Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carmi Company purchased Machine #4 on August 1, 2019 for a cash price of P360,000. Installation costs of P18,000 were also paid. Carmi estimated

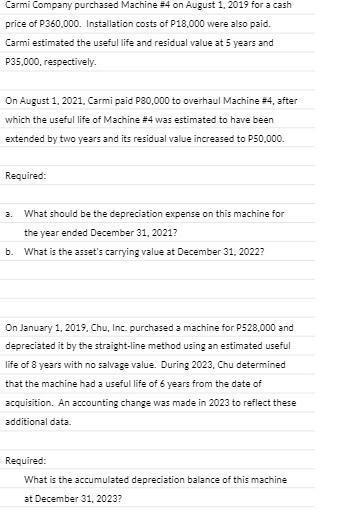

Carmi Company purchased Machine #4 on August 1, 2019 for a cash price of P360,000. Installation costs of P18,000 were also paid. Carmi estimated the useful life and residual value at 5 years and P35,000, respectively. On August 1, 2021, Carmi paid P80,000 to overhaul Machine #4, after which the useful life of Machine #4 was estimated to have been extended by two years and its residual value increased to P50,000. Required: What should be the depreciation expense on this machine for the year ended December 31, 2021? b. What is the asset's carrying value at December 31, 2022? a. On January 1, 2019, Chu, Inc. purchased a machine for P528,000 and depreciated it by the straight-line method using an estimated useful life of 8 years with no salvage value. During 2023, Chu determined that the machine had a useful life of 6 years from the date of acquisition. An accounting change was made in 2023 to reflect these additional data. Required: What is the accumulated depreciation balance of this machine at December 31, 2023?

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started