Answered step by step

Verified Expert Solution

Question

1 Approved Answer

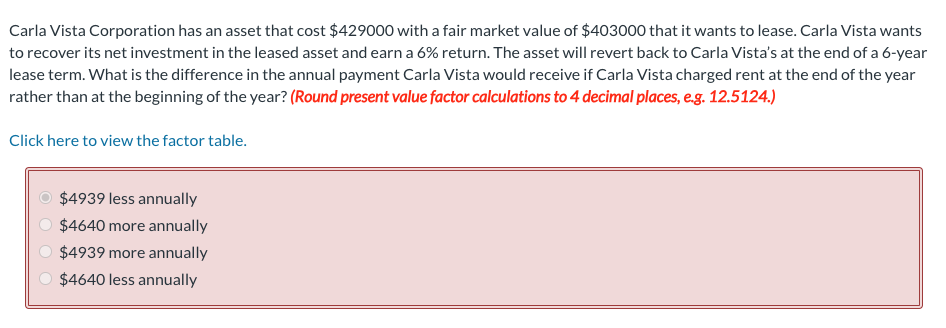

Carla Vista Corporation has an asset that cost $ 4 2 9 0 0 0 with a fair market value of $ 4 0 3

Carla Vista Corporation has an asset that cost $ with a fair market value of $ that it wants to lease. Carla Vista wants to recover its net investment in the leased asset and earn a return. The asset will revert back to Carla Vista's at the end of a year lease term. What is the difference in the annual payment Carla Vista would receive if Carla Vista charged rent at the end of the year rather than at the beginning of the year? Round present value factor calculations to decimal places, egCarla Vista Corporation has an asset that cost $ with a fair market value of $ that it wants to lease. Carla Vista wants

to recover its net investment in the leased asset and earn a return. The asset will revert back to Carla Vista's at the end of a year

lease term. What is the difference in the annual payment Carla Vista would receive if Carla Vista charged rent at the end of the year

rather than at the beginning of the year? Round present value factor calculations to decimal places, eg

Click here to view the factor table.

$ less annually

$ more annually

$ more annually

$ less annually

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started