Question

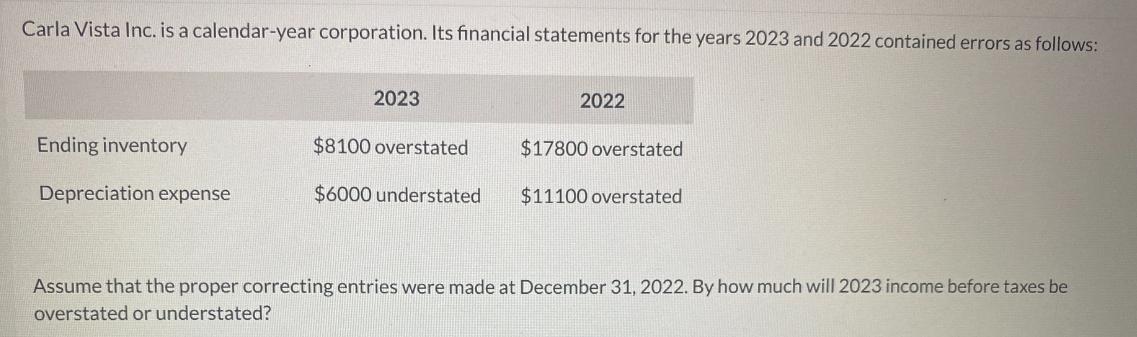

Carla Vista Inc. is a calendar-year corporation. Its financial statements for the years 2023 and 2022 contained errors as follows: 2023 2022 Ending inventory

Carla Vista Inc. is a calendar-year corporation. Its financial statements for the years 2023 and 2022 contained errors as follows: 2023 2022 Ending inventory $8100 overstated $17800 overstated Depreciation expense $6000 understated $11100 overstated Assume that the proper correcting entries were made at December 31, 2022. By how much will 2023 income before taxes be overstated or understated?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine the impact of the errors on the 2023 income before taxes we need to adjust the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: David Spiceland

11th Edition

1264134525, 9781264134526

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App