Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carla Tortelli was divorced last year. She currently provides a home for her 15-year-old son Anthony. Anthony lived in Carla's home for the entire

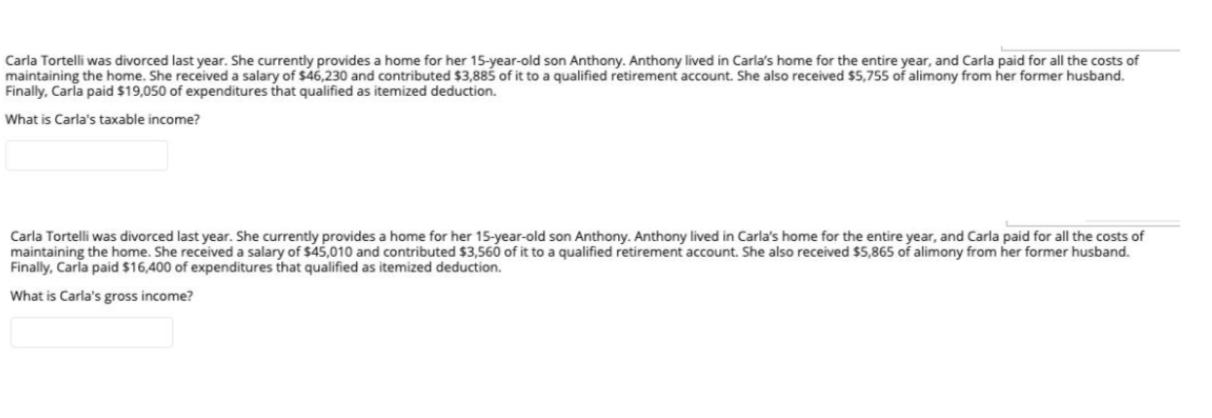

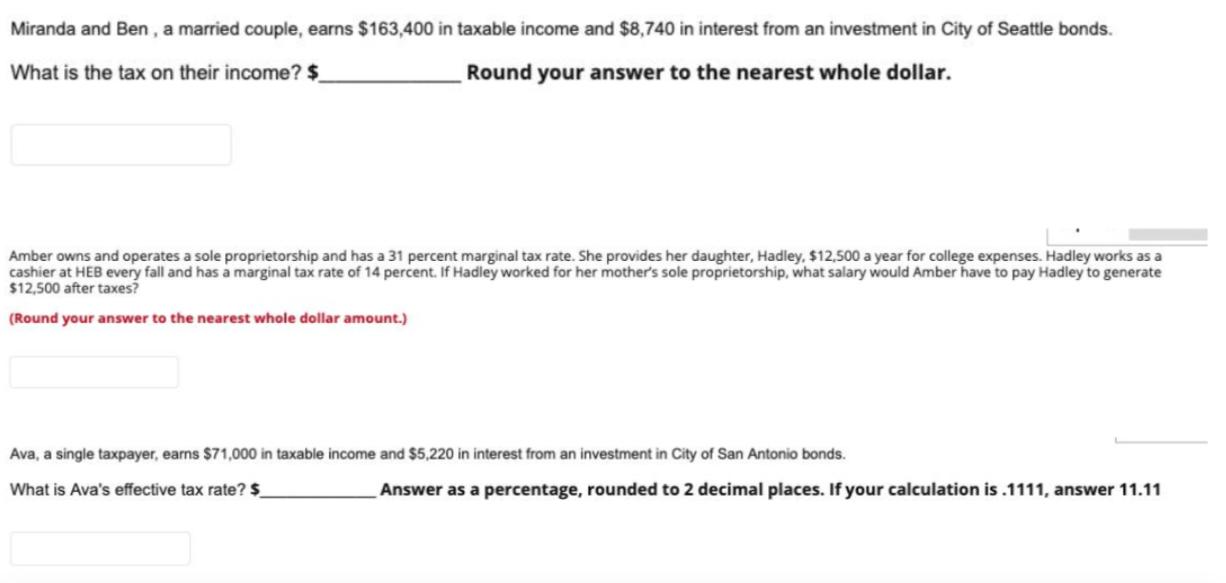

Carla Tortelli was divorced last year. She currently provides a home for her 15-year-old son Anthony. Anthony lived in Carla's home for the entire year, and Carla paid for all the costs of maintaining the home. She received a salary of $46,230 and contributed $3,885 of it to a qualified retirement account. She also received $5,755 of alimony from her former husband. Finally, Carla paid $19,050 of expenditures that qualified as itemized deduction. What is Carla's taxable income? Carla Tortelli was divorced last year. She currently provides a home for her 15-year-old son Anthony. Anthony lived in Carla's home for the entire year, and Carla paid for all the costs of maintaining the home. She received a salary of $45,010 and contributed $3,560 of it to a qualified retirement account. She also received $5,865 of alimony from her former husband. Finally, Carla paid $16,400 of expenditures that qualified as itemized deduction. What is Carla's gross income? Miranda and Ben , a married couple, earns $163,400 in taxable income and $8,740 in interest from an investment in City of Seattle bonds. What is the tax on their income? $ Round your answer to the nearest whole dollar. Amber owns and operates a sole proprietorship and has a 31 percent marginal tax rate. She provides her daughter, Hadley, $12,500 a year for college expenses. Hadley works as a cashier at HEB every fall and has a marginal tax rate of 14 percent. If Hadley worked for her mother's sole proprietorship, what salary would Amber have to pay Hadley to generate $12,500 after taxes? (Round your answer to the nearest whole dollar amount.) Ava, a single taxpayer, earns $71,000 in taxable income and $5,220 in interest from an investment in City of San Antonio bonds. What is Ava's effective tax rate? $ Answer as a percentage, rounded to 2 decimal places. If your calculation is .1111, answer 11.11

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

income of carla Salary 46230 alimony from husband 5755 Total income 46230575551985 Deduction3885 Ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started