Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carl's Tires is planning to merge with Joe's Body Shop to offer a combined auto repair service shop. Carl's Tires has total costs of $1,500,000

| Carl's Tires is planning to merge with Joe's Body Shop to offer a combined auto repair service shop. Carl's Tires has total costs of $1,500,000 and sales of $2,000,000, while Joe's Body Shop features costs of $2,200,000 and sales of $4,000,000. The combined firms will be able to achieve economies of scope sufficient to reduce costs by $400,000 while maintaining sales at current levels. Calculate the difference between the percentage values of the average costs of the merged firms and the combined average costs of two nearby competitors. These competitors continue to sell tires and do auto repair separately, having total costs of $2,000,000 and sales of $2,500,000, $2,400,000, and $3,200,000, respectively. | ||||||||||||||||||||||||||||||||||

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started

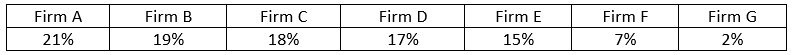

Given this, which of firm A's competitors has the largest percentage market share it could merge with while staying within DOJ guidelines?

Given this, which of firm A's competitors has the largest percentage market share it could merge with while staying within DOJ guidelines?