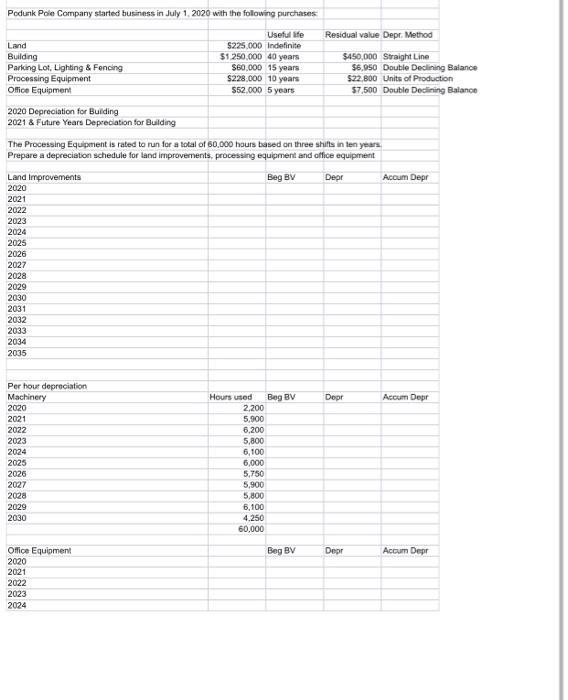

Podunk Pole Company started business in July 1, 2020 with the following purchases Useful life $225,000 Indefinite $1.250.000 40 years $60,000 15 years $228.000

Podunk Pole Company started business in July 1, 2020 with the following purchases Useful life $225,000 Indefinite $1.250.000 40 years $60,000 15 years $228.000 10 years $52.000 5 years Land Building Parking Lot, Lighting & Fencing Processing Equipment Office Equipment 2020 Depreciation for Building 2021 & Future Years Depreciation for Building The Processing Equipment is rated to run for a total of 60,000 hours based on three shifts in ten years. Prepare a depreciation schedule for land improvements, processing equipment and office equipment Beg BV Depr Land Improvements 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Per hour depreciation Machinery 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Office Equipment 2020 Residual value Depr. Method $450,000 Straight Line $6,950 Double Declining Balance $22,800 Units of Production $7,500 Double Declining Balance 2021 2022 2023 2024 Hours used Beg BV Depr 2,200 5,900 6,200 5,800 6,100 T 6,000 5,750 5,900 5,800 6,100 4,250 60,000 Beg BV Depr Accum Depr Accum Depr Accum Depr

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started