Answered step by step

Verified Expert Solution

Question

1 Approved Answer

X and Y are partners, sharing profits and losses in the ratio of 3: 2. They employed Z as their Manager, to whom they

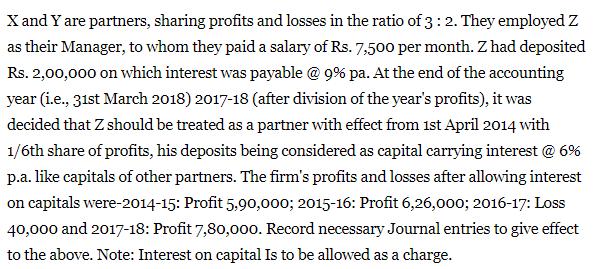

X and Y are partners, sharing profits and losses in the ratio of 3: 2. They employed Z as their Manager, to whom they paid a salary of Rs. 7,500 per month. Z had deposited Rs. 2,00,000 on which interest was payable @ 9% pa. At the end of the accounting year (i.e., 31st March 2018) 2017-18 (after division of the year's profits), it was decided that Z should be treated as a partner with effect from 1st April 2014 with 1/6th share of profits, his deposits being considered as capital carrying interest @ 6% p.a. like capitals of other partners. The firm's profits and losses after allowing interest on capitals were-2014-15: Profit 5,90,000; 2015-16: Profit 6,26,000; 2016-17: Loss 40,000 and 2017-18: Profit 7,80,000. Record necessary Journal entries to give effect to the above. Note: Interest on capital is to be allowed as a charge.

Step by Step Solution

★★★★★

3.59 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of profit before Zs salary and Interest on loan Year 201617 profitloss 40000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635de8af6662b_179889.pdf

180 KBs PDF File

635de8af6662b_179889.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started