Answered step by step

Verified Expert Solution

Question

1 Approved Answer

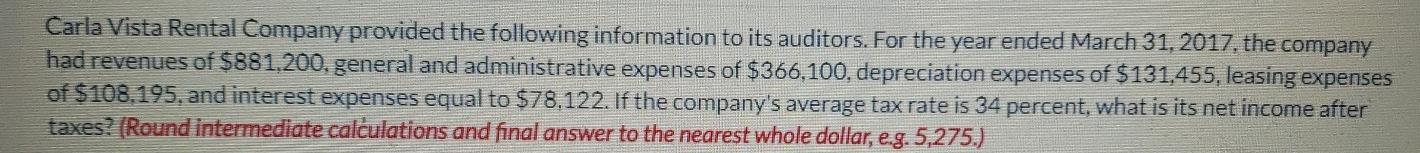

Carla Vista Rental Company provided the following information to its auditors. For the year ended March 31, 2017, the company had revenues of $881,200, general

Carla Vista Rental Company provided the following information to its auditors. For the year ended March 31, 2017, the company had revenues of $881,200, general and administrative expenses of $366,100, depreciation expenses of $131,455, leasing expenses of $108,195, and interest expenses equal to $78,122. If the company's average tax rate is 34 percent, what is its net income after taxes? (Round intermediate calculations and final answer to the nearest whole dollar, e.g. 5,275.) Income Statement as of March 31, 2017 Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started