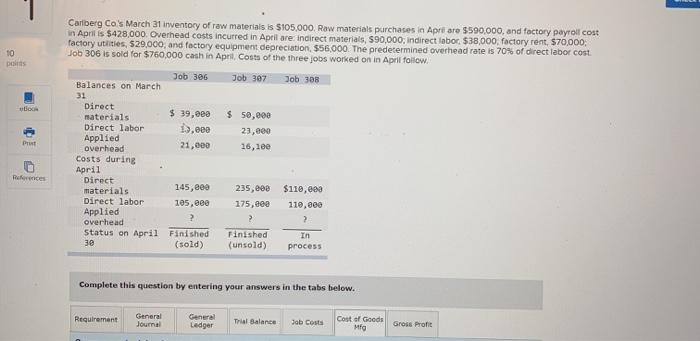

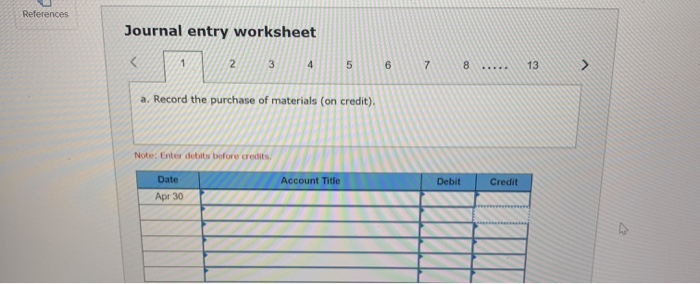

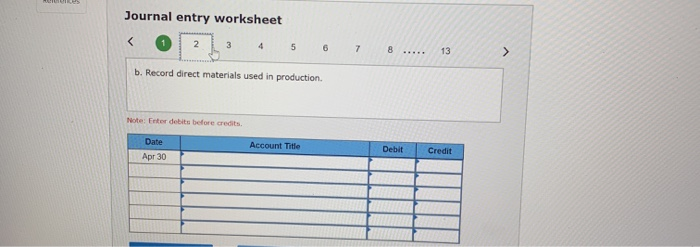

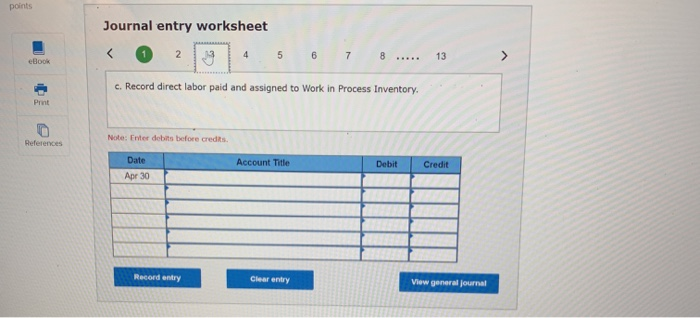

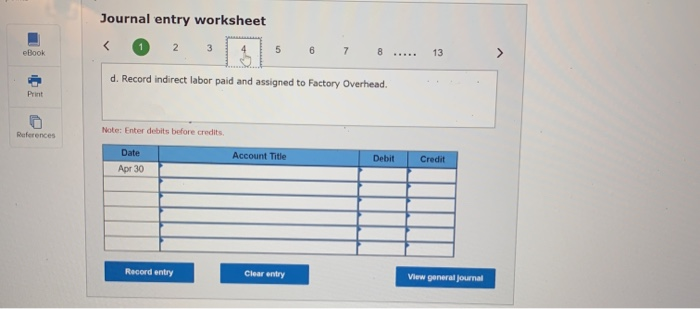

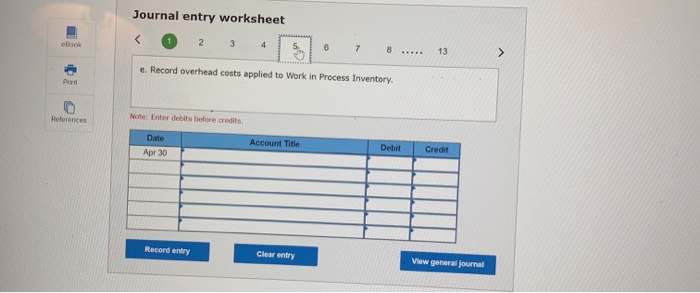

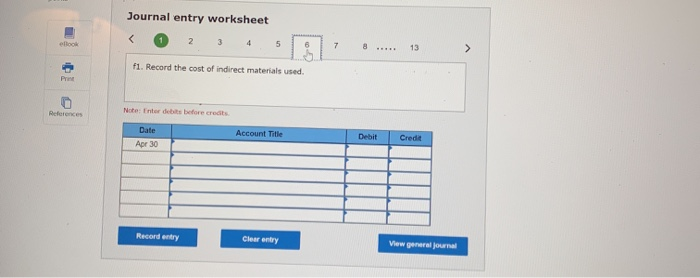

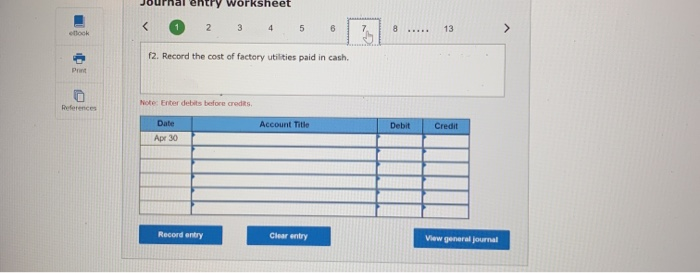

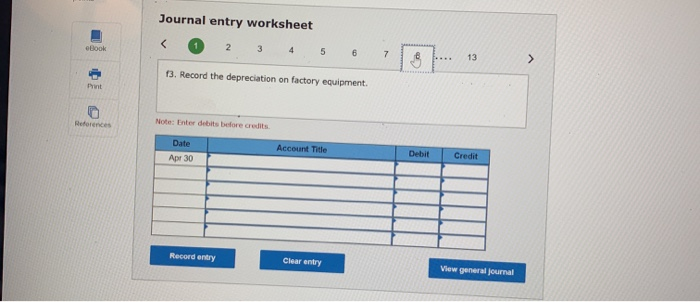

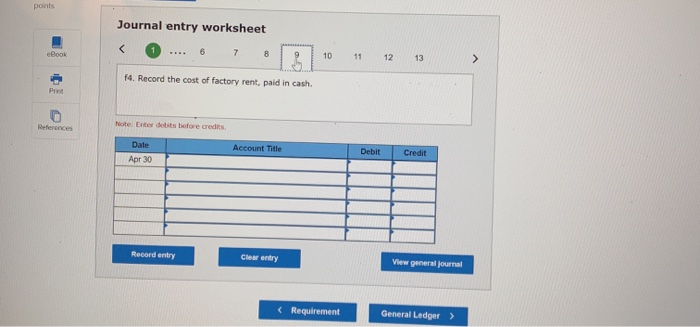

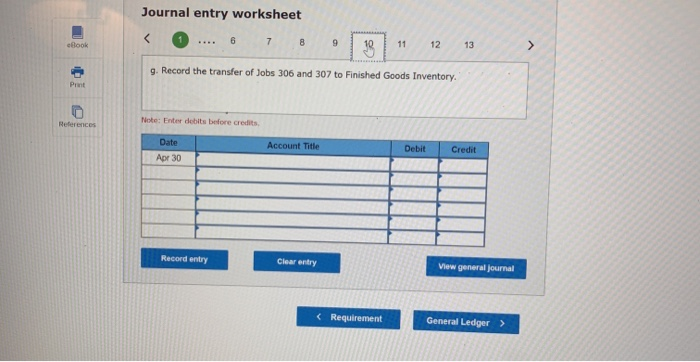

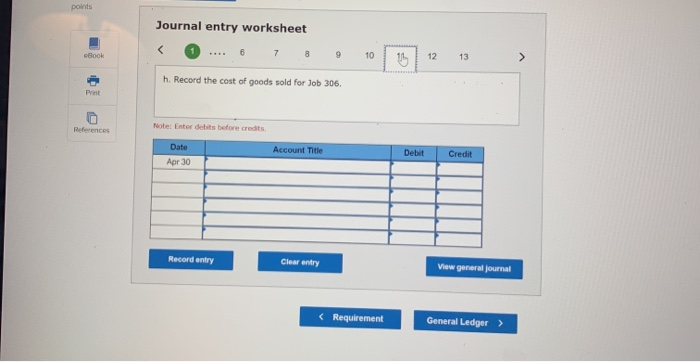

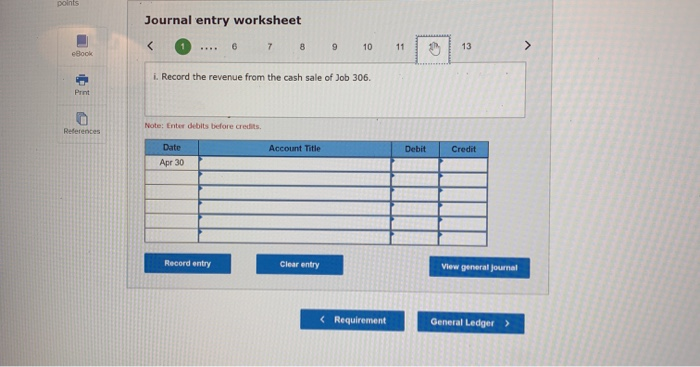

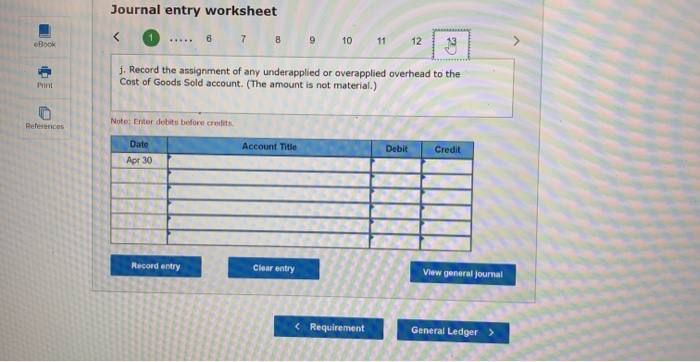

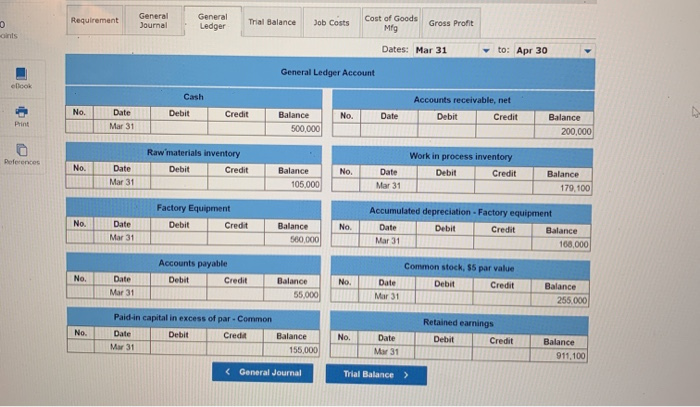

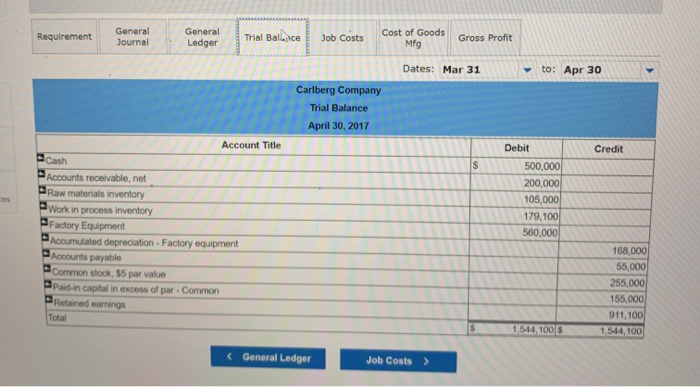

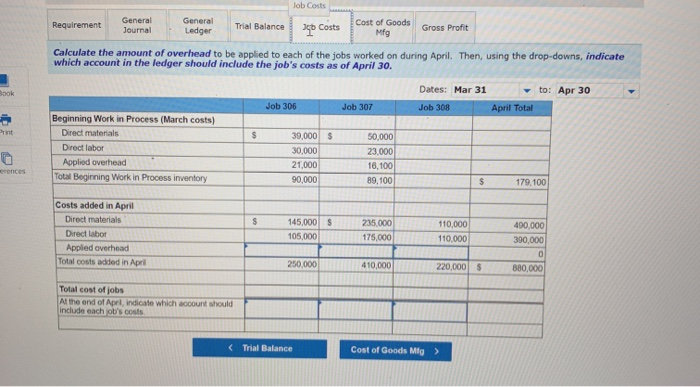

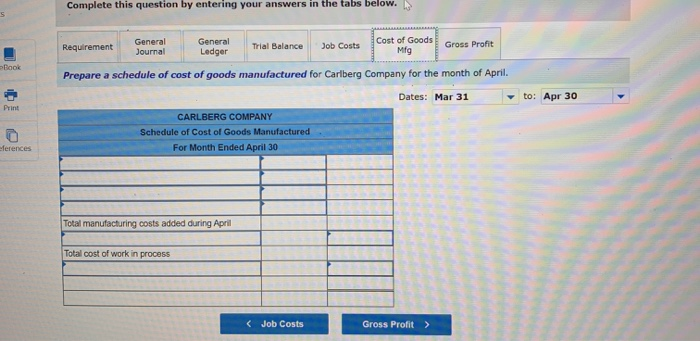

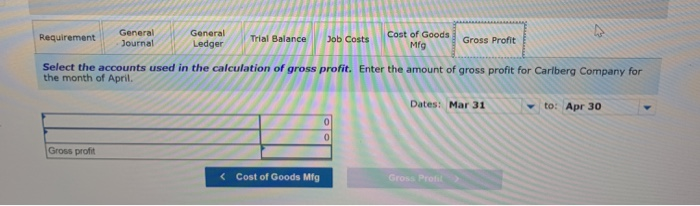

Carlberg Co.'s March 31 inventory of raw materials is $105,000. Raw materials purchases in April are $590,000, and factory payroll cost in April is $428,000 Overhead costs incurred in Aprilare Indirect materials, $90,000 indirect labor, $38,000, factory rent, $70,000: factory utilities, $29,000, and factory equipment depreciation, $56.000. The predetermined overhead rate is 70% of direct labor cost Job 306 is sold for $760,000 cash in April. Costs of the three jobs worked on in April follow. 10 points Job 386 Job 307 Job 308 Balances on March $50,000 23,000 16,100 Direct $ 39,000 materials Direct labor 13,000 Applied Overhead 21,000 Costs during April Direct 145,000 materials Direct labor 105, Applied overhead Status on April Finished (sold) 235,000 175,000 $110,000 110,000 Finished (unsold) In process @ Complete this question by entering your answers in the tabs below. Requirement General Journal Bob Costs Trial Balance Cost of Goods Mfg Gross Profit Ledger References Journal entry worksheet a. Record the purchase of materials (on credit). Note: Enter dobits before credits Date Apr 30 Account Title Debit Credit Journal entry worksheet 2 3 4 5 6 7 8 ..... 13 b. Record direct materials used in production Note: Enter debits before credits Account Title Debit Credit Date Apr 30 points Journal entry worksheet c. Record direct labor paid and assigned to Work in Process Inventory. Note: Frede r e credits References Date Account Title Debit Credit Apr 30 Racord entry Clear entry View general Journal Journal entry worksheet d. Record indirect labor paid and assigned to Factory Overhead. Note: Enter debits before credits References Account Title Debit Credit Date Apr 30 Record entry Clearly View general Journal Journal entry worksheet 7 8 ..... 13 e. Record overhead costs applied to Work in Process Inventory. Note: Enter debits before credits Date Account Title Debit Credit Apr 30 Record entry Clear entry View general journal Journal entry worksheet 11. Record the cost of indirect materials used Net Entert be credits Account Title Debit Credit Apr 30 Record entry Clear entry View general al Journdl entry worksheet 12. Record the cost of factory utilities paid in cash. ce Account Title Debit Credit Date Apr 30 Record entry Clear entry View general Journal Journal entry worksheet Journal entry worksheet 9 10 11 12 13 > g. Record the transfer of Jobs 306 and 307 to Finished Goods Inventory Note: Enter debits before credits Date Account Title Debit Credit Apr 30 Record entry Clear entry View general journal points Journal entry worksheet Journal entry worksheet Journal entry worksheet 1 ... 6 7 8 9 10 j. Record the assignment of any underapplied or overapplied overhead to the Cost of Goods Sold account. (The amount is not material.) Enver detits before credits Account Title Debit Credit TTTTTT 1 OLI & IT E . 3 View general journal Gener Requirement General Journal General Ledger Trial Balice Job Costs Cost of Goods ods Gross Profit MfG Dates: Mar 31 to: Apr 30 E Debit Credit Account Title Cash Accounts receivable, net Raw materials inventory Work in process inventory Factory Equipment Accumulated depreciation - Factory equipment Accounts payable Common stock, 55 par value Paid in capital in excess of par. Common Retained earrings Total 500,000 200,000 105,000 179,100 560,000 168,000 55,000 255,000 155,000 911,100 1,544,100 1,544, 100 S Job Costs Requirement General Journal General Ledger Balance Costs Cost of Goods MfG Gross Profit Calculate the amount of overhead to be applied to each of the jobs worked on during April. Then, using the drop-downs, indicate which account in the ledger should include the job's costs as of April 30. Dates: Mar 31 to: Apr 30 Job 306 Job 307 Job 308 April Total Beginning Work in Process (March costs) Direct materials $ 39,000 $ 50,000 Direct labor 30,000 23,000 Applied overhead 21,000 16,100 Total Beginning Work in Process inventory 90,000 89,100 $ 179,100 S S Costs added in April Direct materials Direct labor Applied overhead Total costs added in April 145,000 105,000 235,000 175,000 4 110.000 110.000 00,000 300.000 250,000 410,000 220,000 S 880,000 Total cost of jobs At the end of April, indicate which account should include each ob's costs ( Trial Balance Cost of Goods Mig> Complete this question by entering your answers in the tabs below. > General Journal Requirement General Ledger Trial Balance Job Costs Cost of Goods Gr eat to: Apr 30 Prepare a schedule of cost of goods manufactured for Carlberg Company for the month of April. Dates: Mar 31 CARLBERG COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 TTTTT Total manufacturing costs added during April Total cost of work in process TL ( Job Costs Gross Profit Cost of Goods Requirement General Journal General Ledger Gross Profit Ma Gross Profit Select the accounts used in the calculation of gro the month of April Enter the amount of gross profit for Carlberg Company for Mar 31 to: Apr 30 Gross pro Journal entry worksheet 9 10 11 12 13 > g. Record the transfer of Jobs 306 and 307 to Finished Goods Inventory Note: Enter debits before credits Date Account Title Debit Credit Apr 30 Record entry Clear entry View general journal points Journal entry worksheet Journal entry worksheet Journal entry worksheet 1 ... 6 7 8 9 10 j. Record the assignment of any underapplied or overapplied overhead to the Cost of Goods Sold account. (The amount is not material.) Enver detits before credits Account Title Debit Credit TTTTTT 1 OLI & IT E . 3 View general journal Gener Requirement General Journal General Ledger Trial Balice Job Costs Cost of Goods ods Gross Profit MfG Dates: Mar 31 to: Apr 30 E Debit Credit Account Title Cash Accounts receivable, net Raw materials inventory Work in process inventory Factory Equipment Accumulated depreciation - Factory equipment Accounts payable Common stock, 55 par value Paid in capital in excess of par. Common Retained earrings Total 500,000 200,000 105,000 179,100 560,000 168,000 55,000 255,000 155,000 911,100 1,544,100 1,544, 100 S Job Costs Requirement General Journal General Ledger Balance Costs Cost of Goods MfG Gross Profit Calculate the amount of overhead to be applied to each of the jobs worked on during April. Then, using the drop-downs, indicate which account in the ledger should include the job's costs as of April 30. Dates: Mar 31 to: Apr 30 Job 306 Job 307 Job 308 April Total Beginning Work in Process (March costs) Direct materials $ 39,000 $ 50,000 Direct labor 30,000 23,000 Applied overhead 21,000 16,100 Total Beginning Work in Process inventory 90,000 89,100 $ 179,100 S S Costs added in April Direct materials Direct labor Applied overhead Total costs added in April 145,000 105,000 235,000 175,000 4 110.000 110.000 00,000 300.000 250,000 410,000 220,000 S 880,000 Total cost of jobs At the end of April, indicate which account should include each ob's costs ( Trial Balance Cost of Goods Mig> Complete this question by entering your answers in the tabs below. > General Journal Requirement General Ledger Trial Balance Job Costs Cost of Goods Gr eat to: Apr 30 Prepare a schedule of cost of goods manufactured for Carlberg Company for the month of April. Dates: Mar 31 CARLBERG COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 TTTTT Total manufacturing costs added during April Total cost of work in process TL ( Job Costs Gross Profit Cost of Goods Requirement General Journal General Ledger Gross Profit Ma Gross Profit Select the accounts used in the calculation of gro the month of April Enter the amount of gross profit for Carlberg Company for Mar 31 to: Apr 30 Gross pro