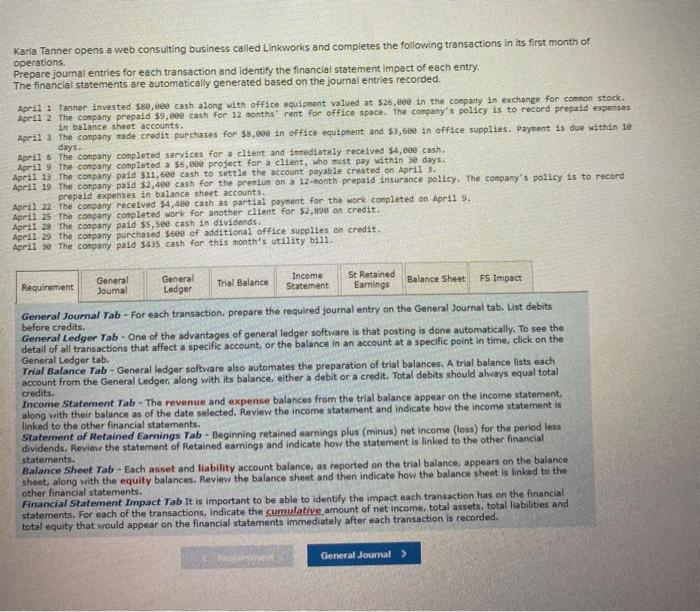

Carla Tanner opens a Web consulting business called Linkworks and completes the following transactions in its first month of operations. Prepare journal entries for each transaction and identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded.

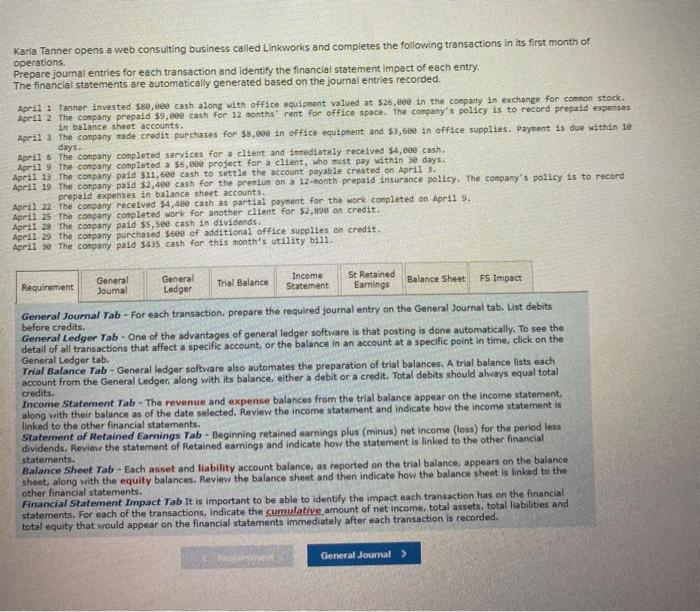

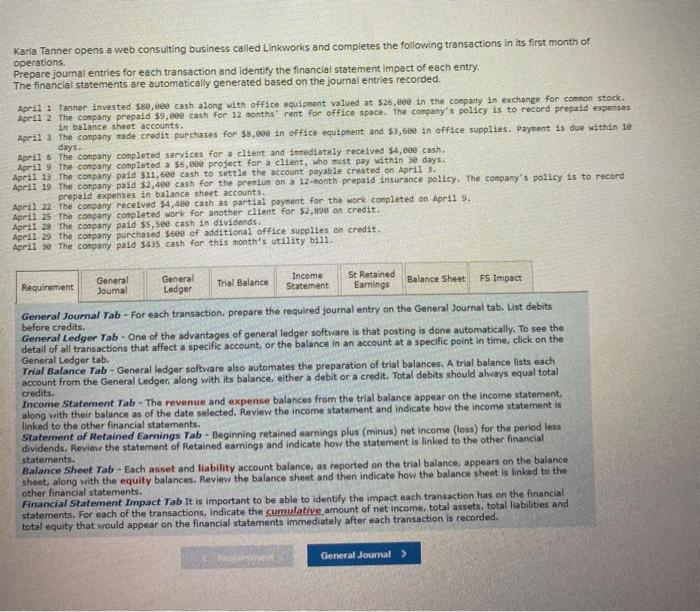

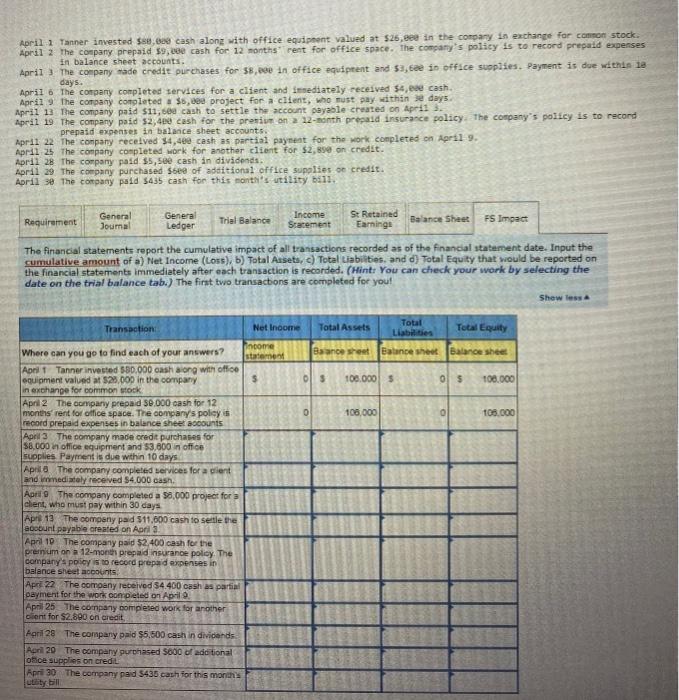

Karla Tanner opens a web consulting business called Linkworks and completes the following transactions in its first month of operations Prepare journal entries for each transaction and identify the financial statement impact of each entry The financial statements are automatically generated based on the journal entries recorded. April i Tanner invested $80,000 cash along with office equipment valued at $26,000 in the company in exchange for common stock. April 2 The company prepaid 59,eee cash for 12 months' rent for office space. The company's policy is to record prepaid expenses in balance sheet accounts April 3 The company made credit purchases for $5,000 in office equipment and $3,600 in office supplies. Payment is due within 10 days April 6 The company completed services for a client and immediately received $4, eee cash. April 9 The company completed a $6,000 project for a client, who must pay within se days April 13 The company paid $11,600 cash to settle the account payable created on April . April 19 The company paid $2,4ee cash for the premium on a 12-month prepaid insurance policy. The company's policy is to record prepaid expenses in balance sheet accounts April 22 The company received $4,400 cash as partial payment for the work completed on April 9. April 25 The company completed work for another client for $2,890 on credit April 28 The company paid $5,500 cash in dividends. April 29 The company purchased Stee of additional office supplies on credit. April 3e The company paid $435 cash for this month's utility bili General General Income Trial Balance St Retained Requirement Joumal Ledger Statement Balance Sheet Earnings FS Impact General Journal Tab - For each transaction, prepare the required journal entry on the General Journal tab. List debits before credits. General Ledger Tab - One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab. Trial Balance Tab - General ledger software also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits. Income Statement Tab - The revenue and expense balances from the trial balance appear on the income statement, along with their balance as of the date selected. Review the income statement and indicate how the income statement is linked to the other financial statements. Statement of Retained Earnings Tab. Beginning retained earnings plus (minus) net income (loss) for the period less dividends, Review the statement of Retained earnings and indicate how the statement is linked to the other financial statements. Balance Sheet Tab - Each asset and liability account balance, as reported on the trial balance, appears on the balance sheet, along with the equity balances. Review the balance sheet and then indicate how the balance sheet is linked to the other financial statements. Financial Statement Impact Tab It is important to be able to identify the impact each transaction has on the financial statements. For each of the transactions, indicate the cumulative amount of net income, total assets, total liabilities and total equity that would appear on the financial statements immediately after each transaction is recorded. General Journal > April 1 Tanner invested $80.000 cash along with office equipment valued at $26,eee in the company in exchange for common stock. April 2 The company prepaid $9.cee cash for 12 months' rent for office space. The company's policy is to record prepaid expenses In balance sheet accounts. April) The company made credit purchases for 38,000 in office equipment and $3,6ae in office supplies. Payment is due with a days. April 6 The company completed services for a client and insediately received $4, cash April 9 The company completed a 36,000 project for a client, who must pay within se days April 13 The company paid $11,600 cash to settle the account payable created on April 3. April 19 The company paid 32,400 cash for the premium on 22-nonth prepaid insurance policy. The company's policy is to record prepaid expenses in balance sheet accounts. April 22 The company received 34,400 cast as partial payment for the work completed on April 9. April 25 The company completed work for another client for $2,858 on credit April 28 The company paid $5,500 cash in dividends April 29 The company purchased $6ee of additional office supplies credit. April 30 The company paid $435 cash for this month's utility bill. Requirement General Joumal General Ledger Trial Balance Income Stacement St Retained Earnings Balance Sheet FS Impact The financial statements report the cumulative impact of all transactions recorded as of the financial statement date. Input the cumulative amount of a) Net Income (Loss), b) Total Assets, ) Total Liabilities, and d) Total Equity that would be reported on the financial statements immediately after each transaction is recorded. (Hint: You can check your work by selecting the date on the trial balance tab.) The first two transactions are completed for you! Show less 0 Total Transaction Net Income Total Assets Total Equity Liabilities income Where can you go to find each of your answers? Bance sheet Balance sheet Balance sheet statement Apel T Tanner invested 580,000 cash song with office equipment valued at $28.000 in the company 5 Ols 100.000 $ 05 100.000 in exchange for common stock April 2 The company prepad 30,000 cash for 12 months' rent for office space. The company's policy is 0 106,000 108.000 record prepaid expenses in balance sheet accounts April 3 The company made credit purchases for $8,000 in office equipment and $3,600 in office Supplies Payment is due within 10 days April The company completed services for a rient and immediately received $4.000 cash April o The company completed a 58.000 project for client, who must pay within 30 days Apr 13 The company paid $11.600 cash to settle the acobunt payable created on April 3 April 10 The company paid $2.400 cash for the premium on a 12-month prepaid insurance policy. The company's policy to record prepaid expenses in balance sheet accounts Apr 22 The comoeny received $4.400 cash as partial payment for the work on Dieted on April April 25 The company completed work for another Gent for $2.800 on credit Aani 28 The company paid $5,500 cash in dividends April 20 The company purchased 5000 of additional ofice supplies on credit April 30 The company paid $436 cash for this month's utility bill