Prepare a federal income tax return based on the attached scenario and the second file which contains relevant tax forms provided by the client. If

Prepare a federal income tax return based on the attached scenario and the second file which contains relevant tax forms provided by the client. If you struggle to read the attached forms clearly, looking at a blank copy may be helpful to read titles, etc.

Instructions:

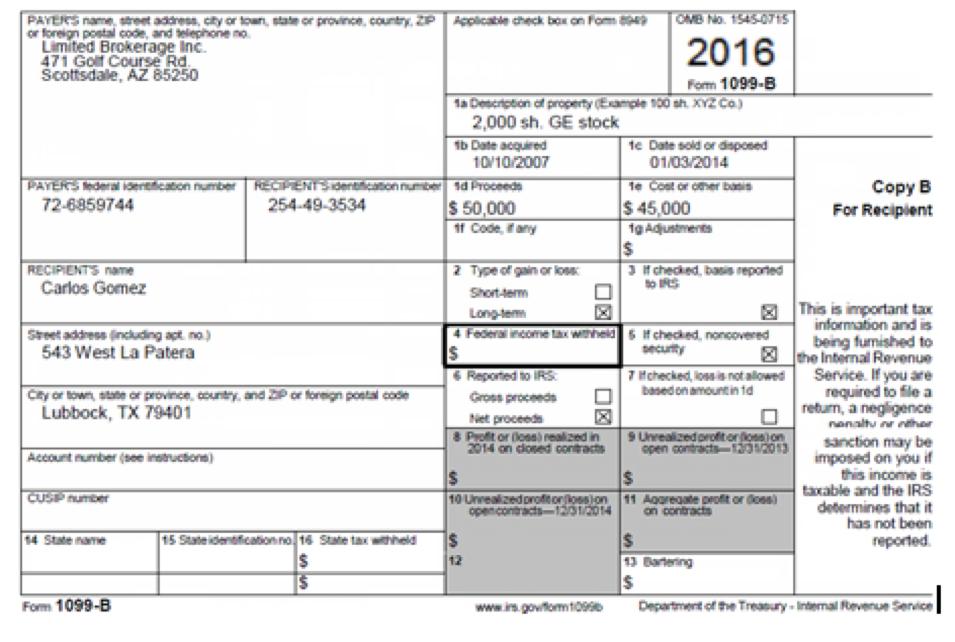

Please complete the 2017 federal income tax return for Carlos and Maria Gomez. Ignore the requirement to attach the form(s) W-2 to the front page of the Form 1040. Ignore any impact by AMT or Passive Activity Loss rules. If required information is missing, use reasonable assumptions to fill in the gaps. Some supporting tax forms are provided in a separate document on Blackboard. ASSUME ALL TAX FORMS ARE FOR 2017 EVEN IF THEY SAY 2016.

Carlos (age 40) and Maria (age 38) Gomez live in Lubbock, Texas. The Gomezes have two children: Luis (age 14) and Amanda (age 12). Both children qualify as federal income tax dependents of Carlos and Maria. The Gomezes provided the following information:

Luis’s social security number is 589-24-8432

Amanda’s social security number is 599-74-8733

The Gomez’s current mailing address is 543 West La Patera, Lubbock, Texas 79401

Carlos is a civil engineer. For the first two months of the year, he was employed by West Texas Engineering (WTE). However, he resigned his position with WTE to start his own engineering firm called Gomez Professional Engineers (GPE). GPE is conducted as a sole proprietorship with Carlos being the sole owner. GPE started business on January 1, 2017 and is located at 1515 West Industrial Road Lubbock, Texas 79401 (EIN 20-1616167). Maria is self-employed as a part-time bookkeeper.

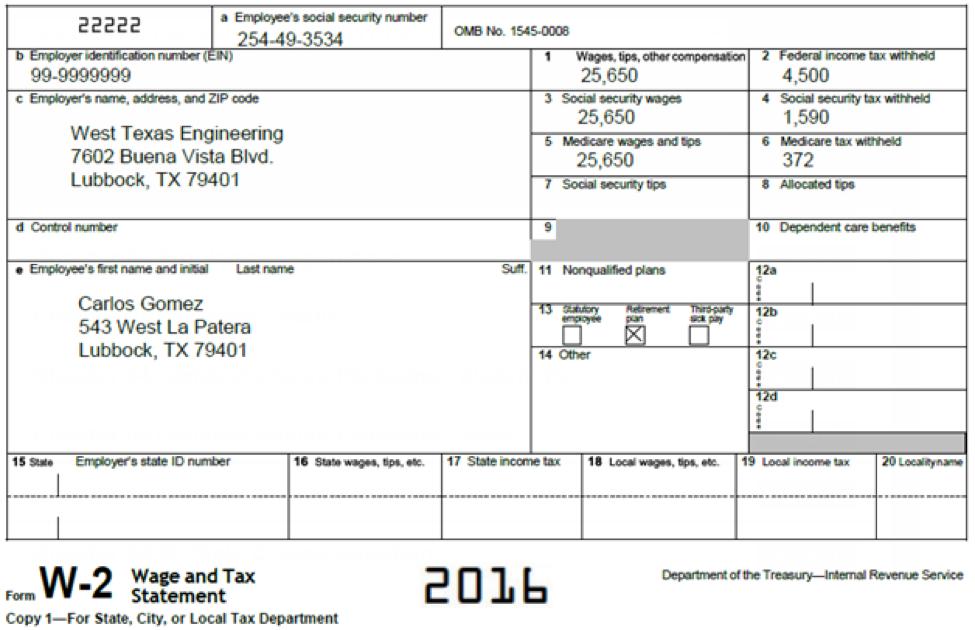

Carlos provided a W-2 from WTE; see attached.

Carlos reported the following information for GPE’s business activities (GPE uses the cash method of accounting):

Revenues:

Credit card receipts $352,000

Cash receipts 648,000

Total revenue $1,000,000

Expenses:

Advertising $5,450

Insurance-professional 15,750

Office building rent 62,000

Equipment leases 6,050

Travel 14,200

Meals and entertainment 2,975

Wages 498,725

Taxes and licenses 44,875

Employee health insurance 42,000

Employee benefit programs 14,500

Utilities 37,425

Office supplies 18,900

Legal and professional fees 15,550

Repairs and maintenance 10,000

Total Expenses $ 788,400

GPE purchased and placed in service the following fixed assets in 2017:

Item | Date Purchased | Amount |

Laptop computers | March 1 | $20,500 |

Printers | June 1 | $6,500 |

Office furniture | October 10 | $19,000 |

GPE does not want to claim any bonus depreciation or Section 179 expensing on any of these assets.

Carlos worked part-time on GPE business activities until he finished his employment with WTE early in the year. Carlos worked full-time on GPE business activities for the rest of the year.

GPE filed Forms 1099 for payments made to contractors when required to do so.

Carlos and Maria paid $22,000 for health insurance for his family (for the time he was working at GPE). This amount is not included in the GPE expenses listed above. Neither Carlos nor Maria had access to employer-provided health insurance during the year while they were paying the premiums for this policy. The entire Gomez family was covered by minimum essential health insurance during each month in 2017.

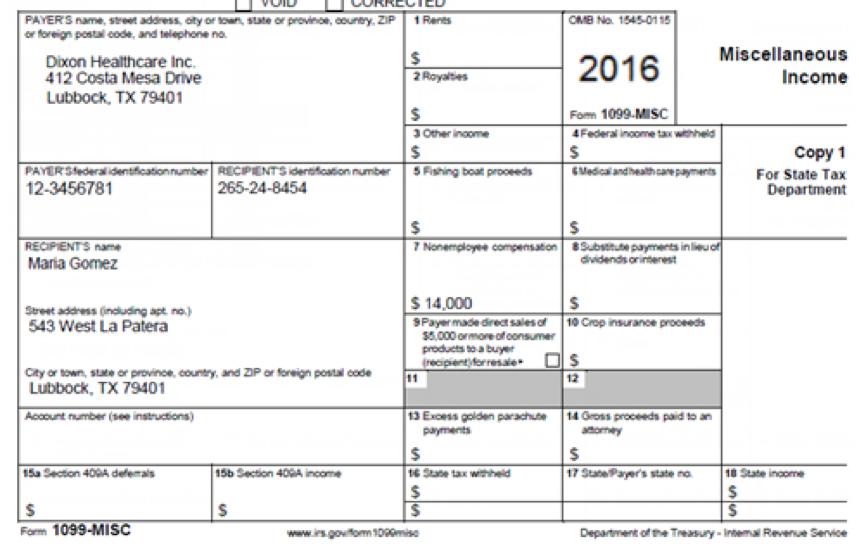

Maria received the following Form 1099-MISC from her bookkeeping activities for her largest client which is attached.

Maria received an additional $4,000 from clients who were not required to issue Maria a Form 1099-MISC.

During the year, Maria paid the following business-related expenses:

Paper $365

Toner $450

Meals $580

Maria purchased and placed in service the following fixed assets for her business in 2017:

Item | Date Purchased | Amount |

New laptop computers | March 1 | $1,850 |

New laser printers | March 1 | $ 840 |

New computer software | April 2 | $ 400 |

Maria would like to recover the cost of these business assets as soon as possible.

Maria owns a 2014 Acura. She started to use the Acura for her business on January 1, 2015. She drove 2,050 business miles during 2017 (she has documentation to verify). She drove the vehicle for a total of 10,000 miles during the year (7,950 personal miles). She also has access to another vehicle that she can use for personal purposes.

Maria started her bookkeeping service in 2013 and she uses the cash method of accounting. She is the only person performing services in the business. She did not make any payments that would have required her to file a Form 1099.

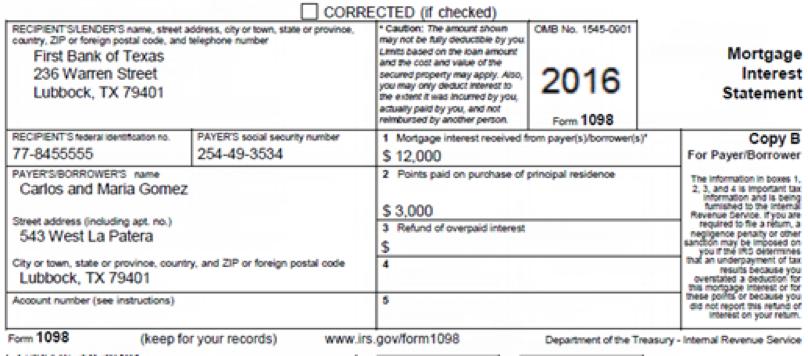

The Gomez family purchased (and moved into) their current residence at 543 West La Patera, Lubbock, Texas 79401 in late January of 2017. The La Patera residence is 2,000 square feet. The purchase price of the residence was $500,000 (building value was $350,000 and the lot value was $150,000). The mortgage on the purchase was $300,000. In addition to the Form 1098 from First Bank of Texas, expenses relating to the La Patera residence were as follows:

Property taxes $10,750

Utilities $3,000

Insurance $2,000

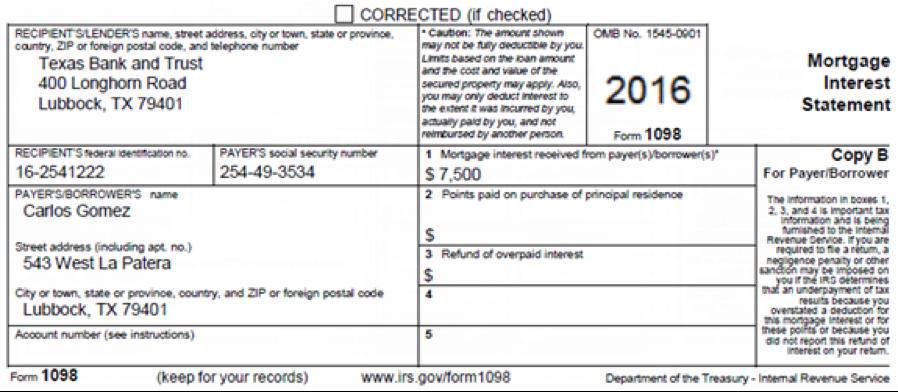

In addition to the primary mortgage on the home, the Gomezes borrowed $150,000 on a home equity line of credit (“HELOC”) against the La Patera home from Texas Bank and Trust. They received an attached Form 1098 relating to the line of credit:

They used the funds from the line of credit borrowed funds to pay off personal debts on credit cards and take a European vacation.

Maria owns a condominium in Lubbock that is valued at $160,000. Maria acquired the land as a gift from her parents on July 1, 2009. The building was valued at $120,000 and the land was valued at $40,000. The condominium is located at 990 El Mar, Unit A, Lubbock Texas 79401.

Maria first rented out the El Mar unit on October 1, 2017. The revenue and expenses from the rental unit from October through December are as follows:

Rental revenue $3,600

HOA fee expense $300

Property taxes paid $225

Utilities expense $350

No Form(s) 1099 were required to be filed for this rental.

The Gomezes also received the following interest and dividends (as originally reported on 1099’s but not included here):

Grand Junction City – Box 8, Tax Exempt Interest - $3,500

First Bank of Texas – Box 1, Interest Income - $125

Lubbock Texas School District – Box 8, Tax Exempt Interest - $400

Department of the Treasury – Box 3, Interest on U.s. Savings Bonds - $150

Rio Tinto Minerals – Box 1, Interest Income – $600

General Mills – Box 1a Total Ordinary Dividends - $400; Box 1b Qualified Dividends $400

Sysco Corporation - Box 1a Total Ordinary Dividends - $250; Box 1b Qualified Dividends $250

Tyco Integrated Security - Box 1a Total Ordinary Dividends - $350; Box 1b Qualified Dividends $350

J.M. Smucker Co. - Box 1a Total Ordinary Dividends - $525; Box 1b Qualified Dividends $525

The Gomezes sold 2000 shares of GE stock, as reported on form 1099-B attached.

The Gomezes did not own, control, or manage any foreign bank accounts, nor were they grantors or beneficiaries of a foreign trust during the tax year.

The Gomezes paid the following expenses during the year (in addition to the personal residence-related items listed above):

Dentist (unreimbursed by insurance) $ 500

Doctors (unreimbursed by insurance) $1,750

Prescriptions (unreimbursed by insurance) $ 425

Vehicle property tax based upon value $ 1,950

Contribution to qualified charities $3,500

The Gomezes did not pay any state income taxes during the year.

Other Information

The Gomezes made timely federal estimated tax payments for 2017 as follows:

April 15, 2017 $11,000

June 15, 2017 $11,000

September 15, 2017 $11,000

January 15, 2017 $11,000

The Gomezes want to contribute to the Presidential Election Campaign Fund. The Gomezes would like to receive a refund (if any) of tax they may have overpaid for the year. Their preferred method of receiving the refund is by check.

22222 b Employer identification number (EIN) 99-9999999 c Employer's name, address, and ZIP code d Control number a Employee's social security number 254-49-3534 West Texas Engineering 7602 Buena Vista Blvd. Lubbock, TX 79401 State e Employee's first name and initial Carlos Gomez 543 West La Patera Lubbock, TX 79401 Emp state ID nber Last name 16 State wages, Form W-2 Wage and Tax Statement Copy 1-For State, City, or Local Tax Department etc. OMB No. 1545-0008 3 Social security wages 25,650 5 Medicare wages and tips 25,650 7 Social security tips 9 Wages, tips, other compensation 25,650 Suff. 11 Nonqualified plans 13 tutory Retirement employee plan 14 Other 17 State income tax 2016 Third-party sick pay 18 Local wages, tips, etc. 2 Federal income tax withheld 4,500 4 Social security tax withheld 1,590 6 Medicare tax withheld 372 8 Allocated tips 10 Dependent care benefits 12a 1 12b # 12c 12d 19 Loc incom tax 20 Locality name Department of the Treasury-Internal Revenue Service

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

2017 Form 1040 US Individual Income Tax Return Filing Status MARRIED FILING JOINTLY Your first name and initial Last name CARLOS GOMEZ MARIA GOMEZ Social security number 589248432 599748733 Make sure ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started