Question

Carla Vista Company is a manufacturer with a fiscal year that runs from July 1 to June 30. The company uses a normal job-order cost

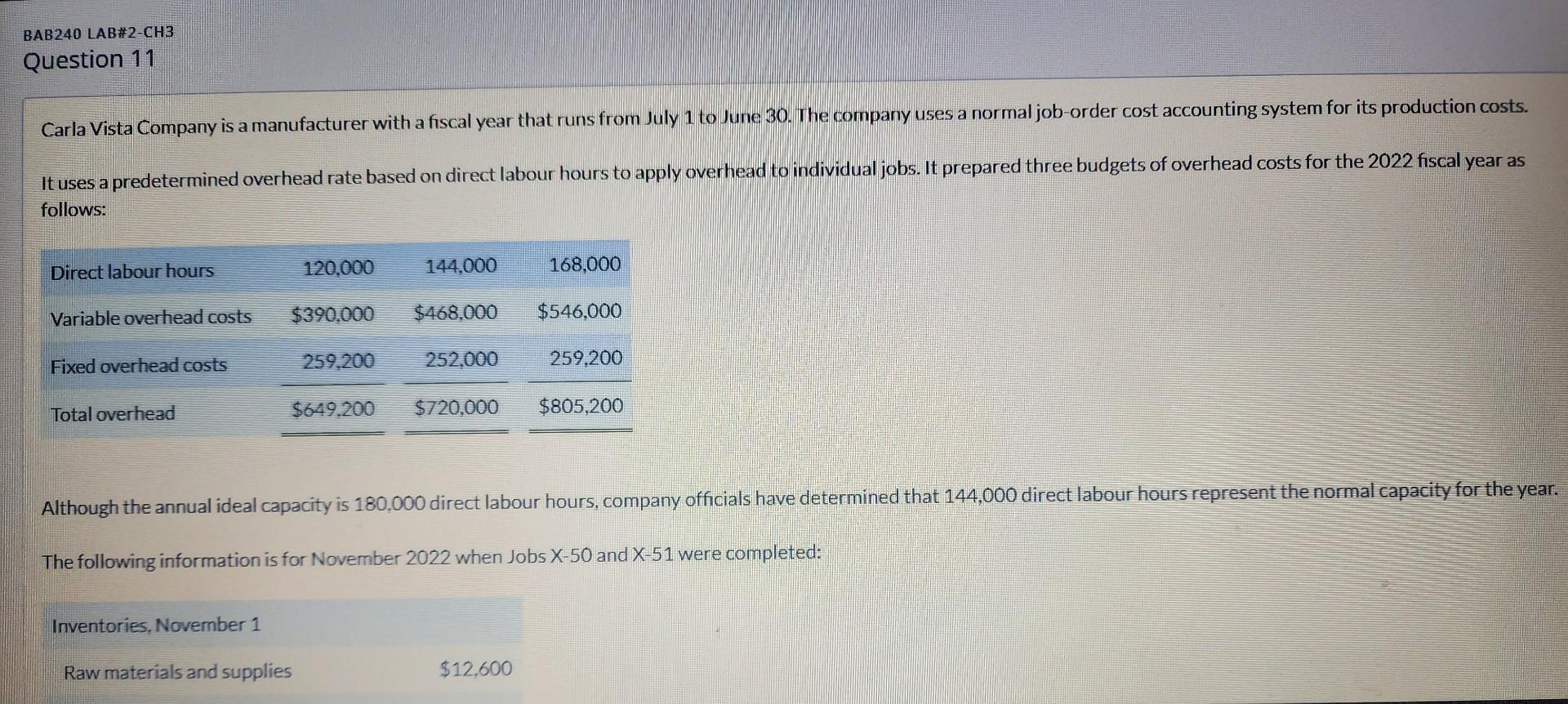

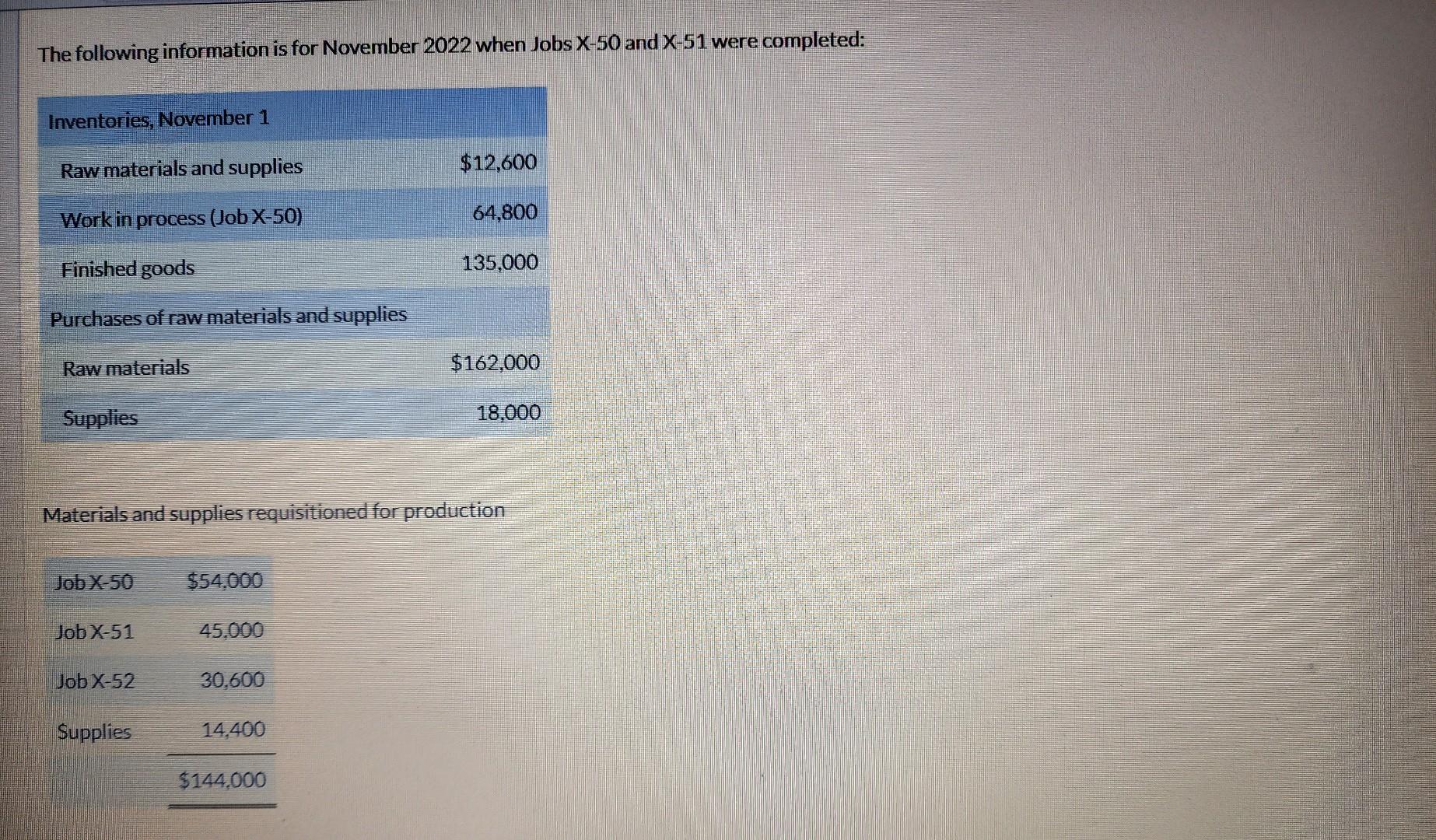

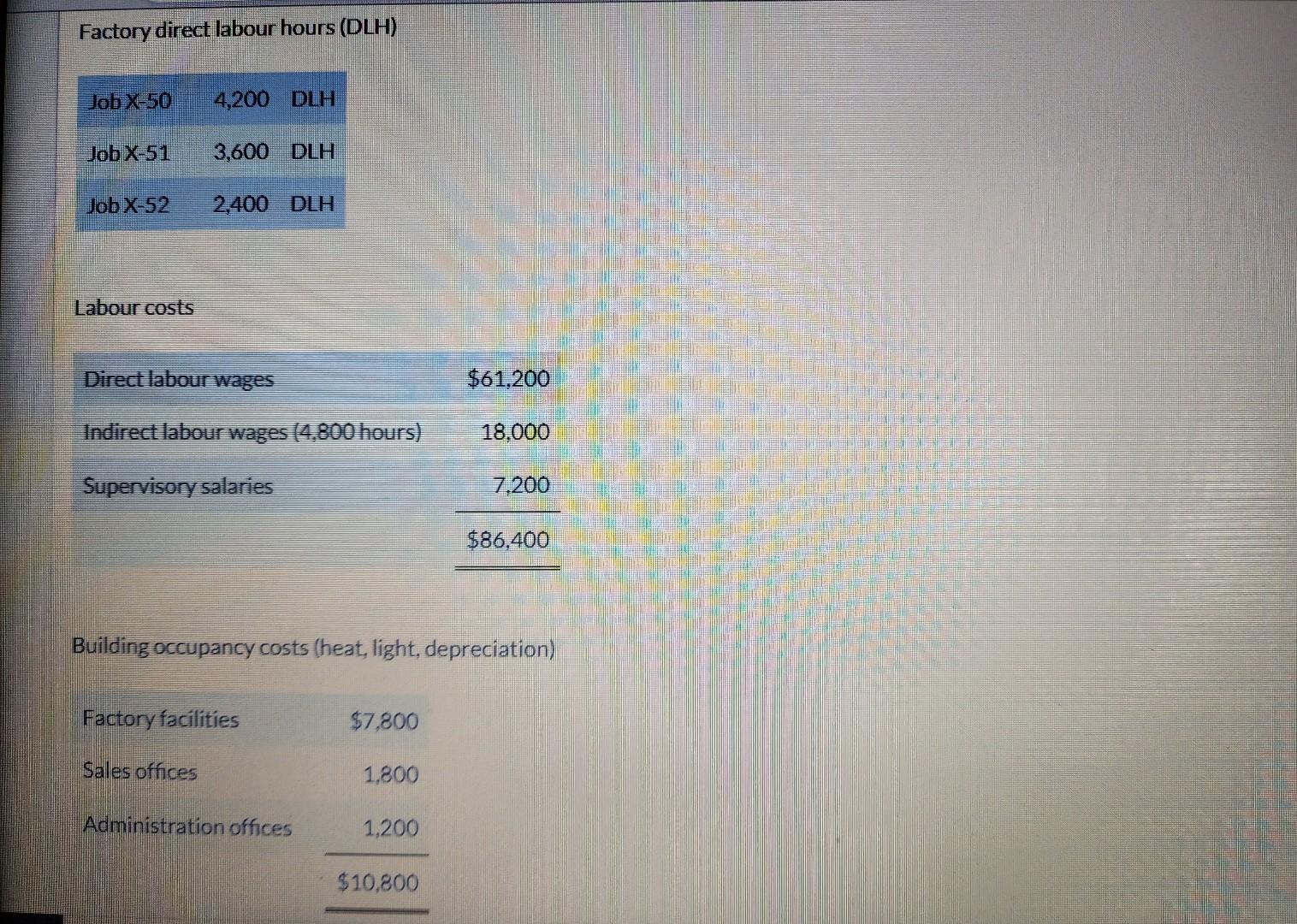

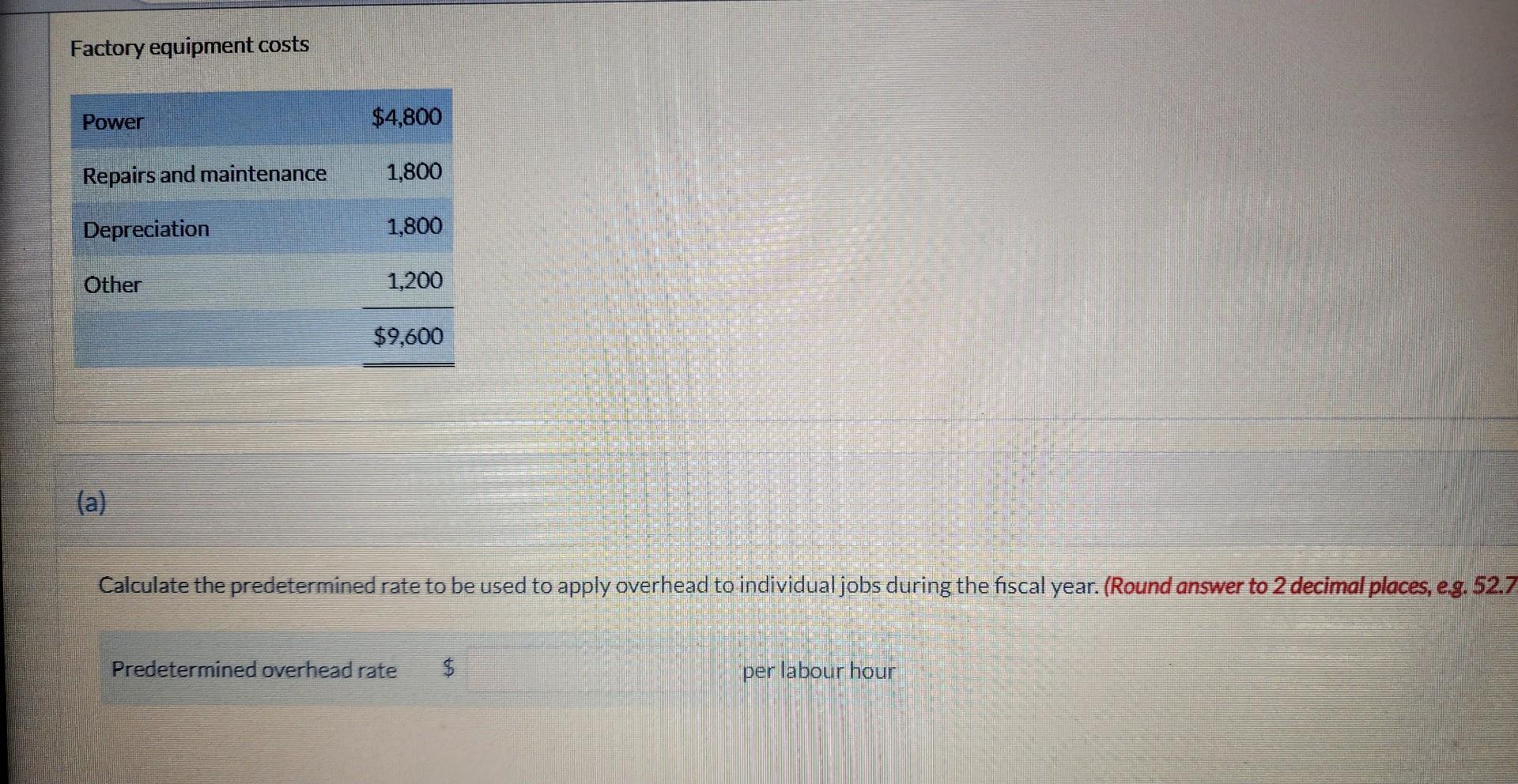

Carla Vista Company is a manufacturer with a fiscal year that runs from July 1 to June 30. The company uses a normal job-order cost accounting system for its production costs. It uses a predetermined overhead rate based on direct labour hours to apply overhead to individual jobs. It prepared three budgets of overhead costs for the 2022 fiscal year as follows: Direct labour hours 120,000 144,000 168,000 Variable overhead costs $390,000 $468,000 $546,000 Fixed overhead costs 259,200 252,000 259,200 Total overhead $649,200 $720,000 $805,200 Although the annual ideal capacity is 180,000 direct labour hours, company officials have determined that 144,000 direct labour hours represent the normal capacity for the year. The following information is for November 2022 when Jobs X-50 and X-51 were completed: Inventories, November 1 Raw materials and supplies $12,600 Work in process (Job X-50) 64,800 Finished goods 135,000 Purchases of raw materials and supplies Raw materials $162,000 Supplies 18,000 Materials and supplies requisitioned for production Job X-50 $54,000 Job X-51 45,000 Job X-52 30,600 Supplies 14,400 $144,000 Factory direct labour hours (DLH) Job X-50 4,200 DLH Job X-51 3,600 DLH Job X-52 2,400 DLH Labour costs Direct labour wages $61,200 Indirect labour wages (4,800 hours) 18,000 Supervisory salaries 7,200 $86,400 Building occupancy costs (heat, light, depreciation) Factory facilities $7,800 Sales offices 1,800 Administration offices 1,200 $10,800 Factory equipment costs Power $4,800 Repairs and maintenance 1,800 Depreciation 1,800 Other 1,200 $9,600

(a) Calculate the predetermined rate to be used to apply overhead to individual jobs during the fiscal year. (Round answer to 2 decimal places, e.g. 52.75.)

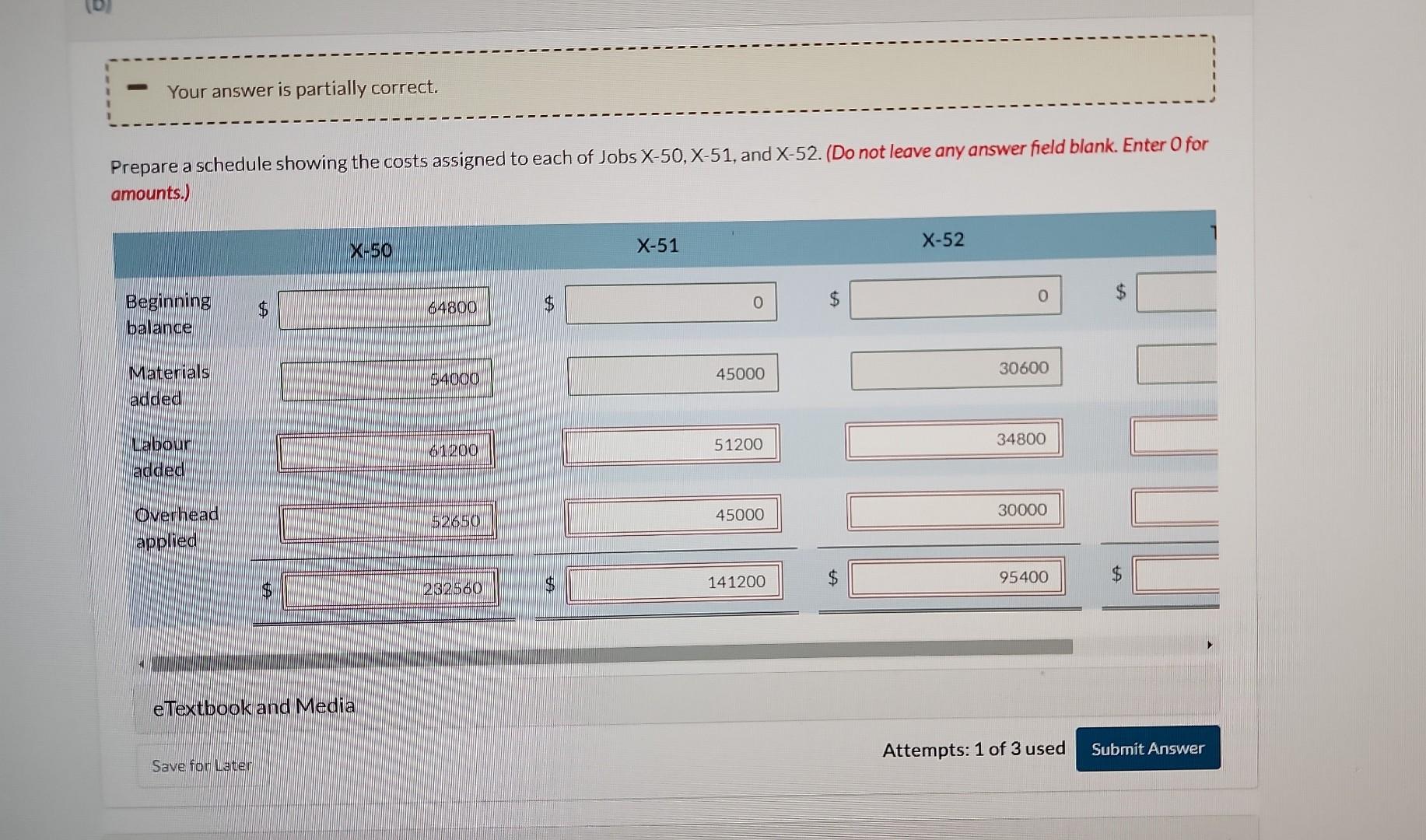

Carla Vista Company is a manufacturer with a fiscal year that runs from July 1 to June 30 . The company uses a normal job-order cost accounting system for its production costs. It uses a predetermined overhead rate based on direct labour hours to apply overhead to individual jobs. It prepared three budgets of overhead costs for the 2022 fiscal year as follows: Although the annual ideal capacity is 180,000 direct labour hours, company officials have determined that 144,000 direct labour hours represent the normal capacity for the year. The following information is for November 2022 when Jobs X- 50 and X51 were completed: The following information is for November 2022 when Jobs X50 and X51 were completed: Materials and supplies requisitioned for production Factory direct labour hours (DLH) Labour costs Building occupancy costs (heat, light, depreciation) Factory equipment costs (a) Calculate the predetermined rate to be used to apply overhead to individual jobs during the fiscal year. (Round answer to 2 decimal places, eg. 52 . per labour hour Prepare a schedule showing the costs assigned to each of Jobs X50,X51, and X52. (Do not leave any answer field blank. Enter 0 for amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started