Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carlos would like to make a gift to his son, but does not want the value of the gift and the associated gift tax to

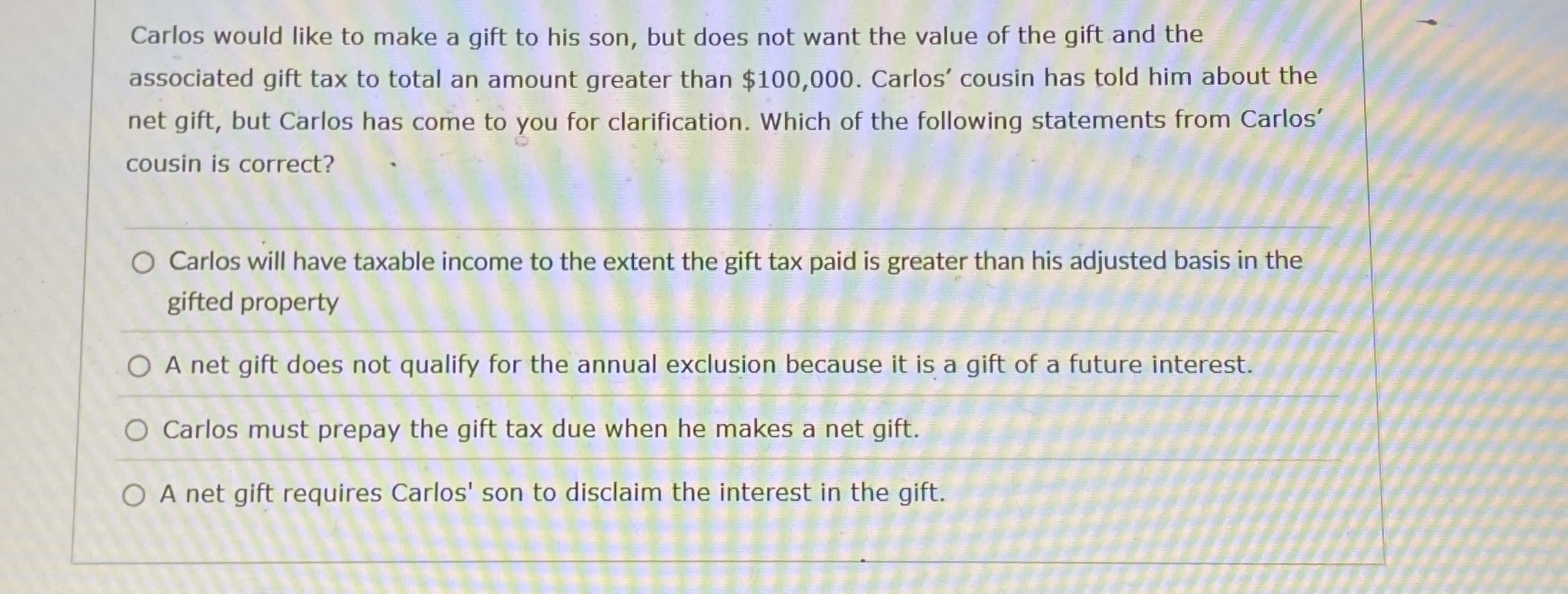

Carlos would like to make a gift to his son, but does not want the value of the gift and the

associated gift tax to total an amount greater than $ Carlos' cousin has told him about the

net gift, but Carlos has come to you for clarification. Which of the following statements from Carlos'

cousin is correct?

Carlos will have taxable income to the extent the gift tax paid is greater than his adjusted basis in the

gifted property

A net gift does not qualify for the annual exclusion because it is a gift of a future interest.

Carlos must prepay the gift tax due when he makes a net gift.

A net gift requires Carlos' son to disclaim the interest in the gift.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started