John is planning for his retirement in 40 years. He plans to invest an equal amount for the next 40 years in order to

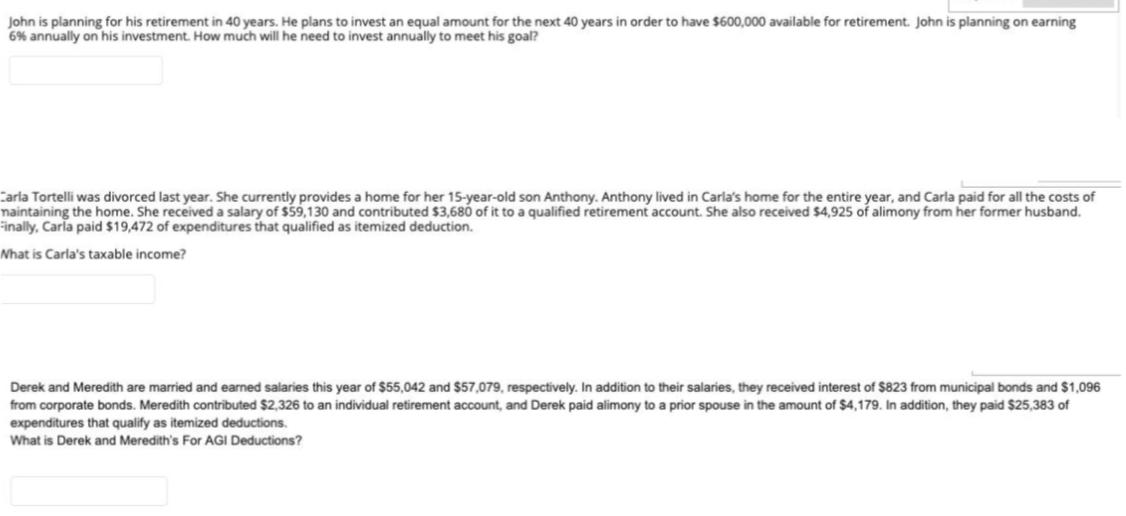

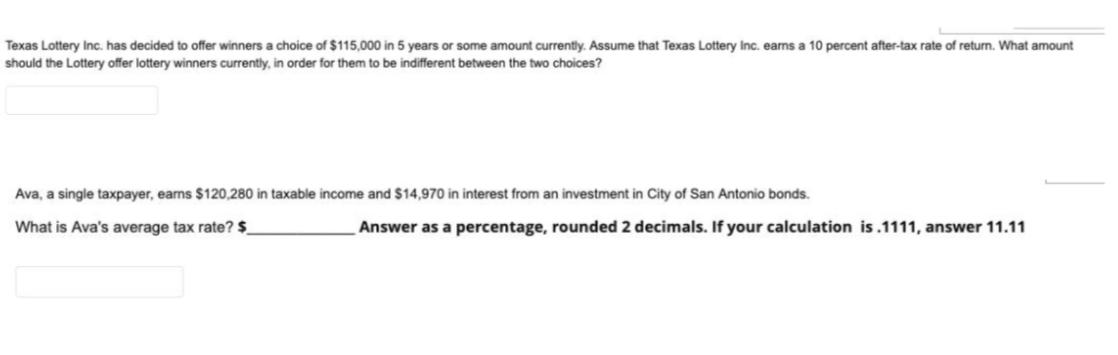

John is planning for his retirement in 40 years. He plans to invest an equal amount for the next 40 years in order to have $600,000 available for retirement. John is planning on earning 6% annually on his investment. How much will he need to invest annually to meet his goal? Carla Tortelli was divorced last year. She currently provides a home for her 15-year-old son Anthony. Anthony lived in Carla's home for the entire year, and Carla paid for all the costs of naintaining the home. She received a salary of $59,130 and contributed $3,680 of it to a qualified retirement account. She also received $4,925 of alimony from her former husband. Finally, Carla paid $19,472 of expenditures that qualified as itemized deduction. Nhat is Carla's taxable income? Derek and Meredith are married and earned salaries this year of $55,042 and $57,079, respectively. In addition to their salaries, they received interest of $823 from municipal bonds and $1,096 from corporate bonds. Meredith contributed $2,326 to an individual retirement account, and Derek paid alimony to a prior spouse in the amount of $4,179. In addition, they paid $25,383 of expenditures that qualify as itemized deductions. What is Derek and Meredith's For AGI Deductions? Texas Lottery Inc. has decided to offer winners a choice of $115,000 in 5 years or some amount currently. Assume that Texas Lottery Inc. earns a 10 percent after-tax rate of return. What amount should the Lottery offer lottery winners currently, in order for them to be indifferent between the two choices? Ava, a single taxpayer, earns $120,280 in taxable income and $14,970 in interest from an investment in City of San Antonio bonds. What is Ava's average tax rate? $ Answer as a percentage, rounded 2 decimals. If your calculation is.1111, answer 11.11

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 interest rate6 Period 40 years Future value interest factor annuity1rn1r FVIFA 10064010061547...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started