Question

Carol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them

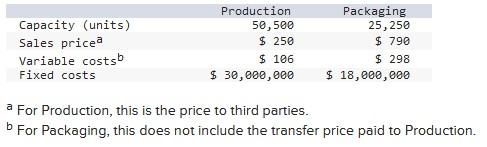

Carol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition to Packaging. Selected data from the two operations follow:

Suppose Production is located in Country A with a tax rate of 30 percent and Distribution in Country B with a tax rate of 10 percent. All other facts remain the same.

Required:

a. Current output in Production is 25,250 units. Packaging requests an additional 5,800 units to produce a special order. What transfer price would you recommend?

b. Suppose Production is operating at full capacity. What transfer price would you recommend?

c. Suppose Production is operating at 47,600 units. What transfer price would you recommend?

Please answer A, B & C

a For Production, this is the price to third parties. b For Packaging, this does not include the transfer price paid to ProductionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started