Answered step by step

Verified Expert Solution

Question

1 Approved Answer

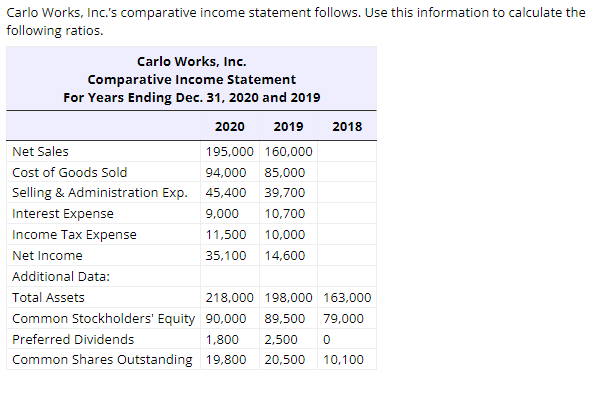

Carlo Works, Inc.'s comparative income statement follows. Use this information to calculate the following ratios. 1. Calculate the profit margin ratio for 2020 and 2019.

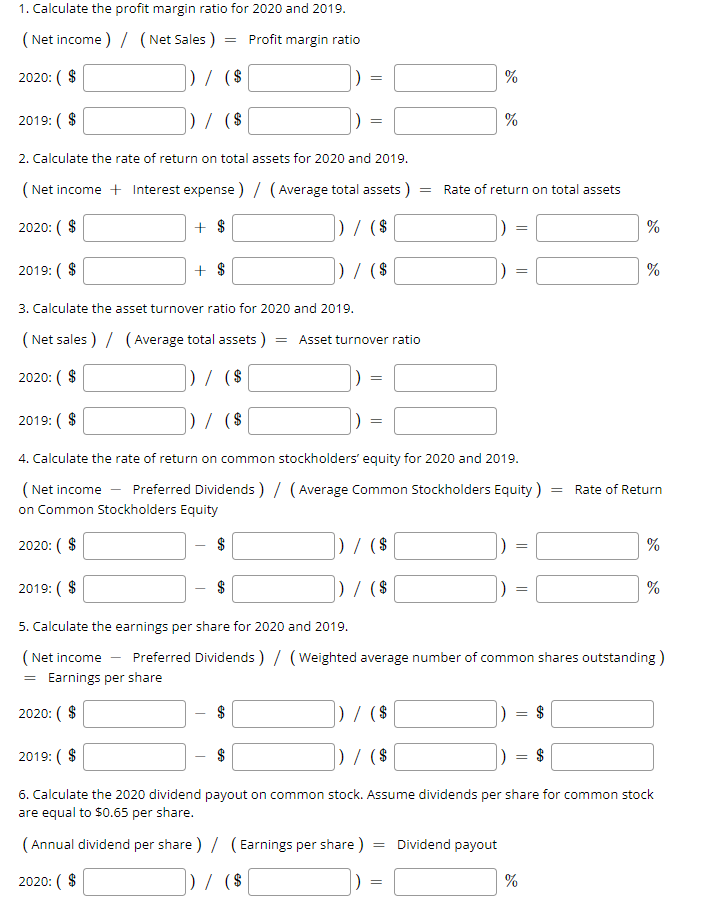

Carlo Works, Inc.'s comparative income statement follows. Use this information to calculate the following ratios. 1. Calculate the profit margin ratio for 2020 and 2019. (Net income )/( Net Sales )= Profit margin ratio 2. Calculate the rate of return on total assets for 2020 and 2019. (Net income + Interest expense )/( Average total assets )= Rate of return on total assets \begin{tabular}{llll} 2020: ($ & +$ & )/($ & \\ 2019:($ & +$ & )/($ & % \end{tabular} 3. Calculate the asset turnover ratio for 2020 and 2019. (Net sales ) / (Average total assets ) = Asset turnover ratio 4. Calculate the rate of return on common stockholders' equity for 2020 and 2019. (Net income - Preferred Dividends ) / (Average Common Stockholders Equity) = Rate of Return on Common Stockholders Equity \begin{tabular}{|c|c|c|c|} \hline 2020: (\$ & $ & )/($ & )= \\ \hline 019: ( \$ & $ & )/($ & )= \\ \hline \end{tabular} 5. Calculate the earnings per share for 2020 and 2019. (Net income - Preferred Dividends ) / (Weighted average number of common shares outstanding ) = Earnings per share \begin{tabular}{|c|c|c|c|} \hline 2020: (\$ & $ & )/($ & )=$ \\ \hline 019: ( \$ & $ & )/($ & )= \\ \hline \end{tabular} 6. Calculate the 2020 dividend payout on common stock. Assume dividends per share for common stock are equal to $0.65 per share. (Annual dividend per share ) / (Earnings per share ) = Dividend payout 2020:($)/($

Carlo Works, Inc.'s comparative income statement follows. Use this information to calculate the following ratios. 1. Calculate the profit margin ratio for 2020 and 2019. (Net income )/( Net Sales )= Profit margin ratio 2. Calculate the rate of return on total assets for 2020 and 2019. (Net income + Interest expense )/( Average total assets )= Rate of return on total assets \begin{tabular}{llll} 2020: ($ & +$ & )/($ & \\ 2019:($ & +$ & )/($ & % \end{tabular} 3. Calculate the asset turnover ratio for 2020 and 2019. (Net sales ) / (Average total assets ) = Asset turnover ratio 4. Calculate the rate of return on common stockholders' equity for 2020 and 2019. (Net income - Preferred Dividends ) / (Average Common Stockholders Equity) = Rate of Return on Common Stockholders Equity \begin{tabular}{|c|c|c|c|} \hline 2020: (\$ & $ & )/($ & )= \\ \hline 019: ( \$ & $ & )/($ & )= \\ \hline \end{tabular} 5. Calculate the earnings per share for 2020 and 2019. (Net income - Preferred Dividends ) / (Weighted average number of common shares outstanding ) = Earnings per share \begin{tabular}{|c|c|c|c|} \hline 2020: (\$ & $ & )/($ & )=$ \\ \hline 019: ( \$ & $ & )/($ & )= \\ \hline \end{tabular} 6. Calculate the 2020 dividend payout on common stock. Assume dividends per share for common stock are equal to $0.65 per share. (Annual dividend per share ) / (Earnings per share ) = Dividend payout 2020:($)/($ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started