Answered step by step

Verified Expert Solution

Question

1 Approved Answer

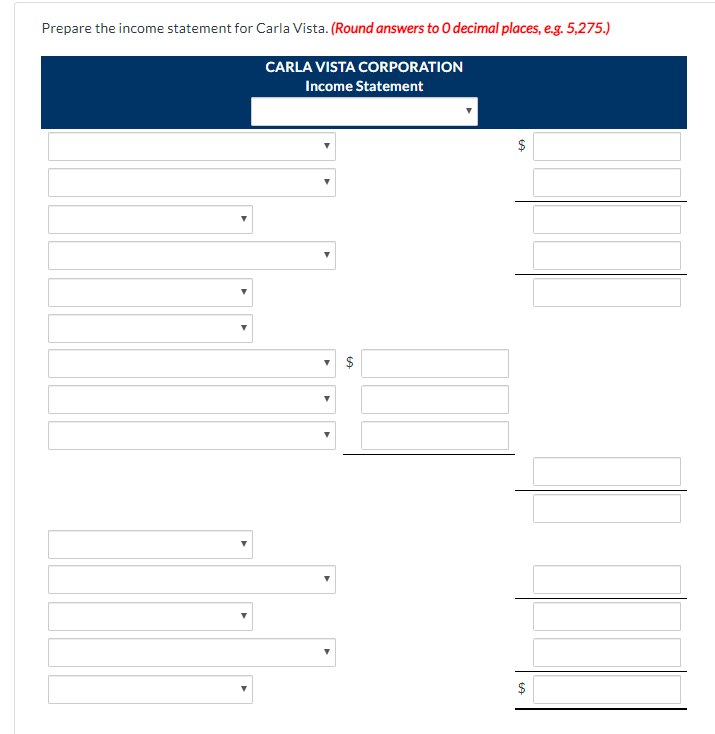

Carla Vista Corporations trial balance at December 31, 2021, is presented below. CARLA VISTA CORPORATION Trial Balance December 31, 2021 Debit Credit Cash $ 48,000

Carla Vista Corporations trial balance at December 31, 2021, is presented below.

| CARLA VISTA CORPORATION Trial Balance December 31, 2021 | |||

| Debit | Credit | ||

| Cash | $ 48,000 | ||

| Accounts receivable | 51,000 | ||

| Allowance for doubtful accounts | $ 2,500 | ||

| Merchandise inventory | 22,700 | ||

| Investment in associate | 85,000 | ||

| Investment at FVTOCIequity | 30,000 | ||

| Land | 90,000 | ||

| Building | 200,000 | ||

| Accumulated depreciationbuilding | 40,000 | ||

| Equipment | 40,000 | ||

| Accumulated depreciationequipment | 15,000 | ||

| Accounts payable | 18,775 | ||

| Income tax payable | 4,500 | ||

| Bonds payable (6%, due January 1, 2026) | 126,025 | ||

| Common shares, unlimited number of no par value shares authorized, 100,000 issued | 100,000 | ||

| Retained earnings | 110,775 | ||

| Accumulated other comprehensive income | 5,000 | ||

| Sales | 750,000 | ||

| Cost of goods sold | 370,000 | ||

| Operating expenses | 180,000 | ||

| Interest revenue | 375 | ||

| Interest expense | 6,250 | ||

| Income tax expense | 50,000 | ||

| Total | $1,172,950 | $1,172,950 | |

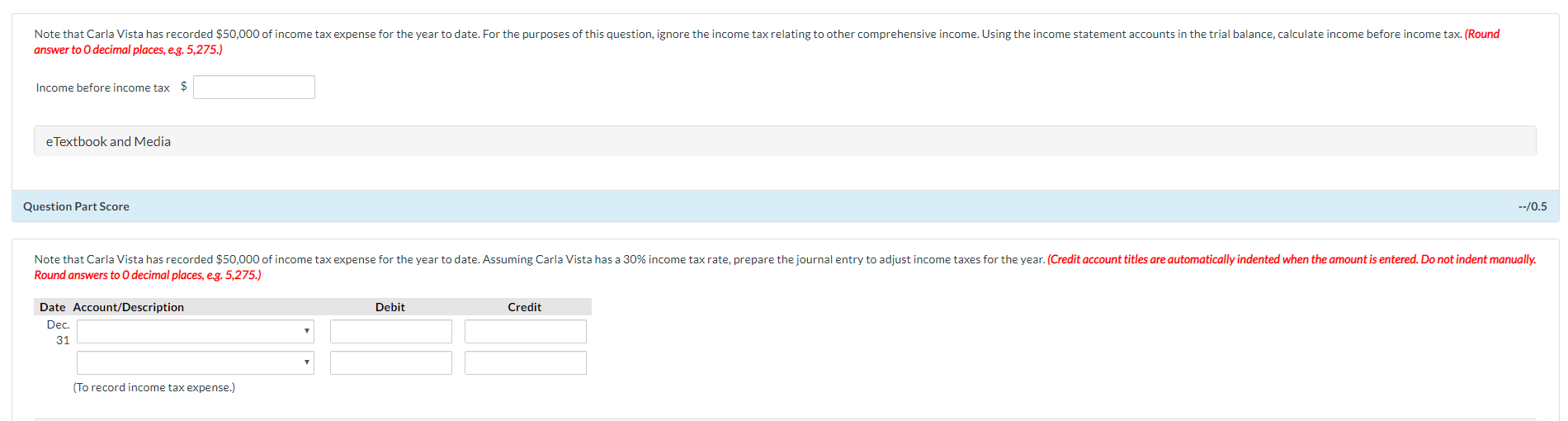

All transactions and adjustments for 2021 have been recorded and reported in the trial balance except for the items described below.

| Jan. 7 | Issued 1,100 preferred shares for $25,000. In total, 100,000, $2, noncumulative, convertible, preferred shares are authorized. Each preferred share is convertible into five common shares. |

| Mar. 16 | Purchased 800 common shares of Osborne Inc., to be held for trading purposes, for $28 per share. |

| July 1 | Purchased $100,000 Solar Inc. 10-year, 5% bonds at 108.2, when the market interest rate was 4%. Interest is received semi-annually on July 1 and January 1. Carla Vista purchased the bonds to earn interest. |

| Aug. 2 | Sold the Osborne common shares for $29 per share. |

| 5 | Invested $20,000 in a money-market fund. |

| Sept. 25 | 550 of the preferred shares issued on January 7 were converted into common shares. |

| Oct. 24 | Cashed in the money-market fund, receiving $20,000 plus $200 interest. |

| Nov. 30 | Obtained a $50,000 bank loan by issuing a three-year, 6% note payable. Carla Vista is required to make equal blended payments of $1,521 at the end of each month. The first payment was made on December 31. Note that at December 31, $15,757 of the note payable is due within the next year. |

| Dec. 1 | Declared the annual dividend on the preferred shares on December 1 to shareholders of record on December 23, payable on January 15. |

| 31 | Carla Vista owns 40% of RES. RES earned $21,300 and paid dividends of $1,600 in 2021. The fair value of the RES investment was $98,000. |

| 31 | Semi-annual interest is receivable on the Solar Inc. bonds on January 1, 2022. The bonds were trading at 106 on December 31, 2021. |

| 31 | The annual interest is due on the bonds payable on January 1, 2022. The par value of the bonds is $130,000 and the bonds were issued when the market interest rate was 7%. |

| 31 | The fair value of the long-term investment at FVTOCIequity was $28,900. Ignore income tax calculation. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started