Question

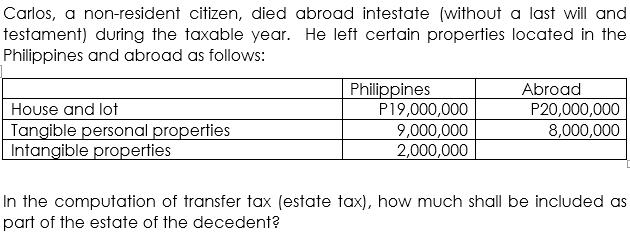

Carlos, a non-resident citizen, died abroad intestate (without a last will and testament) during the taxable year. He left certain properties located in the

Carlos, a non-resident citizen, died abroad intestate (without a last will and testament) during the taxable year. He left certain properties located in the Philippines and abroad as follows: House and lot Tangible personal properties Intangible properties Philippines P19,000,000 9,000,000 2,000,000 Abroad P20,000,000 8,000,000 In the computation of transfer tax (estate tax), how much shall be included as part of the estate of the decedent?

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To compute the transfer tax estate tax for the estate of the deced...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App