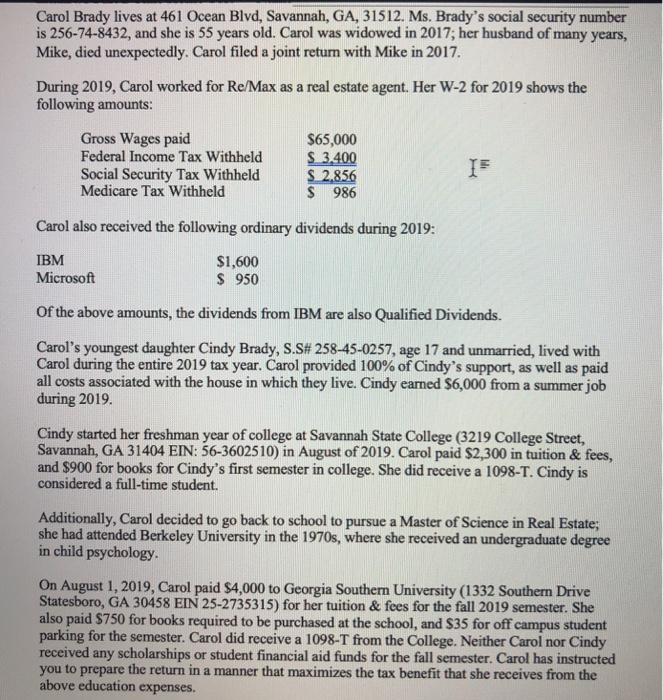

Carol Brady lives at 461 Ocean Blvd, Savannah, GA, 31512. Ms. Brady's social security number is 256-74-8432, and she is 55 years old. Carol was widowed in 2017, her husband of many years, Mike, died unexpectedly. Carol filed a joint return with Mike in 2017. During 2019, Carol worked for Re/Max as a real estate agent. Her W-2 for 2019 shows the following amounts: Gross Wages paid $65,000 Federal Income Tax Withheld $ 3.400 IF Social Security Tax Withheld $ 2.856 Medicare Tax Withheld $ 986 Carol also received the following ordinary dividends during 2019: IBM Microsoft $1,600 $ 950 Of the above amounts, the dividends from IBM are also Qualified Dividends. Carol's youngest daughter Cindy Brady, S.S# 258-45-0257, age 17 and unmarried, lived with Carol during the entire 2019 tax year. Carol provided 100% of Cindy's support, as well as paid all costs associated with the house in which they live. Cindy earned $6,000 from a summer job during 2019. Cindy started her freshman year of college at Savannah State College (3219 College Street, Savannah, GA 31404 EIN: 56-3602510) in August of 2019. Carol paid $2,300 in tuition & fees, and $900 for books for Cindy's first semester in college. She did receive a 1098-T. Cindy is considered a full-time student. Additionally, Carol decided to go back to school to pursue a Master of Science in Real Estate; she had attended Berkeley University in the 1970s, where she received an undergraduate degree in child psychology On August 1, 2019, Carol paid $4,000 to Georgia Southern University (1332 Southern Drive Statesboro, GA 30458 EIN 25-2735315) for her tuition & fees for the fall 2019 semester. She also paid $750 for books required to be purchased at the school, and $35 for off campus student parking for the semester. Carol did receive a 1098-T from the College. Neither Carol nor Cindy received any scholarships or student financial aid funds for the fall semester. Carol has instructed you to prepare the return in a manner that maximizes the tax benefit that she receives from the above education expenses. Carol Brady lives at 461 Ocean Blvd, Savannah, GA, 31512. Ms. Brady's social security number is 256-74-8432, and she is 55 years old. Carol was widowed in 2017, her husband of many years, Mike, died unexpectedly. Carol filed a joint return with Mike in 2017. During 2019, Carol worked for Re/Max as a real estate agent. Her W-2 for 2019 shows the following amounts: Gross Wages paid $65,000 Federal Income Tax Withheld $ 3.400 IF Social Security Tax Withheld $ 2.856 Medicare Tax Withheld $ 986 Carol also received the following ordinary dividends during 2019: IBM Microsoft $1,600 $ 950 Of the above amounts, the dividends from IBM are also Qualified Dividends. Carol's youngest daughter Cindy Brady, S.S# 258-45-0257, age 17 and unmarried, lived with Carol during the entire 2019 tax year. Carol provided 100% of Cindy's support, as well as paid all costs associated with the house in which they live. Cindy earned $6,000 from a summer job during 2019. Cindy started her freshman year of college at Savannah State College (3219 College Street, Savannah, GA 31404 EIN: 56-3602510) in August of 2019. Carol paid $2,300 in tuition & fees, and $900 for books for Cindy's first semester in college. She did receive a 1098-T. Cindy is considered a full-time student. Additionally, Carol decided to go back to school to pursue a Master of Science in Real Estate; she had attended Berkeley University in the 1970s, where she received an undergraduate degree in child psychology On August 1, 2019, Carol paid $4,000 to Georgia Southern University (1332 Southern Drive Statesboro, GA 30458 EIN 25-2735315) for her tuition & fees for the fall 2019 semester. She also paid $750 for books required to be purchased at the school, and $35 for off campus student parking for the semester. Carol did receive a 1098-T from the College. Neither Carol nor Cindy received any scholarships or student financial aid funds for the fall semester. Carol has instructed you to prepare the return in a manner that maximizes the tax benefit that she receives from the above education expenses