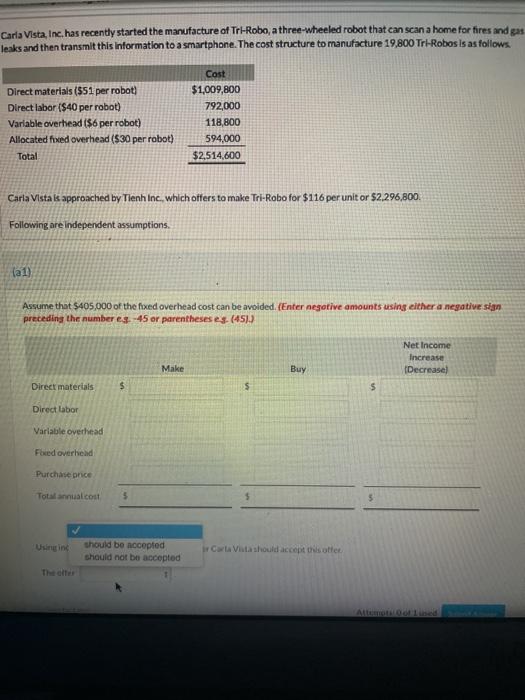

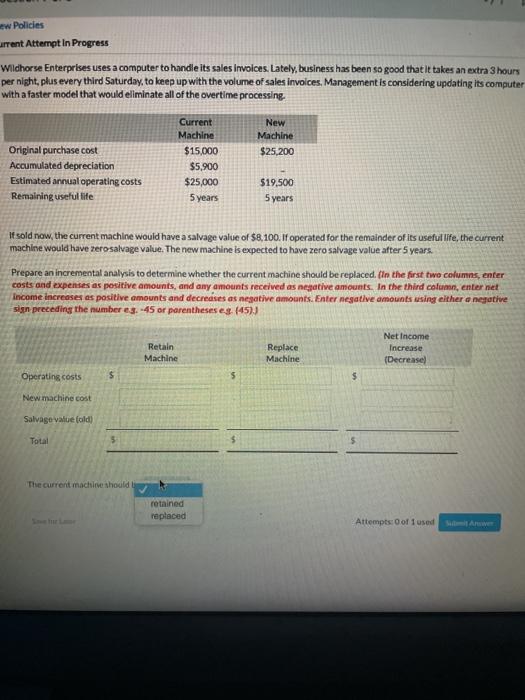

Carla Vista, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a home for tires and gas leaks and then transmit this information to a smartphone. The cost structure to manufacture 19,800 Tri-Robos is as follows. Direct materials ($51 per robot) Direct labor ($40 per robot) Variable overhead ($6 per robot) Allocated fixed overhead ($30 per robot) Total Cost $1,009,800 792,000 118,800 594,000 $2,514,600 Carla Vista is approached by Tenh Inc., which offers to make Tri-Robo for $116 per unit or $2.296,800 Following are independent assumptions. a1 Assume that S405,000 of the fixed overhead cost can be avoided. (Enter negative amounts using either a negative sign preceding the number es 45 or parentheseses (451.) Net Income Increase (Decrease] Make Buy Direct materials $ s $ Direct labor Variable overhead Fored overhead Purchase price Total anual.com should be accepted should not be accepted Vistashould accept Notte The te w Policies urrent Attempt In Progress Wildhorse Enterprises uses a computer to handle its sales invoices. Lately, business has been so good that it takes an extra 3 hours per night, plus every third Saturday, to keep up with the volume of sales involces, Management is considering updating its computer with a faster model that would eliminate all of the overtime processing. New Machine $25,200 Original purchase cost Accumulated depreciation Estimated annual operating costs Remaining useful lite Current Machine $15.000 $5,900 $25,000 5 years $19,500 5 years If sold now, the current machine would have a salvage value of $8,100. If operated for the remainder of its useful life, the current machine would have rerosalvage value. The new machine is expected to have zero salvage value after 5 years. Prepare an incremental analysis to determine whether the current machine should be replaced. (In the first two columns, enter costs and expenses as positive amounts, and any amounts received as negative amounts. In the third column, enter net Income increases es positive amounts and decreases as negative amounts. Enter negative amounts using either a negative sign preceding the number e3.-45 or parentheses es (45) Retain Machine Replace Machine Net Income Increase (Decrease] Operating costs $ $ New machine cost Salvage value (old) Total The current machine should retained replaced Attempts: 0 of 1 used