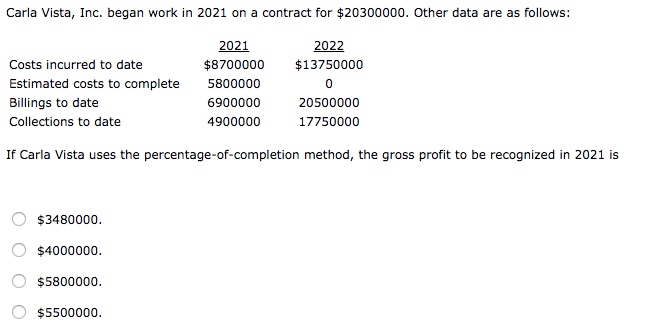

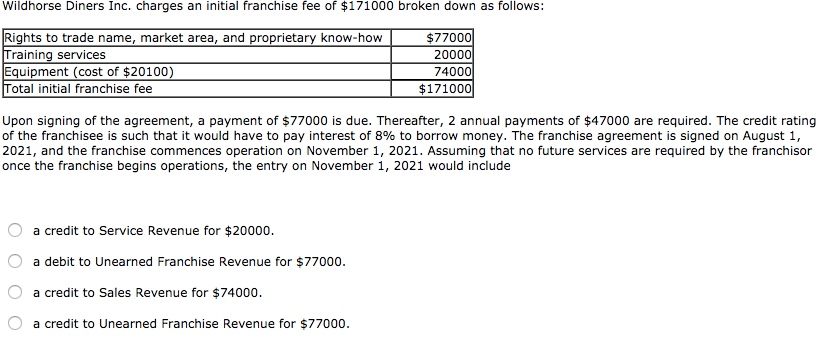

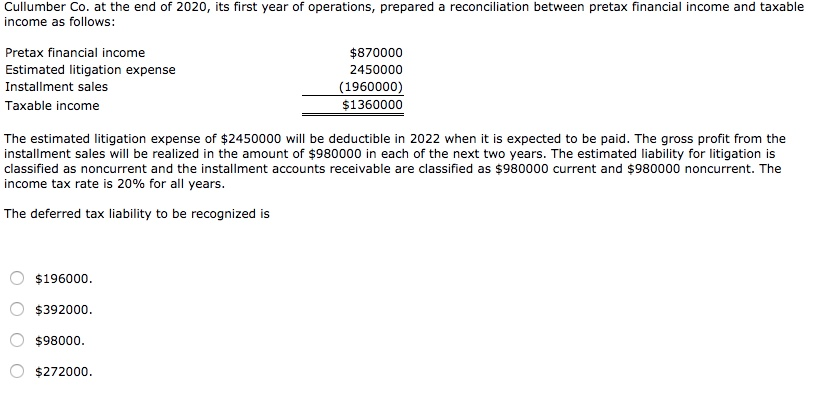

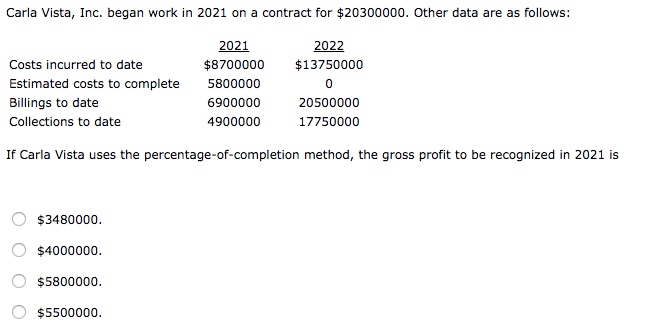

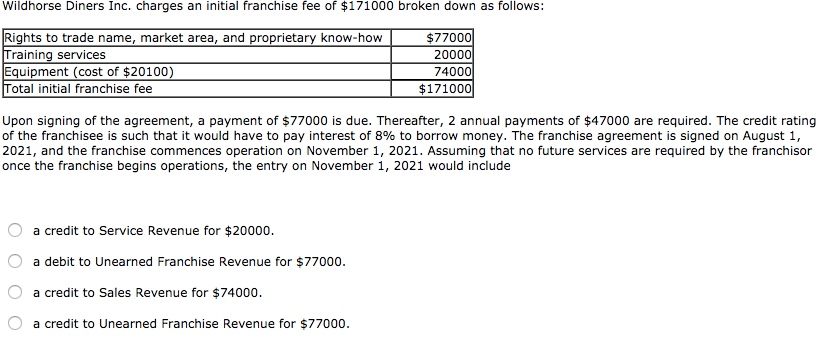

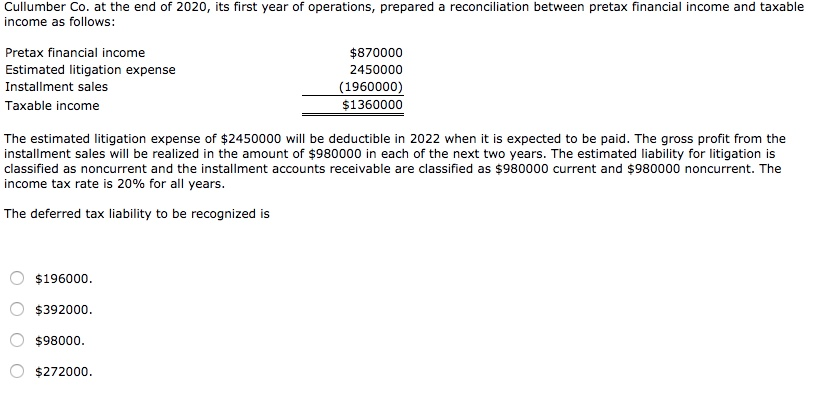

Carla Vista, Inc. began work in 2021 on a contract for $20300000. Other data are as follows: 2022 $13750000 Costs incurred to date Estimated costs to complete Billings to date Collections to date 2021 $8700000 5800000 6900000 4900000 20500000 17750000 If Carla Vista uses the percentage-of-completion method, the gross profit to be recognized in 2021 is O $3480000 $4000000. O $5800000. O $5500000. Wildhorse Diners Inc. charges an initial franchise fee of $171000 broken down as follows: Rights to trade name, market area, and proprietary know-how Training services Equipment (cost of $20100) Total initial franchise fee $77000 20000 740001 $171000 Upon signing of the agreement, a payment of $77000 is due. Thereafter, 2 annual payments of $47000 are required. The credit rating of the franchisee is such that it would have to pay interest of 8% to borrow money. The franchise agreement is signed on August 1, 2021, and the franchise commences operation on November 1, 2021. Assuming that no future services are required by the franchisor once the franchise begins operations, the entry on November 1, 2021 would include O a credit to Service Revenue for $20000. O a debit to Unearned Franchise Revenue for $77000. O a credit to Sales Revenue for $74000. O a credit to Unearned Franchise Revenue for $77000. Cullumber Co. at the end of 2020, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income Estimated litigation expense Installment sales Taxable income $870000 2450000 (1960000) $1360000 The estimated litigation expense of $2450000 will be deductible in 2022 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $980000 in each of the next two years. The estimated liability for litigation is classified as noncurrent and the installment accounts receivable are classified as $980000 current and $980000 noncurrent. The income tax rate is 20% for all years. The deferred tax liability to be recognized is $196000 O $392000. O $98000. $272000. O