Goods Sold Rent Expense Item Item Utilities Expense Item Cash Cash Journ Ref Journ Ref Journ Ref Journ Ref Debit Debit Debit 750 Debit 200 Credit Credit Credit Credit Account No. 402 Balance Debit Account No. 501 Balance Debit Debit Account No. 502 Balance 750 750 Credit Debit 200 Credit Account No. 503 Balance 200 Credit Credit Account Date 12/31/2017 Account Date 12/31/2017 Account Date 12/31/2017 Account Date 12/31/2017 Salary Expense Item Depreciation Expense - Equipment Item Computer Depreciation Secretary Salary Depreciation Expense - Furniture Item Furniture Depreciation Supplies Expense Item Supplies Journ Ref Journ Ref Journ Ref Journ Ref Debit 1333 Debit Debit Debit 32 69 100 Credit Credit Credit Credit Account No. 504 Balance Debit 1,333 1,333 Account No. 505 Balance Debit 32 Debit 32 Account No. 506 Balance Debit 69 69 Credit 100 Credit Account No. 507 Balance 100 Credit Credit Account Date 12/31/2017 Account Date Insurance Expense Item Income Summary Item Dec insurance Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation - Equipment Furniture Accumulated Depreciation - Furniture Accounts Payable Salary Payable Unearned Service Revenue Carl Redmon, Capital Carl Redmon, Withdrawals Service Revenue Salary Expense Insurance Expense Rent Expense Supplies Expense Utilities Expense Depreciation Expense - Equipment Depreciation Expense - Furniture TOTAL Journ Ref Journ Ref Debit 250 Debit Credit Credit Account No. 508 Balance Debit 250 250 Account No. 601 Balance Debit 16,350 1,500 400 5,750 2,400 4,500 1,600 1,333 250 750 100 200 33 75 Credit 35241 Credit S 33 75 4,700 1,333 800 25,000 3,300 35241

Step by Step Solution

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries before adjustments For the period from 1 jan to 31 jan 2018 SN Date Particulars De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

606ad56861b59_48483.pdf

180 KBs PDF File

606ad56861b59_48483.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started